The Stocks I bought Today

With my insights

Hi Multis 👋

The end of May is nearing. As I buy shares every two weeks, twice a month, it was time to buy my second batch of this month.

This time, I only bought three Potential Multibaggers, which is not a lot, considering I bought nine positions.

The reason?

I want to point out that before this buy, about 64% of the Forever Portfolio is in Potential Multibaggers. After these additions, the percentage remains at 62.30%. My loosely-held target is between 60% and 65%.

Sometimes, when I think many Potential Multibaggers are attractive, I'm not afraid to let that grow to 70% or even 75%. I did that in 2022.

On the other hand, if I think other stocks are more interesting than Potential Multibaggers, I could see myself lowering the percentage to 55%, maybe in extreme cases to 50%.

But right now, I'm still in that sweetspot between 60% and 65%. So, this one addition says nothing about the whole.

But why 60%-65%, you may wonder?

Well, it's simple. I always say that your portfolio should reflect your personality. Almost your book or music collection shows who you are. And probably, you don't have just one genre there. That's the same for portfolios.

Many Multis have dividend stocks, blue chips, REITs, gold or other commodities, bitcoin and other crypto coins and many stocks I forget here. That's perfectly OK.

When it comes to investing, there's no purity demand, even though some online commentators make you want to feel as if you are stupid if you have different styles. Guess which people say about others that they are stupid?

For me, that 60%-65% range feels good. Higher and the volatility in my portfolio will be even bigger. Lower and I would not own enough of the stocks I’m excited about.

But we have digressed. Let's go to what I have added to my portfolio and go over the additions one by one.

1. ASML

As you may know, I visited ASML's Headquarters a few weeks ago, and what I saw there really convinced me about the company, its technology and its future.

You can read my article about the visit here.

You hear a lot of noise about chip makers in general right now. I think that they are attractive at this moment. You'll see that further in this article.

ASML showed this slide, taken from AMD.

While the compute demand increased 2x per year until 2018, it's now 20x per year due to LLMs like ChatGPT.

And that computing power must come from somewhere, from chips. The fabs that make these chips see increased demand. What will they do? They will buy more DUV and EUV machines.

ASML is by far the leader in that market.

The company holds a market share of 85-90% in the DUV market. DUV machines can be upgraded consistently. That too generates money for ASML For EUV, it's simple. Only ASML can make it.

There has been "official" communication from China that Huawei can make EUV as well now. I already wrote at the time this news came out that it was likely propaganda from the Chinese.

But while I was at ASML, I had the opportunity to ask. Investor Relations Director for Europe, Sam van der Zalm, answered by pointing out that China had copied a DUV machine, nut for nut and bolt for bolt, 15 years ago. Right now, they still cannot make it function reliably at an industrial scale.

EUV is 100x more complex (like, really!) and we should believe China can make that and make it work? Call me sceptical, but I don't believe it. And neither do the people at ASML.

Secondly, I also asked about quantum computing. The answer was that it would take at least 15 years before it is fully functional at an industrial scale. Of course, ASML is watching that too, and I'm sure they will be ahead of the curve when the time comes.

But there's another reason to buy ASML now.

That reason?

The stock is cheap.

Or at least relatively cheap, compared to its past.

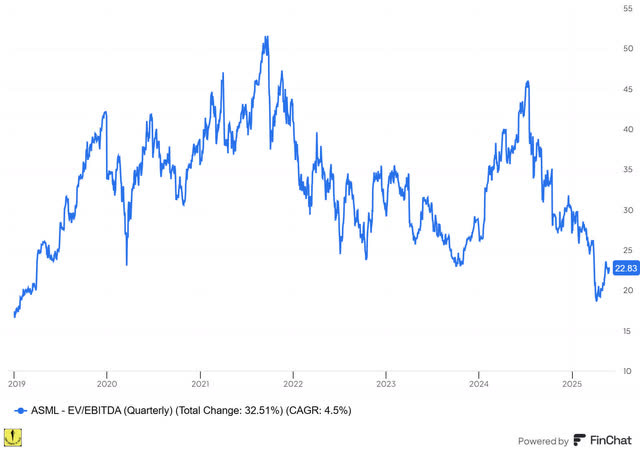

On an EV/EBITDA basis, the stock has not been this cheap since March of 2019. Even the bottom of the COVID crash was still 23, while the stock now trades at 22.8 times.

(Made with Finchat, which I use dozens of times every day. Get your 15% discount here.)

With the vast growth you should expect in chips and ASML's huge market share, you should expect good times to come for the company.

Of course, with the High NA EUV machines coming at up to $400 million per piece, you should expect volatility in the quarterly results. One machine in this quarter or the next can make a huge difference. But I’m not afraid of some volatility.

There are no multibaggers without volatility.

Except for Constellation Software, of course. :-)

(Here stops the part for free subscribers. Grab this 20% discount to get access to the 8 other stocks I bought and my portfolio.)