Hi Multi 👋

Another week is in the rearview mirror. I didn’t write so much this week, as I made time for my family, friends and reading. Earnings season is already knocking on the door again and that’s always a busy period. You can expect more articles in the weeks to come.

But before that, you will also get the Best Buys Now for October on Wednesday, of course.

Wanna Write For Potential Multibaggers?

This week, I also focused on my own business and I decided that I could use another author at Potential Multibaggers.

If you have writing experience or think you have some writing talent and are interested in growth stocks, I could use your help.

You can have your own service (and you are allowed to promote it) but I have to feel alignment with Potential Multibaggers. There are several possibilities for payment, depending on your experience and situation. Are you interested?

You can write in the comment section to let me know! Or maybe you know someone who might be interested? Please let them know in that case.

Articles In The Past Week

This is only the second article this week.

This week, Tempus got its first PM Quality Score and Valuation Score.

Memes Of The Week

Two memes this week.

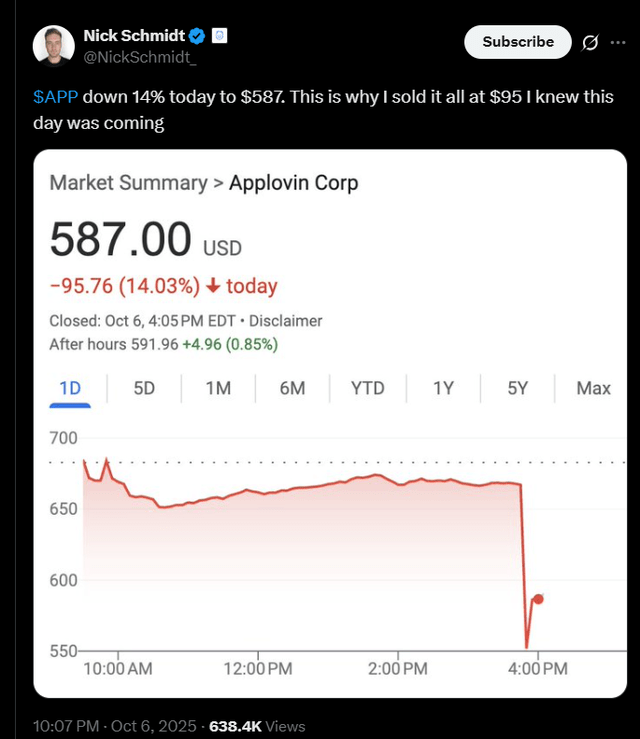

This was a great post.

The second one is about the tariffs.

