It’s Sunday Funday time again!

I hope you had a great Thanksgiving long weekend if you live in the States. For those not living in the US, Thanksgiving is a great moment to be grateful. There are so many things to be thankful for: Health, wealth, family, children, partners, and so much more.

Articles In The Past Week

This is the third article this week.

In the first article this week, I wrote about what I added to my portfolio.

We also looked at the Tempus AI earnings.

I expected to publish more articles, but I dealt with some of the consequences of the food poisoning I got in Lisbon last week.

Memes Of The Week

A few memes again this week. Here we go with the first one.

To a certain extent, this is funny because it’s true, of course. But I think AI will be an accelerator for CEO quality differences. The best CEOs will use AI in a way that will help them stand out even more. Think of Shopify, for example. Mediocre and bad CEOs will use AI inefficiently and fall even more behind.

But hey, on to the next, one I made myself.

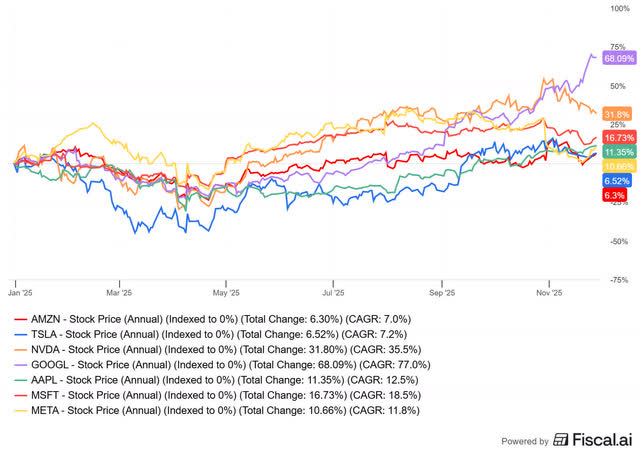

Google’s all the rage now (more about this later in this article) and Amazon has had the lowest YTD return of the whole Mag7, just 6.3% versus 68.1% for Alphabet.

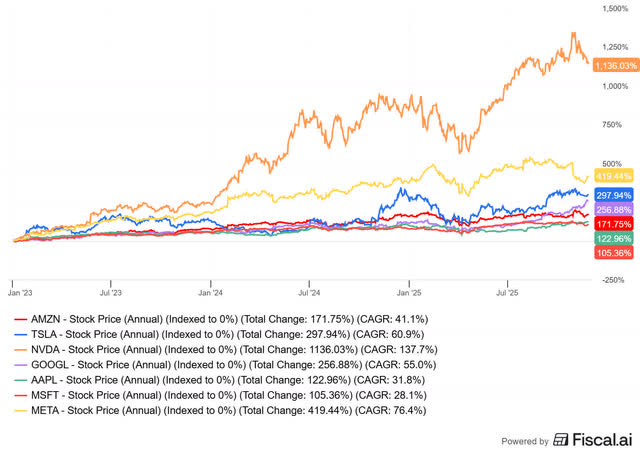

Now, if you zoom out, the picture looks completely different. This is the last three years.

Here, Google’s just number 4, after Nvidia (a 12-bagger over that period!), Meta and Tesla. The laggard here is Microsoft. But hey, we are looking at things too seriously now, aren’t we? Back to the memes.

This is a problem I had in the past. Sometimes, so many people talk about the value of a certain stock that it becomes appealing, even if you wouldn’t normally invest in it. Think of PayPal for years already now.

PS: These graphs are made with Fiscal AI.

It has now rolled out its Black Friday discount. It only does that from now to Cyber Monday, so hurry! You get a 30% discount if you use this link.

Interesting Podcasts Or Books

This week, I enjoyed the In Good Company podcast episode. The guest is Greg Jensen, the co-CIO (together with Ray Dalio) of Bridgewater

We live in a time in which we can listen to the best people in their fields for free. Platforms like YouTube and Spotify have erased the boundaries that used to be set by the traditional media. The result is more valuable content.

