Overview Of The Week 21

With news about CrowdStrike, Adyen, The Trade Desk and much more.

Hi Multis

The week's over already again and that means it's time for your weekly dose of Potential Multibaggers news! Let's dive in.

Memes Of The Week

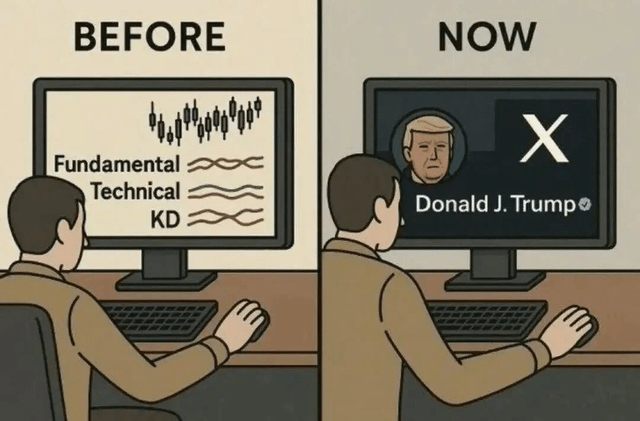

Multi Niko shared this meme on our Slack channel. Just like the best memes, it shows a truth in a funny way. Thanks, Niko!

Interesting Podcasts Or Books

It's a classic, but I haven't read it yet. I started Walter Isaacson's biography of Steve Jobs. Jobs himself had asked Isaacson to write his autobiography.

It lives up to my expectations so far. For the people who have read it, I'm currently at the MacIntosh chapter. Steve Jobs had been pushed out of the Lisa team and decided to work on a side project that had been leading a quiet life inside Apple: the Macintosh, which would revolutionize computing, just like the Apple 2 did.

The markets in the past weeks

What a week for the Nasdaq! It was up 7.15%. The S&P 500 gained 5.27% and the Russell 2000 4.46%.

The Greed & Fear Index remained in Greed territory, but it's already close to Extreme Greed. It's been quite a while since it was this high, and it shows again that it's impossible to time the market. About a month ago, it was in extreme fear and everyone and their aunt said that there would be high inflation and probably a recession. Those worries are much lower now.

Quick Facts

1. Mag7: Not Showing Any Weakness

My friend Eugene NG shared this chart on X.

It shows that the Mag 7 is still in a league of its own. Expected EPS growth for 2025? 17.1% versus just 7% for the S&P 500 without the Mag7.

I have never understood people who have been calling the Mag7 in a bubble for years already. Just look at the numbers, not some superficial opinion. That doesn't mean that there are no overvaluations in the Mag7, but it means that as a group, they are called the Magnificent 7 because they have done so well fundamentally. The stock price just followed.

2. Microsoft's Xandr Is Shut Down

I didn't have this news on my bingo card for this year, but Microsoft's Xandr is shut down. Xandr is Microsoft's DSP (demand-side platform).

When Netflix started with advertisements, it initially chose to work with Xandr, to the surprise of many. The Trade Desk's Jeff Green, who used to work at Microsoft's ad agency before starting The Trade Desk, said that Netflix would not have enough demand to fill all the ad slots if they worked with Xandr. Another one of his risky predictions. But, as with all of his other predictions, he was right again. Netflix first stopped working with Xandr exclusively and added The Trade Desk as a partner. It then completely stopped working with Xandr.

In other words, this could be a boost for The Trade Desk, Google, and Amazon.

3. Hims & Hers raised even more

Imagine this: you start out with the wish to raise $450 million at 0%. The conversion price was set at $70.67 with a capped call up to $89.95. There will be no payments due until 2030.

In other words, institutional investors get no interest at all, get back their money (without interest) if the stock trades under $70.67 in 2030 and can convert their notes into shares if the stock trades above $70.67. This is what happened to Hims & Hers. Despite these advantageous conditions for HIMS, the offer was hugely oversubscribed.

Last week, I already told you that the company had raised $870 million, but this week, it was announced that the offer eventually raised $1 billion.

4. The most volatile stocks? HIMS

This chart shows it all.

8 days with a 20% move

13 days with a 15% move

28 days with a 10% move

112 days with a 5% move

The Returns of the Potential Multibaggers

This week, twelve Potential Multibaggers stocks were up more than 5%. Not bad on 18 active picks, right?

Five of them were up by more than 15%, and two by more than 20%. One stock dropped more than 5%.