Hi Multis

Last week, we had the first Overview Of The Week of 2026.

This inspires me to thank you from the bottom of my heart. Without you, dear Multi, I would never have come this far. Your feedback, your words of appreciation and your kindness are the fuel that keeps me going.

Before I get too emotional (I could), let’s dive into this Overview!

Articles In The Past Weeks

This is the third article this week.

In the first article, you got an earnings analysis of Celsius. I also updated the Quality Score and Valuation.

The other article was also an earnings analysis and an evaluation to see whether the stock was a buy right now. The company is one that’s under the radar: Global-e. You can read the analysis here.

Changes at Potential Multibaggers

Something will change at Potential Multibaggers.

Starting next week, the Forever Portfolio will only be visible in the $1,200 subscription plan.

But don’t panic yet, dear Multi. If you are already a paid subscriber, you will be upgraded for free! So, nothing will change for you. You will get a free upgrade.

If you are not a subscriber yet, now is the time to switch!

Because today, your price isn’t $1,200. It’s not even the regular price of $499.

It’s $399, as you get a 20% discount.

For a bit over $1 a day, you get:

🚀 The Full 10 Stocks for 2026: the list that returned 54.16% last year is off an a great start already.

📈 The Real Money Portfolio: My personal trades and allocations (Value: $1,200).

🎯 Best Buys Now: 5 curated picks every month (Beating the S&P by 25%+).

👥 Private Community: Access to 800+ high-level investors.

🛡️ 7-Day Guarantee: If you don’t like what you see, I give you your money back.

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Don’t wait too long. The offer is about to expire.

If you want my real-money portfolio, you will need to upgrade to the $1,200 subscription in a few days, unless you already have a subscription before the switch I’m making in the upcoming week. Then you will get the upgrade for free.

If you’ve been on the fence, NOW is the time to act. You get an upgrade worth $800. Not once, but for as long as you subscribe, year after year!

Memes Of The Week

Two memes this week. This is the first one.

The second meme says a lot about how many people feel right now, I think. It’s from Flo, aka our Slack Meme King (yes, capital letters!).

Thanks for being Flo, Flo!

Interesting Podcasts Or Books

Some weeks, I have to think hard about what to include here. For example, because I only listened to one podcast or didn’t start or finish a new book. Other weeks, I have to select because there was so much. This week is in that second category. These are the three most interesting podcasts I listened to this week.

The first one was with James Clear, the author of Atomic Habits. It’s a thoughtful conversation about how changing our behaviors can change our lives.

You can listen to the podcast here.

The second was with a famous founder. Sometimes, that means expectations are blown up, but in this case, the reality was better than the expectations, which is not easy. I’m talking about an episode of Invest Like The Best with Patrick O’Shaughnessy, and the guest was Netflix founder Reed Hastings. You can listen to that episode here.

The third and last podcast episode I want to share with you was with Gavin Baker. It had been on my list for a few weeks but with all the holidays, I hadn’t found the time yet before this week.

There are few analysts who are as knowledgeable about AI, tech, chips, and software as he is, and it’s always a pleasure to listen to him. You can listen to this episode of Invest Like The Best here.

The markets in the past week

Let’s look at the markets this week.

