AI Agents Don't Threaten Shopify, They Need It

What most don't understand about Shopify

Hi Multis

I hope you can keep up with the pace... This is the third article already this week, after the Adyen earnings analysis and the Best Buys Now.

You can imagine these are busy days for me, but fortunately, I get help from Zack for the Shopify (SHOP) earnings analysis.

Of course, as usual, I will then look at the Selling Rules, the Quality Score update and the valuation. I also contributed some extra content to the analysis. That’s how it goes when you know a company very well (as I’ve been a shareholder since May 2017): you want to add a few accents. But most of the work is Zack’s.

Hi Multis

It’s Zack, back for another quarterly review of Shopify’s earnings.

When I wrote last quarter’s article, Shopify’s price was sitting around $160, and a significant portion of my write-up consisted of holding despite the (over)valuation. It’s amazing how quickly things can change...

Now here we are, around $123 (up already from $112 or so), 30% lower. To add insult to injury, during the earnings call, the stock popped 8% after hours and then sold off 20% from its peak the next day.

Ok, enough about price action. I know it’s fun to talk about, but anyone can look at the ticker price. What we really want to know is how the business did this last quarter, so let’s get right to it.

Headline Numbers

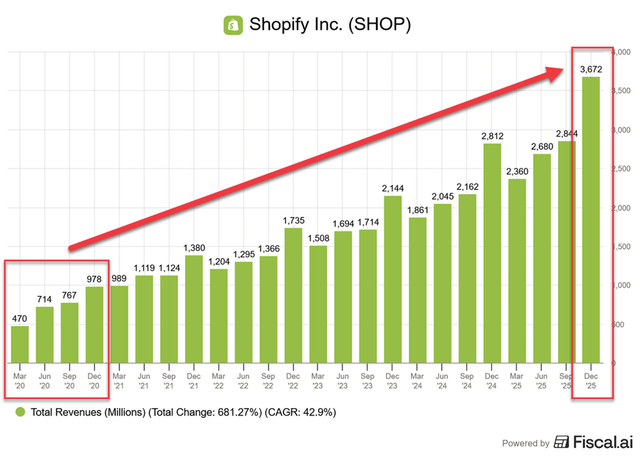

Revenue came in at $3.67B, beating estimates by 2% and growing 31% year-over-year.

President Harley Finkelstein had this amazing stat to highlight:

“Q4 was our first-ever quarter of revenue above $3 billion. That’s more than all of our revenue in 2020.”

Wow, that’s impressive!

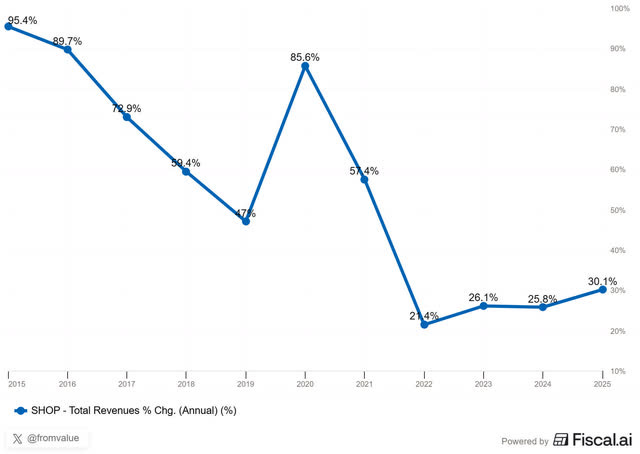

And this wasn’t a one-quarter fluke. Full-year 2025 revenue came in at $11.6 billion, up 30%, the highest annual growth rate since the COVID-driven results of 2021. Since its IPO in 2015, Shopify has grown revenue by over 20% every single year. That kind of durability is rare, but it’s exactly what we look for at Potential Multibaggers.

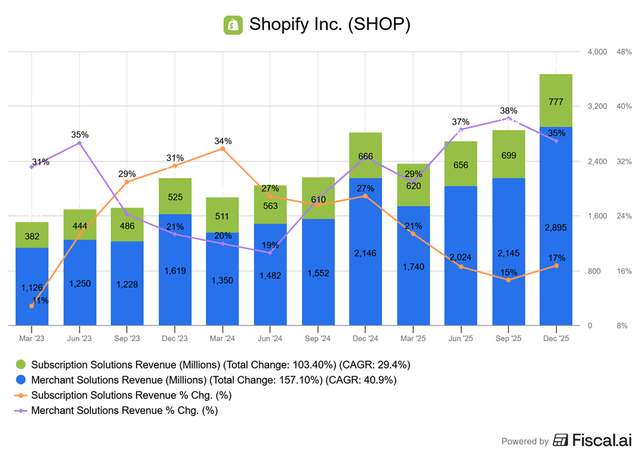

We can break out revenue further by looking at both Merchant and Subscription Revenue:

Grab your 15% discount for great charts like this at Fiscal.

