Boom! Another New Potential Multibagger Pick! (OOTW 36)

On Tuesday, 9 am, the new pick will be released!

Hi Multis

It was a productive week. This is the fourth article this week. And yes, I also worked on another Potential Multibagger, as you can see in the title.

Yep, just two weeks after the last one.

I’ve always said: picks come when the opportunity is there, not when I “should” publish one, like most services do.

Sometimes that means months without a new pick. Sometimes it means two in two weeks. Like now.

The pick will be released on Tuesday at 9 am EST, so half an hour before the market opens. Exciting times at Potential Multibaggers!

Articles In The Past Week

As I mentioned, this is the fourth article this week.

In the first article, we looked at the 5 Best Buys Now for September. In the first three years after the launch of the Best Buys Now, the outperformance is 32.19% on average per pick versus the S&P 500.

If you want to know what the 5 Best Buys Now are and see the whole track record, you can upgrade. Until Monday evening, there’s a $100 discount with this link.

I think the most recent Best Buys Now show that same pattern again: stocks of fantastic companies that have negative sentiment because of stories.

Often, those stocks suddenly shoot up, after good results, or they stealthily climb and keep climbing.

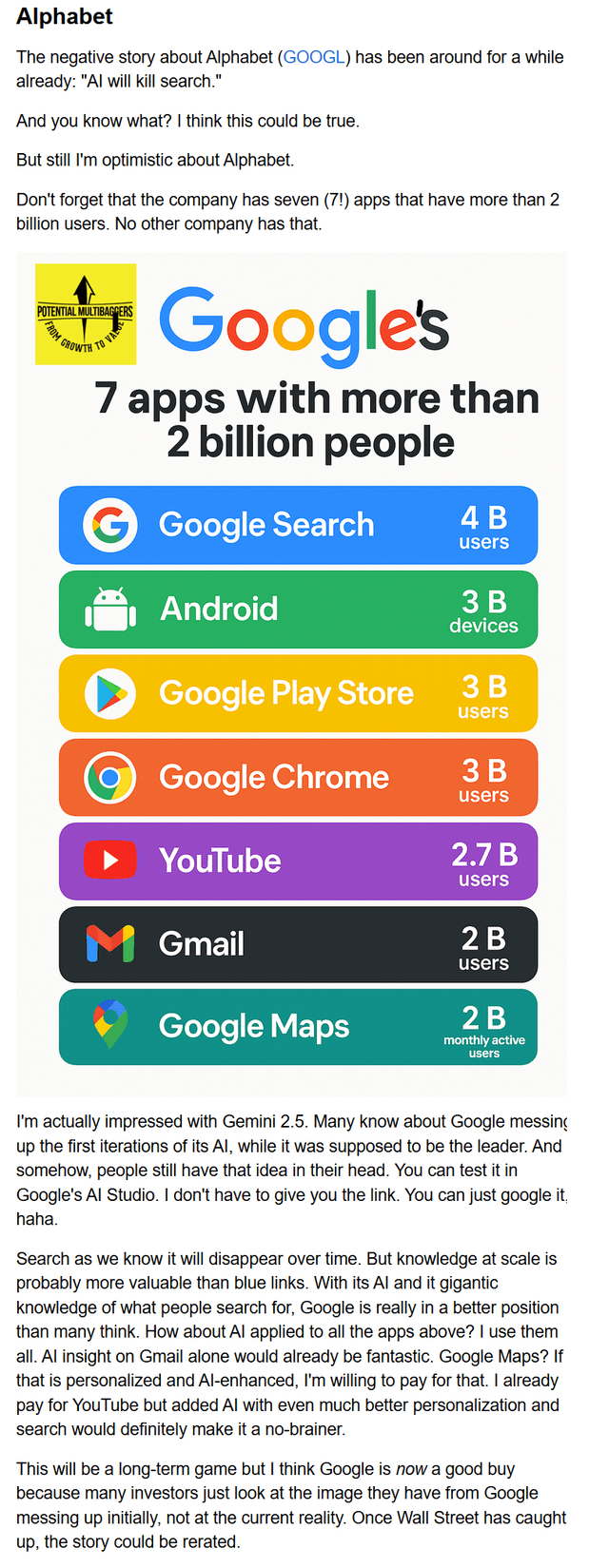

An example? I picked Alphabet (GOOGL) (GOOG) in June when sentiment was that AI would kill its search. This is what I wrote in the Best Buys Now of June, just three months ago:

The stock is up 44.1% in three months.

