I Visited ASML

And this is what I learned from that visit

Hi Multis

For most of the year, my days look pretty similar: I get up, grab a cup of coffee, and start writing or researching, which I continue to do most of the day, usually seven days out of seven.

That may sound boring, but it's my best life. Of course, I take some time for my wife and our daughter and my health. But for the rest, I don't need much to be happy.

In the last 10 days, though, my life was also exciting outside of my head.

First, I went to Omaha. The Berkshire Hathaway Annual General Meeting is often called 'The Woodstock Of Capitalism,' but before I was there for the first time last year, I didn't understand how accurate that comparison was. Of course, the Berkshire AGM is the main act on the main stage, and you simply must see it.

But what most don't understand before they go, is how many side stages there are at Woodstock of Capitalism. Vitaliy Katsenelson's breakfast, Mario Gabelli's and Markel's brunch, and dozens of other events are all free and amazing. You get food for your mouth and mind.

But this article is not about Berkshire but about ASML. On Wednesday, still hugely jetlagged, I had the chance to visit the Dutch company's headquarters in Veldhoven, The Netherlands, near Eindhoven.

(Picture by Ben Granjé, used with kind permission)

For those who don't know what ASML (ASML) does, it's a crucial link in the chip chain. In simple terms, it makes the machines that make the chips that are everywhere: in laptops, mobile phones, data centers, fridges, cars etc. On top of that, it also offers testing and inspection of chips.

There are basically two types of chip machines: DUV and EUV, or deep ultraviolet and Extreme Ultraviolet lithography. You don't have to know the technical difference between the two, but EUV is much more advanced than DUV.

There are no official numbers that I know of, but industry estimates see a market share of 85% to 90% for ASML in the DUV market. Nikon and Canon hold the rest.

For EUV, it's simple, as ASML has a monopoly there, 100%. No other company is even close to being able to make EUV. And you need EUV for more and more industries. The magenta part is EUV and it's growing. Just for context, an EUV machine costs about $200 million per piece. The new EUV NA will even go above $250 million.

(From ASML's retail investor presentation, picture by the author)

I had informed you earlier that China's claim that it can make EUV is preposterous. Just for context, during the visit, we learned that China had copied a DUV machine nut for nut and bolt for bolt 15 years ago. Today, they still can't make it work reliably at an industrial scale. And EUV is multiple times more complicated. I labeled the 'China has EUV' claim as fake news, and my view was strengthened during the ASML visit. Don't believe that hype.

But back to the visit. When we arrived, we were given a badge and brought to a modern auditorium with about 100 seats.

(Picture: Peter De Neve, used with kind permission)

There, we got a presentation from Sam van der Zalm, ASML’s Director of Investor Relations Europe. He's very knowledgeable, both about the tech and the business side of ASML and he did a terrific job.

What ASML Does Exactly

Chips are basically electrical circuits at a microscopic scale. Layers are printed on top of each other, as you can see in this slide.

Maybe you think that ASML's focus on cost and energy is a sign of virtue signalling, but that's not the case. Energy has become very expensive in the current environment. It's not a coincidence that big companies like Microsoft, Amazon, and Google are partnering with energy players to ensure the energy supply for their data centers.

Modern AI chips are extremely energy-intensive. Jensen Huang, Nvidia's founder and CEO, even said that Nvidia's competitors could give away their chips for free and Nvidia would still be cheaper from the perspective of total cost of ownership. That's why cost and energy reduction is a strategic advantage for Nvidia and that's also why ASML should focus on it.

Explosive Growth From AI

So, what did we learn from the presentation? A lot. I consider myself quite knowledgeable about ASML and the semiconductor space in general, but the presentation and visit taught me a lot more details than I had thought.

First, van der Zalm talked about employees. About 40% of ASML’s employees are non-Dutch and therefore, the common language at ASML is English. The churn rate is just 3.8% of the employees, which is very low for a tech company. I don't know the number in Europe, but in Silicon Valley, the average churn is about 13%. ASML goes to great lengths to make its employees feel at home. We saw a supermarket and signs to the building's hairdresser, spa, and massage center.

