Celsius Just Grew 84%. Here’s What You Should Know

Revenue jumped 84%, but most came from Alani Nu

Hi Multis

I’m thrilled to introduce our newest contributor: David.

He’s got a sharp analytical mind, a genuine passion for investing, and a knack for clear, thoughtful writing. Starting today, he’ll be sharing his insights with you through regular articles.

This is his first article, and I think it’s a strong debut.

Rather than give you a long intro, I’ll let David do the talking and introduce himself.

Hi Multis,

My name is David, and I’ve been fascinated with the stock market from a very young age, devouring every book about investing and business I could get my hands on. Business, finance, and markets have always been a passion of mine and this made me pursue a career in finance.

Outside of my work, I enjoy reading, still mostly about business and investing, but also about history, science, and human behavior. Next to this, I enjoy games with a strategic flavor, such as the board game Risk. Cooking for friends and family while having amazing dinner conversations rounds up the list.

Most of all, I’m excited to be joining the team! Here's my first article.

Celsius HOLDINGS (CELH) Q2 Results

The Numbers

Revenue: HIT

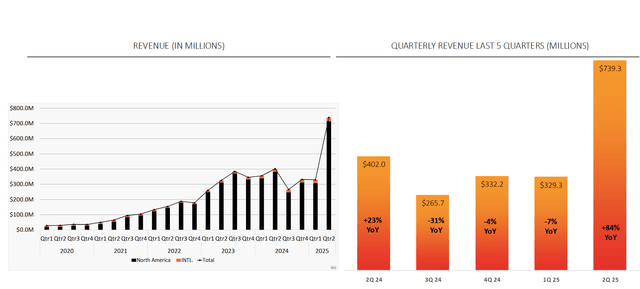

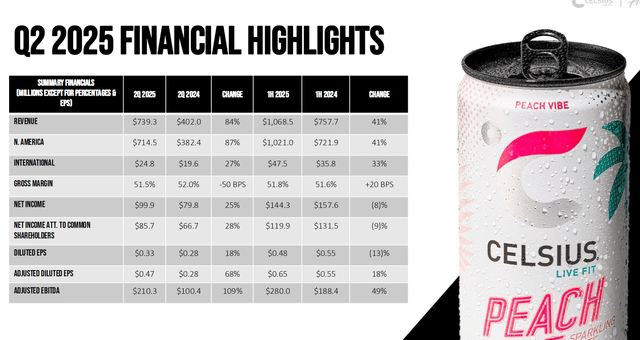

Revenue $739.3 million (+84% Y/Y).

Celsius posted an incredible increase in revenue numbers. However, most of the increase came from newly acquired company Alani Nu’s revenue contribution, but more on that later.

EPS: BEAT

Q2 GAAP EPS of $0.47 beats the consensus of $0.20-0.25 by about $0.22 an increase of 68% Q/Q, but $0.08 lower Y/Y.

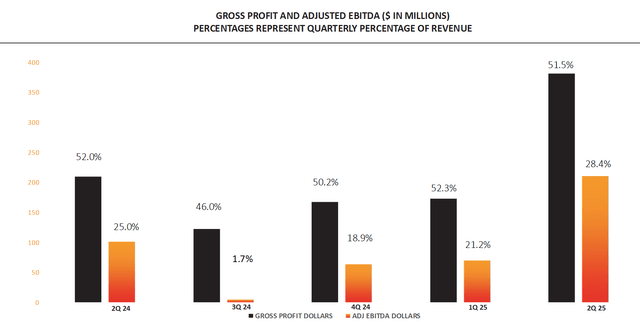

Gross Profit:

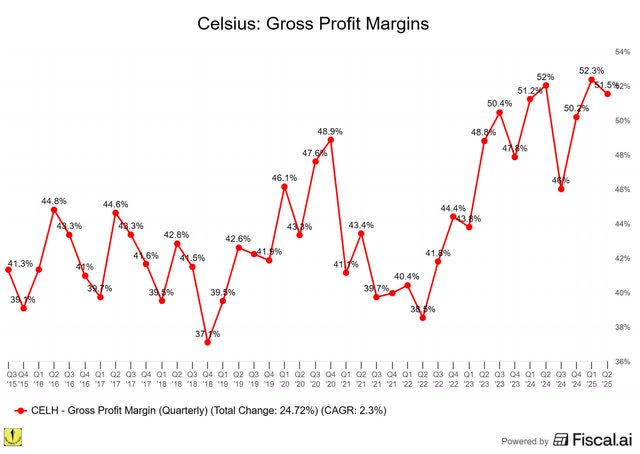

$380.9 million, up from $172.9 million last quarter and $209.1 million last year. Gross profit margins stayed strong at 51.5% (compared to 52.3% last quarter and 52% Y/Y).

Gross Margin:

51.5%, down from 52.3% previous quarter due to inclusion of Alani Nu’s lower margin products.

These numbers are very strong, especially since Celsius was able to increase revenue and profits while maintaining its operating margins at a stable level. The obvious question here is, then, how did Celsius increase its top line significantly without incurring margin loss?

The Alani Acquisition and Margins

Celsius acquired competitor Alani Nu in April 2025, for $1.8 billion (including $150 million in tax assets) to cater to consumers who seek zero-sugar alternatives. Alani Nu immediately increased the top revenue line by $301 million, which accounts for about 41% of the revenue generated in Q2. Celsius itself was able to increase the top line by 9% for its brands, due to expanded velocity and expanded distribution channel sales, which gives a good view of the increase Celsius was able to generate.

On the Alani acquisition, John Fieldly, Chairman and CEO of Celsius, had the following to say:

The Alani Nu founders and team have built a leading portfolio of health and wellness lifestyle products enjoyed by a large and loyal consumer base. We expect to continue creating the same great-tasting products Alani Nu is known for and innovating even more great flavors and collaborations to reach more people, in more places, more often.

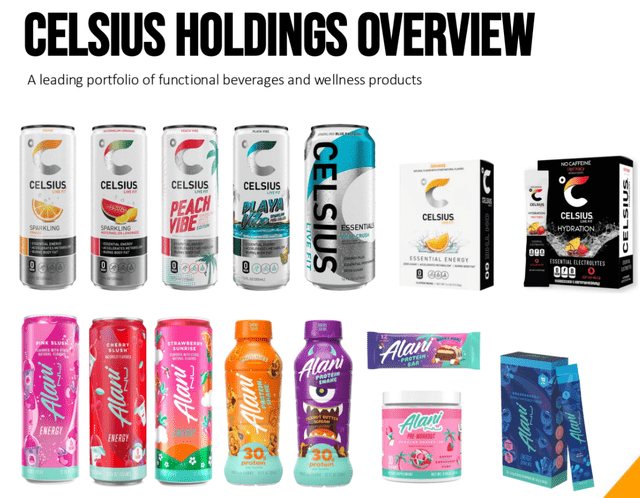

Celsius wants to be a company that offers more than only energy drinks; they do this as well within their marketing, where “a portfolio of premium, lifestyle energy and hydration beverages” can be found in numerous references. The investment thesis of Alani Nu is an interesting one as it increases Celsius' portfolio substantially; however, most of the added revenue will be from energy drinks.

Making an acquisition work is always tricky, even when it is a horizontal acquisition, as Celsius did by taking over Alani Nu. The risk of cannibalization of market share is always lurking around the corner.

Analyzing the success of a merger of this size will be challenging to perform beforehand, but let’s dive a little into the combined firepower of the two companies and see how they can increase the value of Celsius.

Celsius now has a household penetration of 43%, a fancy way of saying that about 43% of all American households have purchased a Celsius product at least once during the measured period. For Celsius itself, the penetration is 34% and for Alani Nu, it is 22%.

