Hi Multis

You may or may not have seen it, but The Trade Desk (TTD) released its earnings yesterday.

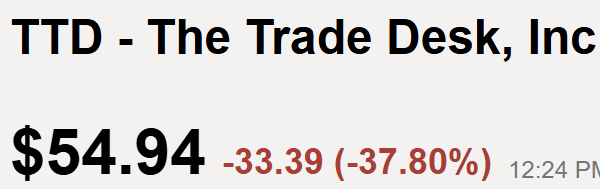

The stock crashed by about 30% after the market and it's down even more after multiple downgrades from analysts today. It's now down about 38%.

I know this creates uncertainty for many Multis and that's why I wanted to be fast with this analysis. So, I already analyzed yesterday (after my HIMS article) and then set my alarm clock early this morning. Because I know you want to know: What really happened here? Is it an opportunity or a trap?

Let's have a quick look at the numbers first.

The Numbers

Revenue: +19% YoY to $694M, a beat by $8M

Operating Margin: 17% (+1pp YoY)

Adjusted EBITDA: $271M, 39% margin (-2pp YoY but +1pp vs. guidance)

Non-GAAP EPS: $0.41, a beat by $0.01

Customer Retention: >95% for 11 consecutive years

Channel Mix: CTV 47.5%, Mobile 35%, Display 12.5%, Audio 5%

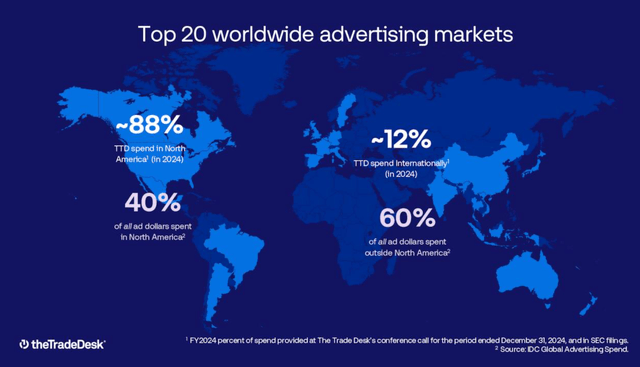

Geographic Split: North America 86%, International 14%

Operating Cash Flow: $165M (+103% YoY), FCF $117M (+106% YoY)

Cash Position: $1.7B with no long-term debt

Guidance: Q3 revenue "at least" $717M (+14% YoY); Adj EBITDA ~$277M

The Trade Desk delivered a solid quarter with a beat on revenue and EPS. While the beats were small, they were still beats. But the stock cratered 30% in after-hours trading, as we saw, and it continued to drop further today. This was not a repeat of their Q4 2024 quarter, though. Then the company missed its own guidance and Jeff Green plainly said they messed up. This was a fundamentally solid quarter that beat both revenue, EPS and EBITDA expectations, albeit slightly. There were good reasons for that, as you’ll see later in this article.

While some point at the guidance as the culprit ('just 14%), I want to point out that the guidance still beats the consensus. Just a little bit, again, but still. Don't forget that 2024 was an election year and that The Trade Desk usually sees mid-single-digit extra revenue from elections, often combined with slightly higher margins.