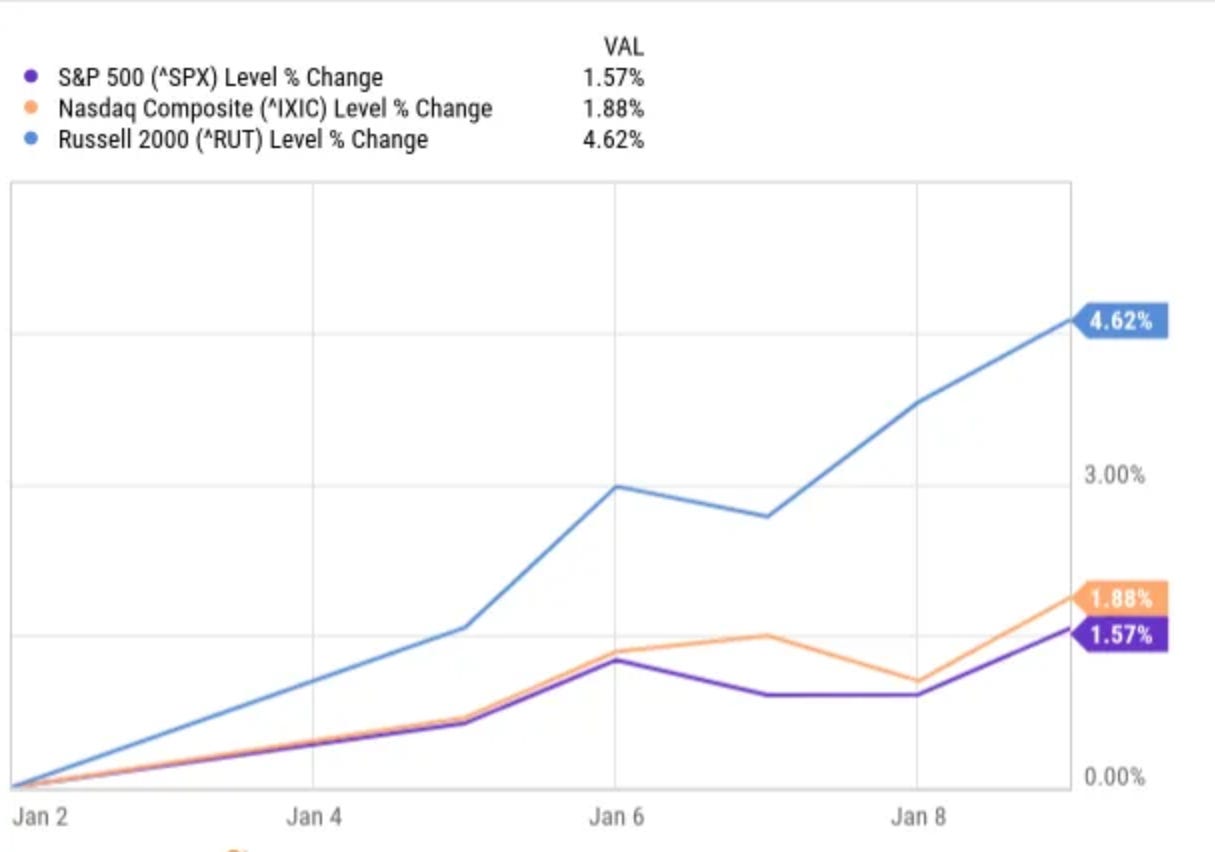

It’s remarkable that the Russell 2000 is up 4.62%. The S&P 500 was up 1.57% and the Nasdaq 1.88%%.

Why was the Russell 2000 up so much? Well, there are always multiple explanations out there. One is the “overvalued megacaps” story. I’m not a big believer here. While I see some overvaluation in some megacaps, that’s definitely not the case overall. But hey, it’s a story that sounds knowledgeable, right?

A second explanation makes more sense, I think. The Russell 2000 had quite a few losers in 2025. Investors sell those at the end of the year for tax purposes and then buy them back in January. It’s the so-called January effect, supported by the lower interest rates, which are favorable for small caps.

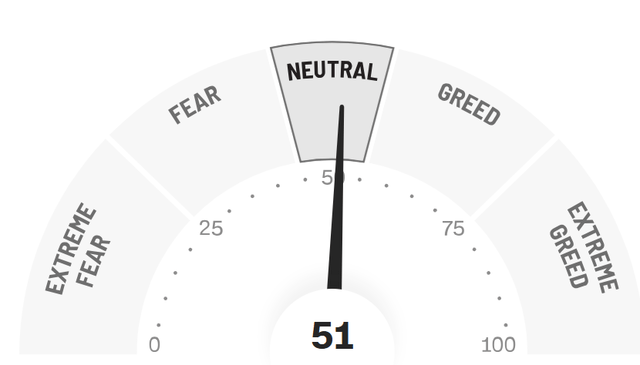

The Greed & Fear Index remained in Neutral territory.

Quick Facts

There wasn’t much stock market news in the last few weeks, so no Mark this week. But here are the Quick Facts.

1. Fiscal Slashes Price of Top Tier Plan to $79

Many will know that I have a partnership with Fiscal AI. And I have great news. Fiscal just dropped the cost of its most advanced plan from $199 to $79, making high-end analytics tools far more accessible. These are intended for industry experts but are now sold at consumer prices.

And with my link, you even get a discount of 15%. That means just $67.15 per month.

Fiscal has its own data, which sets it apart from everyone else. It uses AI, while big data providers often rely on people in the Philippines to manually enter the data. What do you think has the fewest errors? And usually, Fiscal has the earnings data within a few minutes. For smaller companies, with the other data providers, that takes a day, sometimes two. That’s how it can offer accurate, institutional-quality fundamental data for over 100,000 global stocks, ETFs, funds, and other investments,

You can also listen to or read earnings calls (transcripts) or conference presentations, track analyst estimates, look what superinvestors have in their portfolio, screen for your next investment with the best stock screener I know, talk intuitively with the data through the copilot function, make great charts, see Morningstar research, export and download your data in Excel, and so much more.

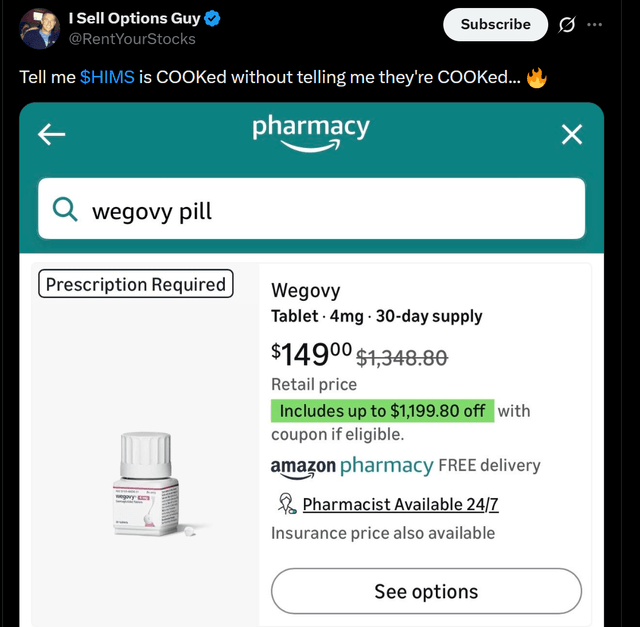

2. Does Amazon Wegovy Kill Hims & Hers?

This week, this post went viral on X.

