Datadog: The Acceleration Nobody Expected

The Serial Sandbagger (and why I LOOOOOVE that!)

Hi Multis

Datadog (DDOG) reported its Q4 2025 results this morning (February 10, 2026, to avoid any confusion), and this was a strong close to what was already a strong year.

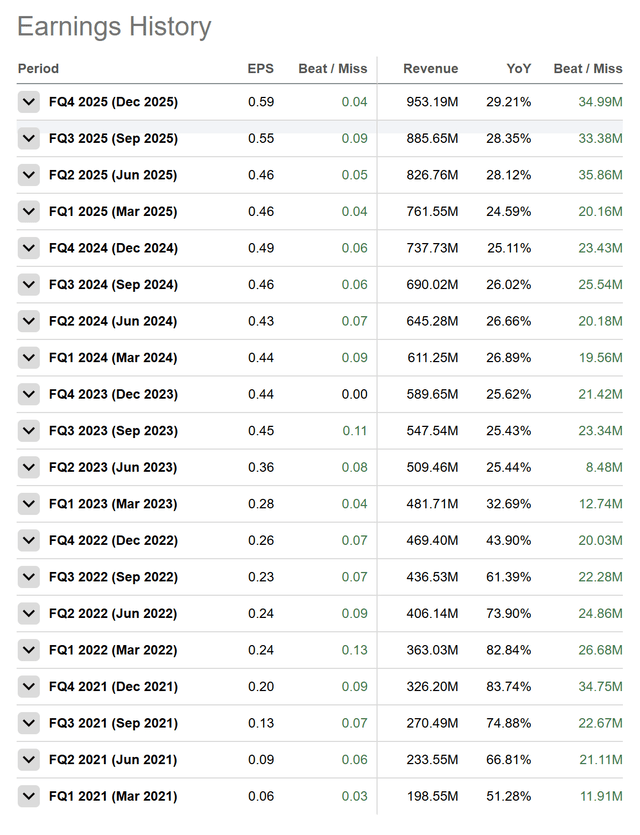

Datadog earnings have become synonymous with beat-beat-raise. As a shareholder, that’s very comforting and exciting.

Again, there was acceleration in revenue growth. But while Datadog benefits from AI customers, the broad base of non-AI customers performed even stronger. That last part is really important, and that’s why we will get back to it later in this article.

Let me walk you through the numbers, the key developments, and what I think matters most here.

The Numbers

Datadog’s Q4 revenue came in at $953 million, up 29% year-over-year and above the high end of guidance. The consensus was $918 million, so this was a beat of almost $35 million or a strong 3.8%.

Non-GAAP EPS was $0.59, beating the consensus of $0.55 by $0.04. Non-GAAP operating income was $230 million, good for a 24% operating margin. Free cash flow was $291 million with a 31% margin. Healthy numbers.

For the full year 2025, Datadog delivered $3.47 billion in revenue, making the full-year guidance raised from the previous quarters look conservative in hindsight. But that’s what Datadog does. They guide conservatively, then they beat. Every single quarter this year. And the previous years. Just look at this immaculate track record. It’s a beauty.

Source: Seeking Alpha

Datadog ended Q4 with about 32,700 total customers, up from about 30,000 a year ago. There were 4,310 customers with an ARR of $100,000 or more, a 19% increase from 3,610 a year ago. These large customers generated about 90% of ARR.

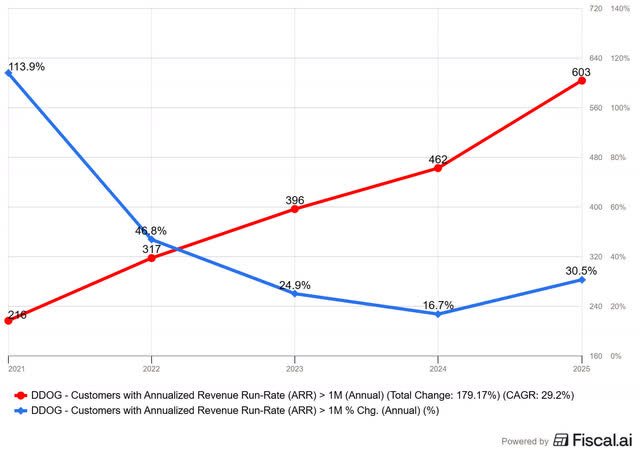

Datadog now has 603 customers with ARR of $1 million or more, up 31% from 462 a year ago.

