Cloudflare: The Next Internet Is Here Already

The insights of the fantastic Q4 quarter.

Hi Multis

Cloudflare (NET) reported its Q4 2025 results yesterday evening (February 10, 2026), and this was an absolute monster quarter.

The numbers were terrific but what’s happening underneath the surface is at least as important. If you follow this company closely, and we have since I picked it at $39 in 2020, you can see that the company has been ready for the future at any moment. Now that AI is here, the company benefits.

But at least as important is that management delivers. In 2025, CEO Matthew Prince repeatedly promised revenue reacceleration. Well, he and his team delivered again. And the setup for 2026 looks exciting as well.

Let me walk you through the numbers first, and then we’ll get into the things that really matter.

The Numbers

The numbers were very strong, with acceleration across the board:

Revenue: $614.5M, +33.6% YoY growth, beating the consensus by $23.1M or almost 4%, very impressive at this size.

Non-GAAP EPS: $0.28 per diluted share, beating the consensus by $0.01.

Non-GAAP operating income: $89.6M, which means an operating margin of 14.6%.

Free cash flow: $99.4M, or 16% of revenue, up from $47.8M (10%) in Q4 2024. That’s more than doubling the free cash flow year-over-year.

RPO*: $2.496B, up 48% YoY.

Current RPO**: +34% YoY.

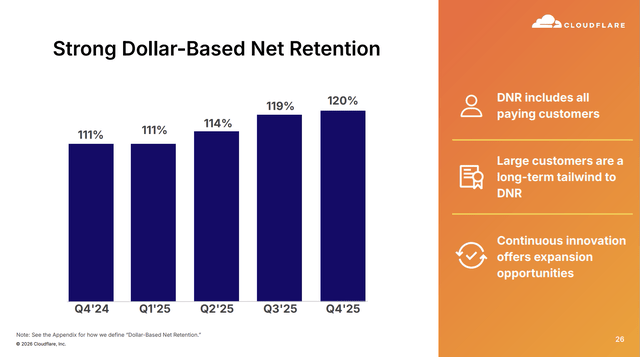

DBNRR: 120%, up 1% sequentially and 9% year-over-year.

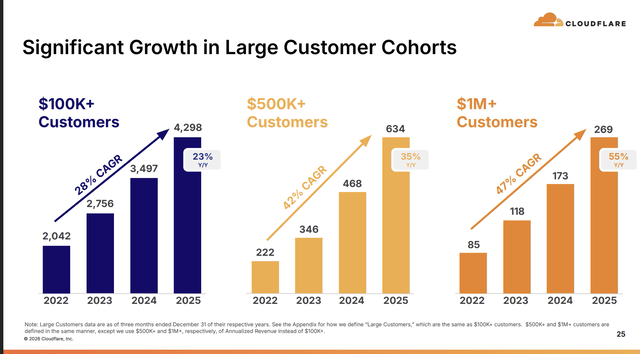

Customers: ~332,000 paying customers, up 40% YoY. 4,298 customers paying >$100K/year, up 23% YoY.

(* RPO: Remaining Performance Obligation. The money that is already under contract but can’t be recognized as revenue yet because the services still have to be delivered

** Current RPO: the RPO of the services that will be delivered (and so recognized as revenue) in the next 12 months.)

That DBNRR bounce-back is worth looking at. If you’ve followed Cloudflare over the last two years, you know this metric dropped to 110% at its trough. Management kept repeating that it was not the best metric to look at, as there was downward pressure from the pool of funds system. Now those pools are being consumed, and DBNRR has returned to 120%. That’s a very strong for a company at this scale.

From the company’s slide deck

Cloudflare guided for revenue of $620M to $621M for Q1 2026, or about 29-30% growth. That’s above the consensus of $614M. Knowing them, they will beat this.

For the full year, management sees revenue of $2.785B to $2.795B, or 28-29% growth, versus the consensus of $2.74B. For non-GAAP EPS, guidance comes in at $1.11 to $1.12. The consensus was at $1.18, so optically, that’s a miss. But there’s context here. The company expects a 20% effective tax rate and is assuming a cash settlement of its 2026 convertible notes, which affects the share count.

Network CapEx is guided at 12-15% of revenue for 2026. That’s remarkably efficient compared to hyperscalers that invest tens of billions of dollars on Capex.

The Go-to-Market Strategy Clearly Works

Matthew Prince got quite some flak a few years ago when he said that his go-to-market team was underperforming and that they fired some people and did a reorganization. I actually like the open communication. With the reorganisation, things turned around.

New ACV (annual contract value) booked grew nearly 50% year-over-year. That’s not only a record in absolute dollars but also the fastest growth percentage rate since 2021.

Global sales productivity increased for the eighth consecutive quarter, surpassing the all-time high set back in Q4 2021. Quota attainment was the highest in four years. For the fifth straight quarter, Cloudflare added a record number of $1M+ customers.

