Hi Multis

Another new author at Potential Multibaggers, Friso. He will introduce himself and then analyze the Tempus results.

Friso had sent this analysis when I was in Dubai, two weeks ago, but I could only process it today, for which I want to apologize both to you and to Friso.

Hi Multis

My name is Friso Alenus and I’ve recently joined Kris’ team as a writer.

I work in finance for a local Belgian investment company. My primary areas of focus involve analysing new investment opportunities and following up on earnings reports of active investments in the portfolio. Next to that, I am also a contributing writer on Seeking Alpha, like Kris.

I started investing at the beginning of 2021 and currently manage multiple family members’ portfolios with around 300k EUR under management. I love following the markets, reading books about investing, and developing myself to be a better investor. My hobbies are playing tennis and traveling the world.

Let’s now jump right into the analysis!

Tempus AI (TEM) has reported earnings on the 4th of November.

Despite showcasing another quarter of strong revenue growth and a first positive adjusted EBITDA quarter, the stock dropped after earnings.

On such days, it is important to zoom out and look at the full picture. Tempus AI had already appreciated by 140% since the IPO last year. So, a little breather after earnings is more the norm and not always caused by a bad earnings report.

The Numbers

Non-GAAP EPS: -$0.11 vs the analyst forecast of -$0.18 (beat).

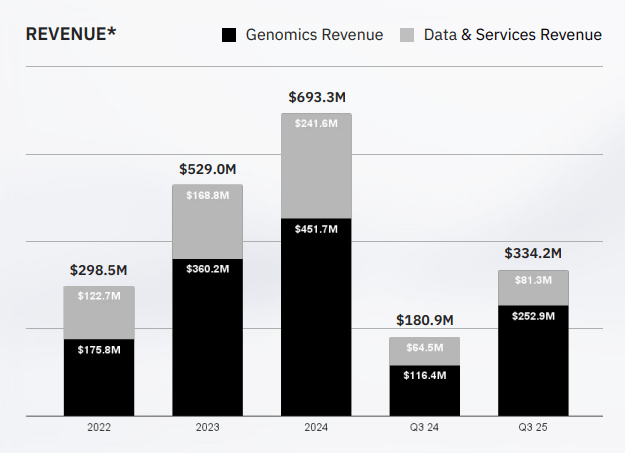

Revenue: $334.2 million (up 84.7% year over year) vs the analyst forecast of $328.6 million (beat). Last year, the quarterly revenue was $180.9 million.

Gross profit:$209.9 million, an improvement of 98.4% year over year.

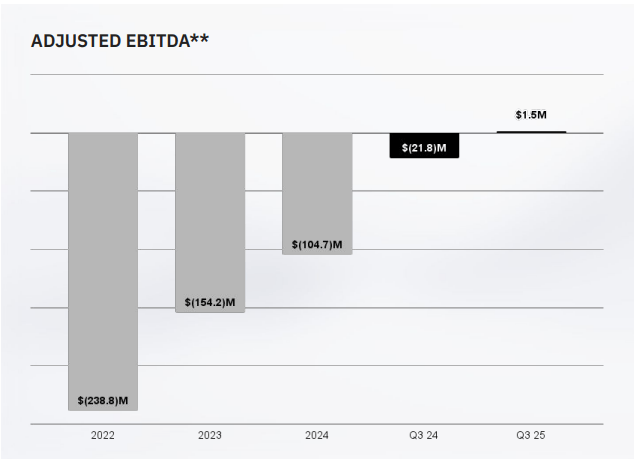

Adjusted EBITDA:$1.5 million vs -$21.8 million last year

Net income:-$80 million vs -$75.8 million last year

Tempus AI reported another exceptional quarter with explosive revenue growth and improving margins. The highlight of the quarter is the first positive adjusted EBITDA quarter. A company can only be successful if it can be profitable in the long run.

Following the latest quarter, we can also calculate the rule of 40 to check their efficiency in balancing aggressive growth with spending.

The Rule of 40 is calculated by summing the revenue growth and the profitability. The question then becomes what kind of profitability? Usually, the FCF margin is used, but I am more conservative and take net income margin.