The second article of the week was a more contemplative article about AI and whether this is a bubble or not.

And last but not least, there was an analysis of Celsius Holdings, which was David's first article. Welcome to the team, David!

Memes Of The Week

I already used this one before, but I still think it's one of the best memes out there.

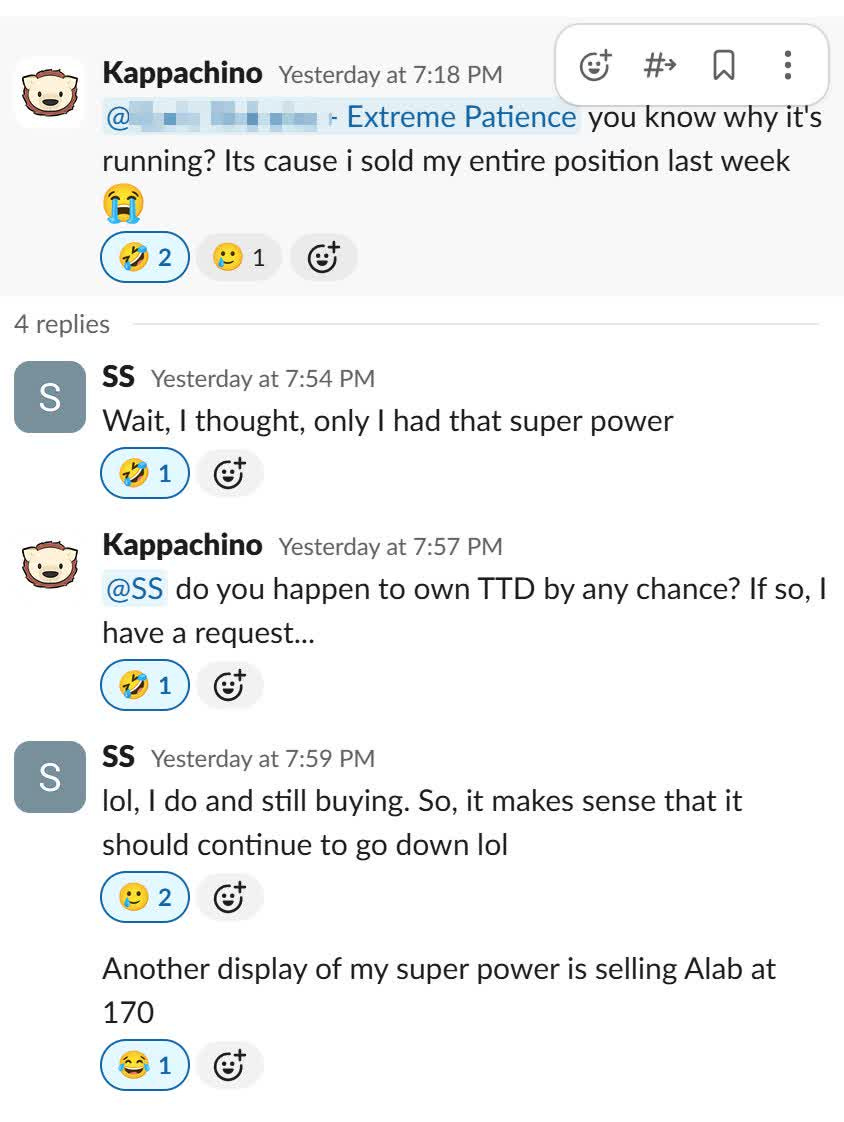

I also laughed out loud with this conversation in our private Potential Multibaggers group for paid members. The question someone asked was why ASML was running this week.

