Hi Multis

Another Sunday, another Overview Of The Week! I’ve written 300 before this one and still, I like it each and every time, also because I know that many Multis have a ritual of reading the Overview Of The Week, before going to bed on Sunday evening or even more often on Monday morning with a cup of coffee.

Articles In The Past Weeks

This week, this is just the second article, as I focused on my health this week, with some hospital visits. For those who missed it earlier, I was diagnosed with lung-COVID, which had triggered severe asthma. This week, I had to have some tests in that context. Those tests were

In the article that was published, you got the Best Buys Now.

Memes Of The Week

Two memes this week. This is the first one. It’s actually a clip, but the caption is funny.

It’s indeed true that Software-as-a-Service companies have suffered recently. The “AI will kill everything” narrative is very strong right now. For a part, that will be warranted but for quite a substantial part, it won’t. That’s always the case. The market overreacts to both extremes. Some very interesting SaaS companies could become very attractive soon. We will follow this up, of course. But we are in the meme section of this article, so not too serious here. :-)

And we talk about memes, we can’t pass our Meme King, Flo;

Interesting Podcasts Or Books

This week, I listened to an episode of Invest Like The Best from early December. It’s an interview with David George. He’s General Partner at Andreessen Horowitz, aka A16Z, where he leads the growth investing business.

This was a good interview if you want to get an insight into early companies.

You can listen to the episode here.

One that I have not listened to (it only came out today) but definitely will listen to in the upcoming week is David Senra’s interview with Tobi Lütke. As you probably know, Tobi Lütke is the founder and CEO of Shopify (SHOP). I’ve followed him since I made Shopify the first Potential Multibaggers pick on May 2, 2017, at $7.74.

Tobi Lütke is whip-smart, and maybe because English is not his native language (that’s German), he often formulates things differently, but (like a real German) very precisely and authentically.

As David Senra is a great interviewer, I’m looking forward to this episode. You can listen to it here.

The markets in the past week

Let’s look at the markets this week.