Interesting Podcasts Or Books

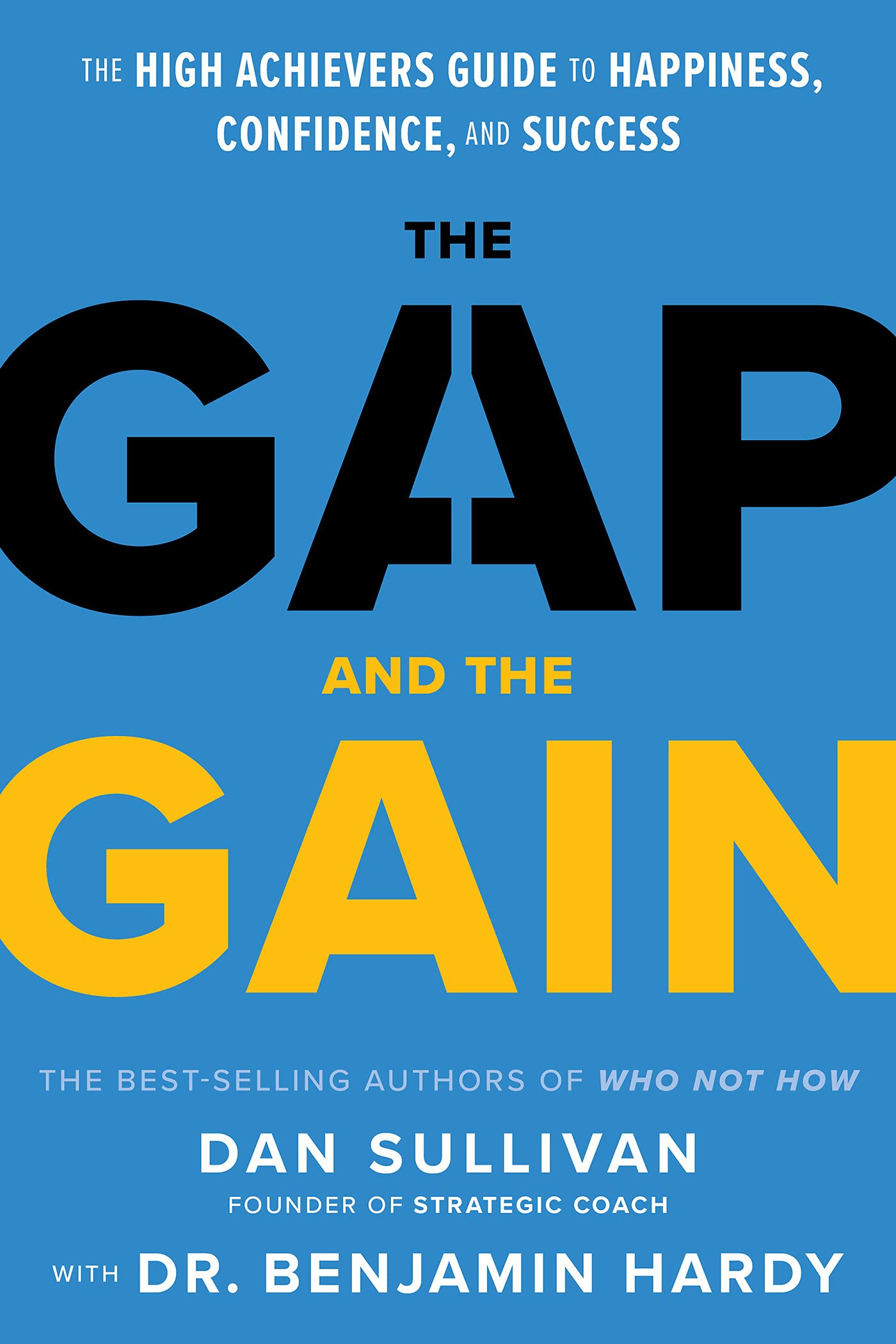

Last week, I shared that I was reading 10x Is Easier Than 2x by Dan Sullivan and Dr. Benjamin Hardy.

The underlying thought is that you have less competition if you go for 10x instead of 2x, which almost everyone wants. It was a great book, so good I started another one from these two: The Gap And The Gain.

It’s another interesting book. It’s a fast read (I finished it earlier today). The focus of the book is broader than 10x Is Easier Than 2x. It tries to make people happier and find fulfillment.

The book contrasts living in “the gap” (focusing on what’s missing) with living in “the gain” (celebrating how far you’ve come). It sounds pretty simple, but it’s a powerful concept that can really shift your thinking.

