Hi Multis

Last week, you got the Overview Of The Week on Monday, but we are back to Sunday. Hooray!

Mark is on a mini-cruise with his wife (Valentine’s Day!) so it will be only me this time.

I know many of you read this on Monday morning. So, grab your cup of black gold (wait, did you think that was oil?) and enjoy the OOTW.

Articles In The Past Weeks

This is the third article this week. Let’s look at the two previous ones.

The first one analyzed the Datadog earnings. Is the stock a buy now?

In the second article, I analyzed the Cloudflare earnings.

Memes Of The Week

Let’s check the meme harvest of this week.

I made the first one myself.

Multi Fabian posted a great one.

My friend Pieter at Compounding Quality posted this one, shared by all-star Multi BK Lee.

This was a great one on X.

Interesting Podcasts Or Books

This week, I listened to Ben Horowitz, the co-founder of Andreessen Horowitz, also known as a16z. He was in Patrick O’Shaughnessy’s outstanding podcast Invest Like The Best. I liked the open and wide-ranging conversation.

You can listen to the episode here.

The markets in the past week

I wrote this last week:

The markets continue to feel weird and divided. Just look at this chart of the indexes over the last week.

I can just repeat that here for this week.

As you can see, the Russell 2000 did best again this week, albeit with a lot of volatility. The Nasdaq dropped by 2.10%, which is quite a lot for one week.

The S&P 500 was down 1.39%.

So, what does this mean for the Greed & Fear Index? It is now firmly in Fear territory.

Quick Facts

1. The Anti-AI Bubble Is Entering The Ridiculous Stage

We are officially entering the ridiculous stage of the anti-AI bubble. I have already written this multiple times before here, but there is no AI bubble. In the dotcom bubble, there were many companies that were ridiculously valued. You don’t have that now. Of course, you could point out a stock like Palantir, which is still very much overvalued, but it’s more of an exception than the rule.

This time, there’s an anti-bubble. With that term, I mean that everything that is not AI is sold off because it’s seen as worthless.

And we are officially entering the ridiculous phase there.

Algorhythm Holdings (RIME), which I’m sure nobody had heard of before this week, is a microcap. Before this week, it traded on a market cap of $5.8 million. It was involved in, of all things, karaoke machine imports.

That company announced a new AI-powered tool or platform called SemiCab that claims to dramatically improve freight efficiency. It talks about boosting shipment volumes by 300–400% without adding headcount, or reducing empty miles by over 70%. The results?

First, this.

Ok, it’s not the first penny stock that gets such a pump. But the really crazy thing is that the industry giants of transportation dropped like a rock because of that. The Dow Jones US Trucking Index as a whole was down 5% because of the announcement.

This is very ridiculous. One former karaoke machine importers’ press release triggered this? If it was a movie, you wouldn’t believe it.

This perfectly illustrates the ongoing anti-AI bubble. It’s so ridiculous it’s comical.

2. Crash Coming?

For weeks, I’ve been saying that this starts to feel like 2021, when a lot of tech companies were down a lot 50%-60%-70% or even 80%. The same is happening now. And just like in 2021, the index barely moved.

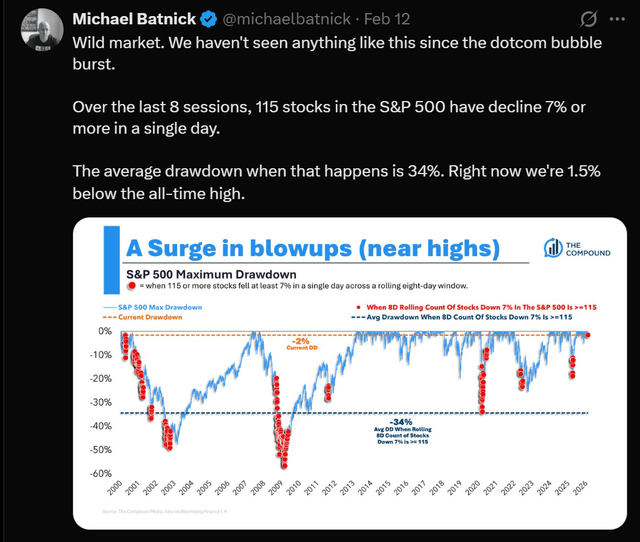

Michael Batnick pointed this out in this chart.

It’s the first time since the dotcom bubble that the indexes are so close to all-time highs and there’s a red dot, meaning 115+ stocks that declined 7%+ on a single day.

Could it be that a crash is brewing? Yes, but it’s the same as ever: we don’t know. As humans, we have an almost pathological need to see patterns and this could be one of that’s either useful or useless. You can’t know. 99% of patterns are unuseful but when there’s one that proved to be right, many are very loudly beating the drum about the one that worked.

The two things could easily be tied together: the AI-inspired anti-bubble and the crash could be the same.

There’s uncertainty and markets hate that. That’s probably the main reason for the SaaS sell-off and the ridiculous trucker companies’ sell-offs, driven by a tiny former karaoke machine importer. There’s certainly a strong exaggeration happening here.

So, yes, this is lunacy. But at the same time, the markets can be irrational for much longer than you can stay solvent, to paraphrase John Maynard Keynes. Put differently, even if you are correct about the long term, the market can act irrationally for a long time. If you don’t pay attention in that case, you may run out of money.

Since the start, I have emphasized that I never use leverage, as it can make you insolvent faster than anything else in investing. With leverage, crashes work seriously against you. If you are not leveraged, drops don’t harm you; they can even create great opportunities if you have cash coming in.