The markets in the past week

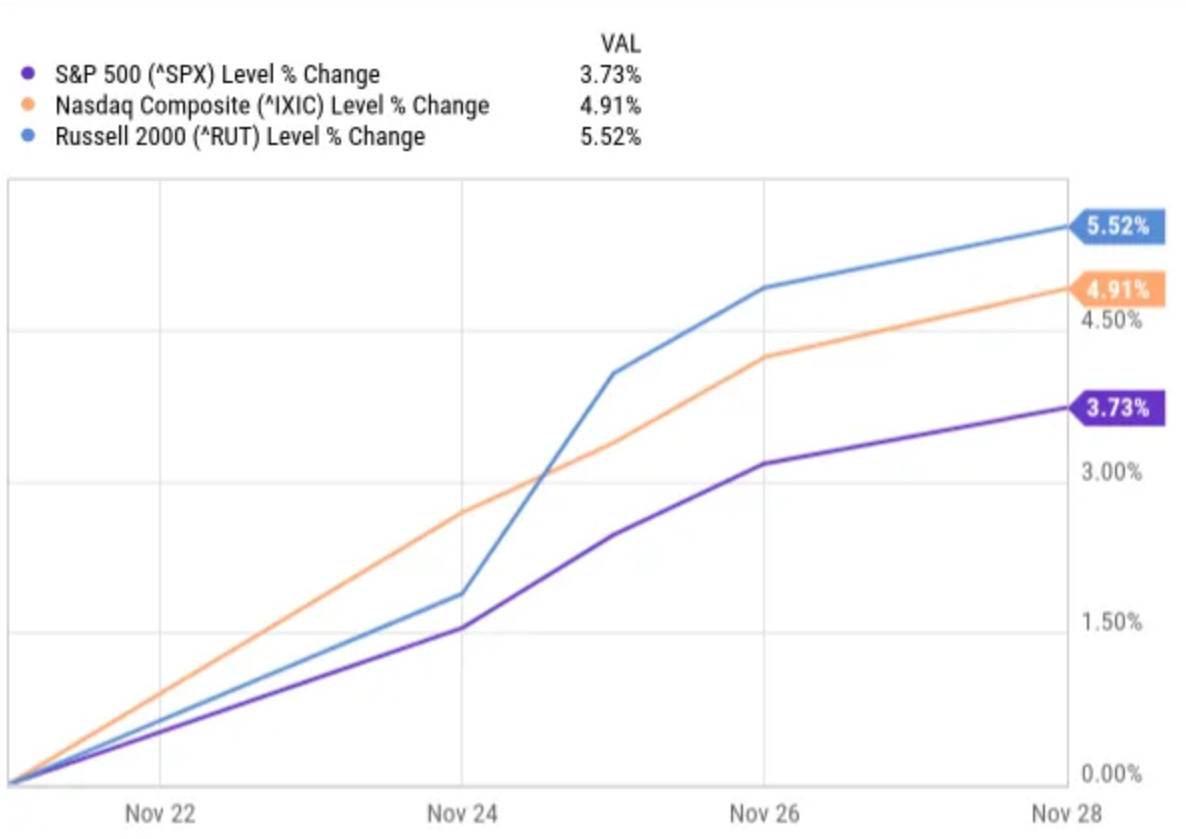

This was a truncated week because of Thanksgiving. And we can thank the market for giving great returns.

The S&P 500 was up 3.73%, the Nasdaq 4.91% and the Russell 2000 5.52%. That’s an exceptionally strong week, but with the market being closed for a day and a half, it’s even more remarkable.

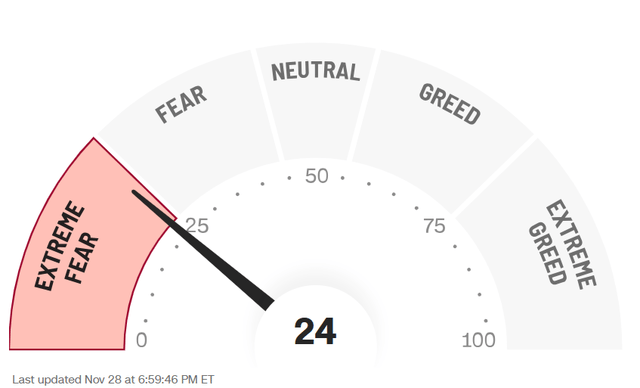

After hitting 4 last week, the Greed & Fear Index rose to 24 this week. That’s still in Extreme Fear teritorry, but up substantially nonetheless.

Lesson Of The Week

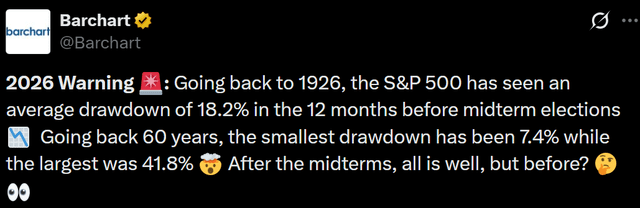

This week, this table was shared widely on the internet and social media.