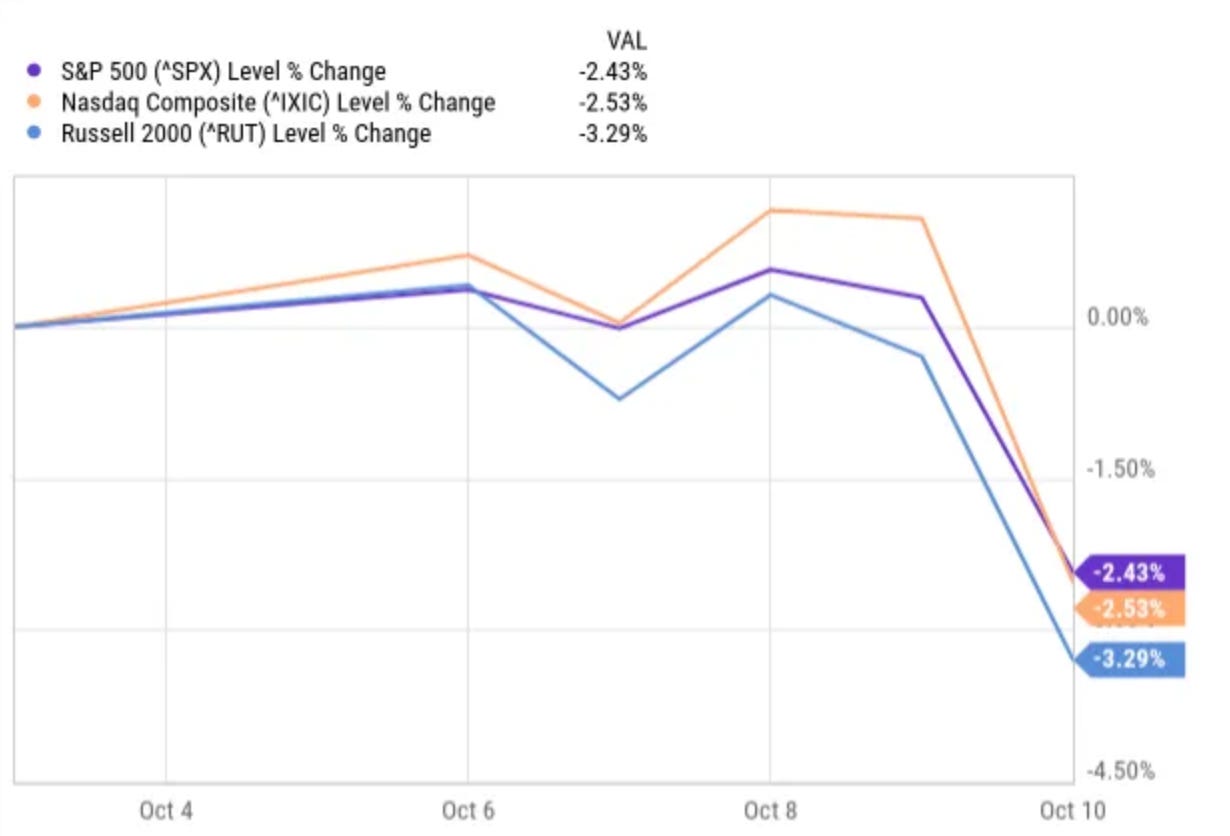

The markets in the past week

Tariffs took the headline again this week, and that resulted in big drops. The S&P 500 was down 2.43%, the Nasdaq 2.53% and the Russell 2000 even 3.29%.

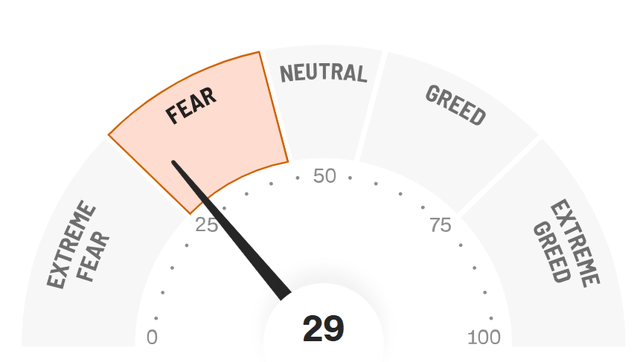

The Greed & Fear Index dropped from Neutral to Fear really quickly.

100% Tariffs for China or Another TACO?

You saw the big drop and you read the headlines: 100% extra tariffs for China. But what’s actually happening?

