Hi Multis

It's already Sunday again. I hope you had a great week and that this Overview Of The Week can top it off or can be the start of a new great week.

Articles In The Past Week

This week, you got the Best Buys Now.

To be totally open: this week, I wanted to provide more value than just this article, but I didn't feel too well and I slept like I hadn't slept for a full week. I still don't know what's the case. I'm not fully recovered yet, but I feel already better.

But delay doesn't mean you won't get it. Think of the old internet, where it took half an hour to upload a picture. Value uploading, in this case.

Memes Of The Week

Now that the situation is starting to resemble 2021 a little bit (nuance is important here), let's discuss NFTs, the 2020-2021 craze surrounding the "ownership" of digital products, such as the Bored Apes.

Bored Apes, source

This is a great reminder of that. Thanks for sharing in our private chat group, Multi Niko!

Now, full disclosure, I bought an NFT at the time.

It wasn’t for profit. It wasn’t for hype.

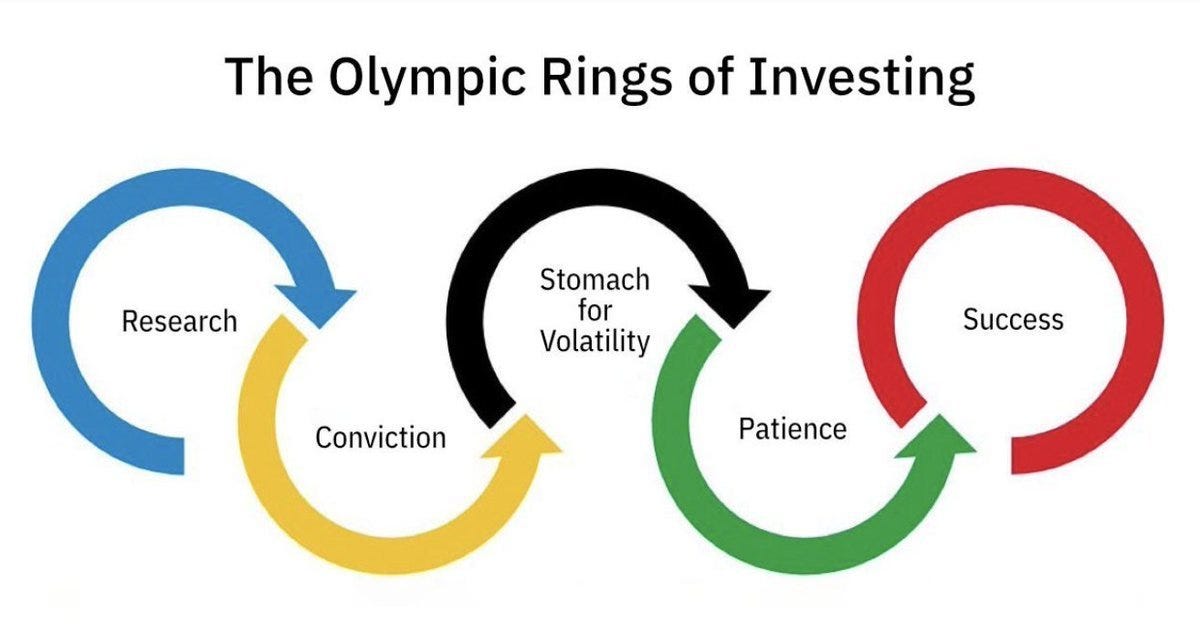

It was this: The Olympic Rings of Investing by my friend Dhaval Kotecha.

Dhaval, who created the NFT, also helped me through the process. I don't remember how much I paid, but it was not much’t much. When NFTs crashed, Dhaval even kindly offered to repay that small amount, which I refused.

It was never an investment; I just wanted to understand how the tech worked. But I was never convinced about the hype.

And of course, you couldn't avoid memes like this one. :-)

Interesting Podcasts Or Books

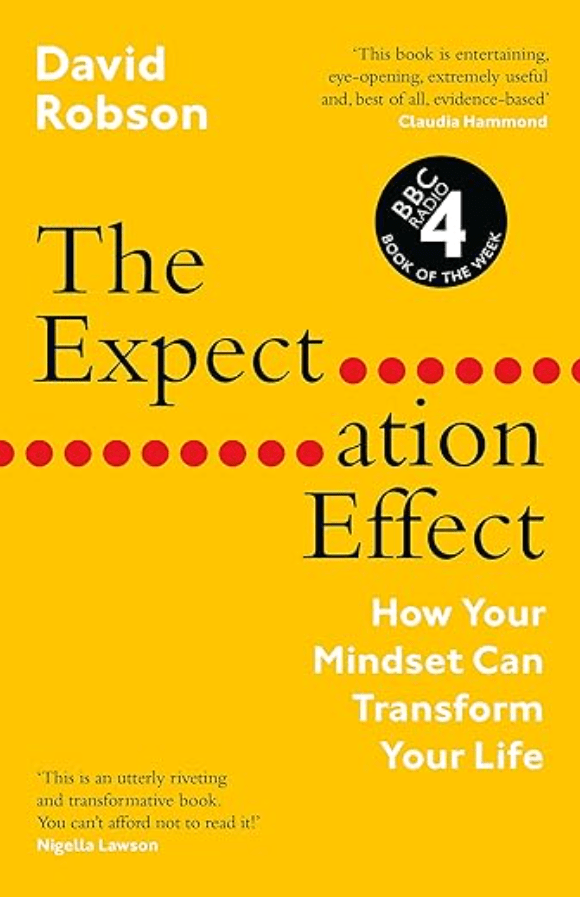

This week, I started reading in ‘The Expectation Effect (How Your Mindset Can Transform Your Life’) by David Robson.

