Taking Action In This Mess

Hi Multis

Another red day in the market yesterday, and I used it to add to the Forever Portfolio, like I usually do in the first week of the month. If you are a paid subscriber, you got a notification through Slack and mail yesterday with what I bought. Of course, there’s also an article where I explain what I bought and why.

The last two days of the trading week felt terrible, but these are often the days where you find the best opportunities.

This is the sentiment right now.

If it's that bad, it usually means a rebound is coming. We don't know if that rebound will be temporary or permanent, of course, but this extreme level of fear usually doesn't hold long.

The S&P 500 is now down 17.4% and the Nasdaq 22.7%. That means the Nasdaq is already in bear territory and the S&P 500 is approaching it.

But don't lean into the fear porn that's out there now. We are long-term investors and that means at least 5 years, preferably longer. These are the charts of the last 5 years and the last 10 years.

As usual, the starting point matters and we were in the Covid crash 5 years ago. But I think you get the point. Zoom out. This is not the first drop ever.

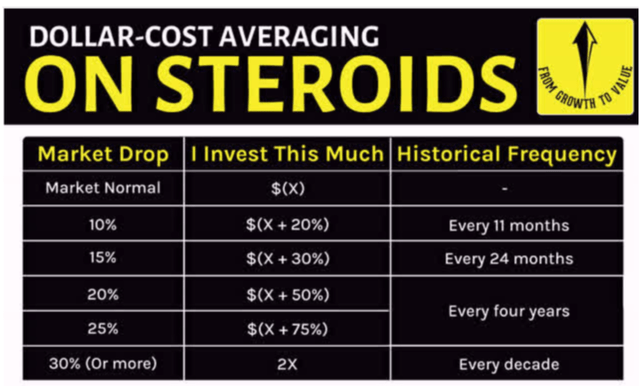

With the S&P 500 down 17.4%, that also means my DCA On Steroids has kicked in, as I shared earlier this week. This is my system.

I meant to add €3,500 plus an extra €700 because we’re in a correction, but I fat-fingered the transfer and sent €4,500. I only noticed it after I finished buying, so that’s why the amount is higher this time.

But then, there was another twist when I started writing this article and I saw that the S&P 500 was already down more than 15%. That means the next step in the DCA On Steroids scheme should kick in, adding 30% more. That would be €4550. So, actually, my fat-fingered mistake is pretty close to what I should have invested.

Unless the market drops a lot more, I’ll add another tranche in two weeks, after the Best Buys Now, which usually comes out around the 15th. I'm curious where the markets will be then.

Let’s go over what I bought.

If you want to continue reading, you will need a paid subscription, but you can grab this offer. As the S&P 500 is down 17.5%, I decided to give an 18% discount to subscribe.