Merchant Solutions Revenue grew 35% year-over-year and made up a bigger piece of revenue, especially in Q4 given the increased purchase volume. Subscription Solutions Revenue grew 17% year-over-year. Both solid growth numbers.

Monthly Recurring Revenue took another meaningful jump to $205M and 15% growth year-over-year, continuing to re-accelerate from 10% YoY growth a quarter earlier despite some comparability headwinds from the three-month trials last year. Tier adoption showed a slight uptick, with Shopify Plus accounting for 34% of MRR, up from 33% last year.

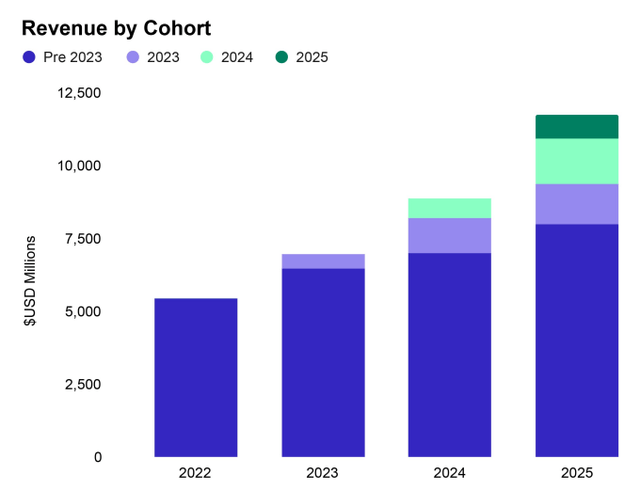

Worth noting here: the company shared that the 2024 and 2025 merchant cohorts are larger and more productive than prior cohorts, outperforming older cohorts in both GMV and revenue after similar time on the platform.

Source: Shopify

This is a really healthy sign. It proves that Shopify isn’t just adding more merchants but also better merchants.

Gross Merchandise Volume (’GMV’), the total dollar amount sold through Shopify, came in at $124B, 31% growth year-over-year.

This was also Shopify’s first-ever quarter with GMV above $100 billion. On a constant currency basis, growth was 29%. Regionally, North America did better than the expectations, mainly because of Plus merchants. But the international story stood out: nearly half of incremental GMV came from outside North America.

European merchants, in particular, had a superb quarter, with GMV up 45% (35% constant currency). Shopify now has nearly half its merchants from outside North America.

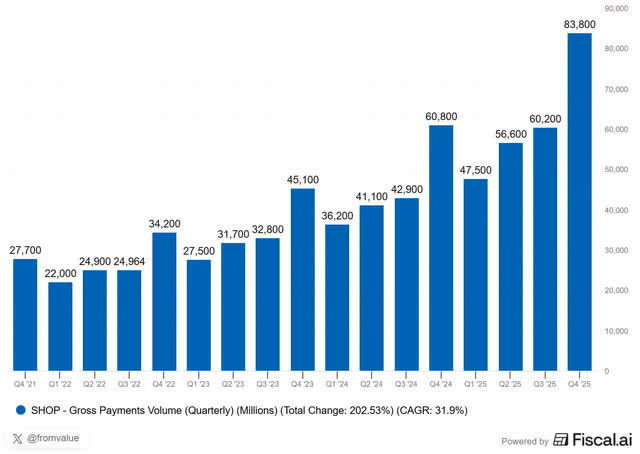

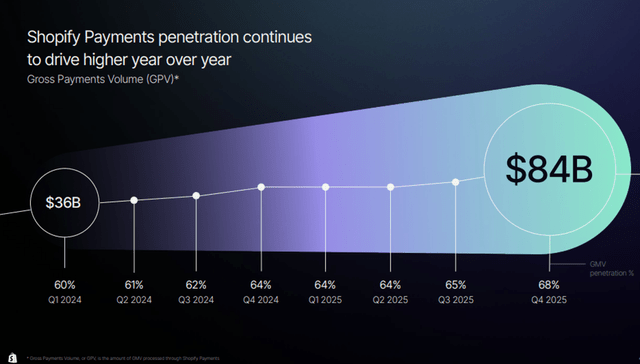

Gross Payment Volume (GPV), which is payment volume through Shopify Payments, came in at $84B, 38% year-over-year growth.