Interesting Podcasts Or Books

A podcast that was already out last week, but I only listened to it this week was The Business Brew interview with Braden Dennis.

I always enjoy podcast episodes with people I know from outside the podcast and that's the case for Braden Dennis. He's the founder and CEO of Fiscal.ai, the financial data platform I use every single day.

If you want to listen to Braden's cool story, you can do that here (or click on the image).

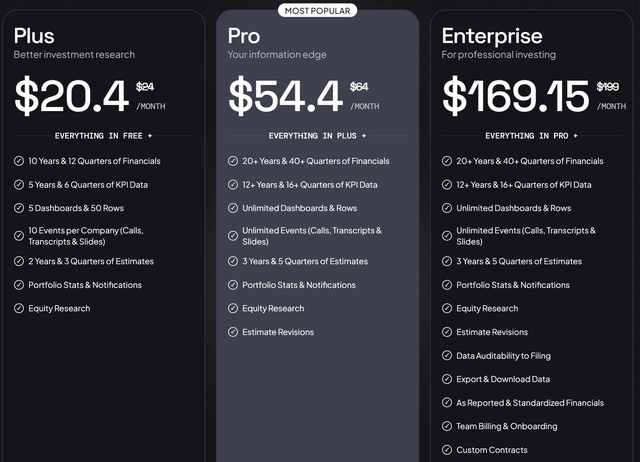

If you want to try out the Fiscal AI platform yourself, here’s a nice little bonus. Use this link and you’ll get 15% off.

Many Multis have already taken the offer. So far? Zero complaints.

And let’s be honest… People usually love to complain.

The fact that nobody did? That tells you everything you need to know about the value.

It’s a great tool. At a fair price. These are the prices you get with my link.

This week, Bill Brewster, the podcast host of The Business Brew, had David Gardner as a guest. And while I have not listened to that episode yet, I definitely will. And so, David Gardner makes it three times in a row in the Overview Of The Week, a record. You can listen to the episode here (or by clicking the image).

The markets in the past week

Yet another week that the markets were up. Now, I'm not complaining, mind you, but every now and then, a down week is healthy for the markets to let out some hot air.

