Hi Multis

It’s the 15th of the month and you know what that means: the Best Buys Now!

For newer Multis (hi, there!), just a quick update. Since May 2022, I have picked 5 stocks every month.

Up to now, the results have been good. In the first three years, the picks have outperformed the S&P 500 by more than 20%.

Illustration made with Nano Banana

Now, just to set the expectations straight, the picks usually start by not performing great. I tend to pick stocks that are a bit out of favor. And that trend sometimes continues for months. Then suddenly, they can shoot up after a good earnings release or some other good news.

That’s also why many picks come back for months in a row. In 2024, for example, I picked NU Holdings 10 times out of 12. Right now, the stock is up considerably for these picks.

So, if the price doesn’t change and the fundamental outlook remains strong, I keep adding the stock to the Best Buys Now. That means there’s often quite some overlap between the months, but that’s also the reason why the stocks outperform the S&P 500. Patience, equanimity and fundamentals over stock moves, that’s what makes you outperform over the long term.

While the average of the months outperforms the S&P 500 by a wide margin, that doesn’t go for each month, of course.

Also important is that there will always be losers and outsized winners. It’s funny that some people comment, “Yeah, but without that big winner, you would only match or underperform the S&P 500.” Well, that’s exactly how investing works. Even if you look at the S&P 500, the growth comes from a very limited group of stocks.

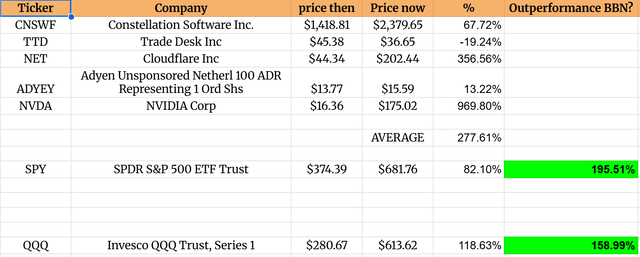

This is from June 2022, probably the biggest outperforming selection.

As you can see, if you take out Nvidia and Cloudflare, it would underperform the S&P 500 by quite a large margin. But that’s exactly the system. It’s not a coincidence I picked these stocks. And it was definitely not the only time I picked them.

By the way, I also want to show you the worst month, just to even it out. Commercially, that’s probably an awful mistake, but whatever. I want to keep it real.

As you can see, this selection from August 2022 (just two months after the best BBNs) is still up 39%, but it’s underperforming the S&P 500 by almost 20% and the Nasdaq by 45%.

If you are one of the people who do not take anything for granted, you are like me. That’s why all subscribers can see all of the Best Buys Now and follow them live.

Some people may even have seen that the price for PubMatic is ‘not correct.’ The stock now trades at about $9. But this $15.33 is the price at which I sold the stock. So, that was a good sell decision. By the way, this is also the only time ever that I have removed a stock from the Best Buys Now. I replaced Sea Ltd. with ASML, but I still calculate the 15% loss on SE in the average.

It’s funny, in a way, that I dedicate so much time to this underperforming Best Buys Now, because there are multiple times more winners than losers. And psychology shows that people losers feel 3 or 4 times more than winners. So, I should probably show you another 5 winning months. But I don’t want to do that. The 20% outperformance on average per pick should tell you more than enough and if it doesn’t, well, so be it.

Let’s start with the picks.

1. The Trade Desk

Price: $36.19

Two weeks ago, I published The Trade Desk’s earnings analysis, how high the Quality Score is, and how attractive the valuation is. The stock was at $38.61, it’s now even lower, at $36.19. That means it’s now down 74%.

It’s normal that there’s extra downside pressure in the last weeks. There’s a lot of tax-loss harvesting, where people sell their losers to offset their winners.

This time last year, the stock was worth $100 more. It’s the biggest drop since going public almost 10 years ago. The market sees slowing growth and Amazon competition. I see a company still executing trading at its cheapest valuation in 7.5 years.

Revenue grew 17.7% YoY to $739M. That looks weak compared to last year’s 27% growth. But political spending distorts the picture. Excluding political spend, growth was 22%, both last year and this year.

The Trade Desk revamped its entire C-suite and launched transformative AI improvements. Its Kokai platform now delivers 26% better cost per acquisition, 58% better cost per unique reach, and 94% better click-through rates than the old system. 85% of customers have already adopted it.

OpenPath is revolutionizing the advertising supply chain by creating direct, transparent connections.

At an EV/Gross Profit of less than 8, The Trade Desk trades at its cheapest level since May 2018.

You can read the full article here.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Of course, I know that investing in Potential Multibaggers is spending money. But what if it brings you more money than it costs? That’s called investing. Potential Multibaggers may be a great investment for you.