Hi Multis

Normally, you get the Best Buys Now on the 15th of every month. The 15th this time was a Sunday. You already got the Overview of the Week there. Yesterday the markets were closed because of Presidents’ Day. So that’s why I’m only releasing them today, on the 17th.

This is also an exceptional Best Buys Now in another sense.

Because... what do you do when there are too many great opportunities you want to include in the Best Buys Now? You stay in analysis paralysis. I couldn’t choose this time, so I kept tinkering and kept getting stuck.

Five Best Buys Now felt impossible right now. So for once, I took 10.

I won’t make this a recurring thing. I plan to go back to five. But this time, even 10 felt like a serious constraint. I had to leave out companies I like. I’m talking about Datadog. I’m talking about Mercado Libre. I’m talking about Chapters Group. None of them made the list. That’s how deep the bench is right now. In other months they would have been here.

So, this article will be a bit longer than usual.

Let’s dive in.

Duolingo

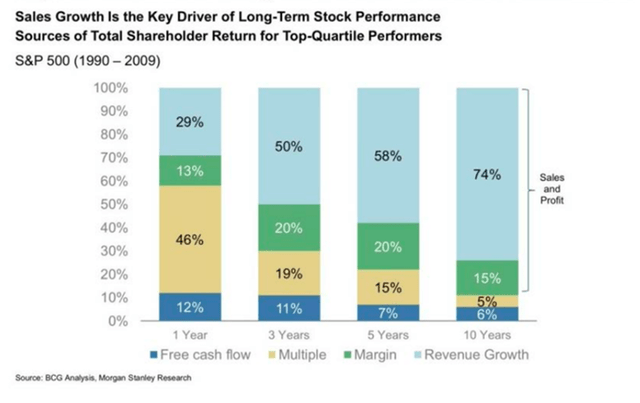

If you remember the basics of Potential Multibaggers, we could go to the list of multibagger features, and the first one is revenue growth. The reason is this chart. Sales growth is by far the most important contributor to long-term share performance.

Last quarter, Duolingo (DUOL) reported 41% revenue growth.

Now, that will be lower this quarter, and that’s partly because the company wants it to be lower. They’re shifting focus away from monetization toward content quality and the free tier to attract more users. Despite this strategic choice, the consensus for Q4 is still almost 32% revenue growth. That’s not a number you see from companies in trouble.

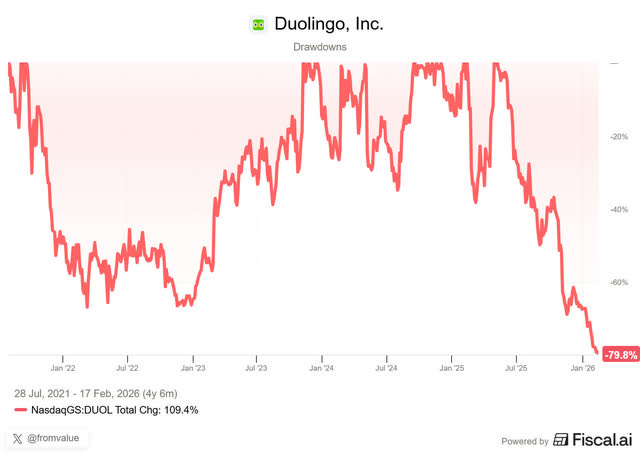

The stock price is down about 80% from its high.

I didn’t buy when the stock was so expensive. It was an exaggeration to the upside. What we see right now is an exaggeration to the downside.

The market also underestimates that Duolingo is changing. It’s not just a language app anymore. I picked it not because of language learning but because I thought it could become a learning platform. In the meantime, Duolingo has rolled out math, music, and chess. I think there’s a lot of potential left for other courses.

Why not coding, for example? I would love that. Because even in these days of AI, when I vibe code things, the problem is that I don’t understand what I’ve done. It would be great if, almost like with a language, you know enough of the basics to spot the big mistakes. I’m not talking about the nitty-gritty details, but the reasoning errors that you can weed out.

Now, let me emphasize an element that is often overlooked. When you look back at the history of disruption, there’s an important lesson. The disrupted company was usually one that didn’t want to, or could not, adapt to the new reality or technology. Netflix versus Blockbuster is the iconic example, of course. Blockbuster didn’t start adapting to streaming until it was much too late. There were discussions in the executive room, but because it had so many stores, there was a huge cost to turn the company and bet everything on innovation.

Duolingo is not in that case. It embraces AI. It’s probably one of the biggest users of OpenAI tokens. At the end of 2025, a Reddit leak revealed the largest individual users, and Duolingo ranked at the top.

