Hi Multis

Have you checked the calendar?

It's the 15th of April and on or around the 15th, you get the Best Buys Now. Each month, I select 5 stocks that I think have the most long-term upside. Always remember that phrasing: 'long-term upside.'

Especially in this context, it's very important to repeat that. The best long-term investments may underperform for months. Be prepared for that. That's also one of the reasons I dollar-cost average. It's not because a stock is attractive it can't keep dropping.

With that in mind, let's go to the 5 Best Buys Now.

1. The Trade Desk ($49.24)

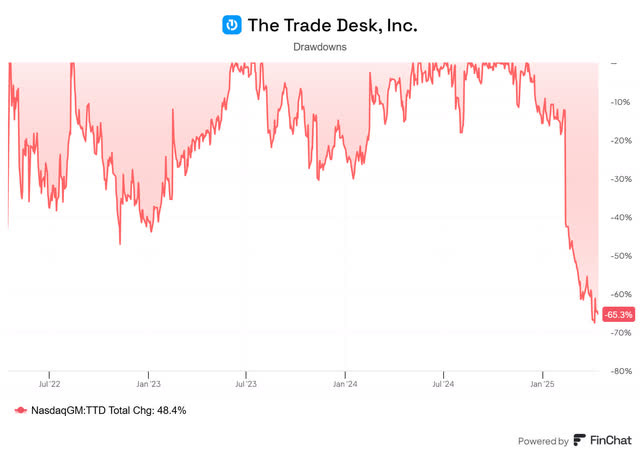

For most Multis, it won’t be a big surprise that The Trade Desk (TTD) is in the Best Buys Now. The stock is now down 65% from its high.

(Get the promo price for Finchat through this link)

I feel pretty confident that the stock will look attractive in a few years. But of course, it could go down further. The great thing is that you don't have to catch the bottom to have a great investment.

I got feedback from several Multis that they liked my reverse DCF. I just want to point out that you have to be careful because the assumptions are very personal and subjective, even if all the numbers and the model make it look objective. But with that in mind, let's look at the reverse DCF.

As you can see, even if we ask for a 15% return per year for the next 10 years, with 23% FCF in the first 5 years and 15% in the second five years, the stock is undervalued by almost 30%.

Even under much more conservative assumptions of 18% FCF growth in the first 5 years, 12% in the next five and the same 15% return per year, the stock is still undervalued right now.

Mind you, another conservative element was dilution. I took 2% per year because that is the historical number. At 1.5% dilution, with all of the assumptions just above, the stock is undervalued by 11.5%.

What growth is implied in the current price? About 15.5% for the first five years, and 11% for the next five.

All in all, you can keep playing with these numbers as much as you want, they won't matter that much if the company drops the ball fundamentally.

That means that the company can fix the "series of small execution missteps" Jeff Green mentioned on the earnings call. Remember that Green also said that the company prioritized long-term gains over short-term gains in a few instances.

Of course, all the bear cases come out when a stock is down 65%. Let's name a few:

Amazon is killing it in the ad market and is eating The Trade Desk's lunch.

AppLovin is disrupting The Trade Desk

Customers don't like Kokai, The Trade Desk's new platform.

AI is disrupting The Trade Desk.

But none of these really matter, or they are false.

Of course, Amazon is doing great with ads, but that has been the case for years and The Trade Desk still grew a lot. Even in this quarter, revenue was up 22%.

Applovin is not a direct competitor to The Trade Desk. Yes, AppLovin has said they will also create a CTV platform, but I don't know why that would be so bearish. AppLovin has already had three short reports about it in recent months, from reputable short sellers like Muddy Waters. I have looked at the company and to be honest, even if I have followed ad tech for so long, I have the feeling I don't understand everything from AppLovin's business. It feels like I'm missing something and I have learned to listen to that feeling. But besides that, AppLovin and The Trade Desk are in different markets.

As for Kokai, I have the feeling there is a loud minority that, indeed, doesn't like Kokai, but the majority of customers has already switched from Solimar (the previous platform that is still active) to Kokai.

Jeff Green on the conference call:

We’ll move 100% of our clients to Kokai this year. Now, the majority already have. But today we are maintaining two systems, Solimar and Kokai. This slows us down. Kokai is more effective in almost every way.

As for AI, the company has been using AI since 2017 and knows it very well. If more customers use LLMs instead of Google search, that's not a problem for The Trade Desk. CTV (Connected TV) is their biggest market and, simultaneously, the fastest-growing.

I have intensely followed founder and CEO Jeff Green for more than 6 years. I have never seen one remark where he was not candid, saw him break one promise he had made and make one prediction he didn't nail.

Yes, the previous quarter, the company missed its own guidance for the very first time. That may have been the first time he missed a prediction, although projections are more the CFO's work.

The Trade Desk has already appointed a COO, the first since 2022, as you could read in the Overview Of The Week #16.

I'm sure this will turn out a good moment to invest. I have seen similar negative sentiment around many high-quality companies whose stocks dropped. Think of the big drop in Adyen, when the stock dropped 40% on a single day. I made it my biggest position at the time. If The Trade Desk keeps trading around these prices, it might end up being my biggest position too at one point.

Nu Holdings ($10.84)

Another one that has been in the Best Buys Now multiple times before. There are no really new developments, so I'll won't spend too many words on this one.

Maybe this great Finchat chart shows what I mean best.

As you can see, the stock and net income went up in synch, until November 2024. In the last 6 months, there is a disconnection and that's why I want to take advantage by loading up on Nu Holdings shares.

An excellent management, a company that knows what it does, that grows fast and profitable. Hey, if it's good enough for a (small) position in Warren Buffett's portfolio, it's good enough for a (bigger) position in mine. Well, bigger... In percentage terms of my total portfolio, haha.

If you want to know the three other picks and three more stocks to consider, you can grab the 18% discount here.