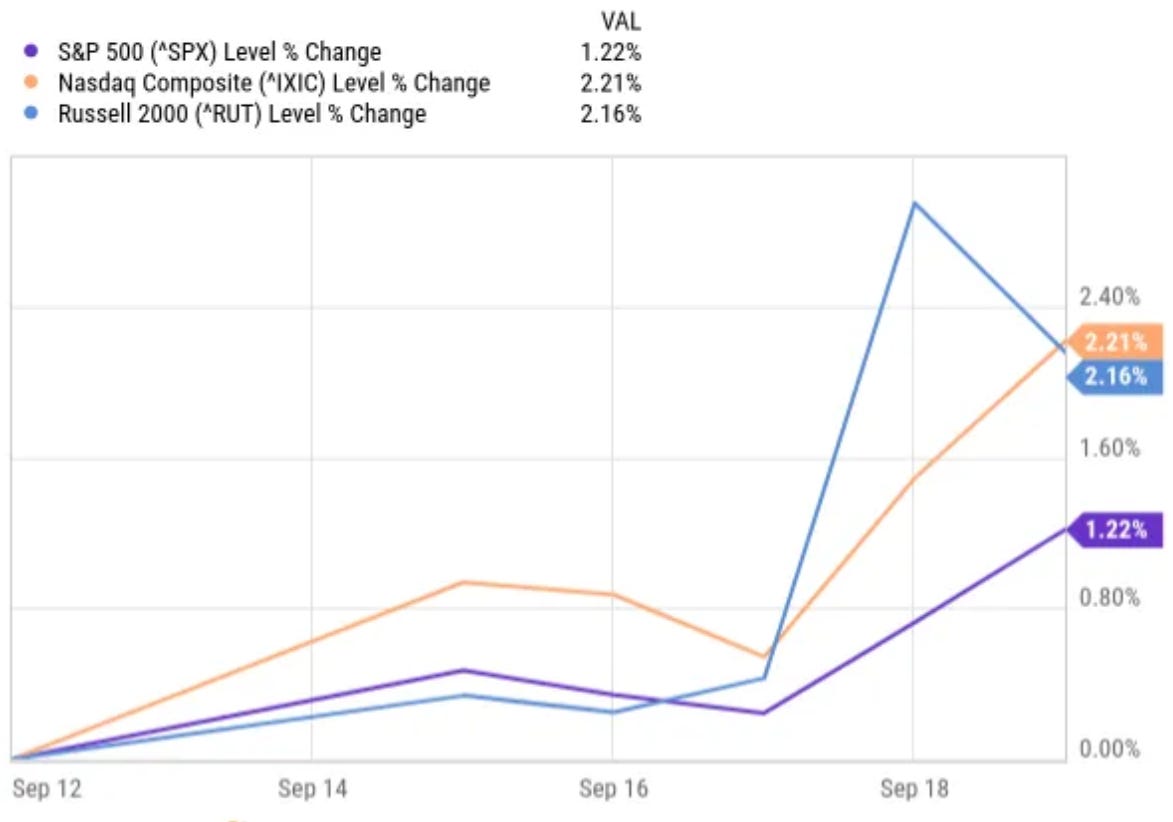

The S&P 500 was up 1.22% this week, while the Russell 2000, which is always more volatile, was up 2.16% and the Nasdaq 2.21%.

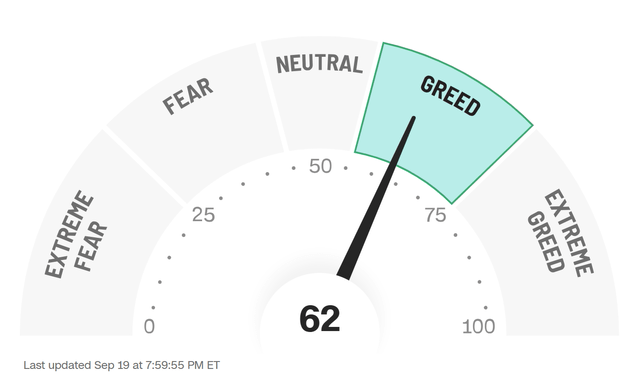

While the markets were up in the last twee weeks as well, the Greed & Fear Index remained in Neutral, weirdly enough. This week, it did what I would have expected in the last two weeks: it went from Neutral to Greed.