On the surface, these numbers seem high, but as reliable data from Red Bull and Monster is absent, it is difficult to ascertain the strength of Celsius in this regard. Estimates for Monster and Red Bull range between 40-60%, which would be higher than Celsius’s; however, considering their market share, this would be reasonable. Household penetration of Coca-Cola, the de facto king here, is estimated to be 70%.

On their own, these numbers don’t say much; however, combined with repeat rates of 65% means that 65% of the customers who bought Celsius products, are returning to the store to buy their products again, turning into repeat customers.

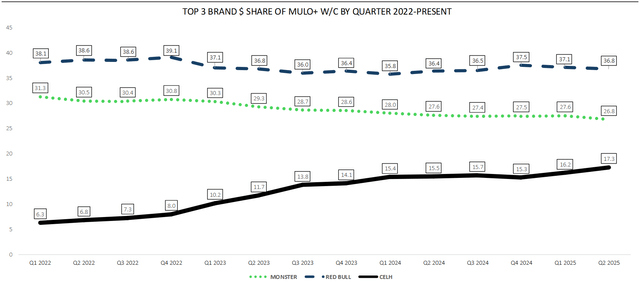

If Celsius can keep backing up these figures, we can really say they are building loyalty within their customer base. Something we can see when we look at the graph of the three brands with the highest market share, the top two brands are well known and are Red Bull and Monster, respectively; however, Celsius is slowly growing to increase their brand awareness and market position, as you can see in this chart.

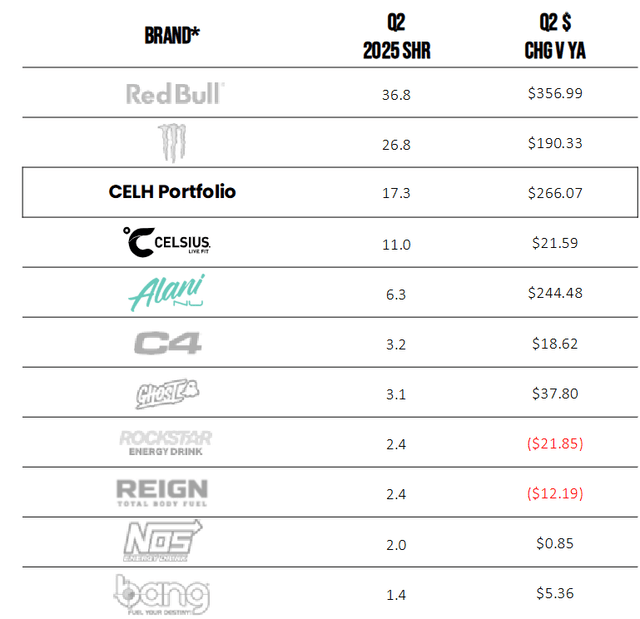

In the following graph, we clearly see Red Bull and Monster holding their top positions of market share; however, the next two brands are owned by Celsius: Celsius and Alani Nu (together the CELH Portfolio now).

Management attributes the increased market share to the introduction of new flavors. The new flavors were mainly limited editions. They all contributed to the increase in market share. Having two brands producing different flavors might put a strain on marketing and development costs. However, Alani Nu caters more towards female customers and a wellness audience, which is a growing trend in the US where zero-sugar, wellness, and functional drinks are part of a shifting consumer trend.

As mentioned before, making a horizontal acquisition of this size work will be a difficult task. That brings us back to margins. After an acquisition, margins often shift. Sometimes, higher, sometimes lower.

Celsius was able to keep its gross margins at 51.5%, down from 52% in Q2 2024 and from 52.3% in Q1 2025.

Alani Nu has structurally lower margins. But that was offset by the lower ingredient costs, stronger production yields, and a favorable mix (driven by the limited flavors). That had a positive impact on the margins.

On top of that, management was already able to include some cost efficiencies within the Alani Nu brand. This was more of a one-off, as structural cost efficiencies cannot always be found. Celsius was able to utilize FIFO on its inventory costs as it did not see any tariff implications on its stock yet.

