Hi Multis

Earnings season is over, but there are still some crumbs on the table after the meal. One of them is Tempus.

We will go over the earnings quite fast and then we will focus on the first Potential Multibaggers Quality Score and the Valuation, to know if the stock is a Buy, Hold or Sell through the QPI (Quality-Price Index).

The Earnings

Tempus AI (TEM) delivered a strong quarter. The results showed great growth and a clear path toward profitability.

Total revenue came in at $314.6 million, up 89.6% year over year, driven mainly by higher testing volumes.

Genomics raked in $241.8 million, up 115% YoY, with oncology as a highlight and, of course, also driven by the Ambry Genetics acquisition. Data and Services came in at $72.8 million, up 36%, with data licensing growing at 41%.

Gross profit more than doubled to $195 million. The operating leverage can be seen in the numbers.

Adjusted EBITDA came in at a loss of $5.6 million. But that’s 82% better than last year. Management reaffirmed its guidance at $1.26 billion in revenue and $5 million in positive adjusted EBITDA for the full year. That means that Tempus should be profitable this year.

Oncology test volumes accelerated to 26% growth from 20% in Q1. Management pointed to better sales execution and an improved tech infrastructure.

Hereditary testing volumes grew 32%. Tempus is taking market share here, and management expects hereditary sequencing to eventually outpace cancer sequencing, as the addressable population is much larger.

Data and Services got a boost from the AstraZeneca deal that closed in April—I covered that in the Overview Of The Week.

Summarized: great quarter, on to the next.

Let’s check how high (or low) the quality of Tempus is.

The First Potential Multibaggers Quality Score

Personal conviction 7/10

Initiated October 2025

This is mainly my or your own conviction based on everything I/you know about the company. Your own conviction may be very different here and you can adapt this score to your own liking.

I start conservatively with newer picks, because I want to get familiar with the company over time. So, that’s why Tempus gets a 7/10 score to start with.

Profitability 4.5/10

Initiated October 2025

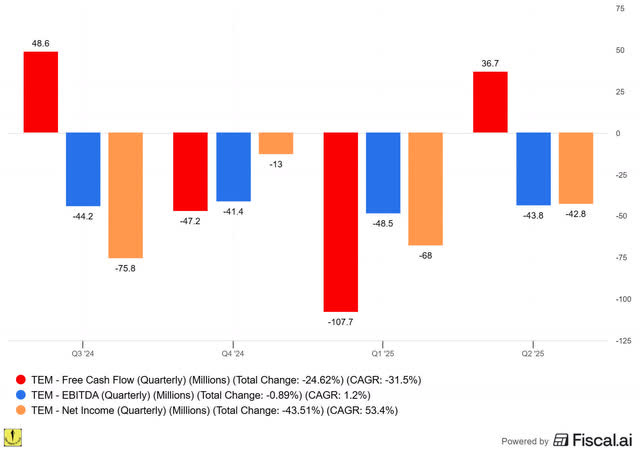

Tempus was profitable on a free cash flow basis in the most recent quarter, but not consistently yet. The big negative FCF in Q1 2025 had to do with the acquisition of Ambry Genetics in February. It’s not on an EBITDA basis or GAAP net income basis.

The company is expected to be profitable on an EBITDA basis next year and on a GAAP net income basis in 2027.

But that’s not the case yet, so I only give a score of 4.5 here.

Sales efficiency 8/10

Initiated October 2025

The sales efficiency score first looks at the marketing efficiency by looking at what percentage of revenue goes to sales and how much revenue growth that brings in the trailing twelve months and what is expected next year. I divide the average of those two by the SG&A number as a % of revenue and that is marketing efficiency. I then multiply that by the gross margin to look at sales efficiency.

Of course, this formula is far from perfect, and it favors companies with higher gross margins and those with higher revenue growth. But it gives you some idea of how well the company sells its product. There are plenty of nuances to add here, but the numbers are what they are.

For Tempus, I took an estimate of 45% for Sales and marketing. The total SG&A (selling, general and administrative) was 57%. Now, if you look at S,G&A it’s down substantially from 2024, which may lead you to think it’s much more efficient, but in 2024, costs were up dramatically because of the IPO.

Because of the high revenue growth, though, Tempus Efficiency Score was still 8/10, remarkably good.

Innovation 5/5

Initiated October 2025

This is part subjective, part measurable. Subjective, as in: how many new products does the company issue versus its competitors? You can also partly measure that, if you want, but the magnitude of the innovations is much more important than the sheer number of innovations.