It's about how expectations alone can change reality. It sounds a bit like pseudoscience, but it's not. It's only about peer-reviewed and published research on how our minds and thoughts can change the physical reality of our bodies. I'm not that far yet, but so far, it's very convincing.

The markets in the past week

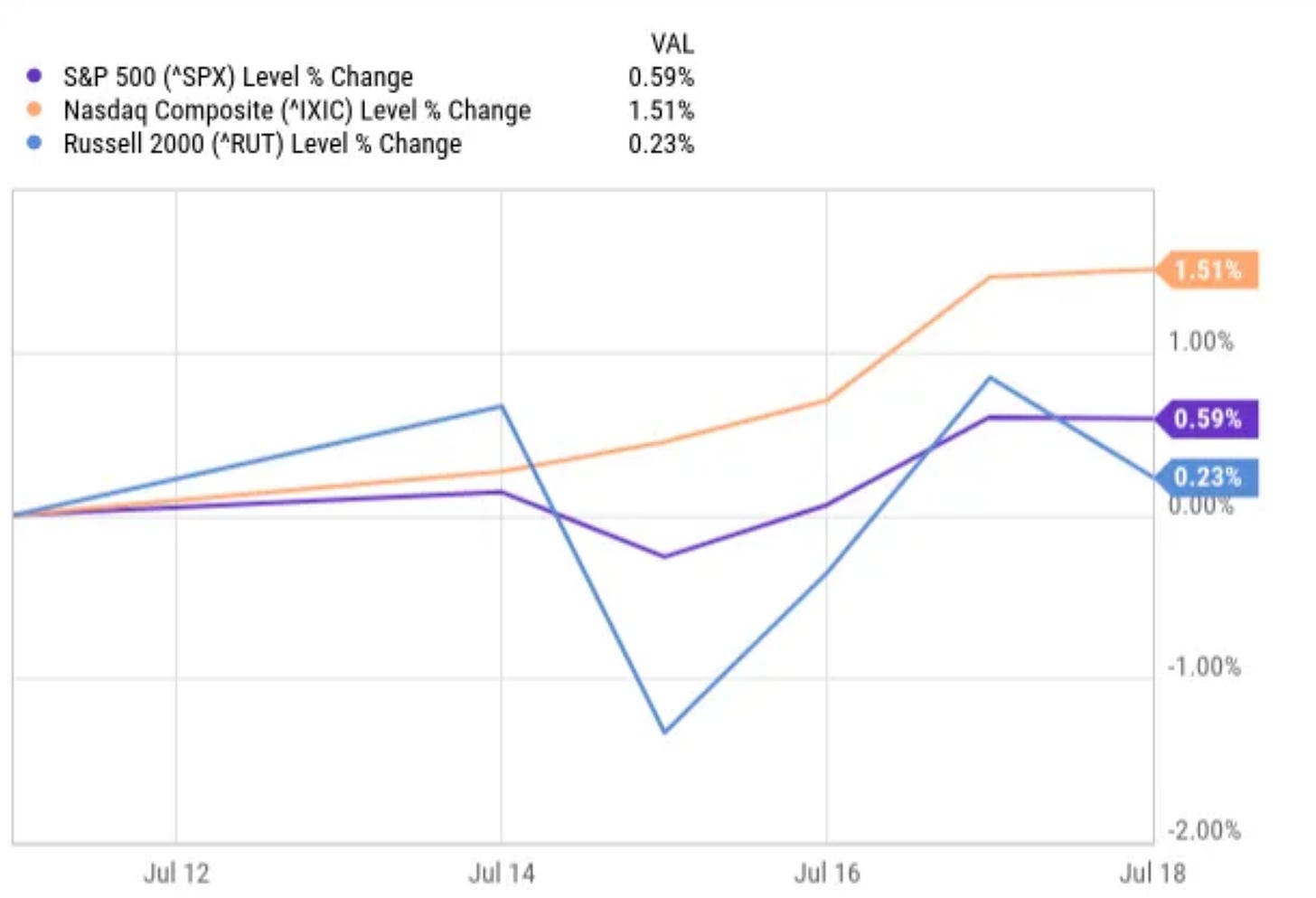

The markets were up again this week. The Russell 2000 had a volatile week but ended up 0.23%. The S&P 500 was up 0.59% and the Nasdaq was up 1.51%.

