Hi Multis

This Sunday evening (where I live) differs from other Sunday evenings for me.

The reason is that tomorrow morning, I'm going to Klosters for ValueX Klosters.

Here you can read a bit more about it from Guy Spier, who organizes the conference:

I started VALUEx in 2011 with the goal of creating a different kind of investment conference: one which did not cost an arm and a leg, while still delivering lasting value. I wanted to enable the participants (a group of thoughtful friends and investors) to meet in a supportive or “unplugged” environment without the interference and noise that comes with broker run affairs.

The objective being shared ideas in pursuit of developing our investing knowledge and wisdom, and above-all, deep, life-long friendships.

So, in the upcoming week, you will hear less of me. I'm not allowed to share the pitches, so I won't.

I met Guy Spier in Omaha last year and we talked briefly. There's also a ValueX conference in Omaha, which I will attend again in May.

Guy Spier, source

Meeting Guy Spier was not enough to be invited to Klosters, though. Like everyone, I had to send an investment case that he read to determine whether I was good enough to be admitted. I wrote about Adyen.

If you want to read the investment case, you can do that here.

Guy Spier also wrote a great book I mentioned in the Overview Of The Week a

In 2014, Guy Spier and his friend Monish Pabrai paid $650,000 to have lunch with their big idol, Warren Buffett. As you may know, Buffett did that once a year for years. The money went to charity.

As you can imagine, I'm really looking forward to Klosters!

Just one warning, though. Multi Flo has discovered a concerning trend for years already: When I'm abroad, the market usually tanks. You're warned! :-)

Articles in the past weeks

This article is the thrid article this week.

In the first article this week, I looked at the hype of this week, DeepSeek, and its impact on American tech.

In the second article, I shared which stocks I bought for the Forever Portfolio.

Memes Of The Week

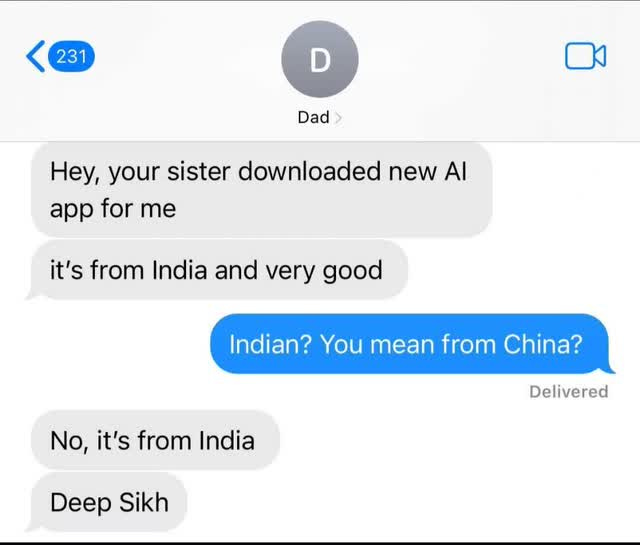

Two memes this week, both about recent "news." This is the first one, about last week's hottest topic.

The second one was about DeepSeek, the talk of this week.

Interesting Podcasts Or Books

This week, I listened to a fantastic podcast episode about Shopify.

Lenny's Podcast is usually good, but but this was especially a good one.

If you want to know why Shopify (SHOP) is such a great company, this podcast will definitely help you.

The markets in the past weeks

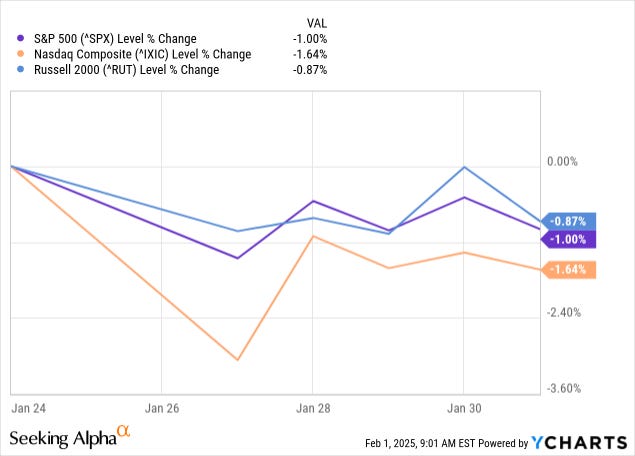

The indexes were down this week. The Russell 2000 lost 0.87%, the Nasdaq 1% and the S&P 1.64%.