GPV penetration grew meaningfully to 68%, indicating increased adoption of Shopify’s payment solutions.

Shopify gave us this great-looking chart.

Gross Profit grew 25% year-over-year to $1.69B for the quarter.

Gross Profit Margin dropped to 46% from 48% last year. A couple of legitimate reasons for this:

First was the revenue mix. In Q4, we typically see a seasonal surge in payment volume, shifting the mix toward the Merchant Services segment. Because Merchant Services carries a lower gross margin (high 30s to 40s) compared to the high-margin Subscription business (low 80s), the overall blended margin took a temporary dip.

There were also a few other gross margin headwinds on the Merchant services side coming from a decrease in third-party referral and transaction fees. But this definitely has a silver lining. It means more revenue is flowing through Shopify’s own payment rails directly. That’s a short-term gross margin headwind, but a long-term moat builder.

There was an impact from PayPal accounting changes, but management said this is now fully normalized.

So, the slightly lower margins are nothing to worry about.

Operating Income was $631M, an increase of 36% year-over-year and Operating Margin came in at 17%.

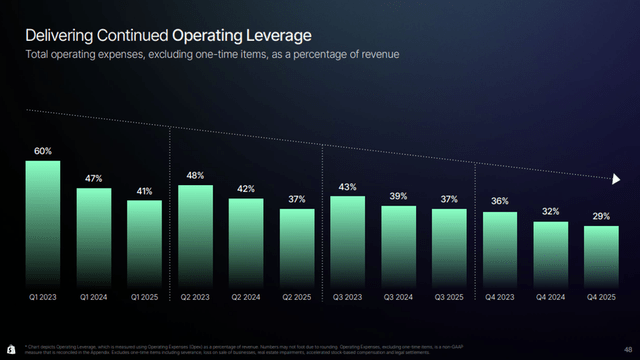

Shopify’s continued operational profitability improvement is further highlighted through one of my favorite charts:

Source: Shopify

Every year, efficiency gains continue. Shopify is demonstrating it can grow revenue without proportionally increasing SG&A and R&D.

Let me put some numbers on this.

Operating expenses were 29% of revenue in Q4 and 35% for the full year, both 3-points better than in 2024. Moreover, CFO Jeff Hoffmeister pointed out that all four key opex/margin milestones (Q4 opex, full-year opex, Q4 operating margin, full-year operating margin) set new records versus 2024, which had itself set records versus every prior year since the IPO.

Shopify achieved operating leverage in every category: R&D, sales & marketing, and G&A, mostly through disciplined headcount management.

Shopify is accelerating product development without growing the team, by leveraging AI and automation internally. That’s practicing what you preach: in 2023, Shopify’s founder and CEO, Tobi Lütke, said the company was AI-first from then on. In other words, if you have a problem, first ask yourself if AI can solve it. Only if the answer is clearly no, can you hire someone.

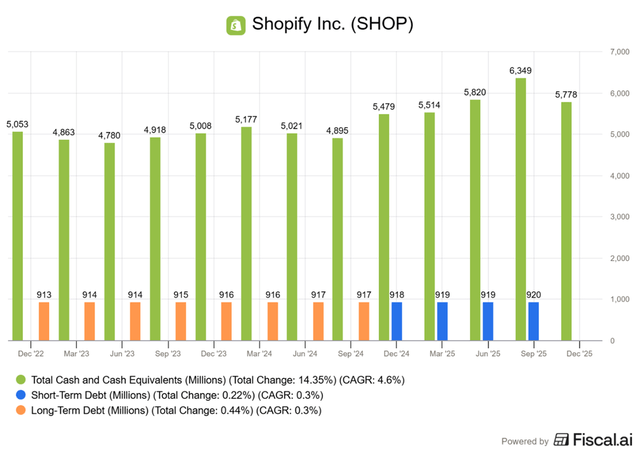

Lastly, Free Cash Flow was $715M, up 17% year-over-year, with a 19% FCF margin.

For the full year, free cash flow hit $2 billion, an increase of 26%. Shopify continues to prove that it can grow the topline significantly while remaining operational and grow cash flow. We can see that reflected on their pristine balance sheet, where they just recently paid off their last bit of debt.

Grab your 15% discount for great charts like this at Fiscal.

Worth noting: they decided to repay the convertible debt in cash rather than issuing shares. That signals confidence in the future of the business.