As there are midterms in 2026, this looks awful, right? So, sell all of your stocks and wait it out until after the elections?

Well, not too fast...

Look at the selection here first. What you see is that you are only served the drawdowns. That’s not the same as the return. That’s already something will not notice.

It shows the volatility. The average drawdown is 14% in general. So, yes, the volatility in drawdowns is a bit higher in pre-midterm election periods. That doesn’t seem to be a wild assumption. But maybe the upside is also higher? Usually, when the volatility is higher, this is the case.

So, please, don’t be influenced by such negative info. Stay the course.

Quick Facts

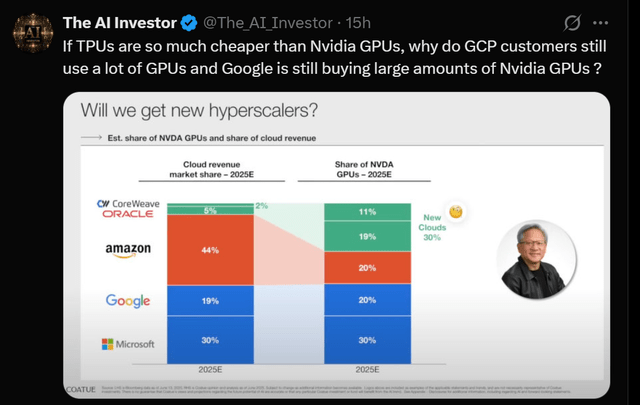

1. Is Nvidia Cooked Because Of TPUs?

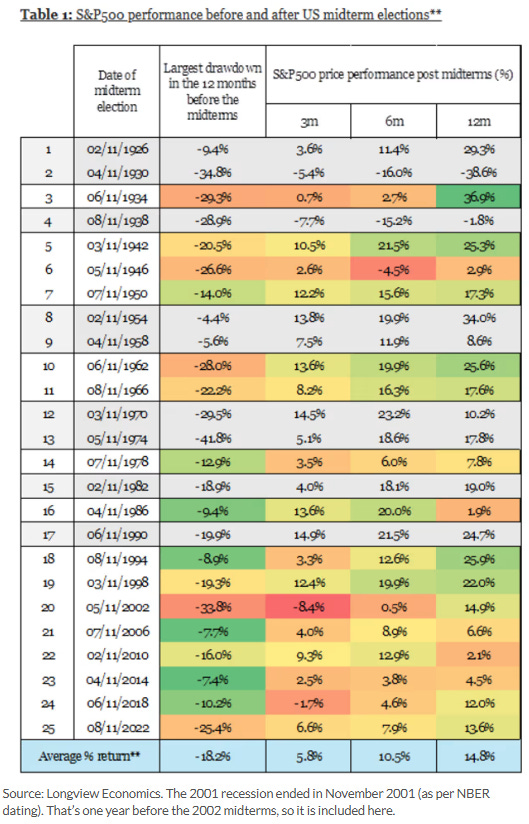

This week, SemiAnalysis published a post that went viral. Google just scored a big TPU deal with Anthropic. SemiAnalysis claims this is the end of Nvidia’s unchallenged dominance. Hence, this meme too.

The report noted that leading models like Gemini 3 and Anthropic’s Claude 4.5 Opus used TPUs for training. Google is shifting its strategy to commercialize these systems externally.

The analysis concludes that the TPU stack offers a significantly lower Total Cost of Ownership (’TCO’), suggesting that system and infrastructure engineering, rather than chip microarchitecture alone, provides a key advantage for deploying and scaling AI applications.

Later, SemiAnalysis posted this awful cartoon to make its point.

Typical for the market. Just a few months ago, Alphabet was dead; now it’s the king of AI, and it will annihilate Nvidia.

I started a position in Alphabet when the market was so negative. Now, I think it’s way too optimistic on Alphabet and too pessimistic on Nvidia. Why?

The central argument in the SemiAnalysis article are the Total Cost of Ownership numbers. But these are completely wrong.

The author wrongly mixed up specialized TPU rental deals, like the friendly $1.60/hour price Google gives Anthropic (which is a Google-invested partner), with general market sales. That’s not an apples-to-apples comparison.

Also, TCO isn’t just the hourly rate. True cost includes software, stability, and compatibility. That’s where Nvidia’s CUDA moat still stands out. Why is Google still buying Nvidia if TPUs are so cheap? It is estimated to have bought 20% of all Nvidia GPUs.

