Hi Multis

Next Saturday, I'm leaving for Vail, Colorado, for the Intellectual Investor Congress, organized by the great Vitaliy Katsenelson.

On June 11, it's our daughter's birthday and my wife and daughter join me in Vail, so that we can celebrate our daughter's 11th birthday together. It's her first time in the US and that alone is already a great birthday gift, of course.

This week, I'll try to plan some content for that week as well. I have a few earnings analysis articles I started but still have to finish.

I'm not sure if there will be an Overview Of The Week the next two weeks. We'll see.

Of course, I will not be completely absent and will come online occasionally, but less frequently than usual.

Articles In The Past Week

This is the fourth article this week. Let's look back at the three previous ones.

I bought stocks for the Forever Portfolio this week. And just like always, I shared what I bought and why. You can find the article here.

The two other articles were about Sea Ltd.

In the first one, Karan shared how it is to use Shopee and Monee (the new name of SeaMoney).

In the second Sea article, the earnings were analyzed and I updated the Quality and Valuations scores.

Memes Of The Week

Two memes this week.

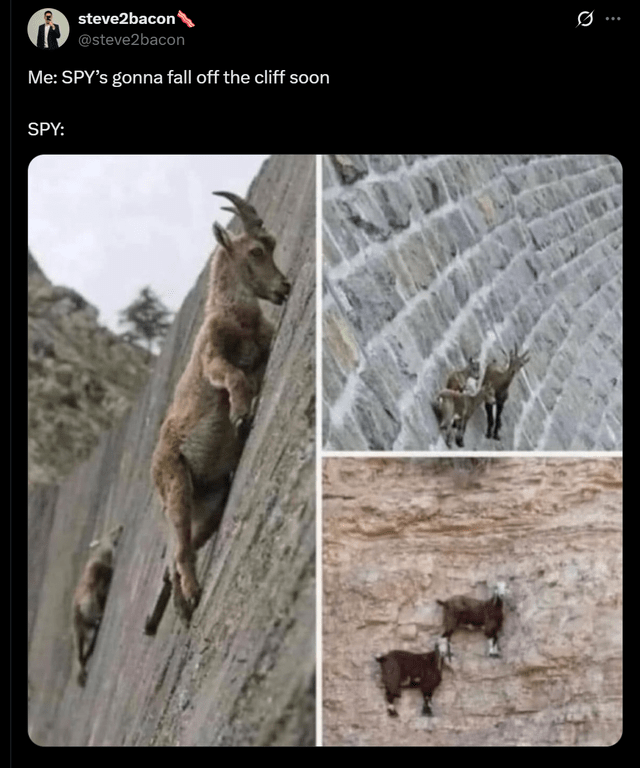

This is the first one.

Karan also posted a meme that I liked.

If you're not on Slack yet and would like to be, please let me know.

Interesting Podcasts Or Books

It's not exactly a hidden secret anymore, but the Founders Podcast is phenomenal. This week, I started listening in reverse order, so the oldest first.

The very first episode, aired in September 2016, was about Elon Musk. You can listen to it here.

The second episode, which I also listened to this week, was about Walt Disney.

Currently, I'm halfway through the episode about Thomas Edison.

Like all episodes, these are all really good to learn about business.

The markets in the past weeks

After the down week last week, the indexes continued their way up.

The S&P 500 was up 1.88%, the Nasdaq 2.01% and the Russell 2000 2.31%.

The Greed & Fear Index remained in Greed territory. Strangely enough, it went down a bit, from 64 to 62.

Quick Facts

1. TACO and Futures

You probably heard about the TACO trade, where TACO stands for Trump Always Chickens Out.

You could see the TACO trade in full swing on Friday. The stock market was dropping until there was a White House announcement that there would be talks with China.

On Friday,

Today, Commerce Secretary Howard Lutnick appeared on Fox News Sunday, where he stated: "Rest assured, tariffs are not going away.”

Guess what happened to futures? Here they are.

All in all, there's a ton of noise. This is extremely important if you are a trader. if you are a long-term investor, just stay calm and ignore the noise.

The great upside from that attitude is also that you can look at it as if it's a soap opera. And it's funny sometimes.

US Treasury Secretary Bessent accused China of holding back products that are essential to the US industrial supply chain, for example. This reaction places Bessent's indignation in context.

I know it may be a big leap for some to see this as funny but it's not black and white. You can see the humor and still take it seriously.

I've said it before, and I'll say it again: trade deficits are NOT the best way to look at this. You can't make Vietnam the production place of Nike's (and other brands') shoes and then complain about a trade deficit.

On top of that, the trade deficit is only looked at through the lens of goods. The EU argues you should include services, where the US is very strong. Then the trade deficit is just $50 billion.

Of course, you could talk about this for a very long time, but I won't. Let's stick to real investing. :-)

2. Google Introduces Gemini In Gmail

This week, Google (GOOGL) announced that it is introducing a Gemini sidebar for Gmail. Now you can summarize the mails of that drama queen colleague or the long mails about football you are not interested in but feel obliged to read because you know your colleague will assume you did. AI is making our lives better.

3. The Tempus Short Report

Did you see the Tempus short report by Spruce Point? I read the 76 pages and saw a typical short report.

That means

1. Discredit management and/or the Board. Try to connect them with companies people don't know. Those are easier to make them sound shady.

2. Hint at accounting irregularities, even if you can't prove anything.

3. Try to make it all sound like this company is the biggest fraud since Enron.

I fed these elements to Grok and asked it to write a short report about Apple in Spruce Point style, using only facts but bending them in a way that sounds suspicious. (Instead of Spruce Point, I used the name Bruce Line.)

Why Apple? To show that you can do it with the best companies.

I think it's interesting to read and to learn that you can write a short report about any company.