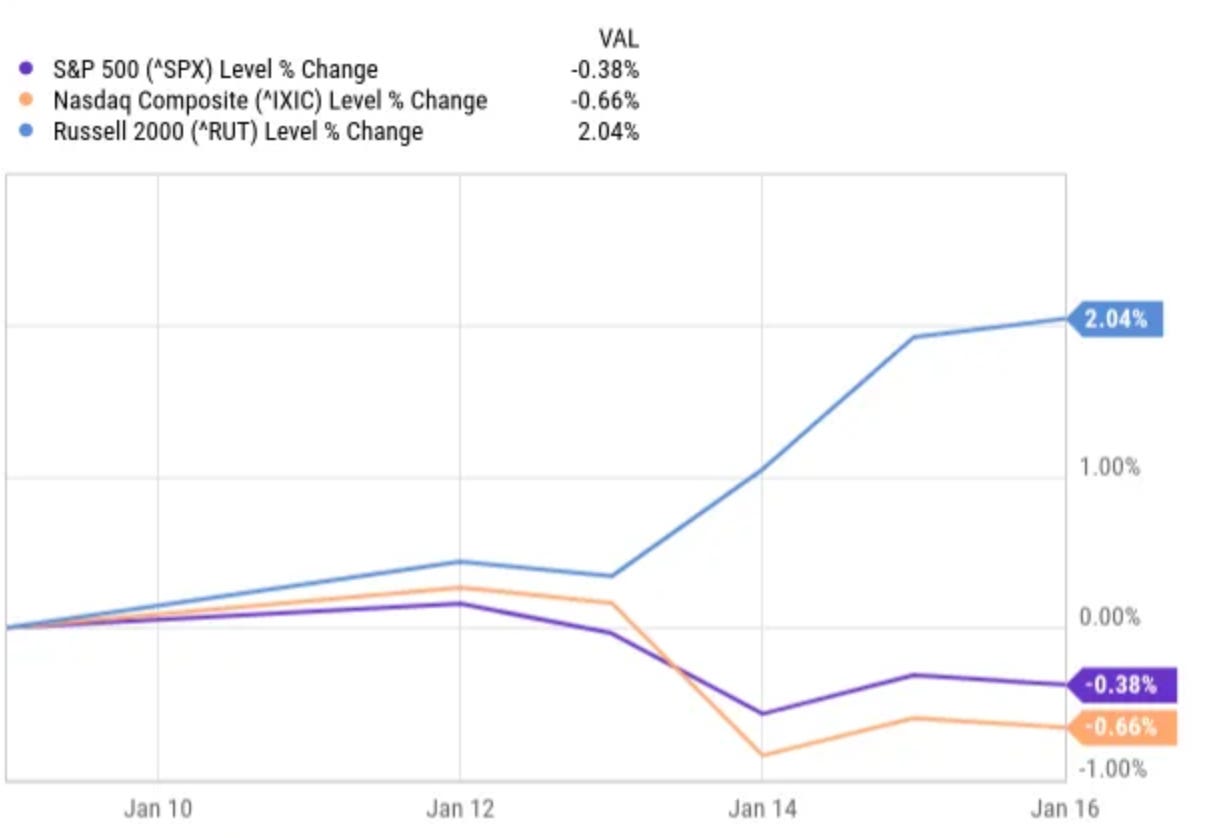

You see the same pattern as last week. The Russell 2000 outperforms the two other indexes. The Russell 2000 was up 2.04%, and the other two indexes were down. The S&P 500 was down 0.38%, and the Nasdaq was down 0.66%. For why the Russell 2000 is up while the others are down, I will repeat the reasons from last week, but add a third one.

Why was the Russell 2000 up so much? Well, there are always multiple explanations out there. One is the “overvalued megacaps” story. I’m not a big believer here. While I see some overvaluation in some megacaps, that’s definitely not the case overall. But hey, it’s a story that sounds knowledgeable, right?

A second explanation makes more sense, I think. The Russell 2000 had quite a few losers in 2025. Investors sell those at the end of the year for tax purposes and then buy them back in January. It’s the so-called January effect, supported by the lower interest rates, which are favorable for small caps.

The third explanation is what we have seen from Jay Powell. It felt almost like a hostage video. The market sees that and assumes Powell will have to bend, which means interest rates would drop. For the more debt-heavy Russell 2000 companies, that would be good news.

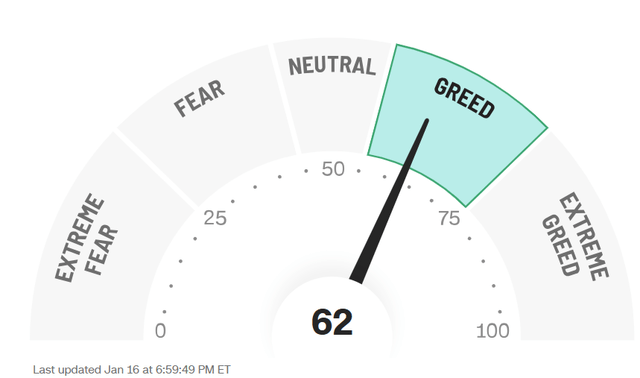

Weirdly enough, the Greed & Fear Index went from Neutral (51) to Greed (62).

Quick Facts

There wasn’t much stock market news in the last few weeks, so no Mark this week. But here are the Quick Facts.

1. The SaaScopalypse

We already touched on it earlier: the big software and SaaS sell-off. I have heard this been called the SaaScopalypse. That’s at least the third time already. It was used in the last quarter of 2018 and in 2022. Did you still remember both? Probably not, only 2022, and that’s great. It probably means there’s a big chance you will not remember this one in 7 years.

But I want to spend some time on the subject here.

First, as I already said, the market always overreacts. Before this big sell-off, many software stocks were priced as if the sky was the limit. If you throw in AI coding, which has the potential to disrupt certain software players, that extra uncertainty makes the market nervous. That’s why it often sells off all names in the space, no matter what.