If you want these incredibly insightful charts from Fiscal, use my link to get 15% off.

That’s a significant acceleration from the last two years, as you can see. When your biggest customers are growing fastest, that tells you something about the stickiness and the expanding value of the platform.

The dollar-based net retention rate held steady at about 120%, and gross revenue retention remained in the mid-to-high 90s. Churn is low and that indicates that Datadog’s platform is mission-critical.

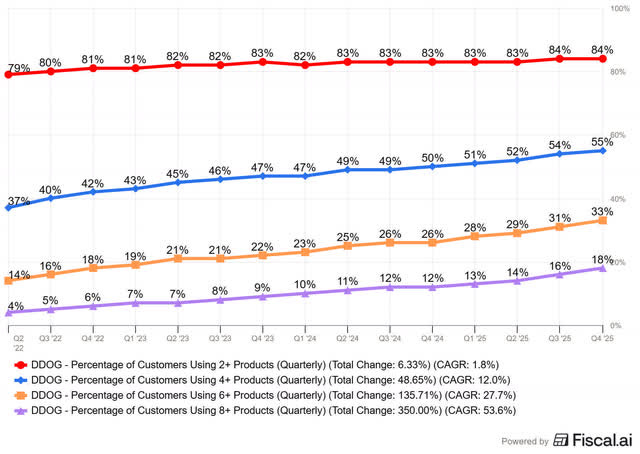

The land-and-expand model continues to work exactly as you want to see it as an investor. By Q4-end, 84% of customers used 2 or more products (up from 83% a year ago), 55% used 4 or more (up from 50%), 33% used 6 or more (up from 26%), 18% used 8 or more (up from 12%), and 9% used 10 or more products (up from 6%). Look at these beautiful climbing lines.

The last metric is new: 9% of customers use 10+ products. When you think about the switching costs that come with that level of integration, you start to understand why the retention rate is so high. It’s not practical to rip all of that out and manage those integrations separately. Or, to put it differently, you can’t go back to point solutions when you have a unified platform.

48% of the Fortune 500 are now Datadog customers, but the median ARR for those Fortune 500 customers is still less than $0.5 million. There is a massive runway just from growing within the existing base.

The Core Business Is Accelerating

Here’s what I think many investors might be underappreciating. CEO Olivier Pomel on the call:

We saw a continued acceleration of our revenue growth. This acceleration was driven in large part by the inflection of our broad-based business outside of the AI-native group of customers we discussed in the past.

So, revenue growth from the non-AI-native customer base accelerated to 23% year-over-year in Q4, up from 20% in Q3 and 18% in Q2. That’s three consecutive quarters of acceleration in the core, broad-based business. This is cloud migration. This is digital transformation. This is the secular trend that was always the backbone of the Datadog thesis, and it’s getting stronger, not weaker.

It’s funny, in these times of what I call the Anti-Non-AI Bubble, to see a company benefiting from AI actually grow most from what’s now seen as ‘the old’: cloud migration and a bigger digital stack. It shows that what the market emphasizes and reality are not the same.

CFO David Obstler confirmed that this acceleration trend has continued into January. Noice!

Meanwhile, Datadog also fully profits from the new paradigm. The AI-native cohort continues to grow rapidly. There are now about 650 customers in the AI-native group (up from about 500 last quarter), with 19 customers spending $1 million or more annually with Datadog. And 14 of the top 20 AI-native companies are Datadog customers.

Datadog shows single-handedly what I’ve been shouting in the wind: Yes, AI is great, but don’t exaggerate the speed of innovation. That always goes slower than you think. Even now, many companies are still switching from on-prem to the cloud. That’s the previous paradigm, yes, started about 15 years ago. That’s how it goes in the real world.

