Hi Multis

Let’s take a look at Global-e’s (GLBE) Q3 results.

David wrote this one, but as always, I edited, changed a few things and while David gave the basis for the PM Quality Score and the Valuation, I changed a few things there as well.

Hi Multis, David here. I’m happy to provide you with the earnings analysis of Global-e. Of course, as the company reported over a month and a half ago, this is not a red-hot subject. But with the way this is structured, with the Quality Score and the Valuation, this is still a very valuable article, I hope. Let’s go!

The Numbers

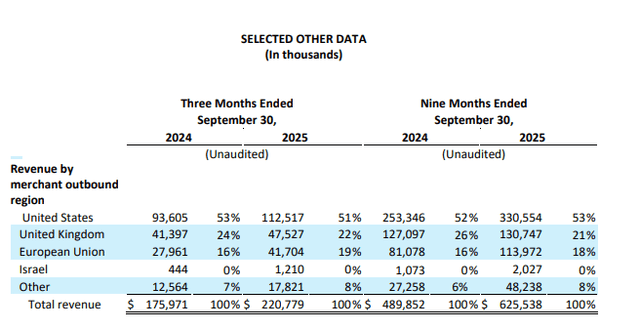

Revenue totaled $220.8 million, up 25.5% year over year and beating estimates by $2.92. The two main revenue components, service fees and fulfillment services, contributed $103.5 million and $117.3 million, respectively. Both segments grew by roughly 25% year over year.

As a reminder, service fees are charges for using the platform and are calculated as a percentage of the gross merchandise volume (’GMV’) processed through it. The more volume flows through the platform, the higher the service fee revenue for Global-e.

Fulfillment services operate differently. Under this model, Global-e manages the full scope of international operations, including shipping, logistics, customs clearance, and returns.

Gross profit came in at $99.6 million, up from $80.0 million last year—an increase of $19.6 million.

Gross Merchandise Volume grew by 33% year-over-year to $1.512 billion, bringing the total GMV for 2025 to $4.208 billion.

Overall, Global-e’s results were solid and the stock surged following the earnings release.

The Shopify Partnership

Global-e and that other Potential Multibagger, Shopify (SHOP), recently renewed and strengthened their strategic partnership. In October, they announced that Shopify’s Shop Pay will now be available to Global-e merchants. Shopify merchants can now offer one-click checkout with pre-filled customer details.

Atlee Clark, VP, Partnerships at Shopify:

Shop Pay offers merchants an accelerated checkout experience that drives conversion and enhances customer loyalty. By making Shop Pay available on Global-e’s platform, brands using Global-e can now offer a consistent, seamless checkout experience to their international shoppers.

This announcement further deepens the partnership, demonstrating that both companies are committed to working together. Shopify also owns about 12% of the shares of Global-e. This reflects more than a simple collaboration. Both want cross-border e-commerce to become a standardized, scalable solution. For merchants, it reduces barriers to international expansion. For Global-e, it reinforces its role as the backbone of Shopify’s cross-border commerce.

Business Growth

Global-e is expanding its business on multiple fronts.

The company recently announced new customer acquisitions, including Everlane, Aritzia, Coach, D1 Milano, October’s Very Own, and Le Coq Sportif. While not all brands are household names, consistently adding new customers is essential to keep the growth alive.

The expansion of its existing merchant base is strong. Bang & Olufsen and Tom Ford entered new European markets, Helmut Lang and JPY Entertainment expanded into Japan, and Vuori extended into over ten countries, demonstrating that Global-e’s services enable clients to seamlessly enter new markets.

Observing the impact of these customers on revenue is particularly insightful. While overall revenue has increased, it is interesting to identify which segments are driving this growth.

Revenue geography remained largely stable, with approximately 53% generated from the United States. Nevertheless, growth in non-U.S. markets should not be underestimated. Global-e remains primarily U.S.-focused but has significant potential for international growth.

Another key area to consider is sales and marketing, particularly the company’s investment in expanding revenue streams through targeted efforts. Notably, the company spent $146.2 million during the first nine months of this year, down from $179.7 million over the same period last year.

This indicates that aggressive marketing spend is not necessary to drive revenue growth. The company highlighted this as a positive development, noting its use of AI-powered tools to improve demand generation and outreach programs.

Adjusted Guidance & Future

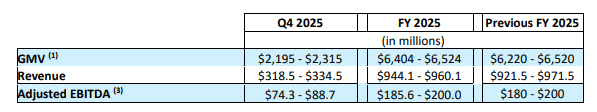

Global-e raised its full-year outlook.

Overall, Global-e has provided a stronger outlook across key metrics, including GMV, revenue, and adjusted EBITDA, reflecting confidence in the company’s performance. The company is on track to achieve its first profitable year in 2025. And with strong cash flows coming in, Global-e’s got the firepower to keep investing in growth.

Conclusion

Global-e delivered a solid Q3 2025, with good revenue growth, driven by GMV. The company continues to benefit from its strategic partnership with Shopify, which strengthens its position as a backbone for cross-border e-commerce. It helps merchants to expand globally with reduced friction.

The addition of high-profile clients and the expansion of existing merchants into new markets demonstrate the scalability and effectiveness of Global-e’s platform. While the U.S. remains the largest revenue contributor, growth in non-U.S. markets shows meaningful international potential, signaling that the company’s expansion strategy is already yielding tangible results.

Looking forward, Global-e’s outlook remains positive. With robust growth, expanding international presence, and a strong partnership ecosystem, the company has the tools and strategy in place to sustain its momentum and capture further market share, while navigating the complexities of global commerce.

The Potential Multibaggers Quality Score

Let’s look at the Quality Score and the Valuation Score, to see whether Global-e is attractive to buy now.

After Q2, Global-e scored high on the Valuation Score and it’s up 20% since. Don’t miss the next opportunity.

And now, for just a few days, there’s a 20% discount. Grab that discount now before it’s gone!

On top of that, if you act NOW, you will be upgraded to the Premium plan, which normally costs $1,200. It will give you my full portfolio, with all the trades. That’s a discount of $800. But don’t wait until it’s gone!