Additionally, the board approved a share repurchase program of up to $2 billion, which leads us to believe they believe the company may be undervalued.

Moving on to Guidance for Q1 2026:

Revenue to grow in the low-thirties (percent) year-over-year.

Gross Profit to grow in the high twenties.

Operating expenses as a percentage of revenue are expected to be 37% to 38%, indicating continued efficiency.

Free Cash Flow margin is expected to be in the low-to-mid teens, a notable drop from previous periods. This is due to seasonally lower Q1 GMV and a higher tax rate than prior years.

In summary, the numbers were great, no question about that. But the highlight of the call was in the product updates.

Product Updates

Let’s just cut to the chase. There were many updates, but the clear star of the show was the agentic commerce solutions.

Harley Finkelstein mentioned the initial success in 2025 with orders from AI search up 15x since January 2025. He did add the caveat that these were smaller numbers, but the growth in this space is just starting.

Finkelstein framed it in terms of long-tail discovery: smaller merchants getting connected to the right buyers who might otherwise have never discovered them. He called it “merit-based discovery at scale.”

Instead of SEO and ad budgets determining who gets found, AI surfaces products based on relevance. That’s a fundamental shift in how discovery works. It disproportionately benefits Shopify’s massive base of smaller merchants who could never outspend the big players on Google Ads.

Multi Market Sense wrote this about Shopify in our Slack community.

I can soothe our fellow Multi’s worries. Shopify will benefit from agentic commerce. The diversification and independence of the shops will mean that the winner-takes-most dynamics, which have been typical for e-commerce, will change. If an agent can search 7000+ websites, that willl benefit the discoverability for Shopify stores. This will hopefully become clear by what follows.

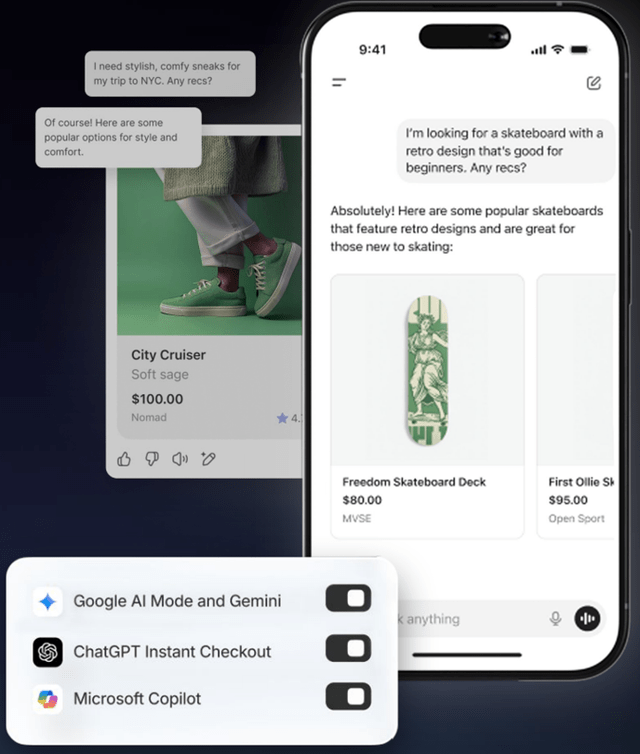

The first AI feature is Agentic Storefronts, which allows merchants to sync product data across all AI-native platforms.

Source: Shopify

As you can see here, with just one click, merchants have access to millions of buyers through AI surfaces. In return, AI platforms get fresher, up-to-date information for a more consistent and trustworthy experience.

Tobi Lütke put this really well when he said something to the effect of: “Everyone else has to scrape the Internet, we actually have the source of it.” Shopify has structured billions of products so agents can surface the most relevant items in seconds. That data advantage, the “Catalog” as they call it internally, is the real asset here. They’ve been building this for 2 years, and it’s only now becoming visible and more relevant.

Multiple brands like Stanley, Vuori, Glossier, Steve Madden and others already sell through AI platforms but 2026 should see a big jump there.

You may wonder, what is the advantage of shopping via AI instead of traditional ways, such as search? A couple of sources reference higher conversion rates when using AI shopping:

38% higher conversion rate for AI-influenced shoppers compared to traditional browsing.

4.4x higher conversion rates for AI-generated product recommendations vs traditional search

While I can’t fully vet the studies deeply, intuitively, the logic holds water. Asking an objective AI to aggregate information and surface the “best” widget seems much more trustworthy and efficient than manual search at times. Oftentimes, we’re forced to sift through SEO-optimized blogs where sometimes “unbiased” reviews can be just thinly veiled sponsorships. AI shopping can cut through the noise and provide an immediate answer in a single response.