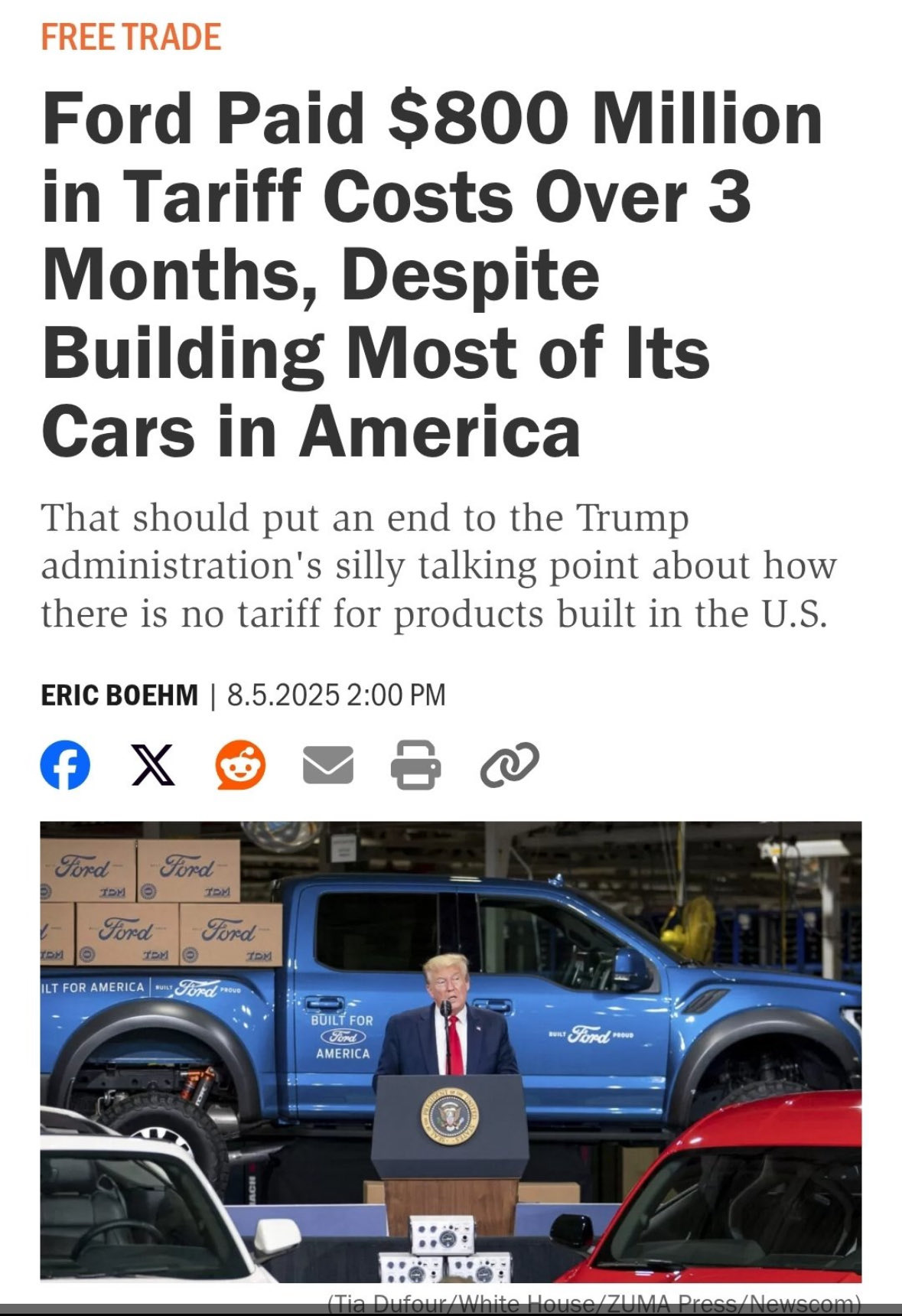

The growth deceleration from 25% in Q1 to 19% in Q2 may appear concerning, but again, this was expected. Large global advertisers, which are TTD's customers, faced significant tariff-related uncertainty starting in April. That temporarily pressured spending in the auto and CPG (consumer packaged goods) sectors. Even former Vice President of the USA, Mike Pence, shared this:

This is just one example. Tariffs are real and hurt the economy. That's not a political statement, just an objective observation. Multiple Fortune 500 companies are dealing with real margin pressures from trade policies. The issue is not a structural shift away from programmatic advertising, let that be clear.

Over the mid-term to long-term, though, the macro uncertainty actually plays into The Trade Desk's strengths, as we have seen in the past. When advertisers face uncertainty, they demand more agility, transparency, and measurable performance. That's exactly what programmatic advertising can deliver. As CEO Jeff Green noted, "programmatic is almost anti-cyclical" because volatile environments historically accelerate the shift toward data-driven advertising.

The 14% Q3 guidance looks disappointing, but the political advertising comparisons fall away next year, and the operational improvements the company implied should also start to pay off then.

