Hi Multis

Sometimes the market collectively jumps on a narrative and forgets to look at the numbers.

That seems to be happening right now. Many of the companies in this Best Buys Now list are down significantly, all with seemingly logical reasons. But do those reasons actually hold up? We will look.

The funny thing is that many people are afraid when the stock already dropped 70% and are overjoyed when the stock is at an all-time high. The risks are perceived much higher when a stock is down significantly from its high.

Good investors try to turn that logic around. When this Warren Buffett quote comes up, everybody nods in agreement.

The problem is that while most agree in theory, they come up with all kinds of excuses in practice. They hear the stories that other people tell and they assume they must be true, as the stock price “proves” this.

Of course, stories can be true but more often they are not. The funny thing is that the market is always very early. Many investors remember stories about this stock or that that went down, but they doubled down and the market was right in the end. Think of Peloton, Teladoc, Zoom and many others. But there are even more stocks that drop for a certain time period and just recover. The story was not false.

Unfortunately, to many, this is not as obvious because the overarching story after the stock has returned to new highs is one of strength, and the stories of when the stock was down significantly are swept under the rug.

There are quite a few beaten-down stocks in this Best Buys Now and that means it could go wrong for some. And I don’t believe the story will change anytime soon. Stories can be very persistent and even survive facts that prove the opposite. For years, a stock can be undervalued because of a certain narrative. But I’m patient and I know that the upside can be very rewarding over the long term.

But enough theory, let’s go to the Best Buys Now.

1. Duolingo: Engagement Is the Key

Price: $156.27

Duolingo has dropped sharply from its peak. 71.1%.

The reasons you read everywhere? Slowing growth and AI as a threat. Let’s take a closer look at both.

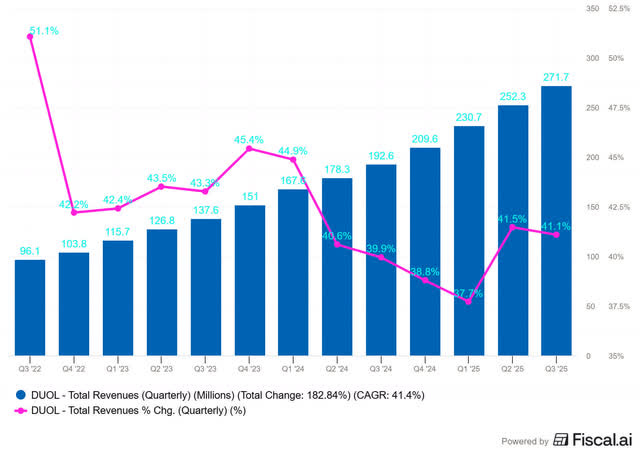

That growth is slowing is true. But that’s simply math. A company can’t keep growing at 70% every year. The bigger you get, the harder it is to maintain those same percentages. Economists call this the law of large numbers. It sounds alarming when growth slows, but in absolute terms, the company is still growing like crazy.

Then AI. This is where many investors make a thinking error. They assume Duolingo is a content company and that AI can easily replicate that content. But the content for learning languages has been freely available on the internet for decades. That’s not the problem Duolingo solves.

The real problem? Motivation. How do you make sure people actually keep learning?

Look at Coursera, a platform full of high-quality courses. Only 3 to 5 percent of users complete a course. The rest drop off somewhere along the way. That’s the problem Duolingo has cracked. They’ve built a machine that brings people back every day.

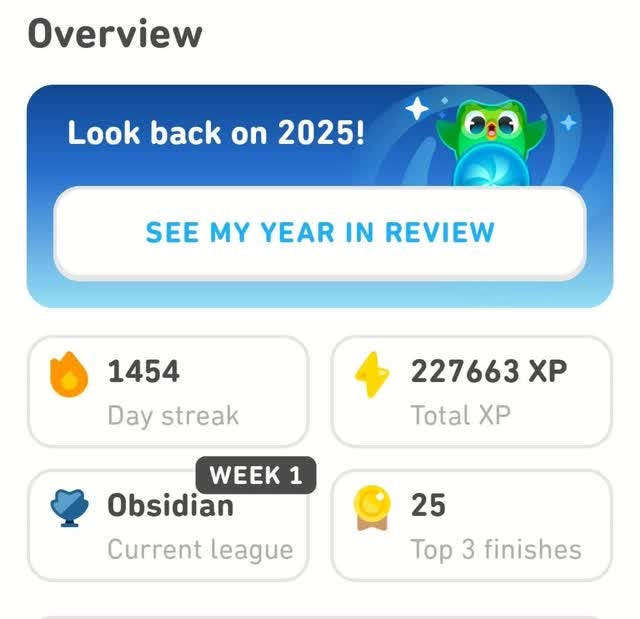

I know this myself very well. I could have learned chess through YouTube, through online courses. I could have refreshed my Italian with other courses and I tried, but never stuck to it longer than two weeks.