Lesson Of The Week

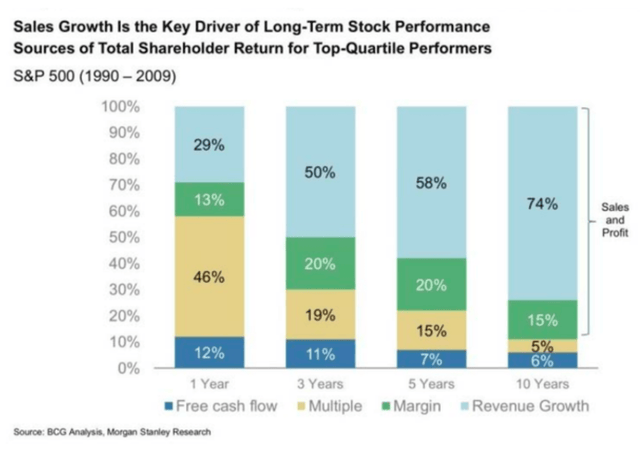

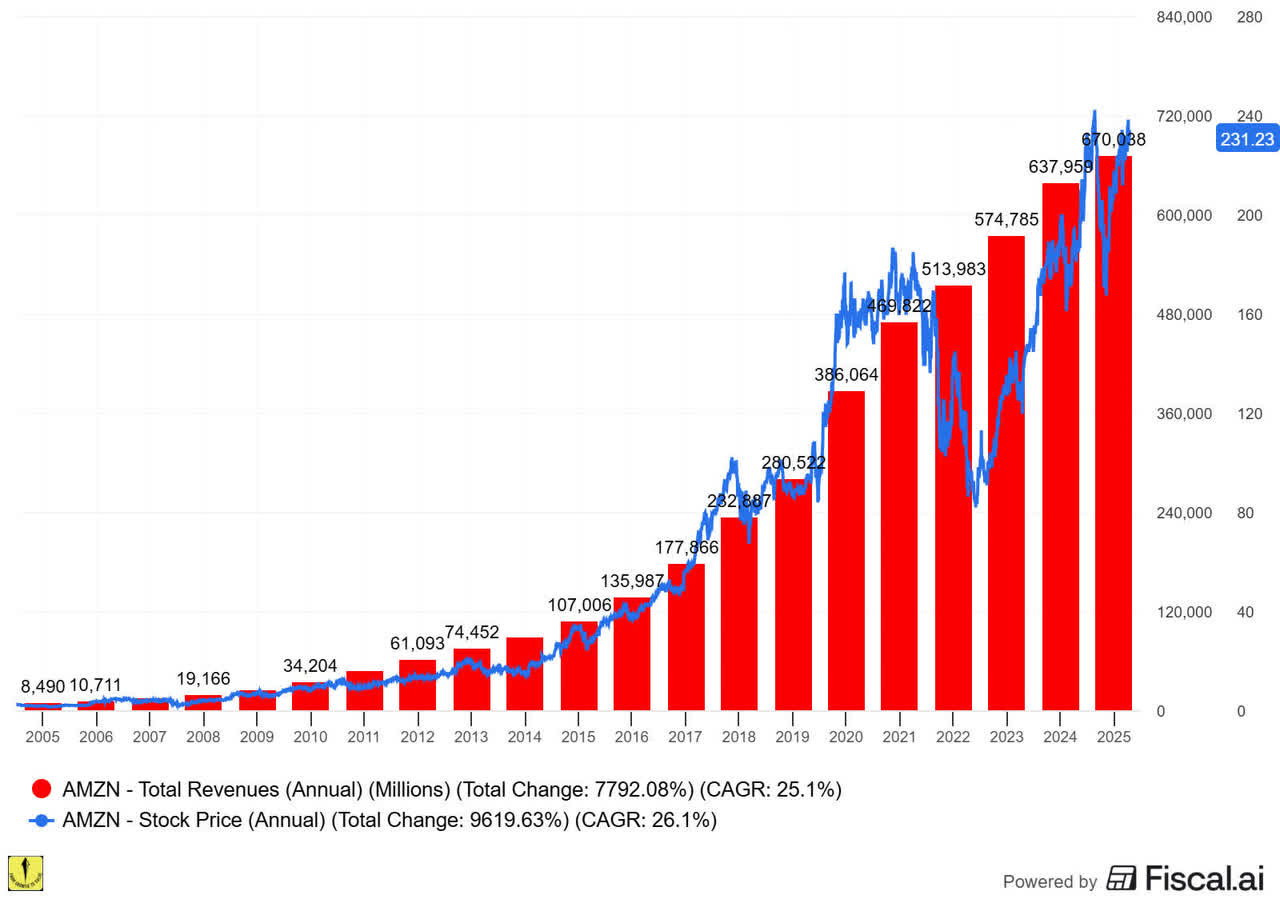

This week, the lesson is another graph. And it's one that shows that the graph of last week is not just theory. This was that graph.

As you can see, the most important element for long-term stock price return is revenue growth. Just look at this Amazon example.