More Insights From The Call

The Trade Desk had some problems with switching customers to its new Kokai AI platform. But Q1 saw a turnaround there and that continued in Q2. Kokai now fuels 75% of platform spend with 100% adoption still expected by the end of the year. The performance improvements are strong. Samsung achieved 43% better audience targeting, while Cashrewards saw a 73% improvement in cost per acquisition. It's good that TTD shares these numbers.

Most importantly, clients who've shifted the majority of their spend to Kokai are increasing their total platform spend 20% faster than those who don't. This proves Kokai drives incremental budget allocation. That's the holy grail of platform upgrades, of course.

The AI integration across forecasting, campaign optimization, and supply path optimization is finally using what Green calls "one of the most underappreciated data assets on the Internet." TTD processes as many transactions in 30 seconds as Visa and Mastercard combined do in a year. So, you bet they have a ton of data.

That quality data feeding AI creates real competitive advantages that compound over time. No doubt about that.

Deal Desk, launching in beta as Kokai's final component, addresses one of programmatic's biggest pain points by using AI forecasting to rescue underperforming deals and present better alternatives. Disney's early adoption provides meaningful validation. The House of Mouse has committed to shifting 75% of its ad revenue to programmatic by 2027, and Deal Desk will help them achieve that goal.

OpenPath continues gaining traction, now handling a "material" portion of TTD spend while delivering impressive publisher results. The New York Post saw a 97% programmatic display revenue growth, while Hearst Newspapers achieved a 4x fill-rate improvement.

The Sincera acquisition is already starting to work out through OpenSincera. It provides free supply chain transparency data to the entire industry. Publishers are using this data to improve their ad experiences, which creates better inventory for TTD's clients.

Things haven't changed. The Trade Desk is still the largest source of third-party demand for many publishers worldwide. That's a powerful position to be in.

The Amazon Competition Issue

If you have followed The Trade Desk over the last year or so, you must have heard "Amazon is eating their lunch."

Yesterday again, when I posted on X about the results, this was a reaction.

Green's extensive commentary on Amazon told another story. Of course, you think, he has to. But it was brought with confidence and insight. Amazon's DSP faces inherent conflicts of interest: they own Prime Video inventory and compete directly with many of TTD's largest clients in retail, CPG, and cloud services.

Amazon's recent doubling of Prime Video inventory actually weakens its objectivity pitch to major brands. TTD competes with only a small portion of Amazon DSP spend that doesn't go to Amazon-owned inventory. Founder and CEO Jeff Green on the conference call:

Amazon is not a competitor, and Google really isn't much of a competitor anymore either. We're trying to buy the open Internet, leveraging technology that values media objectively. We don't have any media, and we don't grade our own homework.

In my opinion, and to me, all the data suggests that we're right on this, despite their mixed messages, they are not trying to buy the open Internet objectively. They can't. They have way too much Prime Video supply to sell to ever honestly pitch large brands to objectively buy the open Internet. They push sponsored listings most and Prime Video after that. Neither of those compete with us, which is why I say that we're not really trying to compete with Amazon. When they argue that their DSP, which is not even their top advertising priority, let alone the core of their business, when they argue that, that's objective to the biggest advertisers in the world, I believe they weaken the rest of their advertising pitch, and they weaken the strength of their AWS pitch.

Green even suggested a future partnership with Amazon:

I think Amazon is more of a potential partner, honestly, than it is a long-term competitor. If Amazon opens Prime Video to external demand, which I believe they should, we believe we'd be an amazing partner to drive demand to them, and it wouldn't surprise us if that were to eventually be the course that they choose to take.

This is not just wishful thinking. Jeff Green has predicted many things in the past that sounded like wishful thinking. He has been spot-on every single time. It's deep industry knowledge combined with pattern recognition.

Don't forget that Jeff Green founded AdECN in 2003, which was the first demand-side ad exchange and one of the earliest true programmatic advertising platforms. Everyone thought Green was crazy when he predicted Netflix would embrace advertising and work with independent platforms but they did. Everyone laughed when he said Google could not depreciate third-party cookies in the planned time. But Google first postponed a few years and then didn't depreciate third-party cookies at all.

I think Jeff Green could be right about this one too. Amazon doesn't want to be in the firing line of regulators, and opening up their DSP would definitely help there.