President Trump posted that China is threatening to impose export controls on rare earth elements and other products starting November 1st, 2025. According to Trump, China sent letters to countries worldwide detailing specific elements they plan to withhold. He called that move “absolutely unheard of” and designed to hold the world “captive.”

Trump’s response was an additional 100% tariff on all Chinese products, also starting November 1st, plus export controls on critical software. He claims the U.S. has stronger monopoly positions than China and is ready to use them. China’s announcement came on the day Trump celebrated peace in the Middle East, which he found “especially inappropriate.”

China controls about 90% of the market for rare earth metals. Under the new rules, foreign companies need approval from the Chinese government to export all products with rare earths, even in small quantities. The intended use will have to be declared.

Rare earth elements are metals essential for modern tech: smartphones, EVs, wind turbines, and military hardware like guided missiles and fighter jets. They’re not actually rare, but extracting and refining them is difficult and expensive and China controls 90% of the global production. So, they are very important for the rest of the world.

Multi Market Sense With Patience shared an interesting post. Thank you, Market Sense!

This post argues China didn’t use rare earths as leverage during Trump’s first term or Biden’s chip controls because they couldn’t do it at that time. The US had a trump card (pun intended): helium. Until 2022, China imported 95% of its helium, controlled mainly by American companies and American technology. Helium is critical for rockets, MRI machines, quantum computing and chip manufacturing. If China were to retaliate with rare earth metals, the US could strangle its helium supply.

China saw the threat. A 2022 study warned that a US helium blockade would devastate them. So they went all-in: China built seven extraction facilities, switched imports to Russia, and funded research like crazy. By late 2024, US helium dependence dropped from 95% to under 5%.

Countries don’t retaliate against US sanctions because they can’t. They have no alternatives, no technology, and no supply chains. China is the first to systematically eliminate every pressure point: helium, chips, energy, telecom, and pharmaceuticals. Now they can say “no.”

After the 2018 trade war, China’s government surveyed every company to identify which US-made components were irreplaceable. They compiled the list and mobilized universities, national labs, research institutes, and companies to fix each vulnerability.

The White House has a 15% stake in rare earth producer MP Materials (MP). It’s not a coincidence that this was one of the few stocks that were up a lot in the past week. The US will probably try to do the same as China and not be dependent on China for critical materials.

Just like in April, there’s hope, though. We’ve seen this playbook before. Trump will meet Xi later this month. I would be surprised if there wouldn’t be a deal.

China also already clarified that it doesn’t intend to ban rare earth exports, just control them.

Vice-President JD Vance also further de-escalated the situation, saying Trump hopes he doesn’t need to use leverage on China, that he’s willing to be a reasonable negotiator with China and that there’s a friendship between Trump and Xi.

That could mean that tomorrow, the markets will react positively again.