Universal Commerce Protocol (UCP) is co-developed with Google to serve as the “rails” for agentic commerce. It sets open standards for how agents can interact along the purchase journey (e.g., search, cart, checkout, purchase). Think of it as a common language that ensures all stores can communicate with agents in a consistent way, allowing for the same shopping functionality, whether you are on the merchant’s online store or shopping through AI chat. Because Shopify helped develop this protocol, all Shopify stores are UCP-ready by default.

Just to be sure, there’s another protocol as well, OpenAI’s ACP (Agentic Commerce Protocol). Shopify supports ACP too, but UCP is universal (not just OpenAI). When an analyst asked if this was VHS vs. Betamax, Finkelstein didn’t address this directly, but I think this misses the point. It’s an open system versus a closed one.

There’s a crucial point here that multiple analysts (and Market Sense) seemed to miss. Finkelstein had to repeat three times and probably he will get questions about it in the next conference call again. LLMs do not bypass Shopify’s checkout. Commerce has a front end (the interface buyers see) and a back end (processing, payments, fulfillment). Under UCP, even when ChatGPT runs the front end, Shopify still runs the back end. Order processing, payments through Shopify Payments, fullfillment, returns... all of it still flows through Shopify’s infrastructure. The economics for merchants and Shopify are identical to a regular online store transaction. Shopify doesn’t lose the customer relationship because the front-end is different. It just uses another discovery mechanism, like Google Search is one.

Moreover, there’s the Agentic Plan. It is an upcoming subscription tier that enables brands to sell products through AI-driven chat without a full Shopify store. This allows any brand, regardless of platform, to plug into agentic commerce features.

You might wonder: “Why isn’t Shopify gatekeeping these features for its own core subscribers?”

If you look back a few years, you will realize this is the exact playbook they used for ShopPay. By offering a best-in-class checkout experience to non-core subscribers, they created a low-friction on-ramp. Once a brand sees the conversion power of Shopify’s infrastructure, the conversation about transitioning their entire merchant stack becomes much easier. They are doing so again, but this time with agentic shopping features.

Harley Finkelstein explicitly confirmed this on the call. He said the Agentic Plan mirrors the Commerce Components strategy from a couple of years ago. Some brands that initially came to Shopify just for Shop Pay ended up migrating their entire stack. The Agentic Plan is designed to do the same thing. It wants to start a relationship with brands that aren’t ready for a full migration, but don’t want to miss the agentic wave. It’s a wedge product, and Shopify consistently lands enterprise accounts through this tactic.

Shopify is in a transition. It’s in the process of creating the infrastructure of modern commerce and shifting there from “just” a platform. By creating solutions in which all brands use their agentic rails, they ensure that, no matter where an AI transaction occurs, Shopify processes it.

This closely parallels Microsoft in 1999 during the dawn of the internet. During this period, Microsoft established dominance by bundling Internet Explorer with Windows and providing developers with the tools they needed to build IE-compatible sites. They leveraged their existing scale to set the standards (HTML/CSS) for a new era, which is exactly what Shopify is doing now with UCP and agentic commerce.

Source: Web Design Museum

I’m sure you know what happened next: Internet Explorer became the dominant browser and had 95% share of the browser market by 2004.

I’m not saying Shopify will play out exactly this way, but there are similarities. Clearly, they don’t want to just be a player on the board; they want to be the board on which the game is played.

Now, agentic commerce dominated the call but it wasn’t the only thing happening. There were several other product updates that deserve attention because they demonstrate how Shopify is compounding growth initiatives.

Shop Campaigns & the Advertising Flywheel

Shop Campaigns is a pay-for-performance advertising product and it had a breakout year. Revenue doubled and merchant adoption tripled in 2025.

The product now spans 8 channels: Google, Instagram, Facebook, X, Snapchat, Bing, the Shop App, and Shopify storefronts.

The growth comes from a clear value proposition. Merchants only pay when a customer actually converts. No sale, no spend. That’s a genuinely differentiated offering that removes the risk of advertising for smaller merchants who can’t afford to burn cash on awareness campaigns.

The Shopify Product Network was launched. It’s a new opt-in app that automatically surfaces relevant products from other Shopify stores on a merchant’s site. If a shopper buys, the host merchant earns a commission. It’s basically turning the entire Shopify ecosystem into a distribution engine. This is a brand-new offering (launched in December) and one to watch closely.

