Hi Multis

The Q3 earnings season is over and Q4 is already almost knocking on the door. There are a few companies left that we haven’t covered the Q3 results yet, and that’s something we will do now. Celsius Holdings (CELH) is one of these. David analyzed the earnings. The stage for you, David!

Hi Multis

Without much ado, let’s dive right into the numbers.

The Numbers

Q3 2025 Revenue: BEAT

Q3 revenue reached $725.1 million. Although slightly lower than Q2’s $739.3 million, it surpassed analyst expectations of approximately $720 million.

Celsius posted 173% year-over-year growth, primarily driven by the inclusion of Alani Nu’s results. Alani Nu generated $332 million in sales, its strongest quarter to date, supported by successful limited-time offerings.

As noted last quarter, the Alani Nu acquisition continues to pay off. With two quarters now reported, Alani Nu is clearly sustaining overall revenue growth for Celsius.

Gross Profit

Gross profit totaled $372.3 million, up from $122.2 million the previous year, representing an increase of $250.1 million.

Gross Margin:

A year ago, Celsius operated with significantly lower gross profit margins: 46% in Q3 2024. This quarter, the company again delivered solid results with a 51.3% margin, slightly below Q2’s 51.5%. Very few beverage brands have 51% margins while continuing to expand market share.

Celsius posted solid numbers across the board for Q3. Let’s take a closer look at what else they accomplished.

The PepsiCo Connection

Celsius maintains a strategic partnership with PepsiCo focused on the energy drink category. In August, the two companies announced a deeper partnership.

PepsiCo is expanding its distribution network for Celsius Holdings, including Alani Nu, across the U.S. and Canada. PepsiCo purchased $585 million in newly issued convertible preferred stock from Celsius. Celsius, in its turn, acquired the Rockstar Energy brand from PepsiCo in the U.S. and Canada.

This is already a significant partnership. Celsius also appointed Garrett Quigley, formerly President and SVP of PepsiCo and the man behind Pepsi Max, to lead the company’s expanding footprint.

Integrating Alani Nu into PepsiCo’s distribution network should accelerate its reach and support its positioning as the fastest-growing brand in the energy drink category.

This appears to be a mutually beneficial partnership. Celsius can further leverage PepsiCo’s scale and expertise, especially in North America.

Meanwhile, adding Rockstar to the Celsius portfolio may not materially change results today, but it signals that PepsiCo is leaning into Celsius’s understanding of the energy drink market and prefers partnership over competition.

PepsiCo clearly does not want to lose ground in the energy drink space. Increasing its investment in Celsius allows PepsiCo to benefit from category growth without directly competing against Celsius, creating a strategic, non-competitive alignment.

CEO John Fieldly emphasized this:

Stepping into the role of PepsiCo’s strategic energy drink captain in the U.S. is expected to be a pivotal milestone in our journey to shape the future of modern energy and grow our brands within a leading beverage distribution system.

With a proven functional beverage portfolio and a stronger long-term partnership with PepsiCo, we believe that Celsius Holdings is well-positioned to deliver greater innovation, sharper execution and sustained brand growth. Together, we will reach more people, in more places, more often, with a total energy portfolio that offers options for every consumer and creates greater value for all our stakeholders.”

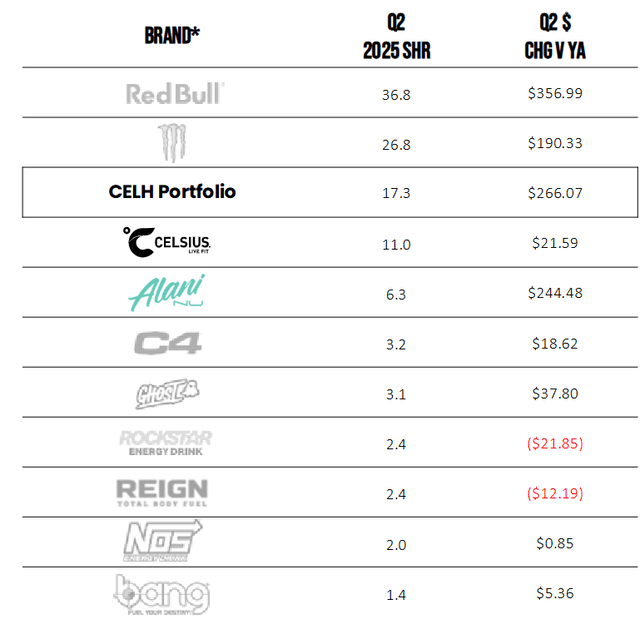

Looking back at the Q2 data, Rockstar held only 2.4% market share. No surprise, then, that PepsiCo is comfortable letting Celsius manage the brand.