So, just to make sure, this is completely FAKE and Grok made it.

Remark: I don't think all short reports are bad. There are a good few sometimes. But a lot of them are FUD-spraying. Ok, this is Grok:

Bruce Line Capital Management Short Report:

Apple Inc. (AAPL) Date: June 2, 2025

Executive Summary

Bruce Line Capital Management’s deep dive into Apple Inc. reveals a company teetering on the edge of a catastrophic reckoning.

Behind its polished façade lies a web of governance lapses, questionable accounting practices, and management ties to obscure entities that scream conflicts of interest. We see 40-50% downside risk as Apple’s Enron-like house of cards faces mounting scrutiny.

Investors beware: the iPhone maker’s shine is a mirage. Apple’s leadership, led by CEO Tim Cook and a cozy Board, projects stability while entangled in relationships that raise serious red flags.

1. Tim Cook’s Tsinghua Advisory Role: Cook serves on the advisory board of Tsinghua University’s School of Economics and Management in Beijing, alongside executives from lesser-known Chinese firms like China Investment Corporation ('CIC'). CIC, a sovereign wealth fund, has opaque investments in tech supply chains, potentially overlapping with Apple’s operations. While not illegal, Cook’s role suggests divided loyalties at best, especially amid U.S.-China trade tensions. Why is Apple’s CEO advising a state-linked entity with minimal transparency?

2. Board Member Al Gore’s Climate Ventures. Al Gore, director between 2003 and 2024, co-founded Generation Investment Management, a firm with stakes in obscure green tech startups like Current Energy Solutions.

Current’s lackluster financials and questionable ties to overseas carbon credit schemes raise eyebrows. Gore’s dual role as Apple director and climate financier smells of self-dealing, undermining Board independence. Is that why Gore left the Apple Board last year?

3. Arthur Levinson’s Calico Connection: Chairman Levinson, also CEO of Calico Labs (a Google-backed biotech), oversees an entity with scant public disclosures despite burning through billions.

Calico’s murky R&D spending and Levinson’s split focus cast doubt on his commitment to Apple shareholders. Is he prioritizing Google’s pet project over Apple’s governance? This leadership’s web of affiliations with shadowy players signals a Board more focused on personal agendas than fiduciary duty, a classic precursor to corporate implosion.

4. Smoke Signals...

Apple’s "pristine financials" mask troubling inconsistencies that suggest creative bookkeeping designed to prop up its $3 trillion valuation.

Services Revenue Suspicions: Apple’s Services segment, including the App Store, boasts enviable margins, yet its growth trajectory seems too smooth amid global regulatory crackdowns. We suspect Apple may be accelerating revenue recognition from multi-year licensing deals or inflating App Store metrics. Without granular disclosures, investors are blind to potential overstatements—a tactic eerily similar to Enron’s revenue games.

5. Supply Chain Discrepancies:

Apple’s inventory turnover remains oddly robust despite reports of slowing iPhone demand in markets like China. Industry whispers point to possible channel stuffing, with Apple pushing excess inventory onto distributors to juice sales figures. Our checks with Asian suppliers hint at mismatches between reported shipments and actual orders, a red flag for revenue manipulation.

6. Share Buyback Funding Questions: Apple’s $700 billion buyback program is a shareholder darling, but its funding raises concerns. The company’s growing debt pile ($100 billion+) and reliance on complex financing structures suggest potential off-balance-sheet maneuvers. Could Apple be using undisclosed vehicles to mask leverage, much like Enron’s infamous SPVs? These accounting anomalies, while unproven, paint a picture of a company papering over cracks to sustain its market darling status.

6. The Biggest Fraud Since Enron

Apple’s aura as a tech titan is a carefully orchestrated illusion, concealing a rotting core of governance failures, financial sleight-of-hand, and existential risks.

Like Enron, Apple has hypnotized Wall Street with growth narratives while burying vulnerabilities that could trigger a spectacular collapse.

Ecosystem Overhype: Apple’s valuation hinges on its “ecosystem,” yet iPhone sales growth is stalling (down 10% YoY in China, per Q1 2025 earnings).

Management’s pivot to Services and AI feels desperate, with no clear path to justify its bloated market cap. Enron’s energy trading dreams similarly masked a hollow core.

7. Regulatory Guillotine: Apple faces a barrage of antitrust probes—EU’s Digital Markets Act, U.S. DOJ lawsuits, and China’s app store restrictions—that could cost billions in fines or force structural changes. Management’s dismissive tone echoes Enron’s arrogance before its fall. A single adverse ruling could unravel investor confidence.

8. Insider Cash-Outs: SEC filings show Cook and other executives selling $200 million+ in stock over the past 18 months, timed at peak valuations. This mirrors the behavior of many insiders before the collapse, suggesting leadership sees the writing on the wall.

Apple’s inevitable reckoning will shock markets, exposing a fraud that rivals history’s greatest corporate deceptions.

Conclusion

Price Target Bruce Line sees Apple as a ticking time bomb, with governance lapses, accounting red flags, and Enron-esque hubris poised to crater its stock. We assign a price target of $100-$120 (vs. ~$200 current), implying 40-50% downside as the truth emerges. Sell before Apple’s façade collapses.

(Disclaimer: This report reflects Bruce Line's analysis and opinions. We hold a short position in AAPL and may benefit from a stock price decline. Information is believed to be accurate but not guaranteed. Investors should conduct their own due diligence.)

Now, even that sounds weirdly convincing, right? That's because short reports aim at your hear, through the use of certain words, through insinuation and negativity.

So, be careful.

Now, specifically for the short report, the problem is that you often have to do a ton of research to see if it's an insinuation or a real possibility. But in the Tempus short report, I didn't see any smoking guns.