So: 84.7% revenue growth + (-23.9%) net income margin = 60.8%. This is an outstanding score on the Rule of 40% and indicates a good balance between growth and profitability, even while using the strictest form of the rule.

The rule of 40 can also be used as the sum of revenue growth and EBITDA margin or free cash flow margin. The scores are even higher then, 72% with the GAAP EBITDA (-12.3%) and 112% (with FCF).

Source: Tempus AI’s Q3 2025 earnings call slides

Revenue breakdown

When we dive deeper into the financials, we can see that the company’s genomics revenue growth has been accelerating immensely. From 2023 to 2024, the genomics segment slowed down and could not keep up with the growth from the previous year. Nevertheless, the story in 2025 is completely different. Genomics revenue has reaccelerated and grew 117.2% to $252.9 million.

Most of this growth comes from the acquisition of Ambry Genetics, which specializes in hereditary testing. Hereditary testing revenue totaled $102.6 million.

Even without the acquisition growth, Tempus’s oncology testing accelerated to 31.7% year over year, bringing in $139.5 million in revenue. Revenue from data and services was $81.3 million, resulting in 26.1% growth year over year.

Source: Tempus AI’s Q3 2025 earnings call slides

Guidance

So far, the company has increased guidance each quarter in 2025, and the third quarter was no exception. The company increased full year 2025 revenue guidance to $1.265 billion, representing 80% growth compared to 2024.

Q4 revenue is estimated at $360 million (up 79% year over year) and adjusted EBITDA of $20 million.

New acquisition

In the latest quarter, the company also made another acquisition for $81.25 million: Paige. Paige is a company that uses AI in diagnostic decision-making in cancer pathology. This strategic acquisition instantly expands Tempus’s expertise, adds data of 7 million digitized pathology slides and FDA cleared AI tools.

In the third quarter, the acquisition caused a small negative EBITDA impact of -$2.4 million. However, in the long run, this seems like a great addition to Tempus AI’s existing portfolio.

Eric Lefkofsky said this about the acquisition:

We have long invested in digital pathology given its clinical importance. We have built hundreds of algorithms from the library of ~1 million H&E images we have digitized over the years, as we believe generating insights faster and more efficiently is important for care. When Paige became available, we decided it was too strategic to pass up.

Paige is a unique asset. Not only does it have the largest pathology library of cancer patients we know of with ~7 million digitized slides, it was formed through a unique partnership with Memorial Sloan Kettering, who over the past decade has worked hand in hand with the Paige team to assemble millions of patients worth of connected clinical and pathology data.

On top of its proprietary library of slides, Paige has a state-of-the-art pathology viewer, an FDA approved algorithm for prostate cancer with a pancancer application in flight, and the industry leading AI foundation model. Integrating the Paige offering within the Tempus platform will allow us to provide additional actionable insights to the physicians and patients we serve.

Takeaway from the shareholder letter

Eric Lefkofsky reaffirmed in the earnings call that he expects the business to grow at least 25% annually for the next 3 years. This is no easy feat considering the scale Tempus has today. To grow 25% next year, the company will have to add more than $300 million in new revenue in 2026.

But Lefkofskyu is confident to reach that target and mentioned the following in his letter to shareholders:

“One of the hardest things to do, and a sign of business model endurance, is being able to slow down the rate of those investments and still maintain healthy growth, which is exactly what we achieved this quarter.”

These are the kind of quotes you want to hear from a CEO. Tempus AI’s value in the market is validated by experts in the field and large pharma companies. Being able to gather data in the medical sector is extremely difficult and only works in a win-win situation. Tempus AI made this happen.

Conclusion

The post-earnings drop in Tempus AI’s stock appears to be a case of short-term profit-taking rather than a reflection of fundamental weakness. The underlying business performance was exceptional.

Tempus AI delivered a strong beat on both revenue and EPS, demonstrating explosive 84.7% year-over-year revenue growth and impressive 98.4% gross profit growth. Add the first-ever quarter with positive adjusted EBITDA and you can only be happy with the results.

Back to Kris for the Quality Score and Valuation update.