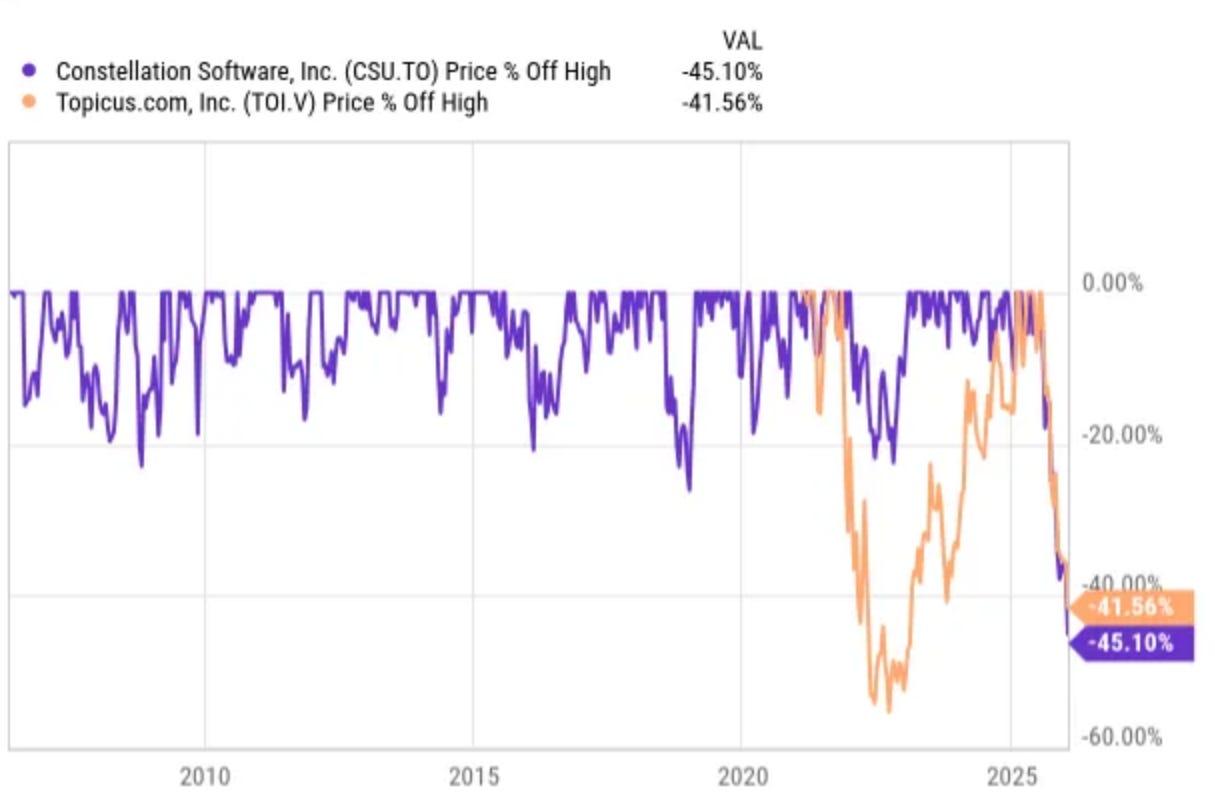

Let me give you the examples of Topicus and Constellation Software. Before now, Constellation had never dropped by 30%. Right now, it’s down 45% from its high. For Topicus, the same goes.

But the funny thing is that the main business of both companies is buying software companies. So, that means the big drop in software valuation is actually a boost for Constellation and Topicus, as they can buy software companies at much lower valuations now.

Both have very strict hurdle rates that they use for the acquisitions, and if they deployed less money (Constellation) and a bit differently (Topicus), that’s mainly because of the high valuations. I don’t think you should expect substantially more deals already in the upcoming quarter, but over the next year if this continues, it might be a great year for both.

But for Constellation, the stock had become expensive because ‘it only goes up.’ So, a part of this is a fair rerating to more normal valuations. But, as often, the market overshoots both ways.