But back to The Trade Desk. Its concentration on large global advertisers creates quarterly volatility but also long-term advantages. When tariffs hit auto and CPG companies, TTD feels it immediately. But when macro conditions stabilize, these same relationships drive disproportionate growth. That's why the slowdown (also caused by the election year 2024, don't forget that) doesn't worry me too much.

The joint business plan ('JBP') pipeline shows promise and it's a drag at the same time. There are nearly 100 JBPs in progress, with active JBPs at record highs and spending growth exceeding 20% year-over-year. These are multi-year partnerships with the world's largest brands. That impacts the short-term growth a bit, as longer contracts usually have lower revenue per year, but these kinds of relationships create sustainable business.

International growth continues outpacing North America, while it's still just 14% of The Trade Desk's revenue. Nearly 2/3 of ad spending is outside of the US, though, which shows what a long runway The Trade Desk still has.

Retail Media and CTV Expansion Accelerating

CTV remains The Trade Desk's fastest-growing channel at 47.5% of revenue. It has partnerships with Disney, Roku, Walmart, and Netflix, just to name a few. The shift toward streaming continues creating massive addressable market expansion, particularly in live sports where the Trade Desk can target key moments like overtime in NBA games.

Retail media partnerships with Instacart, Home Depot, and Walmart, for example, give The Trade Desk granular consumer purchase data. That allows the company to measure the returns of ad campaigns very precisely. Only Amazon has that as well, but not from others, only from its own sales. The Trade Desk's independence allows it to use those retail data in advertiser campaigns to boost returns and get even more insights.

These partnerships create network effects that strengthen over time: more retailers provide better data, which improves campaign performance, which attracts more advertisers, which provides more value to retail partners.

Adjusted EBITDA margins held steady at 39% despite 23% operating expense growth, higher than revenue growth. CFO Laura Schenkein, in her last earnings call for The Trade Desk (see later), says about the rising operating expenses:

During the quarter, we continued to make investments in our team and platform, particularly in areas like platform operations as the AI and machine learning tools embedded in Kokai continue to drive greater campaign performance.

In other words, the margin compression versus last year reflects deliberate investments in future growth capabilities. As a long-term investor, I'm never against those kinds of investments.

The CFO leaving

A few days before the earnings call, The Trade Desk had quietly filed a document at the SEC (Securities and Exchange Commission) in which it announced the replacement of its CFO, Laura Schenkein, by Alex Kayyal. I had not seen that filing.

Although Schenken worked at The Trade Desk for over a decade, she was TTD's CFO for just two years, and to be honest, she never made a strong impression on me. Kayyal brings deep adtech experience as an early TTD investor (since 2014), a TTD Board Member and M&A expertise from Lightspeed Ventures. That's a global venture fund capital fund with $29 billion. Until about a year and a half ago, he was the Senior Vice President of Salesforce Ventures. So, that could lead to more acquisitions for The Trade Desk.

Jeff Green about Alex Kayyal:

I'm thrilled that he's agreed to join our leadership team as I believe there are a few in our industry who have Alex's experience and strategic mindset in finance in a way that incents and drives growth for the organization.

Schenkein didn't sound bitter at all on the conference call, rather grateful. I think she may realize that the CFO role may at the TTD may not be the best fit for her talents. As a CFO, you have to pound the table sometimes, opposing the CEO if necessary and I'm not sure she could do that. Maybe she was too kind.

With Alex Kayyal, that won't be the case, I'm sure. I've seen many executives in a role that doesn't suit them. They can still do OK work, but never excel. I'm just speculating here, of course, but it could be that was the case here.

There was also a new Board addition, Omar Tawakol. He founded BlueKai in 2007 (acquired by Oracle) and Rembrand, a creative AI leader.

Green also addressed the proposed extension of the dual-class share structure that was filed recently. These are his words to defend this:

From the day that Trade Desk was founded, we believe that long-term thinking is our greatest advantage. The vision that we described is a long-term North Star that we think about in nearly every major decision we make. Dual class helps maintain that long-term North Star orientation. When we went public in 2016, we chose a dual-class structure because we knew building something transformative, something that could truly redefine the open Internet would require conviction, patience and freedom from the short-term pressures that weigh on public companies or are the one-size-fits-all approach often promoted by some governance analysts and major proxy advisory firms.