Look, this isn’t a zero-sum game. Yes, TPUs and other ASICs from Amazon and Meta will grow (that’s why I have a position in Broadcom!), but Nvidia and AMD will too. This is simply market diversification. Don’t be fooled by simplified cost curves.

I’m not adding to my Nvidia position now, but if the market keeps playing this stupid game in the next weeks, I might be tempted.

As for Alphabet, it’s an average position, so I’ll let it run. If it were a big position, I might trim here. This looks like it’s close to peak hype.

2. The Investing Pyramid

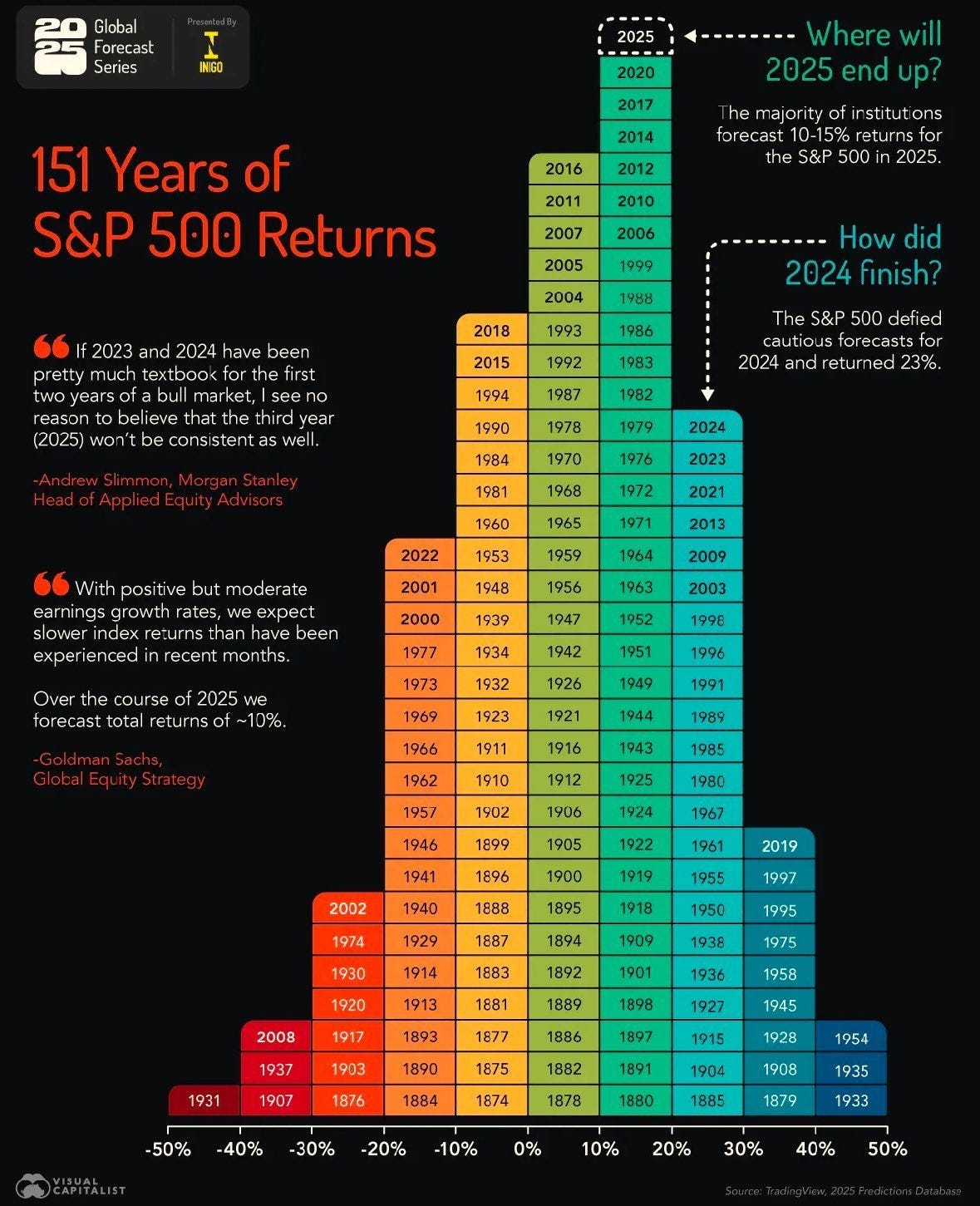

Visual Capitalist already placed 2025 in the Investing Pyramid it made at the beginning of the year and it looks like this will become a reality.