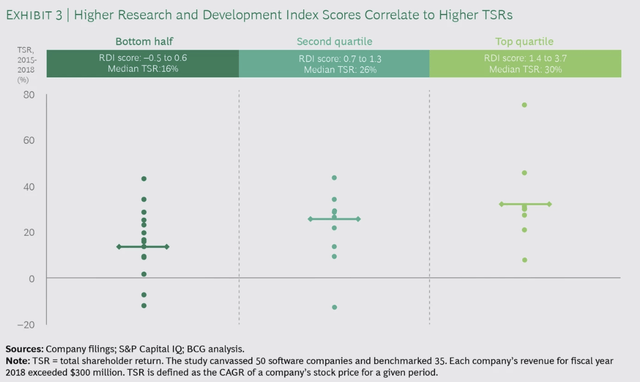

As for measuring, you can look at the % of revenue that is earmarked to R&D. At the same time, I want some efficiency there too, so I look at R&D efficiency by dividing revenue growth by R&D expenses in the previous year.

Not surprisingly, as an innovative company in healthcare, Tempus spent a quite high percentage of its revenue on R&D, 46% last year. This year so far, it has gone down to 27%.

With sales growth of 89.6%, this results in an R&D efficiency score of 1.95. That’s very strong and it places it firmly in the top quartile.

On the subjective side, I also rate Tempus high because it’s creating a category of its own.

That’s why a 5/5 score for innovation is warranted.

Must-have? 4/5

Initiated October 2025

I introduced it because of what Matthew Prince, the founder and CEO of Cloudflare (NET) said in 2022:

I think that the world is about to get sorted into must-haves and nice to haves.

I found this a quite hard one to judge. Overall, healthcare is pretty much a must-have, but this is a company that may still need to prove its value in the chain to big players a bit more to avoid cutting the budget in a recession. But that assumption is pretty speculative. All in all, I think Tempus deserves a higher-than-average score because it can also save companies a ton of money in the early research stages. That’s why I give it a score of 4/5.

Revenue growth 5/5

Initiated October 2025

This is very simple: how high was the revenue growth in the last quarter?

With almost 90% revenue growth, there’s no doubt: 5/5.

Revenue growth durability 9/10

Initiated October 2025

Even more important than revenue growth, is the durability of revenue growth. And I think Tempus is well-placed there too.

When we look at the revenue growth projections, you see 82% for this year but then revenue growth projections drop to around 25%..

I think that could be a considerable underestimation from analysts because of the efficiency of the model. But even with 25% revenue growth, this deserves a high score.

That’s why I give Tempus a score of 9/10.

Management Quality Score 7.5/10

Initiated October 2025

Great management is often one of the most important keys to long-term success. I look at the track record here, so execution, and the vision.

Eric Lefkofsky started this company for a very personal reason. With his background in software (founder of Groupon and several other companies), he couldn’t understand not all data were used for the treatment of his wife’s cancer. That’s why he started the company.

I think he arrived at his final company, the one where it feels good to work on. He was already a billionaire, so he doesn’t need to do this for a living. He has a vision, a mission, a goal: to use data as much as possible to help as many people as possible to stay or become healthy.

Still, you see a score of just 7.5 here. The reason is I want to be conservative. My conviction about management has to grow over time.

Insiders’ Ownership 5/5

Initiated October 2025

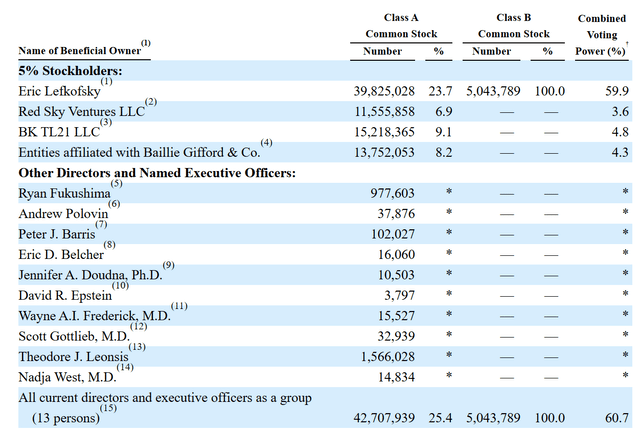

Does management have skin in the game? This is out of 5 as it is not always a make-or-break but often it’s a useful indication. Let’s look at the proxy statement.

As you see, founder and CEO Eric Lefkofsky owns almost 40 million common shares. At the current price of $93, that means $3.7 billion. Add the 5 million B shares and that means more than $4 billion. Enough for a 5/5, of course.

Multibagger potential 4.5/5

Initiated October 2025

We already saw the revenue growth expectations above, and even 25% revenue growth into the future means the potential to multibag is high. That’s why I give a score of 4.5/5.

TAM/SAM: 5/5

Initiated October 2025

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

Both the TAM and the SAM are huge for Tempus. In the end, it covers oncology to start with, which is already a huge field. Unfortunately, cancers are the number two cause of death in the US. In the US alone over 2 million people are diagnozed with cancer every year.