Record Bookings And The Anthropic Deal

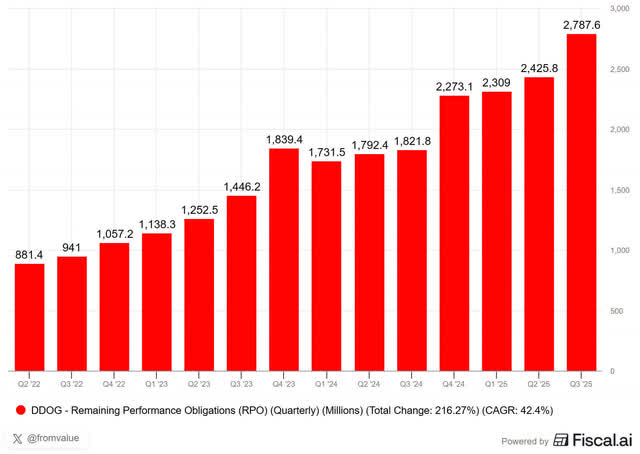

And more positive news. Datadog posted a record $1.63 billion in bookings, up 37% year-over-year. Another acceleration.

Datadog signed 18 deals over $10 million in TCV in Q4, of which 2 were over $100 million, and 1 was an 8-figure land with “a leading AI foundational model company.” This is Anthropic. That AI model deal is worth highlighting: it was Datadog’s biggest new logo deal ever.

Anthropic was known for using a mix of open-source tools (like Prometheus/Grafana), in-house solutions, and cloud-native tools across AWS and Google Cloud. The move to consolidate “more than 5 tools” into one platform is a classic Datadog “consolidation” play used to win over Anthropic’s complex, multi-cloud environment. Anthropic consolidated everything onto Datadog.

When an analyst asked whether the “you can do it on the cheap with open source“ narrative holds up, founder and CEO Olivier Pomel was direct with his answer:

Your engineers typically are very well compensated and are the biggest part of the spend in this company. Their velocity is what gates just about everything else in the business. And so usually, when we come in, when customers start engaging with us, we can very quickly show value that way.

In other words, the “build it yourself” argument collapses when you factor in the real cost of engineering time. Datadog has made this case for years, and these massive deals prove it.

The ARR Milestones Tell A Powerful Story

Several major product milestones were disclosed this quarter and are worth paying attention to.

Infrastructure monitoring now contributes over $1.6 billion in ARR.

Log Management crossed $1 billion in ARR, with Flex Logs (only launched in August 2023) nearing $100 million in ARR on its own.

APM plus Digital Experience Monitoring also crossed the $1 billion ARR mark.

That’s three Datadog pillars at or above a billion, and Datadog noted that about half of its customers still don’t purchase all three pillars. So the cross-sell opportunity remains enormous.

APM specifically is now growing in the mid-30% range year over year, which makes it Datadog’s fastest-growing core pillar. That’s a reacceleration, driven by easier onboarding, the strength of digital experience monitoring, and better go-to-market coverage.

Security ARR growth continues to accelerate too. Datadog is actively displacing established market leaders with Cloud SIEM in large enterprises. The tight integration with Bits AI Security Agent is becoming a strong differentiator.

AI: Both Sides Of The Coin

Datadog frames its AI opportunity in two buckets, and I think it’s a useful way to think about it.

First, AI for Datadog: making the platform smarter.

Bits AI SRE Agent launched for general availability in December, and over 2,000 trial and paying customers have already run investigations in the past month. The Datadog MCP server is in preview for thousands of customers, with tool calls growing 11-fold in Q4 compared to Q3. That’s explosive growth, exactly what we want to see as Multis.

Second, Datadog for AI: observability and security for AI workloads.

More than 1,000 customers use LLM Observability, and the number of spans has increased 10x over the past 6 months. Datadog is also building GPU monitoring, an AI agent console, and security products to protect against prompt injection attacks, model hijacking and data poisoning. With such an abundant use of LLMs, this is crucial and much appreciated.