Strengthened partnership for Celsius, extended reach, and a stronger brand growth of Alani Nu, and for PepsiCo, a bigger foothold in the growing energy drink market. That all sounds good.

Historically, similar partnerships succeed when both parties stay aligned over the long term. The key questions now are:

How far can Celsius expand with PepsiCo’s support?

How committed is PepsiCo to the partnership over time?

While the upside is significant, the risk of dependency is real. Switching costs are another consideration. Celsius must pay a $246 million termination fee to move Alani Nu into PepsiCo’s distribution system. PepsiCo, however, has agreed to cover the entire fee, which reduces the financial risk for Celsius.

Transitioning distributors always comes with operational challenges, but the long-term benefits—improved shelf placement, distribution scale, and better execution—should outweigh the near-term friction. So far, PepsiCo appears genuinely committed.

Expansion

In our Q2 analysis, we highlighted Celsius’s expansion strategy. In Q3, the full portfolio represented 20.8% of the market, up from 17.3%. Excluding Rockstar’s 2.4% share, core CELH/Alani Nu market share increased 1.1%, driven largely by Alani Nu’s rapid rise. Alani Nu held a 3.6% share in Q4 2024 and has nearly doubled to 7.2%.

As noted earlier, Celsius appointed ex-Pepsi President Garrett Quigley to oversee international operations, which is a clear signal that global expansion is a priority.

Last quarter, I mentioned that I couldn’t find any Celsius products in my area. During a recent trip through several European countries, however, I noticed that Celsius products are much more widely available there.

In France, the brand now reaches 88% of shoppers through offerings in Carrefour, E. Leclerc, Intermarché, and many others. In Belgium and Luxembourg, it expanded through Delhaize and Intermarché. And this is only part of the expansion I’ve seen.

Planning international expansion is one thing; executing it efficiently is another. A brief shopping tour revealed that Celsius products are still not as prominently displayed as Monster or Red Bull. In several cases, my partner and I had to ask whether the stores carried the products, and employees directed us to their locations. The cans were often placed very high or low on the shelves, rather than in the premium positions typically occupied by Monster and Red Bull. Below is an image of what I found at a Delhaize in Belgium:

It will be interesting to see the results of their increased expansion. For the full year, Celsius reported international revenue of $70.6 million, a 30% increase from the same period last year. For the quarter, I calculated revenue of $23 million, which is slightly lower than the previous quarter’s $24.8 million.

Conclusion

Celsius delivered another strong quarter, supported largely by the continued absorption of Alani Nu’s revenue and steady margin improvement. The PepsiCo partnership remains the most important long-term catalyst, expanding distribution for both Celsius and Alani Nu while signaling PepsiCo’s deeper strategic alignment through its additional investment. The handoff of Rockstar and the transition of Alani Nu into PepsiCo’s system reinforce that PepsiCo sees Celsius as a core player in its energy portfolio rather than a short-term experiment.

At the same time, Celsius is executing on international expansion faster than expected. Shelf placement and visibility still lag the leaders in many markets, but distribution breadth is increasing meaningfully, particularly across Europe. That early presence gives Celsius room to scale as the brand gains recognition.

Key risks remain execution-related: dependence on PepsiCo for distribution, the integration and expansion of Alani Nu, and potential slower-than-expected international sell-through. Nevertheless, the growth narrative remains intact. With increasing market share, strong margins, and an expanding footprint, Celsius appears well-positioned to continue outpacing the broader energy drink category.

The Potential Multibaggers Quality Score

Let’s look at the Quality Score and the Valuation Score, to see if Celsius is attractive to buy now.

Back in Q4 2024, Celsius scored 9/10 at $25. It’s up +105% since. Don’t miss the next opportunity.

And until Saturday, there’s a 20% discount. Grab that discount now before it’s gone!