Look at how Duolingo built its chess course: it was developed by two people who weren’t real chess players and weren’t even developers, using AI. Only just before launch, an actual developer helped polish the code.

I don’t see a company that’s being disrupted here. I see a company with a lot of users who use it every single day to not lose their streak, who have a friends streak (and they don’t want to disappoint their friends), and who have the feeling that they’re learning something.

I think too many people who are not Duolingo users see it as learning. I don’t see it as learning in the sense of studying. That’s a totally different activity. I see it as a game. And that game takes away a big part of my scrolling time. I don’t go through my Instagram feed anymore. The only time I use Instagram now is when someone sends me a link. I used to check Instagram every single day. Now, I play (see that word?) Duolingo.

Duolingo is not a deep learning platform. If you want to go deep into a subject, you go to YouTube, to your preferred LLM, to Google, to Substack, to Seeking Alpha, just to name a few. You go to places where you’ll get top-notch information and where you expect to need time to digest it.

That’s not the intention of Duolingo. Duolingo is fun. It’s short. It’s engaging. And it gives you the very basics of something. If you expect to speak about investing in Spanish after a Spanish Duolingo course, your expectations are ridiculous.

I keep pounding the table for Duolingo. Also don’t forget there’s a visionary CEO at the helm. Luis von Ahn successfully developed two previous products: CAPTCHA and reCAPTCHA. He gave CAPTCHA to Yahoo for free, sold reCAPTCHA to Google for a few hundred million, and then wanted to realize his dream. He grew up in Guatemala as the son of two doctors, which meant an outstanding education. But he saw that he was lucky and that very few people could afford it. That’s why he wants to provide free education to help people climb the social ladder.

And look, I hear many investors say, “But AI can translate. So why learn a language?” There are multiple reasons to learn languages, even with AI. Making real connections with people is one. Climbing the social ladder is another reason, because speaking more languages is seen as more prestigious. And people like the idea they develop. Sometimes, it’s as simple as that.

For a long time already, a computer can play chess better than any human, but still, chess was the fastest-growing course on Duolingo ever.

The case for Duolingo is extremely pessimistic right now, and in my opinion, that’s totally unwarranted.

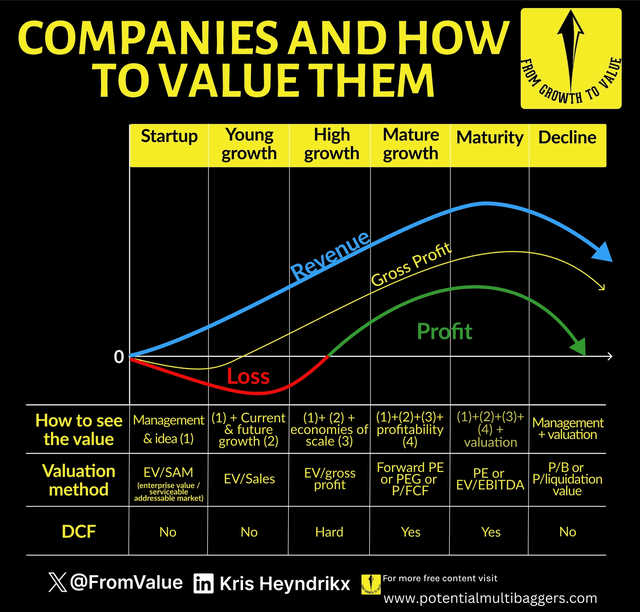

Let’s look at the valuation. As you know, I use this framework.

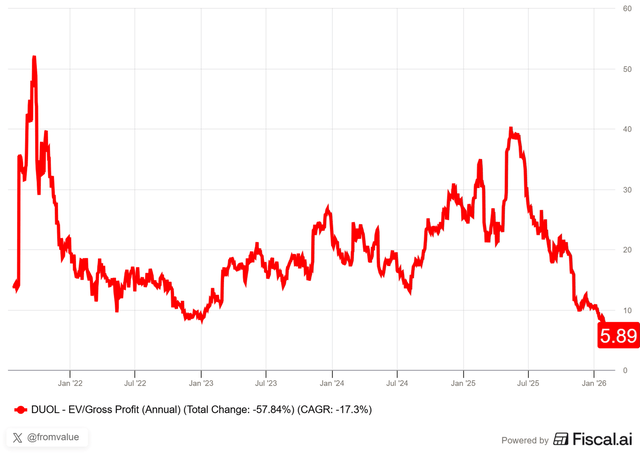

I would place Duolingo between high growth and mature growth and that’s actually very conservative. I want to start with the EV/Gross profit ratio.