Revenue CAGR (20 yrs): +25.1%

Stock CAGR (20 yrs): +26.1%

Do you see the pattern?

Quick Facts

1. Cyber Attacks in European Airports

Airports across Europe continue to face major disruptions on Sunday following a cyber-attack that hit check-in systems provided by Collins Aerospace.

London Heathrow, Berlin and Brussels airports were all affected. The airlines there were forced to switch to manual check-ins. While most flights at Heathrow are expected to operate on Monday, Brussels Airport has asked airlines to cancel half of their scheduled departures to manage the mess.

Collins Aerospace confirmed it was dealing with a “cyber-related incident.”

At Heathrow, 90% of over 350 flights were delayed by at least 15 minutes on Sunday. Additionally, there were six cancellations and an average delay of 34 minutes. Thirteen flights were cancelled on Saturday. Additional staff had been deployed to assist.

Brussels Airport saw 86% of Sunday flights delayed, with delays ranging from 15 minutes to four hours. The airport canceled 50 of 257 scheduled departures on Sunday and 25 on Saturday to reduce queues and avoid last-minute cancellations.

Berlin Airport also reported delays on 73% of its 200 flights. Passengers were advised to use online and self-service check-in options where possible.

The cyberattack is another one in a growing list of incidents affecting major companies across Europe. Jaguar Land Rover recently halted production for three weeks due to a hack, and retailers like Marks & Spencer and the Co-op have also been targeted this year.

There are rumors that the company is willing to pay the ransom. Mind the formulation here; these are just rumors. Officially, no extortion payment has been made public. Based on earlier cases, it is likely to be somewhere in the $1 million to $5 million range. For companies, that's lower than the millions they lose every day from not being able to operate as they should and that's why they are often willing to pay.

More and more, it seems that it's not a matter of 'if' but 'when' you will be hacked. That's why cybersecurity is not an afterthought anymore for companies. Companies like CrowdStrike, Cloudflare and others all have their own specialty in security and these cyberattacks show that it's not a luxury to have such top-notch protection.

2. Meta Bets Big on Smartglasses

At Meta Connect 2025, Mark Zuckerberg made one thing clear: he finally wants Meta (META) to have a breakthrough hardware product. And he thinks smartglasses will be it.

He claimed Ray-Ban sales are now tracking alongside some of the best-selling electronics in history, hinting at 5 to 10 million units sold this year. He stopped short of calling them the next iPhone, but the comparison was obvious.

Meta unveiled a refreshed Ray-Ban line with 3K video recording, longer battery life, and a new “Conversation Focus” feature that isolates voices in noisy environments. Prices start at $379. A live demo of the new “Live AI” assistant flopped on stage, with execs blaming poor Wi-Fi. We've seen that before.

My friend Vitaliy Katsenelson has the Meta Ray Bans and said I had to try them. I was impressed by them, to be honest. The sound of Vitaliy's favorite classical music (follow him here to discover his favorite classical music ) sounded much better than I had thought.

Also announced: the Oakley Vanguard smartglasses. Built for fitness and outdoor use, they feature 9-hour battery life, 3K stabilized video, and integrations with Garmin and Strava. They’re Meta’s most water-resistant glasses yet, launching October 21 at $499.

But the biggest reveal was the Meta Ray-Ban Display. It's the first pair with a built-in screen. The display sits just outside the user’s direct line of sight, remains visible even in sunlight, and boasts sharp pixel density. The glasses come with a neural wristband for gesture control, and support real-time subtitles for accessibility. They’ll ship in a few weeks starting at $799.

I don't know about you, but I think these still look dorky.

On the software side, Meta introduced Horizon Studio. It can replace Unity and support larger multiplayer spaces and Hyperscape Capture, which allows Quest users to scan real-world rooms into 3D replicas.

Meta also rolled out a new entertainment hub for Quest headsets, aggregating content from partners like Disney+, Universal Pictures, and Blumhouse.