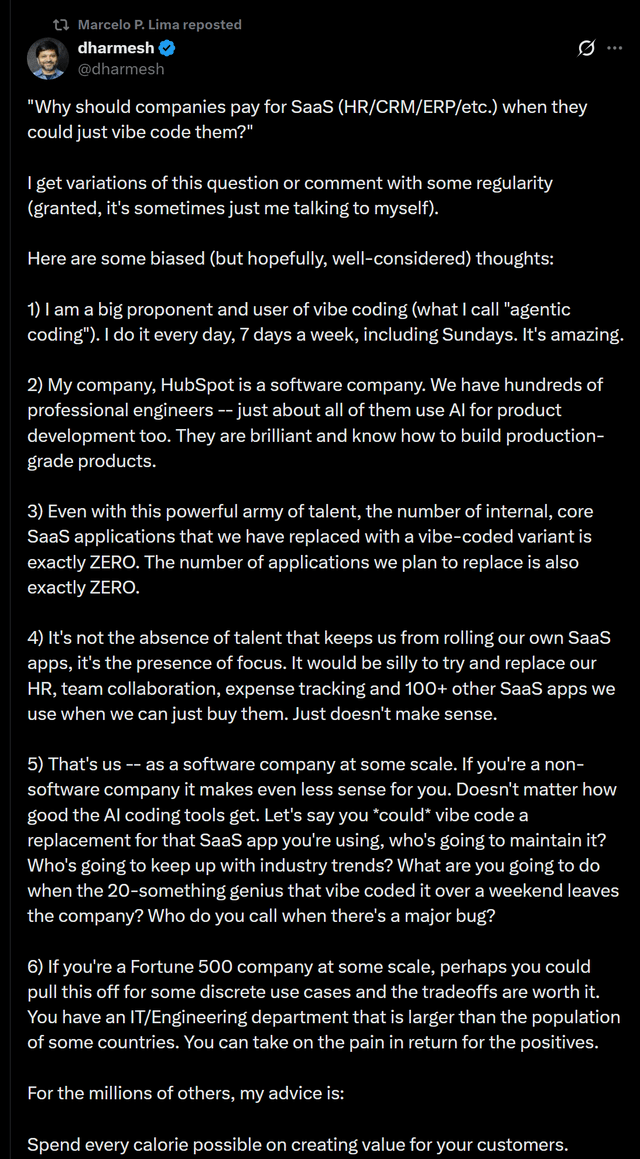

Some software names are already looking more attractive. They are not cheap enough to buy right now, but I’m watching them. I think of a great company like HubSpot, for example. You can’t just replicate that whole platform with AI in a very short amount of time. Another one that starts to look interesting is Monday(.)com.

It’s clear that building software is getting much easier and faster with AI. No doubt about that. But the fact that you can make it doesn’t mean you can distribute it. Or, in other words, it’s not because you can make a damn good coffee that you will disrupt Starbucks. The product is not the hardest part and it never really was. The hardest part is still to find customers, to make them pay more and more, to hook them into your ecosystem etc. It seems like many forget that right now.

Of course, some really talented people will develop faster than ever with AI and AI will open the doors for people who can’t code. That will be a big talent pool for new applications, as creativity is not always the strongsuit of developers. Now, I don’t want to overgeneralize here, as I know many very creative developers, too. But the influx of creativity from new people will turn the industry around and let new ideas flourish.

But concluding from that context that the entire software industry will be disrupted is an exaggeration.

How can you see the difference?

That’s a much simpler question to answer than you might think. The companies that have the data will be the winners, it’s as simple as that. Many of the software companies will even thrive because they will use AI to accelerate their own product development. That could result in fast growth, not decline.

If you still don’t understand what I mean, let me give an example. Microsoft started in the eighties and it was not the best operating system. First, you had the cassettes, floppy disks, hard disks, and CD-ROMs, and later delivery via the internet or preinstalled. At each stage, there were companies trying to disrupt Microsoft. With the internet, you could have thought that Microsoft would die. The fact that Steve Ballmer missed the mobile phone revolution completely didn’t help.

Fortunately for Microsoft, Satya Nadella came just in time to drag Microsoft into the cloud era, so it didn’t miss that train either and now Microsoft is as dominant as it was in the nineties.

This shows that a company has to adapt to the new platforms. If not, it can be disrupted. But if it can, it can give its position a big boost. So, who will adapt the best, do you think?

I want to end this with an interesting post of one of the companies I just named, HubSpot. The co-founder and CTO Dharmesh Shah, wrote this on X.

To be continued, of course. We live in very interesting times!

2. Shopify

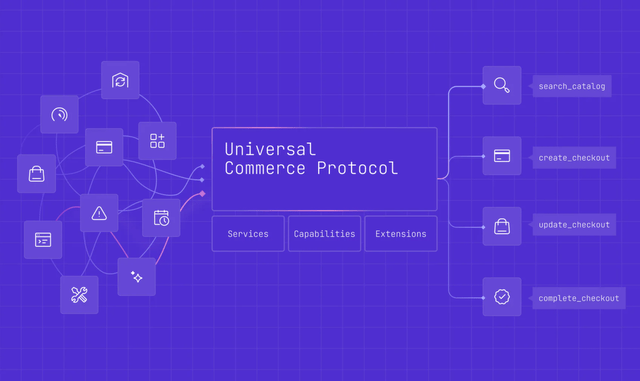

Shopify (SHOP) is building the foundation for agentic commerce. The company calls it Universal Commerce Protocol, and it’s co-developed with Google. It’s an open-source protocol, so others can use it as well.

This release is important because it allows AI agents and retailers to integrate. Agents can handle everything: product discovery, customer support, discounts, subscriptions, loyalty programs, etc. It can be used for all types of commerce.

Shopify founder and CEO Tobi Lütke says that some major retailers are already using it.

If you are not on the paid Potential Multibaggers plan yet, this is the ultimate chance to get your free upgrade worth $800. From now on, I will only show my portfolio in the $1,200 VIP-plan. But everyone who is a subscriber before Tuesday (when I do the upgrade) will be upgraded for FREE FOREVER!

What do you get as a VIP member?

For $399, here’s everything you’ll get:

📈 My Personal Portfolio, the Forever Portfolio

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beats the S&P by more than 40%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.

You will be upgraded to the VIP plan for free