A million people saw this and there was a slew of comments, mostly very negative.

I’m long both Amazon and Hims & Hers and I’m pretty sure both will be OK. 2026 could be a bit of a harder year for Hims & Hers because of the tougher comps but I’m OK with that. A lot of negativity is already in the price, which doesn’t mean that it can’t go down more, of course.

But I also think that too many people see this as a GLP-1-only company. It’s much more than that and it’s changing very fast. Just look at what the company achieved in 2025 alone:

Hims & Hers Health Labs (diagnostics & longitudinal biomarker testing platform)

Menopause & perimenopause specialty care (Hers

Automatic refill & continuity-of-care subscriptions (replacing one-off prescriptions)

Condition-specific long-term treatment plans (hair loss, ED, mental health, weight)

Ongoing clinician messaging & follow-up embedded in subscriptions

Hair growth gummies

Cross-sell of additional conditions into existing subscriber accounts

AI-driven personalization & care automation initiatives

Planned acquisition of Zava (UK, Germany, France, Ireland)

Canadian market entry (via Livewell acquisition)

Biotin + Minoxidil Gummy (hair growth)

Women’s daily wellness supplements (multivitamins, hair, nails, skin...)

Expanded OTC wellness formulations (non-prescription, preventative)

On top of that, management was elaborated and strengthened with many new faces.

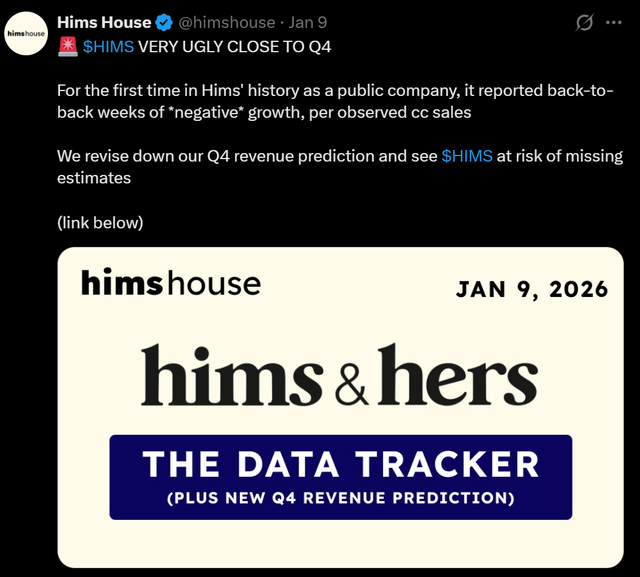

But that doesn’t mean that there’s no downside pressure. Just look at this, for example.

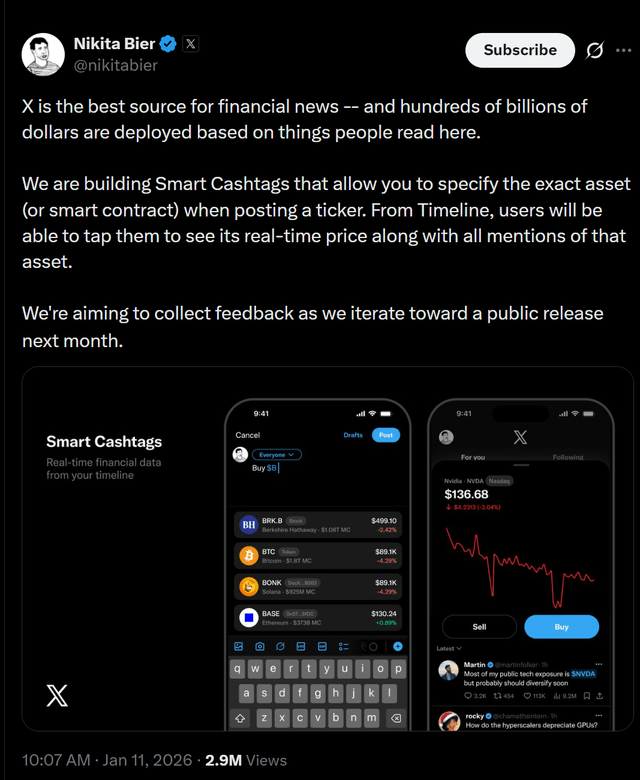

3. X Will Even Become Better For Finance

X, formerly Twitter, is one of the best platforms for getting stock information. And that will become even better. This was announced this week by Nikita Bier, Head of Product of X.

The Return Of The Potential Multibaggers

Here’s where the free part ends.

Don’t forget to subscribe now to get the free upgrade to the $1,200 plan (see above!) a yearly discount of $800.