Every time I hear someone talk about the AI 'hype,' I'm shivering. This is not a hype but a fundamental shift that evolves faster than any shift we have seen before. It needs gigantic computing power, expressed in the increasing number of chips. Just look at this picture to see the hockey stick growth moment starting in 2018.

Gordon Moore, one of the chip pioneers and Intel founders, coined Moore's law in 1965 already. It's not a physical law, but an observation that the number of transistors on a microchip doubles every two years. AI is growing so fast, though, that even Moore's Law can't keep up.

In the last decade, instead of 2x every two years, we have seen 16x more computing power needed every two years. With AI, ASML now expects 20x more computing power per year (not per two years!) will be needed from 2020 to 2030.

This explains clearly why companies are begging Nvidia to get more chips. You should not expect this to stop any time soon. Recently, I heard someone say in a podcast that there is an oversupply of AI chips. People who say that have no clue what they are talking about. They look at chips from a historical point of view, not from the situation we are in right now and in the coming years.

After the presentation, we were taken to the ASML Experience center, where we could see the processes inside the company, from the supply chain to the time-lapse of the assembly of a DUV machine. We got a great explanation of the tech behind what could be Earth's most intricate machine.

This is the lens system that was used in the 90s. The current one is much too big to show.

This is a schematic overview of the current EUV machine. I don't expect you to understand it, but you should know this is around 33 feet long, 17 feet wide, and 13 feet tall (or 10 on 5 on 4 meters). It weighs about 330,000 pounds or more than 150,000 kilograms.

At the same time, the wafer lines that are 'light-printed' on top of each other must be correct to the nanometer.

ASML's Business

Now, of course, that's all interesting and impressive, but in the end, we are investors. A company has to make money for its shareholders, of which I am one. But there, too, ASML has some impressive numbers to share. This slide was shared.

As you can see, the company's CAGR (compound annual growth rate) has been 21% over the last decade. That's very impressive. The best thing? Most of it comes from revenue growth: 18%.

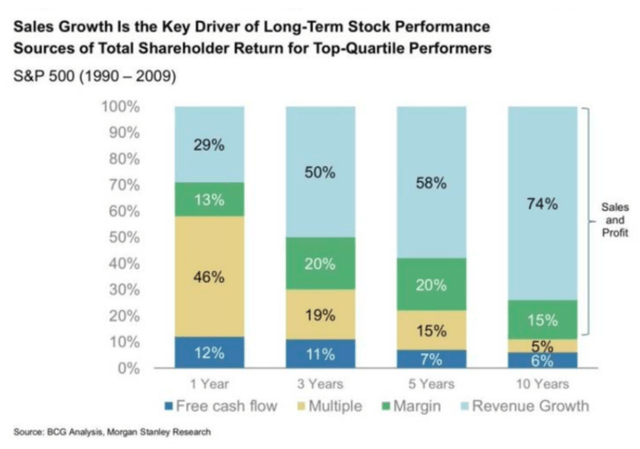

I have used this graph many times before, but I will keep using it until everyone understands that long-term returns mostly come from revenue growth.

ASML's 18% revenue growth per year is a great testament. The stock is up 555% over the last decade, beating the European markets by more than 10x, but also more than tripling the S&P 500 and more than doubling the Nasdaq.

I see no reason why the outperformance couldn't continue. Revenue growth is combined with more efficiency, innovation, a monopoly, a great company culture and great financial management. You can see that in the strong balance sheet, with $4 billion of debt and almost $10 billion in cash and equivalents. The timing of the buybacks also shows this. The big spike in the buyback (the orange line) came near the bottom in 2022.

(If you want the power of Finchat as well, you can get a 15% discount through this link. Most people are shocked about how much value they get for so little money. )

Conclusion

This was a great visit. I already knew a lot about ASML, but I definitely learned a lot more. When you are at ASML, you feel the expertise drip from the walls. As a shareholder, that's a great feeling.

In the meantime, keep growing!