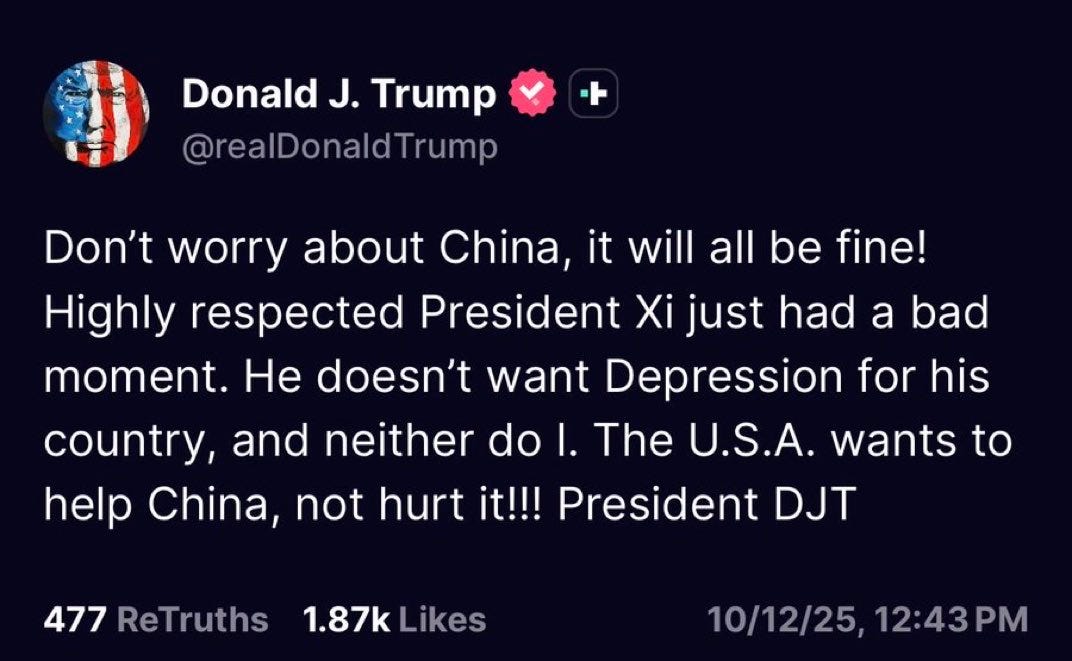

Especially after this:

Was this the shortest TACO (Trump Always Chickens Out) or will this story be really negative this time? We’ll have to see, but the signs are more positive than negative.

Lesson Of The Week

Multi BK Lee shared this one in our Slack channel and I decided to use this one for the Lesson Of The Week.

The typical investor does exactly what they should not do. They buy and sell at the wrong moments. Where are we in the cycle? That’s tough, of course.

Moreover, you don’t have to time the market. Just make sure you are prepared. Your personal situation will dictate your approach. If you have money coming in regularly, you are in a different situation than if you are retired. I still have money on the side, so, if there were a market correction, I would invest more. Having some cash can make it psychologically easier. People often feel the need to do something. If you have a cash position, you have that flexibility.

Quick Facts

1. Are We In A Bubble?

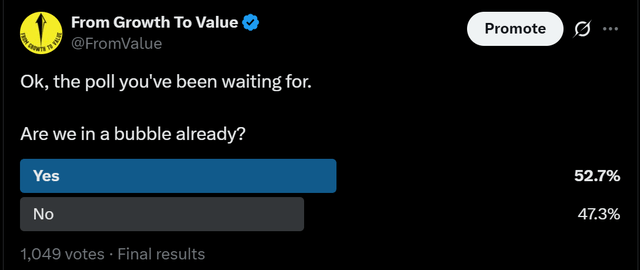

This week, I had a poll on X.

As you can see, the opinions are split, but a majority of 52.7% thinks we are in a bubble. Now, don’t take this too seriously. As I showed above, the typical investor is often wrong.

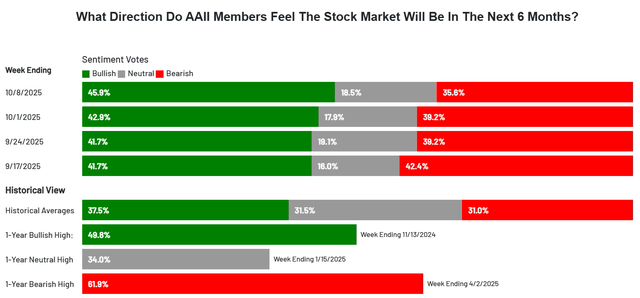

The AAII (American Association of Individual Investors) has sentiment polls every week. These are good predictors... of the opposite. This is the most recent poll, with bullish sentiment high.

The AAII writes on its site (my bold):

If you’re looking at the AAII Investor Sentiment Survey for guidance on the possible future direction of the market, it’s important to understand that it is deemed a contrarian indicator.

So, with bullish sentiment high, the poll could be true. Of course, it’s not a perfect indication for market timing. Those don’t exist. If that was the case, more people could actually time the market.

