Hi Multis

While the S&P 500 is down just 8.9% so far, the Nasdaq is already in 'correction' territory. I put it between 'hyphens' because I hate the term. It sounds like something was wrong before that has to be corrected. So, I prefer to call it 'a drop.'

The median stock in the S&P 500 is already down 18%, though.

That means there are opportunities. You probably wonder: which Potential Multibaggers are worth buying right now? I will try to update the scores asap. I wanted to do that already earlier this week, but I was sick. I’m still not fully recovered but enough to write this. To me, this is not work, but my passion and you always want to do that, even if you’re not 100%.

I know many of you wonder if they are missing something about The Trade Desk (TTD) because the stock keeps dropping, down 60% from its highs already. That's why I wanted to update this one first.

The Trade Desk

I already analyzed the earnings and updated the PMQS (Potential Multibaggers Quality Score) and did a valuation update to get to the QPI (Quality-Price Index), the number that takes both the valuation and the quality into account. But in the meantime, the stock has tanked another 33%, so time to update the valuation.

But before we go into it, I want to touch on something else. It's a mechanism you should always expect in the stock market and keeping it in mind can really make a lot of difference for your returns.

It's simple, but powerful. I'll put it in bold and italics, so the message jumps out:

Price drives the stories you hear.

The Trade Desk has always been an outstanding company. But the stock is now down 60% from its high.

Source: Finchat

When I updated my PMQS (Potential Multibaggers Quality Score) for The Trade Desk, there was no big shift.

But the stories changed for sure.

Suddenly, The Trade Desk will be disrupted by AI (not, they were very early in using it, 2017), disrupted by Applovin (up to now in a totally different market), the new platform sucks (sure, as customers hate AI), the relation with big advertisers are under pressure, their prices are too high (even if the returns are much higher than other channels), Amazon will disrupt them (they have been partners since 2019), etc.

Of course, you have to monitor those risks, but I'm pretty sure they would not even have been written if the stock price had not crashed. That's what 'price drives stories' means.

With a PMQS of 83, the quality at The Trade Desk is still high. Let's re-examine the valuation.

The Trade Desk Valuation

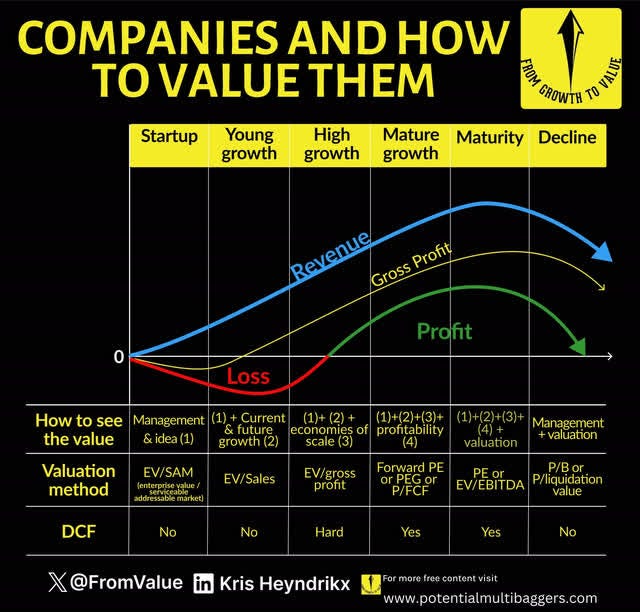

Let's first see how to best value The Trade Desk. You know by now that I use this framework.

I think it's fair to say that The Trade Desk is between high growth and mature growth. Maybe we're even witnessing the transition from the first phase to the second live right now.

Let's first look at the EV/Gross profit, though, as I believe this could be a temporary hiccup. Don't forget that revenue still grew by 22.3%, which is still high growth in my book.

I'm very happy Finchat provides EV/Gross profit as well, while many much more expensive platforms don't. If you want to try it out you can do that here. You also get a 15% discount if you take one of the paying plans.