And the deal sizes keep getting bigger. After signing a $130 million total contract value deal earlier in 2025 (the biggest in Cloudflare’s history), Cloudflare closed a $42.5 million annual contract value deal this quarter, also a new record.

Here’s a stat that really tells the story of how fast this company is scaling upmarket. CFO Thomas Seifert on the call:

For some perspective, we only had 96 $1 million-plus customers in total, just 2.5 years ago. Now that is what Cloudflare is adding in a single year and is still just getting started moving upmarket into the enterprise.

Read that again. They’re adding in one year what used to be their entire $1M+ customer base. An English word expresses this kind of phenomenon perfectly. It’s the word “compounding.”

Just look at how the different customer cohorts are scaling:

The acceleration at the top end is key here. The bigger the customer, the faster the growth. $1M+ customers grew 55% year-over-year, from 173 to 269. That’s a 47% CAGR since 2022. This is the proof that Cloudflare is successfully moving upmarket while not ignoring its self-serve public that has brought the company so much data and feedback over the years.

The pool-of-funds model is clearly working for this group. These deals essentially mean the customer is betting on Cloudflare broadly. They don’t know exactly which products they’ll use or how much, but they’re committing because they trust the platform. Matthew Prince put it well:

Every time you hear that somebody is signing up for a pool of funds deal, they’re betting on Cloudflare, they’re betting on the broad product suite that we have, and they’re betting on the ability for us as a team to continue to execute.

Pool of funds was about 20% of Q4 ACV and mid-teens for full-year 2025, said CFO Seifert. But it’s still very early and there’s a lot of runway left.

The Agentic Internet: Cloudflare’s Biggest Tailwind

This is where it gets really interesting, and where I think most analysts are still underappreciating the opportunity.

Prince laid out a vision on this call that was one of the most compelling things I’ve heard from any CEO in a while. Again, I should say. If you haven’t listened to a conference call with Matthew Prince yet, you should. While most CEOs talk in dense business language, Matthew Prince is freshly direct, open and willing to share. But again to what he said this time. In essence, it comes down to this: the Internet was built for humans. Agents are about to change everything. And Cloudflare sits right in the middle of that shift.

Think about it this way. If a human looks at 5 websites before making a purchase decision, an agent might look at 5,000. If humans follow a night-and-day rhythm, agents never sleep. The volume of internet traffic that agents generate is an order of magnitude higher than human-driven traffic. In January alone, the number of weekly requests generated by AI agents more than doubled on Cloudflare’s network.

With more than 20% of the web sitting behind Cloudflare, it is in the front row to see the agentic Internet. Prince on the call:

If AI agents are the new users of the Internet, Cloudflare is the platform they run on and the network they pass through. This creates a virtuous flywheel — more agents drive more code execution on our Workers development platform, which in turn drives more demand for Cloudflare’s performance, security and networking services. At scale, this compounds powerfully.

And it’s not just the developer platform benefiting. The traditional application services (’Act 1’) are seeing a surge because companies need to handle the massive increase in agentic traffic.

Zero Trust (Act 2) is getting more adoption because, surprise!, people are realizing that giving an AI agent access to everything in your life might not be the best idea. Prince was funny about it: “We’re sort of speedrunning all of the security challenges.”

Unlike the hyperscalers, Cloudflare didn’t blow its CapEx budget to chase this new opportunity. The company spends about 12-15% of revenue on network CapEx, which is nothing compared to the hyperscalers. Why? Because Cloudflare charges for work done, not machines rented. Prince claimed they get up to 10x the work out of the same GPU as a hyperscaler.

The hyperscalers have no incentive to make AI workloads more efficient, as that would just mean fewer leased machines and less revenue. Cloudflare does.

I love this line from Prince:

I do feel at times like we’re kind of goldilocks where we have a business model which I think is going to sustain whatever AI brings. AI agents aren’t going to replace the massive global network that we have. But we’ve also done it in a way which is much more capital efficient than some of the hyperscalers.

Don’t forget that Cloudflare is the company that was visionary about GPUs. I quote Matthew Prince from the Q2 2024 earnings call:

Starting six years ago, we intentionally left one or more PCI slots in every server we built empty.

When the moment and the technology made sense, we started deploying. That means we can use our existing server infrastructure and just add GPU cards, allowing us to add this capability while still staying within our forecasts capex envelope, and customers are excited.

The company continues to benefit from this visionary foresight.

Workers, Vibe Coding, and the Developer Flywheel

The Workers developer platform is becoming a serious growth engine. Most vibe coding platforms are either built on Cloudflare Workers or have it as their preferred deployment target. Cloudflare exited 2025 with more than 4.5 million human developers active on the platform and a lot more if you count their agents.

The examples from the call were telling.

A Fortune 500 pharmaceutical company built an internal vibe coding platform on Cloudflare using Workers AI and Durable Objects.

A publicly traded tech company is migrating its entire plug-in sandbox infrastructure to Cloudflare Containers.

A leading financial services company launched an MCP server on Workers that allows AI agents to interact directly with payment services using natural language.