3. SaaS Multiples Lowest Ever

On X, Sergey posted this interesting chart.

It shows a reacceleration in revenue growth for SaaS companies, while the multiples keep dropping.

The reason why revenue is (slightly) accelerating? Probably the AI layer put on top of the software, the very thing that is supposedly killing it.

Now, that doesn’t mean you should buy software indiscriminately. There are a few filters you should go through:

* Is this a point solution (solving just one problem) or is it a platform that runs through companies? The first could be in danger, the second probably not.

* Is this in a regulated business or not? If not, the barriers to enter are lower.

* Is the pricing seat-based or usage-based? It could be that seat-based pricing faces pressure as fewer people work on a project due to AI.

J.P. Morgan put out this chart.

That means it’s clear: SaaS will continue to grow until 2027 and then will decline, while AI agents will take off.

This means there are two takeaways here.

1. SaaS as a whole won’t disappear but there will definitely SaaS companies that will disappear.

2. The best SaaS companies will be easily recognizable soon. While now, it’s still a bit harder, the SaaS companies that add their own agents as a complement to the software will win. That’s part of the reason I recently bought ServiceNow for the Forever Portfolio. Investors sell it off, even when it will benefit from AI. It’s hard to rip it out and its AI solution is growing fast.

There’s a saying: “The baby is being thrown out with the bath water.” It means that valuable things are lumped are labeled worthless just because they are in the wrong context. That’s exactly what’s happening here. Many babies are thrown out now. Of course, there’s bathwater, but many babies wait for you to save them. :-)

4. Google DeepMind’s Paper

DeepMind, acquired by Google in 2014 and a pioneer in AI, released a new paper this week.

The paper talks about “AI agents,” arguing that they are not real AI agents yet. They just split tasks and call tools, that’s all.

Real delegation means assigning authority, tracking performance in real time, and replacing agents mid-task when they underperform. That’s a fundamentally different game.

The biggest risk the paper flags is accountability. When agent A delegates to B, which delegates to C, nobody owns the failure anymore.

Humans end up as victims. They get the blame for outcomes they never actually controlled.

Another risk is monoculture. If every agent ecosystem depends on the same few foundation models, one mistake will be everywhere.

Delegation needs smart contracts, verification protocols, and permission frameworks. The companies building those for agent-to-agent commerce are positioned like payment processors were in early e-commerce. In other words, that’s where the real innovation should come from.

5. Duolingo appointed a VP of AI

This week, Duolingo (DUOL), one of the biggest victims of the “AI will kill everything” hype, appointed Andrew Hogue as VP of AI.

Duolingo was one of the first companies to partner with OpenAI and it is one of the biggest users of tokens from that company, but it’s still good to see a VP for AI.

Last year, I put Duolingo in the ‘great company but too expensive’ category. I’ve been pounding the table since the big drop and I will continue to do that at these prices. Companies don’t die if they adapt to a new reality. Blockbuster didn’t lose to Netflix because it was simply disrupted but because it didn’t adapt to the new reality of streaming. You can’t say that Duolingo doesn’t adapt to the new AI reality. This is another data point that shows this.

6. Constellation Software’s AI Agents Platform

Too many investors see the world too simple. “AI will kill Constellation Software!”

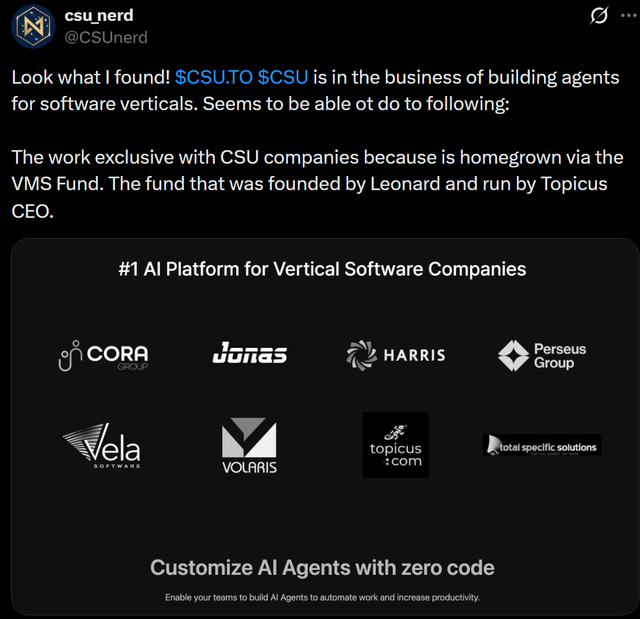

Are you sure? What if Constellation actually has a platform that develops AI agents for the 1,000+ companies it has in vertical market software? This X post shared that.

If you are a customer of one of Constellation’s (or Topicus’) companies and you have been using the software for decades, will you want a vibe-coded new AI agent that has proven nothing when it comes to security, reliability, uptime, and so on? Or will you be happy to pay a bit extra for the AI that your long-time partner offers you?

This is through RAIA, one of the companies acquired. It acquired offrs(.)com in 2019. Rich Swier was a co-founder of that company. In 2022, he built the first version of RAIA (a real estate AI agent) within the Constellation Software ecosystem in 2022. It became an AI agent platform for Constellation (and Topicus) companies. (This is taken from this post).

RAIA even shares that TSS (read Topicus) uses it for its core activity: mergers & acquisitions.

But yeah, of course, Constellation and Topicus will be killed by AI, right?

Do you want to read the rest of this article?

Become a paying member of Potential Multibaggers!

(If you already are, just scroll past this)

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beat the S&P by 54%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.