PwC estimates that the AI healthcare market will be $868 billion by 2030 and Tempus will be a big player and only grow bigger over time.

That’s why I think a score of 5/5 is warranted.

Financial Strength 3/10

Initiated October 2025

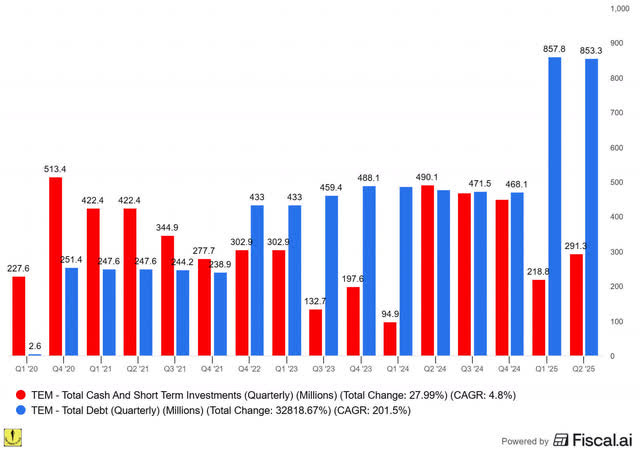

Financial stability is important. First, you have to finish to finish first. That’s why I rate it out of 10.

Let’s look at the company’s finances.

As you can see, there’s high debt, around $850 million. This is the result from from heavy investments in the platform. The testing facilities are capital-intensive, and AI is not cheap either, especially not in a sector that’s so information-sensitive. That’s why Tempus already had venture debt and convertible notes. The acquisition of Ambry Genetics for $397 million, further increased the company’s debt.

I definitely understand the strategy of the investments and I agree with them, but that doesn’t matter for the score here. So 3/10.

The negatives

I also have negative scores, which can subtract extra points from that score. The scores are marked on 5 because a lot is already captured implicitly in the other numbers.

Risk 2/5

Initiated October 2025

Of course, the healthcare sector is a much riskier business than, let’s say, chips. You deal with people’s health. That’s why I rate Tempus a bit higher on the risk score.

Competition 1.5/5

Initiated October 2025

How strong is the competition? Again, you can’t objectively measure that but there are indications. The fast revenue growth is definitely an indication of something significant.

There are three components:

1. The genomic testing. There’s competition from companies like Guardant Health, Roche, and others.

2. For the Data and Services products, Tempus names competitors such as Flatiron Health, IQVIA and ConcertAI. There could also be competition from CROs (Contract Research Organizations), such as Fortrea, ICON, Syneos, PPD, and others.

3. For the third part, AI Applications, Tempus names Roche, Caris Life Sciences, Guardant Health, Illumina, and others.

But because this market is young and growing fast, I keep the score relatively low.

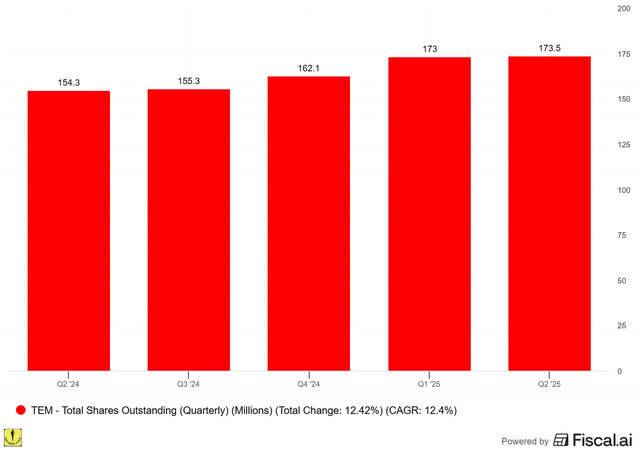

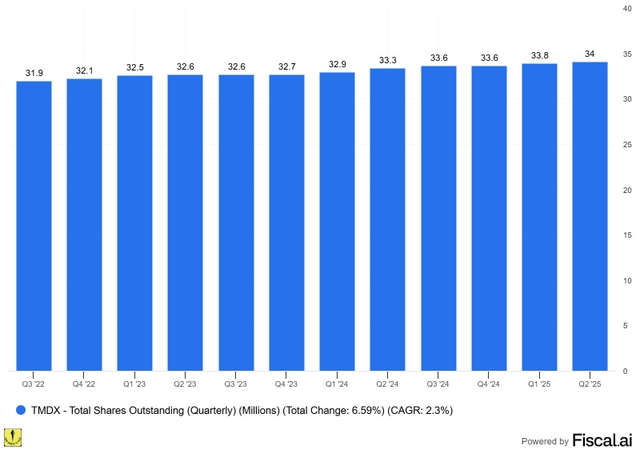

Dilution 2/5

Initiated October 2025

Tempus has stock-based compensation but it has also issued shares for convertible debt. That means that the number of shares is up substantially.