The acquisition strategy fits perfectly here. Cloudflare acquired Human Native (out of Google) to help figure out what the next business model of the Internet looks like. And they brought in Astro, one of the leading developer frameworks that powers a lot of the vibe coding ecosystem. Smart, targeted acquisitions that strengthen the platform.

Act 4: The Business Model of the Internet

This is the long-term bet that I think many investors are enthusiastic about, and that many others don’t understand. Cloudflare is trying to define the future business model of the Internet. What comes after ads and subscriptions?

Up to now, the internet works for free (you see ads to pay for the content) or with subscriptions (like Potential Multibaggers). If you read this for free, thank those great people who pay for Potential Multibaggers, or even better, take responsibility and take a subscription now!

Go to this page.

And subscribe to the annual plan.

But with AI, there’s a problem. AI answer engines don’t drive traffic to content creators the way search engines did. If there’s no traffic, there’s no monetization. Content creators (journalists, analysts, researchers, blog writers, photographers) need to get paid, or the content that makes AI useful will dry up.

Prince made a fascinating point about this beyond the traditional media:

We’ve actually been getting called not just from like the Associated Press and BBC and New York Times, but we’ve been getting calls increasingly from banks where their research teams are saying, we’re actually seeing fewer people subscribe to and read our research because the AI companies, the people are just turning the AI companies, they’re slurping all the data down and taking that intellectual property.

Cloudflare’s position as a neutral broker here is key. Cloudflare is not an AI company building an LLM (or other foundational model). It is not a content company. But 80% of AI companies use them, and a big percentage of the Internet sits behind them. Both sides, AI companies and content creators, prefer Cloudflare to figure this out rather than a hyperscaler with huge conflicts of interest.

Microsoft and Amazon have announced content marketplaces of their own, but Prince noted that both sides prefer a neutral third party. Media companies are already reporting that deals they’re securing with AI companies have improved since Cloudflare got involved.

Prince said 2026 is when they’ll start talking about how this impacts them financially. If Cloudflare successfully establishes itself as the infrastructure for agentic commerce, it could be as transformative as any of the previous “Acts.”

A media company already signed a $3.1 million AI Crawl Control deal and migrated massive internet properties in just two weeks using Workers.

The Margin Story: Still Early Innings

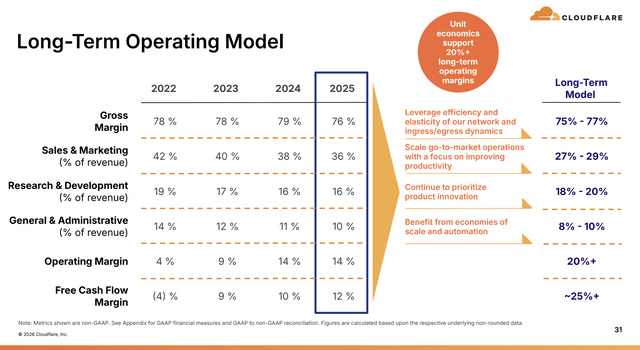

One thing I want to flag because I think it’s underappreciated: the long-term margin trajectory. Cloudflare’s (non-GAAP) operating margin went from 4% in 2022 to 14% in 2025. Free cash flow margin went from negative 4% to 12% over the same period. Those are big moves. But the long-term targets management laid out show there’s still a long way to go: 20%+ operating margins and roughly 25%+ free cash flow margins.

Sales & marketing is the biggest lever. It fell from 42% of revenue in 2022 to 36% in 2025, with a long-term target of 27-29%. You don’t get to 20%+ operating margins just by coincidence. You only get there by growing revenue faster than expenses, which is exactly what we see happening at Cloudflare.

Conclusion

This was an outstanding quarter, probably one of the best in Cloudflare’s history. 34% revenue growth at this scale, 50% new ACV growth, record deal sizes, 48% RPO growth... Cloudflare clearly is a top-of-mind platform for companies.

But what excites me most isn’t the backward-looking numbers. It’s the positioning. Cloudflare is uniquely positioned at the crossroad of the major trends reshaping the Internet: agentic AI, developer platforms, security, content monetization, and multi-cloud infrastructure. If you had to dream up a company for this time, you’d come pretty close to Cloudflare. The company doesn’t need AI to succeed, but AI is making everything they do more valuable.

Prince closed the call with something similar:

Given the opportunity we have ahead and how effectively and efficiently our team is executing on it, I wouldn’t trade places with any CEO of any other company, public or private.

When a founder-CEO with this track record says that, you should pay attention.

So, is Cloudflare a buy now or not?

Let’s find out in the rest of this article, through the Potential Multibaggers Quality Score, the Selling Rules and, of course, the valuation.

Do you want to read the rest of this article and know if Cloudflare is a BUY here or not?

Become a paying member of Potential Multibaggers!

(If you already are, just scroll past this)

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month (coming the next few days!)

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis article like this one

📊 The 10 Best Stocks for 2026 (the selection for 2025 beat the S&P by 54%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.