3. The Fed Meeting

Overall, I'm a big believer in what Peter Lynch famously said:

But OK, let's do this. The Federal Reserve appears to be placing greater emphasis on labor market risks than on inflation.

GDP growth expectations for 2025 were strong and revised up to 1.6% from 1.4% in June. Unemployment projections for 2025 remain at 4.5%, but those for 2026 and 2027 are expected to be lower. The core PCE inflation is the Fed's preferred inflation measure stick. It stands for Personal Consumption Expenditures. Core means that volatile items, such as food and energy, are excluded. The Core PCE is still expected to be 3.1% in 2025, but the 2026 estimate rose slightly to 2.6%.

The Fed funds rate outlook dropped to 3.6% for 2025, meaning there could be two more rate cuts.

Chair Jerome Powell called the job market "unusual." He attributed the recent slowdown in hiring to weaker immigration rather than a decline in demand. This could mean more inflation, of course, but right now, inflation is mostly because of the impact of tariffs, Powell said. But that inflation is seen as manageable and temporary.

4. Mercado Libre Buys Its Brokerage Partner

Mercado Libre (MELI) is buying its long-time Brazilian brokerage partner, Nikos DTVM.

The move gives MELI more freedom to build and scale financial products in Brazil. It can now fully integrate trading, savings, and credit into its platform, making it easier to cross-sell and keep users locked into its ecosystem.

MELI already leads in e-commerce, and its fintech arm is growing fast, which was my investment thesis when I picked MELI. Outside of Nu Holdings, no one is innovating at this pace.

5. Nvidia Invests $5B in Intel

Nvidia is investing $5 billion in Intel to co-develop chips, sending Intel shares up more than 20%. Not a bad start for Nvidia's investment for sure.

The timing raised some eyebrows. Just days earlier, the US government disclosed its own stake in Intel. Taken together, the moves look less like a coincidence and more like a political move.

For now, Nvidia gets an R&D partner, Intel gets cash and credibility, and the government keeps its American chip foundry afloat.

6. Google Embeds Gemini AI Into Chrome

Google is rolling out its Gemini AI assistant inside Chrome across Mac, Windows, and mobile in the US. Users can now ask Gemini to summarize pages, manage tabs, or perform tasks like scheduling meetings and pulling up YouTube videos without leaving the browser.

Gemini is also being deeply integrated into Google apps like Maps, Calendar, and YouTube, tightening the loop between browsing, search, and productivity. It can even handle real-world tasks like booking haircuts or ordering groceries, a capability once tested under “Project Mariner.”

OpenAI is developing a browser. Anthropic’s Claude and Perplexity’s Comet also want to rethink how users browse with AI.

Browsers are strategic control points for the internet. That’s why the DOJ previously tried to force Google to divest Chrome. But a judge recently ruled that AI has shifted the landscape too much for that argument to hold.

For Google, this is both a defensive and offensive move. Embedding Gemini makes Chrome stickier, so offensive. But it also pushes back against AI rivals trying to own the AI browsing experience, so defensive.

7. TikTok US: Oracle, Dell, Ellison, Murdoch...

Under a 2024 law, TikTok must sell about 80% of its U.S. business to American investors or face a nationwide ban.

Earlier this week, it was announced that Oracle, Silver Lake and Andreessen Horowitz would be buying TikTok US to reach that goal.

Earlier today, President Donald Trump also named Larry Ellison, Michael Dell, Rupert, and Lachlan Murdoch as key players in the group set to take over TikTok’s U.S. operations.

The Murdoch involvement could bring Fox Corp. into the deal. That would mean a much-needed digital boost as traditional TV revenues decline.

Oracle will still lead the U.S. data hosting, but it has been doing that since 2020. Next to that, it's also expected to remain a central investor.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ The upcoming pick

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by more than 30% over 3 years.

And good news: there’s a $100 discount.

But be quick! It expires Monday evening.