Sidekick: The AI Co-Founder

While agentic commerce is the external AI play, Sidekick is the internal one. In just 3 weeks after the latest edition drop, Sidekick generated almost 4,000 custom apps, created over 29,000 automations with Shopify Flow, built nearly 355,000 task lists, and edited over 1.2 million photos. Impressive numbers.

The newest feature is Sidekick Pulse. It works in the background and proactively tells merchants what to do next based on their own store data. It’s powered by Shopify’s 2 decades of commerce insights. Finkelstein shared an example: Sidekick Pulse recommended a jewelry brand to bundle 4 products together because it knew they were individually best-sellers and that bundles tend to convert better with higher cart values. That kind of personalized intelligence from hundreds of millions of transactions is extremely valuable, of course.

Shopify also launched SimGym, which simulates real buyer behavior to give merchants feedback on store changes before they ship them. Think of it as A/B testing in real time, powered by AI simulation. The barriers to building a professional store are crumbling before our eyes.

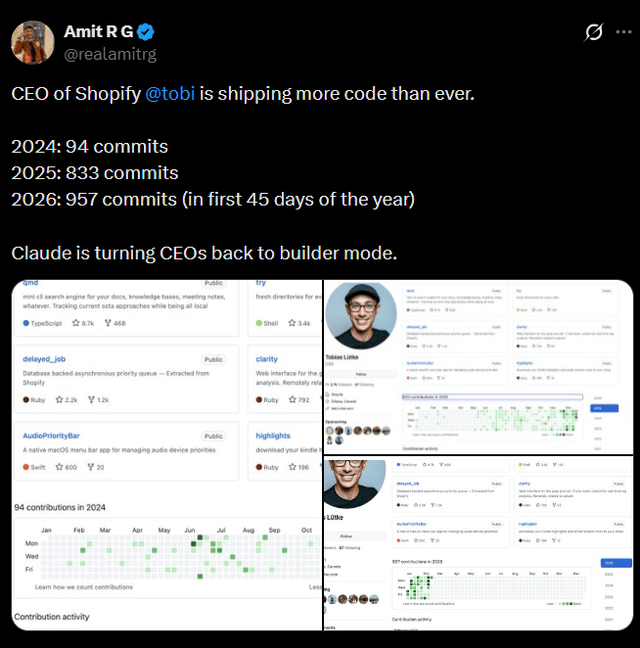

Tobi In Builder Mode

One more thing worth pointing out that isn’t from the earnings call itself but paints an important picture.

Shopify CEO Tobi Lütke’s GitHub activity has exploded. He shipped 94 commits in all of 2024, then 833 in 2025, and as of mid-February 2026, he’s already at 957 commits in just 45 days.

The CEO of a $150B+ company is personally shipping more code than ever, reportedly fueled by Claude (Anthropic’s AI). When the CEO is in builder mode, the whole company tends to follow.

Conclusion

Zooming out, Shopify is clearly re-accelerating. You can clearly see that in the surge in revenue and MRR. More importantly, Shopify is securing the “pole position” in the rising agentic commerce trend. While there is a lot of noise about AI being an existential threat to existing software companies, Shopify’s Q4 results and product roadmap prove they will be in pole position to take advantage of the new wave.

An AI agent can find you the perfect product, but that product still needs to be purchased, shipped, tracked, and potentially returned. Nobody is going to vibe-code a payments flow or a fulfillment system. Shopify already owns that complexity, and AI just adds new surface areas on top of it.

As Jeff Hoffmeister put it:

AI transforms interfaces and accelerates the pace of change, but it doesn’t alter the underlying architecture of commerce.

But what about that post-earnings selloff? Was a -20% drop from the earnings peak justified?

Let’s remember, short-term price action is often a “voting machine” driven by trading and sentiment. The “weighing machine” tells a different story: a company with growing revenue, a debt-free balance sheet, expanding free cash flow, that innovates at a speed as never before.

For those of us riding the Potential Multibagger roller coaster, we have been here before.

So, is Shopify a BUY now? Let’s have a look.

Do you like this analysis? Don’t forget to subscribe if you want more.

If you are not on the paid plan yet, this is the ultimate chance.

(If you are a premium member already, just scroll past this message.)

What do you get as a Premium member?

📊 The rest of this article, answering the question if Shopify is a BUY now.

✍️ Multiple high-quality articles per week (like this one)

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars (coming soon!)

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis (like this one)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the yearly plan.