Expectations are that the tariffs will be implemented in Q3. That will have a negative impact on the business from then on. We can assume that lower margins then.

Expansion

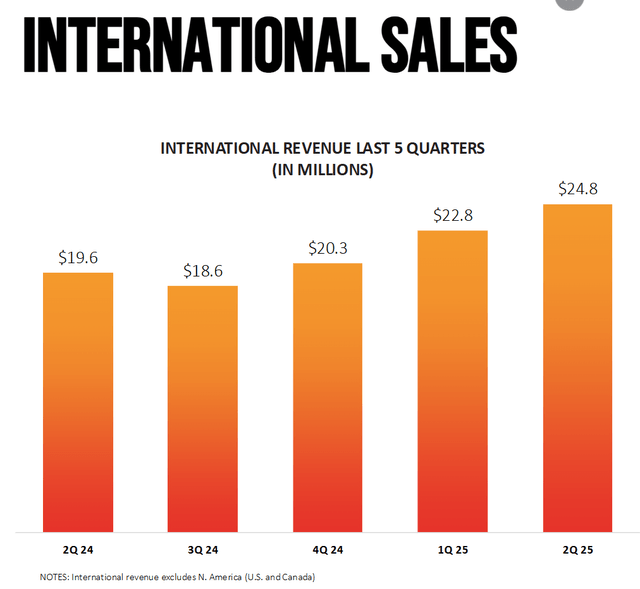

In 2024, Celsius announced its expansion plans. After Canada, it is now expanding further into its international market (outside of the U.S. and Canada). Ex-North American revenues increased by 27% year-over-year. The expansion includes the UK, Ireland, France, Australia, New Zealand, and the Netherlands.

I noticed that there is no Celsius to be found anywhere in my area. When I asked friends, who are fervent Red Bull or Monster drinkers, barely any of them had drunk or even heard of Celsius. Celsius is working with influencers to increase brand awareness, while Red Bull and Monster focus more on big events to showcase their brand. As such, the influencers in Europe are different than the prevailing influencers within the U.S. and Canada who are promoting the brands.

Previously, they mentioned the runway for international expansion is long, as competing against Red Bull and Monster, who have a reliable track record and consumer base, will be challenging. Sales of Celsius in its international market segment are negligible compared to global sales of, for example, Monster, which are estimated to be between $400 million and $ 450 million in Europe, the Middle East, and Africa combined.

International expansion will be a tough nut to crack for Celsius, especially since incumbents are deeply ingrained in the culture and the minds of people. Celsius wants to break through by working closely with Suntory, one of the oldest distributors in the world.

Celsius will have to push on the marketing accelerator to gain traction on the ground, and as with any drinks, making customers try your drink is not the same as effectively buying your product. Figures of repeat customers and increased market share in their home market show that there is potential; however, each market is different.

Conclusion

Celsius Holdings is doing well. It's expanding on its home turf with a (thus far) successful acquisition. There's a rising demand for healthy products, where they can play a crucial role with their expanded product offerings, and they are also gearing towards expansion outside of the U.S. and Canada.

Positive sentiments flowed within the stock afterwards, but were tempered partially due to classic doubts of international expansion as customer flavors differ.

I am convinced, however, that the employed strategy of Celsius, where they look for test markets and small penetration before bringing in the big guns, is the best strategy. And as we have seen, the international sales are increasing, making the case for a much larger expansion in the future.

The Potential Multibaggers Quality Score

Kris taking over here. I hope you enjoyed David's first article. Let's look at the Quality Score and later also the Valuation Score, to see if Celsius is attractive to buy now.

Let's start with the PM Quality Score. If you want a full breakdown with all the nuances of the quality score for Celsius, you can find it here. For now, I'm just going with a fast assessment.

Back in Q4 2024, Celsius scored 9/10 at $25. It’s up +120% since. Don’t miss the next opportunity. And until Monday, there’s a $100 discount. Grab that discount now before it’s gone.