2. Shopee Opens 14th Warehouse in Brazil

Sea’s (SE) Shopee launched its 14th distribution center in Brazil to cut delivery times.

Sea’s been building warehouses since entering the country in 2019. The distributions network helps them compete with MercadoLibre (MELI) and Amazon (AMZN), who are also building out their logistics in the country. More warehouses means faster shipping nationwide and better support for local sellers.

For a long time, I have been saying that there will be a few players in Brazil. Now there are many and I think three big ones will remain eventually: MercadoLibre, Amazon and Shopee. The rest will just have the crumbles they leave on the table.

3. The OpenAI-AMD Deal

AMD announced the biggest deal in its history this week, but it’s a strange one. OpenAI agreed to buy 6 gigawatts of AMD chips over several years, starting in 2026, a contract worth tens of billions.

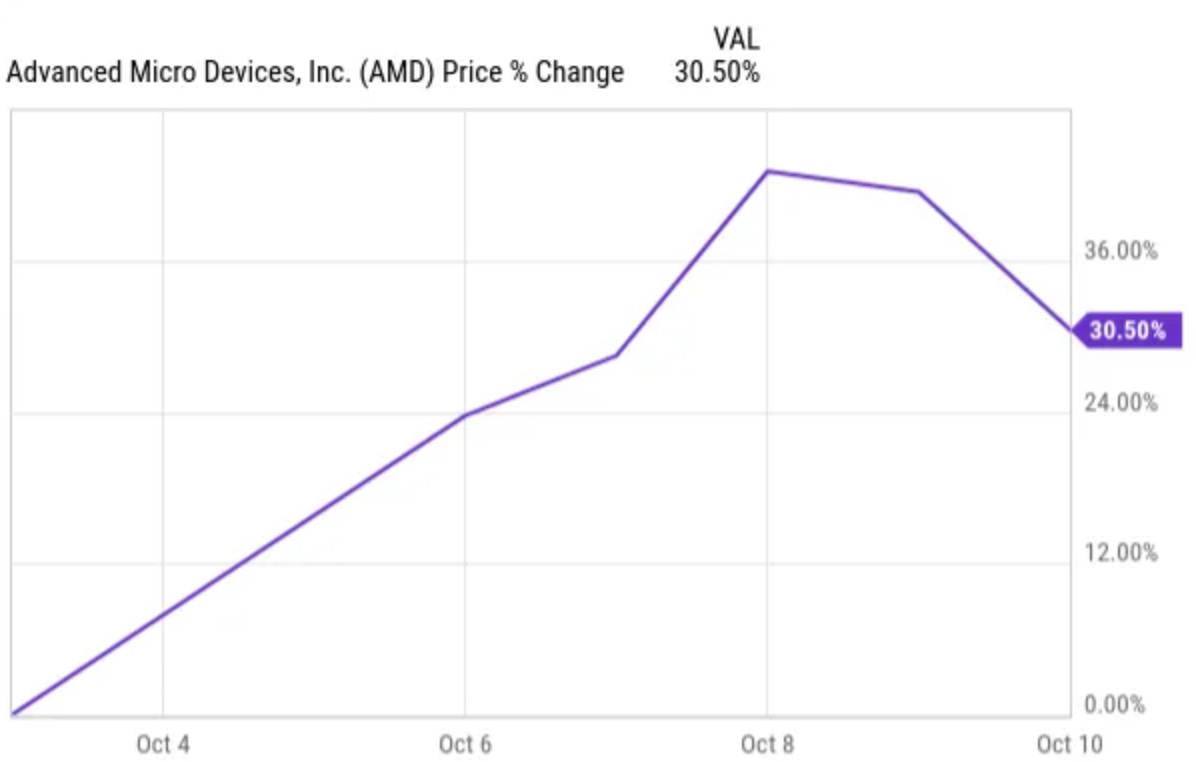

But instead of paying cash, OpenAI is getting up to 160 million AMD shares—roughly 10% of the company through warrants that vest as AMD delivers the chips. AMD’s stock price jumped by more than 30%.