At 5.9, it’s the lowest ever. I bought in September 2022 at $93 and then, the EV/Gross profit was around 10, which I already found very cheap for a company growing so fast.

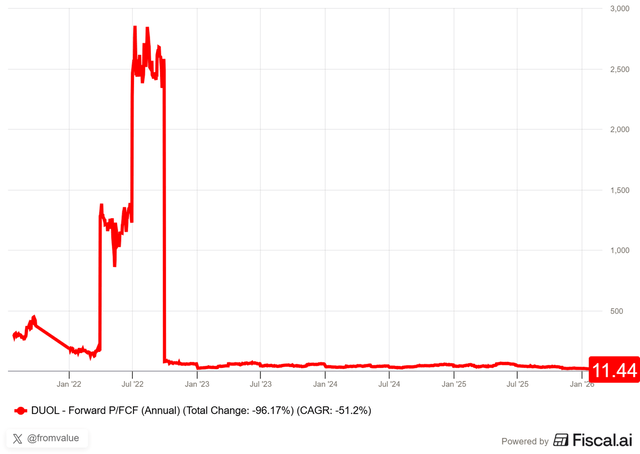

Because of the one-time tax benefit this year, the (forward) PE or PEG are not really of much use. Let’s go to the forward P/FCF. As the company has not yet announced its Q4 2025 earnings, this is based on estimates of 2025 FCF.

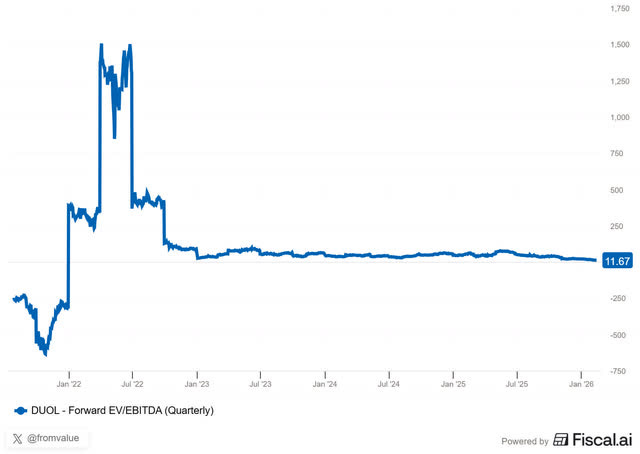

The 2025 EV/EBITDA multiple is about the same.

(Do you want to make these insightful charts yourself? No problem. Use my link for a 15% discount for Fiscal. )

Now, of course, if Duolingo misses the consensus, the stock could drop even more. But who’s wrong in that case? The company or the analysts? Duolingo clearly said it would focus less on monetization.

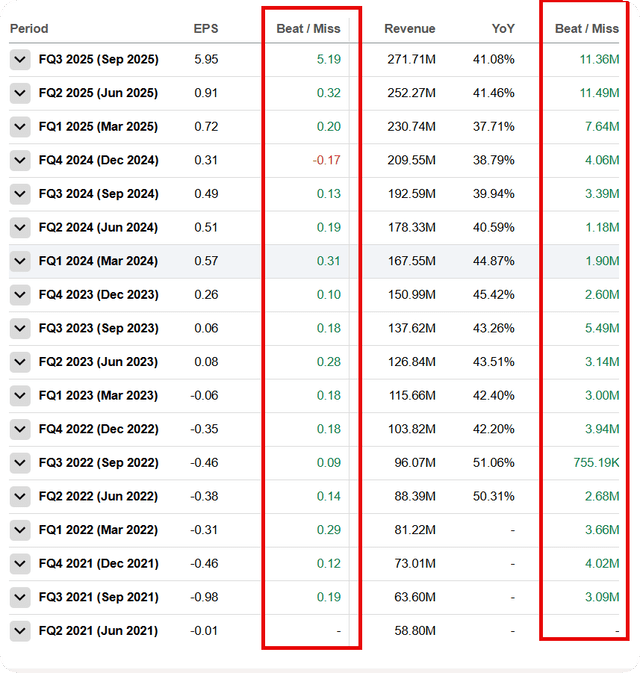

On the other hand, it only missed once on EPS and revenue combined.

Also know that management is very conservative. It guided for 29.5% revenue growth in 2025 at the end of 2024. The consensus now? 37.5%.

If you are not on the paid plan yet, this is the ultimate chance. (If you are a premium member already, just scroll past this message). What do you get as a Premium member?

📊 The 9 other Best Buys Now

📈 My Personal Portfolio, the Forever Portfolio

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.