With the gains, the Greed & Fear Index remained in Neutral.

Quick Facts

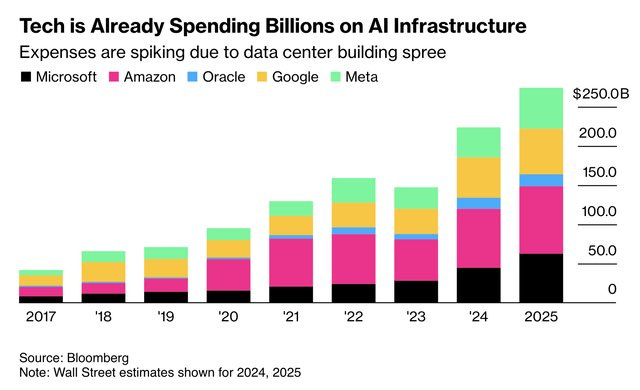

1. AI Infrastructure

This week, there was much to do about DeepSeek and its impact on high-end chips. And you can see that in Nvidia's stock price drop over the last week.

But this is more sentiment than anything else.

My Twitter friend Eric of Fired Up Wealth (sorry, it sounds too weird to call him my X friend) shared this stat about AI infrastructure spending.

I know many people have been saying Nvidia is a hype stock, but I still think it's attractive at this point. It's not a once-in-a-lifetime opportunity, but it is attractive. With Big Tech confirming their spending on AI infra, I wouldn't worry too much about Nvidia.

2. The ASML earnings

The ASML (ASML) earnings were released this week and they were very strong.

Revenue came in at €9.26B, up 27.9% YoY, and beating the expectations by €200M (2.2%). ASML earned €6.85 in GAAP EPS in Q4, €0.12 (1.7%) better than the consensus.

Bookings were especially strong in Q4: €7.1 billion, a full €3 billion better than the €4.1 billion estimates. Of bookings, €3.0 billion are in EUV. Management also said it would stop reporting quarterly about bookings, which I can only applaud, especially if done this way.

If they had done it in the last quarter, it would have been a red flag, as bookings then disappointed, and not reporting quarterly bookings anymore after such a weak quarter would have felt like hiding things. With such a big beat of 73%, management's point of the numbers being too volatile and not representative of the business definitely makes sense.

The guidance for revenue in Q1 2025 was set at €7.5B to €8B, stronger than the consensus of €7.24B.

The 2025 revenue guidance is seen at €30B to €35 billion.

I've said many times that this company is hard to predict. One machine, more or less in a quarter, can make a big difference. Bookings are notoriously volatile. Last time, we saw that on the downside, this time on the upside. So it's not bad that they won't be reported quarterly anymore.

Strong results, and strong guidance! I'm a happy shareholder.

If you want more in-depth, top-quality coverage of ASML, you can always subscribe to Best Anchor Stocks, the other service I run, together with Leandro. With this link, you even get a discount of 20%!

3. Politics (sigh)

I always try to avoid politics, but sometimes, you can't.

This week, tariffs for Canada and Mexico were announced and, not unsurprising, retaliation tariffs from Canada and Mexico were also announced for American goods.

I don't care about your political color, I'm an outsider looking at this, as I live in Belgium, not the US. And yeah, I know there are many preconceptions about Europeans in the US and vice versa. Through what I do, I feel like I live 50% in the US and 50% in Europe. I see the strengths and weaknesses of both. Instead of drifting apart, Europe and the US should collaborate more and learn from each other. But unfortunately, the world is more and more polarized. And that’s about as political as I want to go.

Because of that polarization, I avoid politics. It's not a nuanced debate anymore, but it's trying to win. It's not about having the best outcome but about trying to get it your way.

This tariff war is a perfect illustration, as all involved countries will lose. It will be a problem for Canada and Mexico, but several things will also become more expensive in the US and that might (!) be bad for inflation. I'm careful, stressing the word 'might' because there are always second-order consequences that people don't foresee. But if you think from first-order consequences, it's logical that inflation should go up. That's not what you want, now that it was just tamed.

Mostly, we'll have to see how this evolves but tomorrow it could be a Monday, Bloody Monday on the stock exchange.