I don’t have too many problems with this. This criterion is more about stock-based compensation. So, what’s the dilution since Q2 2022?

But a lot still has to do with options from before the IPO. If you look at the cash flow statement, you see that there was $91 million in stock-based compensation over the last 12 months. That means about 1% of revenue over the same period. That’s not much. I don’t mind issuing shares for business use as much as SBC. That’s why I give a score of 2/5.

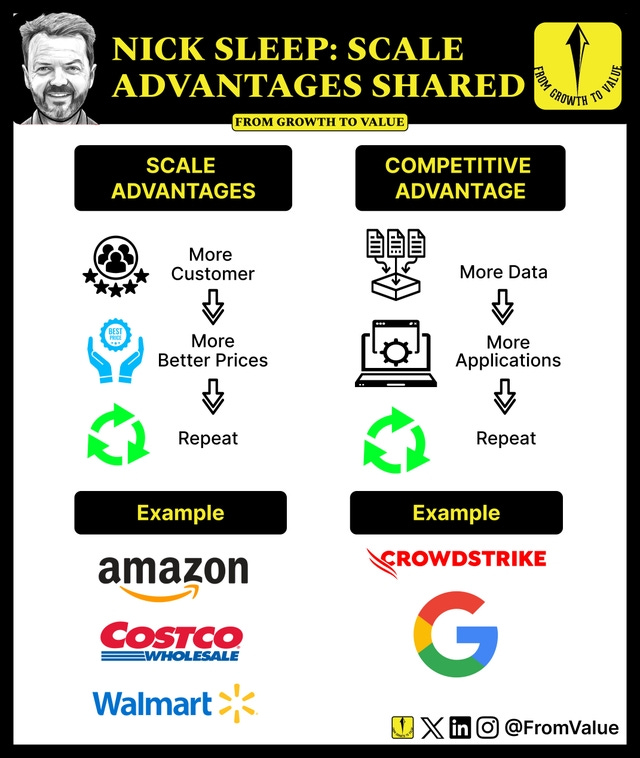

Scale Advantages Shared 5/5

Initiated October 2025

I introduced this concept in this article. When I looked back at some of the best investments, they did not only have substantial scale advantages, but also shared them with their customers in some way. For Amazon or Walmart (at the time), I think this criterion is obvious. Because they are bigger, they can give their customers better prices.

Google has always had a scale advantage: the more people used their products, the more they could give away for free. The data of people was leveraged to generate profits for Google, but the fact that Google could offer so much for free (Gmail, Photos, Drive storage up to a certain limit, etc.) was because of this mechanism.

I have not come up with this concept myself. This is one that I borrow from Nick Sleep from Nomad Capital. He uses this concept to guide all of his investments. That’s why he started investing in Amazon in 2003 already. And he mostly held on to that position to now. He did the same thing with Costco, another company that shares the advantages of its scale with its customers, by only charging 15% on the purchase price, no matter what. This makes these companies almost impossible to compete with unless you start doing exactly the same thing.

This is a visualization I made about this concept.

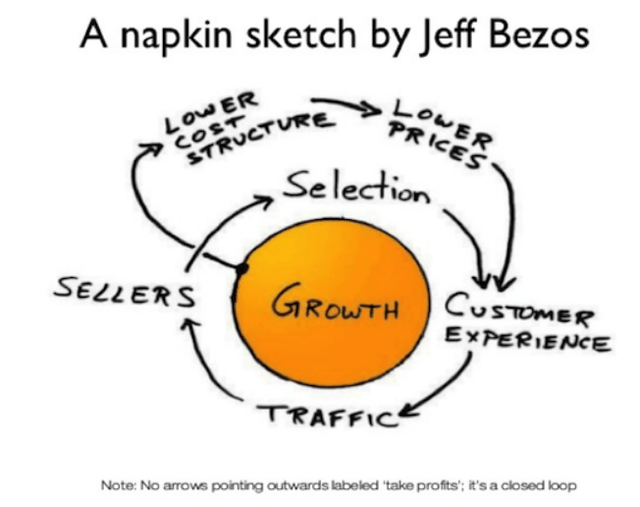

The most famous advocate of scale advantages shared? Jeff Bezos, who made this napkin sketch about it.

This score can range from -5 to +5.

For Tempus, this looks like a really clear 5/5, for both streams in the visual above. More scale in the labs also means cheaper and more data.

Conclusion PM Quality Score

Tempus scores 65.5.5 in total. That’s a normal score for a newer pick, as I’m always a bit more conservative for those. The financial strength criterion cost Tempus quite a bit of points.

Here the free content ends. If you want to know about the valuation of Tempus, and know if it’s a buy, you can always upgrade.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.