Our belief has proven correct. Since then, we've grown from below a $1 billion market cap to about $40 billion today and included in the S&P 500. We've helped shape the future of identity with UID2, built leadership in CTV and retail media, expanded globally and invested in innovations like Kokai, Sincera and our TV operating system, all of which require decisions that didn't pay off in a quarter or even a year, but instead positioned us to lead for years to come.

We're now at another inflection point. The digital advertising landscape is evolving rapidly with ongoing regulatory scrutiny of walled gardens, the rise of AI and growing demand for transparency and independence. We believe the next decade will be pivotal in determining the winners and losers in our space and that staying true to our long-term vision is more important now than ever. This proposed extension isn't about entrenchment. It's about ensuring that the founder-led strategy that got us here can continue to guide us forward.

Green's track record speaks for itself, I think, so I have no problems with this extension. Long-term thinking has been TTD's greatest competitive advantage. It prevents an activist from coming in to squeeze out short-term profits. I'm a long-term shareholder myself and that's also how I like management to think.

2026 Acceleration Thesis Intact

Management believes there will be a growth acceleration in 2026.

The operational improvements implemented after the problems in Q4 2024 are working. The company restructured the engineering teams, separated marketing functions, and invested in leadership. There is already better execution.

The competitive landscape continues improving, Jeff Green argues:

As Google continues to pull away from the open Internet, that creates a vacuum which we're stepping into. Stepping back, it's more of a buyer's market than it's ever been before. Large publishers need partners like The Trade Desk to win. And as Google and Facebook have largely abandoned the open Internet, The Trade Desk is the largest source of third-party demand for many publishers around the world.

With full adoption of Kokai, better execution after the Q4 rearrangements and potentially big partners who can recover from the tariffs, 2026 might look better for The Trade Desk.