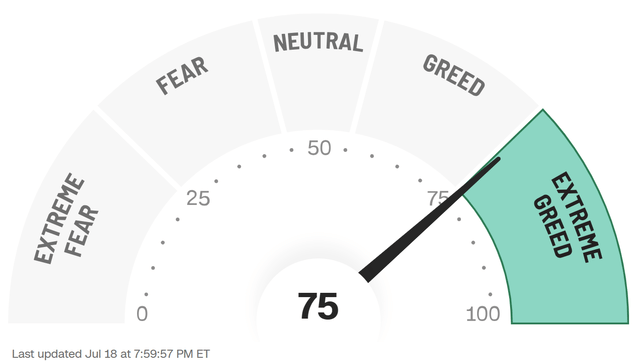

The Greed & Fear Index remained at the exact same score (75) and remained in Extreme Greed in that way for the third week in a row.

Quick Facts

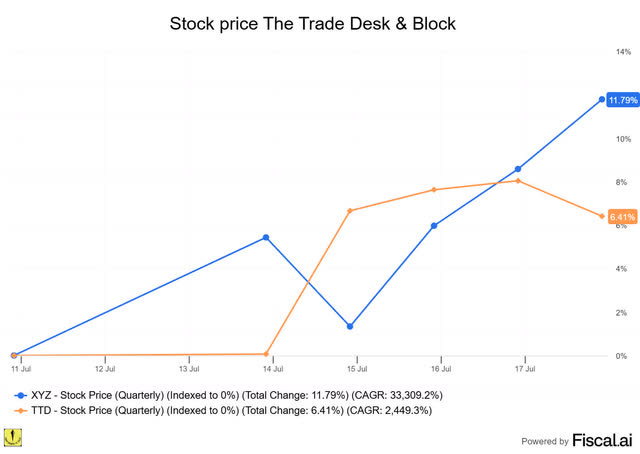

1. The Trade Desk & Block Added To S&P 500

It's going fast with the new additions to the S&P 500. Two weeks ago, Datadog was added to the S&P 500. This week, there were already two new additions again, not unfamiliar to Potential Multibaggers readers, I think.

The first is The Trade Desk (TTD).

The Trade Desk replaced ANSYS on Friday. Synopsys bought Ansys. As both were in the S&P 500, one place was free and The Trade Desk got it.

The second stock joining the S&P 500 is Block (XYZ). It replaces Hess, which was acquired by Chevron.

Standard & Poor's launched the S&P 500 on March 4, 1957. The goal was to track the stock price of 500 prominent companies in the United States. There are several criteria to be considered.

The company must make a profit in its last quarter and last year. There must be enough liquidity, the market cap has to be above $10 billion and it has to contribute to the 'sector balance,' whatever that means.

The additions had an influence on the stock price of both stocks. The Trade Desk was up 6.41%, and Block was up 11.79% this week.

If you're interested in using Fiscal.ai (formerly Finchat), I have a 15% discount for you. I use Fiscal.ai every single day and that’s why it’s the only product I have a partnership with.

2. Nu: Best LatAm Digital Bank

This week, Nu Holdings (NU) got two recognitions.

First it was named as one of the best neobanks by CNBC. Adyen was recognized as one of the best payment systems there again as well.

Euromoney then named Nubank the best Latin American digital bank.

For long-time Multis, this is not a real surprise.

It's what I already said in April 2023, when I picked Nu as a Potential Multibaggers stock at $4.47. It's almost a threebagger since then.

3. A Quick Take On Netflix's Earnings

Netflix had its earnings this week. It beat its Q2 earnings and raised guidance, but the stock still dipped.

The company grew revenue 16% to $11.1 billion, margins jumped to 34%, and ads are set to double, but engagement per viewer might be slipping.

If you dig a little deeper, that better outlook mostly comes from a weaker dollar helping the company's foreign exchange rates, not from actual business wins.

On top of that, there are tough comps ahead in H2. Think of Squid Game, for example, where each follow-up season scores a bit less. Also think of the Paul-Tyson boxing match in Q4 2024. Add in tariff risks that might hit consumer spending and advertising and you know why the market reacted negatively.

Of course, Netflix is a strong company and it's in our daughter's portfolio. I won't sell the stock now, but I wouldn't buy now, either.

4. A Quick Take on TSMC's Earnings

TSMC had a great Q2 with revenue up 44% to $30.1 billion. On an FX-neutral basis, that was 38.6% YoY. Gross margins came in at 59%, and operating margins hit 50%. Net profits were up 60.7% to $12.8 billion or $2.47 per ADR, beating the consensus by $0.16 or 7%.

Management raised full-year growth guidance from 25% to 30%, expecting Q3 revenue to be $32.4 billion, but noted that there may be a sequential decline in Q4. That may be tied to tariffs. Or it could be very conservative guidance, of course.

The reason for this great performance? Don't look too far: it's AI.

I still like TSMC here.

In April, I added it to the Best Buys Now (to consider) and the stock is up 53% from that point.

If you’re still on the free plan, this is just a preview. The full insights are waiting on the other side. News about newer picks, all the picks, stocks on my radar… It’s all just a click away.