I have a considerable position in AMD, so I’m happy with the share price jump, but it’s a bit of a strange deal.

The deal connects OpenAI’s stake to AMD’s success. The final tranche only vests if AMD’s shares hit $600, meaning AMD would become a $1T+ company. Before the deal, the price was around $165. If AMD ever reaches that $1 trillion+ market cap, OpenAI’s stake could be worth about $100 billion. More likely, it will sell shares to cover chip costs. The construction means AMD is effectively financing OpenAI’s purchases partly with its own stock.

Nvidia’s CEO Jensen Huang called the move “clever,” but if you read between the lines, he probably thinks giving away 10% of the company before shipping a product signals how badly AMD needed OpenAI’s validation. Nvidia controls over 90% of the AI chip market. AMD less than 5%. This deal could push AMD to having market share of 15% or maybe even 20%.

The deal also breaks OpenAI’s reliance on Nvidia. The company has struggled to launch new features because of compute shortages. I’ve been saying for months that all the big companies are begging Nvidia for more chips.

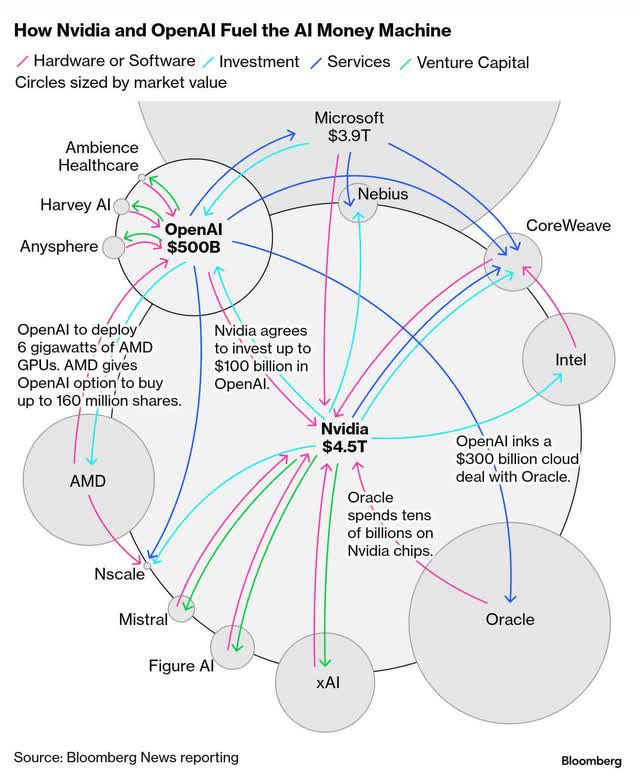

Two weeks ago, Nvidia committed $100 billion to supply OpenAI with 10 gigawatts of capacity; now AMD adds six more. Together, these infrastructure deals approach $1 trillion in commitments. The worrying thing is that most of it is paid through circular investments from the key players. Bloomberg published this overview.

For AMD, this was the only play. It couldn’t beat Nvidia on performance or price, so it made OpenAI a partner instead of a customer. If the new MI450 chips work really well when they arrive in 2026, the dilution will look cheap. If not, AMD just paid 10% of itself for hope.

More and more, though, OpenAI positions itself as the weak link in the story. If it can not pay for its commitments, this could be a big bubble. The company will have to raise money through debt or VC money. But if the market drops and there’s a bear market, this could become very difficult, and a 2000 dotcom scenario is possible. Don’t read more into this than what I write. I call it possible, not ‘likely.’