Now, I’m pretty confident that most analysts will forecast a return between 5% and 15% again. Why? Because it’s safe. They know this pyramid.

3. OpenAI Ads: A Game-Changer?

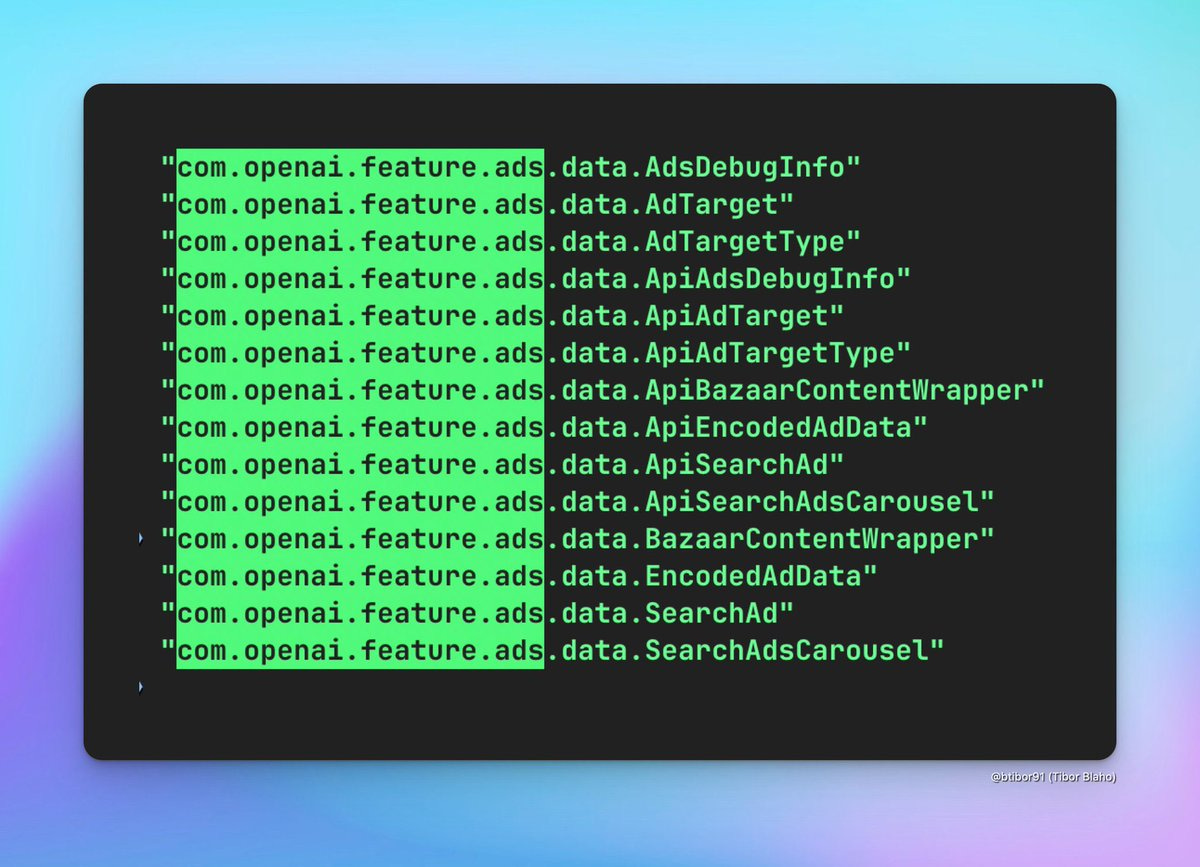

This week, you could see this.

In other words, OpenAI is preparing for ChatGPT ads.

This could be a game-changer for the company. I have been saying for quite a while that I consider OpenAI to be the weak link in the whole system. But if they can figure out ads, that can be a game-changer.

I’m old enough (don’t ask me) to remember when Facebook and Google got so many negative comments because they could not profitably monetize their platforms. Until they did, of course.

If OpenAI can take a share of this ad revenue, things could look very different and OpenAI could make Sam Altman’s dreams come true.

If it happens, it’s also a risk for the current just-promoted King of AI, Google. The headlines could flip fast to “losing ad revenue.” The fickle market...

It could also be a bear case for Meta. Could its own ex-employees undermine it?

This is where the free end stops.

Wanna continue?

Grab the Black Friday - Cyber Monday discount here!

Here’s what you will also get:

✅ Multiple articles every week

✅ My complete portfolio (with every transaction)

✅ Deep earnings analysis, with Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)