But my daily chess lesson on Duolingo? I’ve been doing that for months without missing a day. The same goes for Italian, Latin, and music theory, which I all do on Duolingo. Not because the content is better, but because it simply feels more fun than mindlessly scrolling through social media.

That’s why I have a streak of

Copying that engagement is much harder than it looks. Can a competitor do it? Sure, that risk exists with any company. But so far, no one has pulled it off, except for Duolingo.

What Wall Street also doesn’t like: Duolingo is investing heavily in the business. Management has three levers to pull: content, users, and monetization. They’re deliberately prioritizing the first two right now. That means profits aren’t maximized in the short term, but it’s the right long-term strategy. Users first, money later.

And then there’s the argument that AI will soon offer real-time translation, so you won’t need to learn languages anymore. That argument is honestly a bit absurd. Google Translate has existed for years and people still want to learn languages. Plus, chess was the fastest-growing course on the platform. And chess has no practical use at all. People don’t just learn out of necessity, they also learn for fun.

What I would like to see: programming on Duolingo. Python, or maybe AI-assisted coding. Not because AI can’t do that, but precisely because it’s useful to understand what that code actually does when an AI tool spits it out for you.

I think the negativity for Duolingo could last for a while, but the stock is attractive now for long-term investors.

2. Topicus: Vertical Software Doesn’t Just Disappear

Price: $84.33 or CAD $117.88

Topicus (TOI:CA) (TOITF), the Dutch subsidiary of Constellation Software listed on the Canadian stock exchange, took another hit today. The stock’s now down almost 40% since its all-time high just 6 months ago.

Once again, the AI story is the culprit. The story goes that AI will make the specialized software that Topicus acquires and manages obsolete.

Let’s take a step back. What does Topicus actually do? The company buys what’s called vertical market software. That’s software built for a very specific niche: school administration, prison management, municipal services, that sort of thing. Not sexy products, but absolutely essential for the organizations that use them.

The bear case is that AI tools will replace this software. But here critics are making the same mistake as with Duolingo: they’re focusing on the technology and forgetting about the distribution.

Imagine this.

You are a clerk working at a small town in Belgium, let’s say Maldegem (where I live). There are about 24,000 inhabitants.

You have been using Cipal Schaubroeck for over twenty years, just like your colleagues. Most have never known anything else.

Here comes this 24-year-old kid into your office. He claims to have better software, vibecoded with AI, that will replace your Cipal Schaubroeck bookkeeping and official notetaking software. It will be so much better, dude!

What you think as a clerk is simple:

* How about the security?

* How about compliance?

* Will this be up all the time?

* How long will it take to retrain the full team?

* How much will it cost to implement?

* How will we rip CP’s software out of the whole system?

* How will I sell this to my boss?

* Our software is less than 0.5% of our total cost, is it worth taking that risk?

I could go on, but I think you get the point.

Topicus bought Cipal Schaubroeck earlier this year. And no, it won’t grow that much organically. New towns just don’t get born every day. But with some pricing power, it will grow organically, probably 2% above the inflation or so.

That’s the kind of companies Topicus invests in. And that’s why AI is much less of a threat than most people think.

Can AI play a role over time? Absolutely. And the smartest software companies will integrate AI into their existing products. But that’s very different from AI completely taking over this market. There are too many practical objections: compliance, reliability, ease of use, and simply the cost of switching. The software is usually less than 1% of the total cost, but if you have to retrain your employees, that cost is much higher.

The story sounds logical, but the facts don’t support it.

If you are not on the paid plan yet, this is the ultimate chance. It actually stopped, but you can upgrade now. What do you get as a Premium member?

For $349, here’s everything you’ll get:

📈 My Personal Portfolio, the Forever Portfolio

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beats the S&P by more than 40%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.

You will be upgraded to the VIP plan for free