Bearish Sentiment

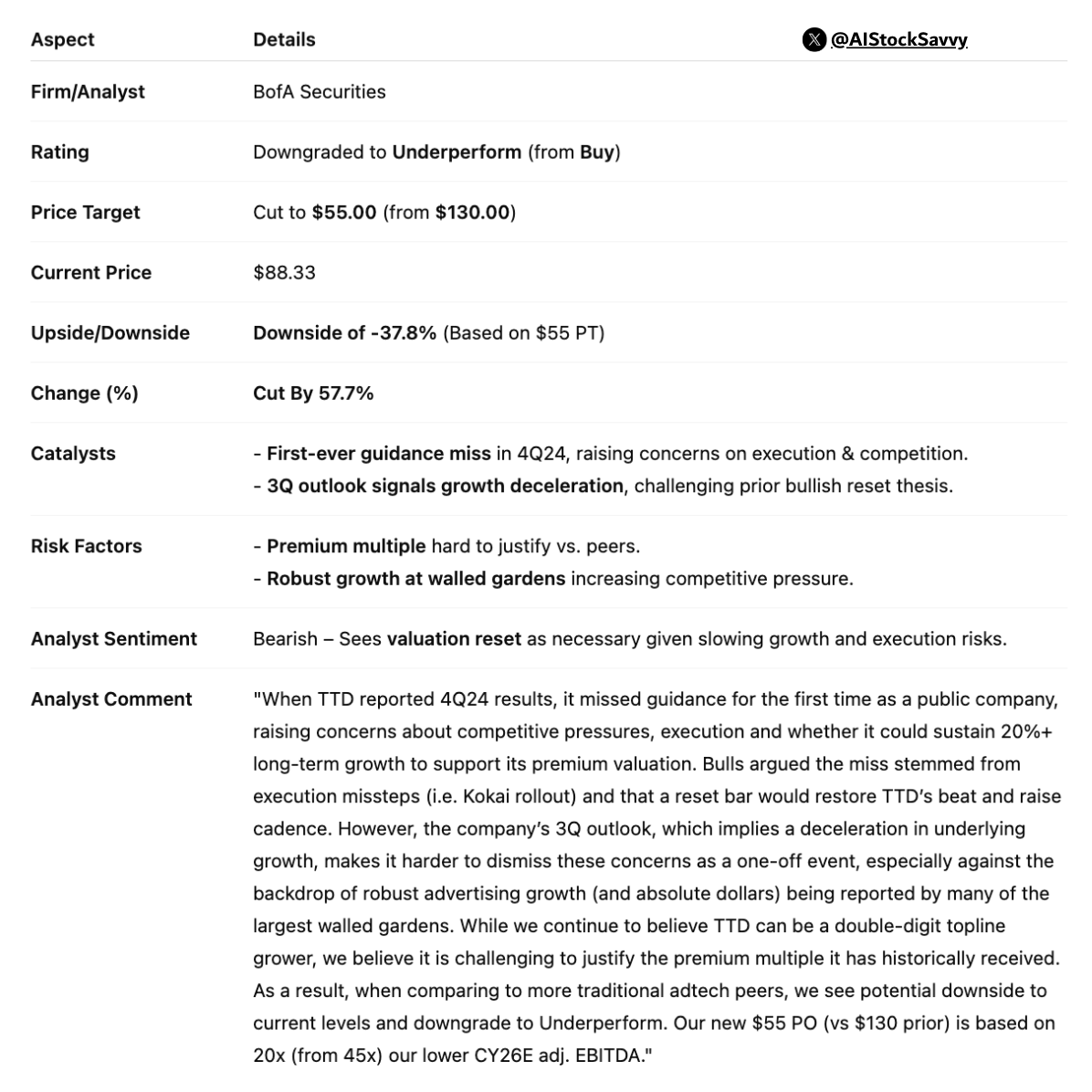

If a stock drops so much on an earnings result, you get extremely emotional reactions from investors as well. I know this will be a surprise for many, but even analysts are people. ;-) So, the Bank of America analyst downgraded the stock from Buy to Underperform, cutting his target price from $130 to $55.

Slowing growth? This was foreseen. In their estimates, mind you.

TTD's fundamental advantages have not suddenly disappeared. To the contrary, the contracts get longer and bigger.

The enterprise customers, especially from the automotive industry, see pressure from the tariffs, as I showed earlier. It's the second-biggest category.

From the Q2 earnings slides

But this volatility will become an advantage. These businesses get so much better returns on their ad dollars with programmatic advertising and value the insights they get.

It's as I have seen so often before: the price action defines the story that's told. The multiple analyst downgrades are nothing more than that too. I saw it when Adyen crashed 40%, too. The analysts see the after-market reaction and want to come up with a story to explain the drop.

This time, it was easy, of course. Just say slowing growth and Amazon and there you have it. Being out with a note before the markets open is much more important than a deep analysis. I've been doing this for 10 years now and you just can't make a deep analysis so fast.

So, what do you do as an analyst? You read the headlines, listen to the confernece call at 2x speed, read some comments from colleagues and there you go. Of course, the price target, that ridiculous habit, has to be slashed. If you leave it at $130, like that BofA analyst, you are probably fired if the stock tanks further to, let's say, $40. If it goes up to $100 from here, nobody will be angry with you and you just raise your price target again. It's a ridiculous game, and it's even more ridiculous so many people believe it's real.

Conclusion

Up to now, I see no reason why The Trade Desk should be sold. Yes, revenue growth was slower and guidance too, but that was fully expected, with tough comps from political ads in 2024, especially in Q3 and Q4, of course, and the impact of the tariffs from big customers.

You will get another article from me soon, with updates on the Selling Rules, the Quality Score, and the valuation for The Trade Desk, but I wanted to share my interpretation of this article before the market closes.

I don't advise going all-in, but I think the sentiment is already way too bearish now. As always, this could even go further and the stock could drop more, but then I will simply add again. I see no fundamental change to the thesis, just a lot of noise as a result of the huge price drop.

In the meantime, keep growing!

I bought 10 shares today as well. I bought them earlier in April at $45 and sold at $75-80.

what are your thoughts exactly on AI putting pressure on TTD business. with less people actually browsing the internet since ChatGPT and other AI agents doing the work for them… that puts pressure on TTDs business with less advertisers using them due to low open network traffic. another thing… what about other Ad giants like GOOG AMZN META all crushing it but TTD struggling?