On the topic of whether general-purpose LLMs could threaten Datadog’s moat, Pomel gave a thoughtful answer.

First, he acknowledged that LLMs will get much better at analyzing broad datasets. But Datadog’s advantage is twofold: the ability to assemble and structure the context (data aggregation, parsing, understanding how systems fit together), and the ability to run analysis in-stream, in real time, at massive scale.

Pomel:

Where the world is going is you’re going to have many more changes, many more things. You cannot actually afford to have incidents to look at for everything that’s happening in your system.

So you need to be proactive. You need to run analysis in stream as all the data flows through. And for that, you need to be embedded into the data plane, which is what we run.

That’s the vision. Not post-hoc analysis fed into an LLM, but real-time, in-stream detection and resolution. That’s a fundamentally different problem, and it’s one Datadog is uniquely positioned to solve. LLMs are phenomenal at solving problems of the past, Datadog will do it in real-time and preventive.

Guidance: The Serial Sandbagger Strikes Again

For Q1 2026, Datadog guided revenue between $951 million and $961 million. At the midpoint, that’s 25-26% year-over-year growth. The consensus was $934 million, so even the low end of guidance beats the estimates. Another raise, in other words, like clockwork.

For the full year 2026, the guide is $4.06 billion to $4.10 billion, or 18-20% year-over-year growth. The consensus was at $4.10 billion. Full-year non-GAAP EPS guidance of $2.08 to $2.16 even came in below the consensus of $2.34.

So, why did the stock jump so much today?

If you are not familiar with Datadog, you will look at that 18-20% full-year guidance and think it signals a deceleration.

The market starts to get it, though. At this time last year, Datadog guided to 19% year-over-year revenue growth for 2025. How did that end up? 28% year-over-year after Q4 results. Now they’re guiding for 19% growth again for 2026. Two years ago, it guided for 19-20% growth. Reality 26% growth.

So... Do you really believe Datadog will really only grow 18% to 20% in 2026?

Datadog is a serial sandbagger when it comes to guidance. They’ve beaten and raised every single quarter in 2025. And I like that: underpromising and overdelivering is a real Potential Multibaggers criterion.

The guidance explicitly models that the broad-based business (excluding the largest customer) grows at least 20%, with conservative assumptions on Anthropic. CFO David Obstler noted on the call that this doesn’t mean the large customer is declining; it’s just that in a consumption model, they can’t control it and so they apply extra conservatism there. You bet, David!

Full-year operating margin guidance is 21%, down from 24% this quarter, reflecting continued heavy investment in R&D and go-to-market. But as we’ve seen in previous years, the beat-and-raise pattern tends to be in the margins as well. So, again, no worries. And this time, it seems like the market finally catches up with this year-long pattern.

Conclusion Earnings Insights

This was one of Datadog’s best quarters ever. Let me recapulate why:

Accelerating revenue growth in both the core business and the AI cohort.

Record bookings.

The biggest new logo deal in company history.

Three product pillars at or above $1 billion in ARR.

A 31% free cash flow margin.

Datadog shows more and more that it’s a platform that is fully embedded in companies’ tech stacks and difficult to replace. To the contrary, companies consolidate point solutions on Datadog’s platform, as Anthropic showcased very clearly.

The guidance looks ultraconservative, but that’s nothing new. Important: the product innovation shows no signs of slowing. More than 400 new features were shipped in 2025, and Pomel said he’s even more excited about 2026.

If you zoom out, the thesis is simple: the world is moving to the cloud, building more software, deploying more AI, and all of that complexity needs to be observed, secured and managed. Datadog is the perfect platform for all of these developments.

Now, does this make Datadog a buy? Let’s find out with the Potential Multibaggers Quality Price, the Selling Rules (new for Datadog!) and the valuation.

Do you want to read the rest of this article and know if Datadog is a BUY here or not?

Become a paying member of Potential Multibaggers!

(If you already are, just scroll past this)

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month (coming this week!)

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis article like this one

📊 The 10 Best Stocks for 2026 (the selection for 2025 beat the S&P by 54%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.