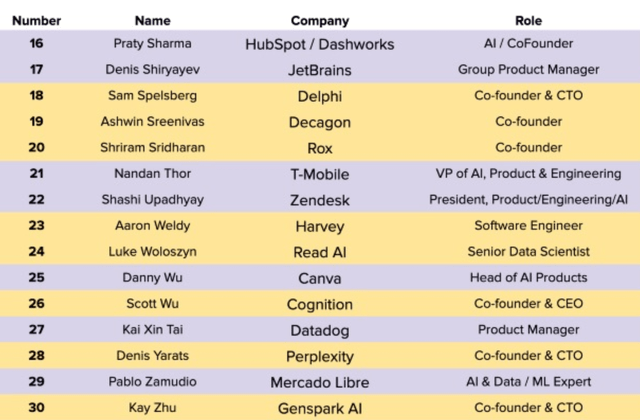

4. Top ChatGPT Users

I saw this top 30 of customers who have used more than 1 trillion OpenAI tokens. The list is alphabetically ranked, not by usage. There’s one mistake: Mahesh Kumar (#7) is from Uber, not Tiger Analytics.

I like seeing Duolingo, Mercado Libre, Datadog and Shopify on the list.

5. MercadoPago and Nubank’s Market Share In Mexico

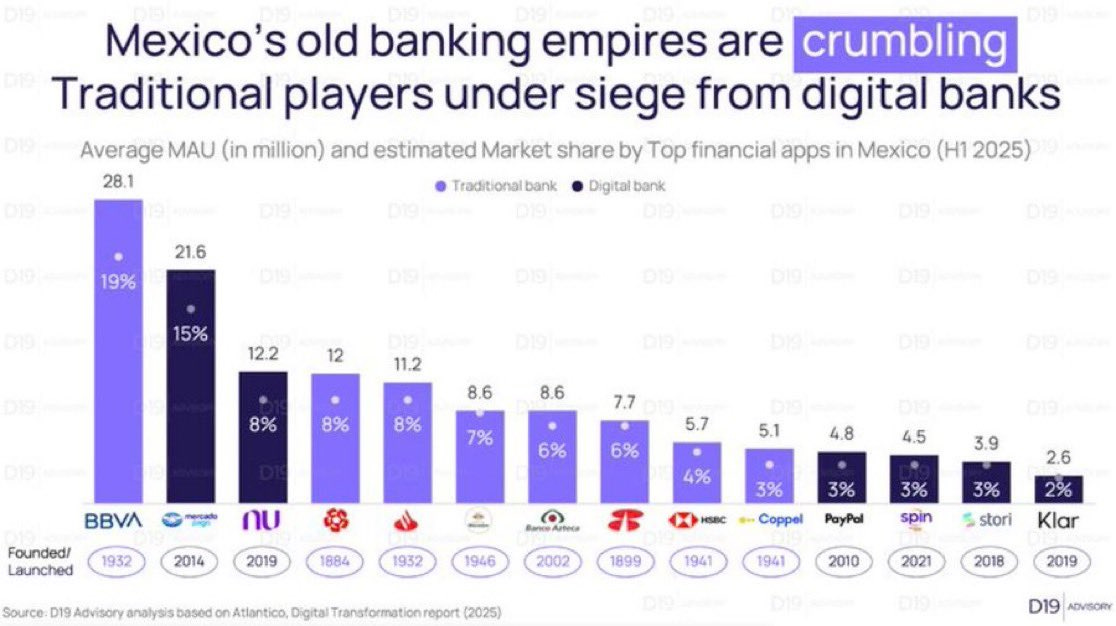

This week, I saw this graph.

This shows how fast MercadoPago and Nubank are growing in Mexico. BBVA is 93 years old and still the biggest. MercadoPago was launched in 2014 in Mexico, Nubank just 5 years ago, with the launch of its credit card. The chart says 2019, because that’s when Nu opened its Mexican subsidiary, but the launch was actually in 2020.

I think this also shows how much market share is still left for both. And then I’m not even talking about the number of products they can launch and the ARPU (average revenue per user) that can grow a lot too.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ An archive with insightful articles

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.)