Hi Multis

It was an intense week, with huge swings up and down. But Sundays are for stepping back. For slowing down. For making sense of the noise. For contemplation. For wisdom. And I hope you will find some nuggets of wisdom again in this Overview Of The Week.

Articles In The Past Week

This is the fourth article of the week. Let's look back at the three previous ones.

In the first article this week, we analyzed the Cloudflare earnings and evaluated whether the stock is a buy now.

The second article of this week focused on the Hims&Hers earnings.

The Trade Desk also announced its earnings and the stock dropped like a rock. That's why I wanted to analyze the earnings as fast as possible. The result is in this article.

I still owe you Quality Score and Valuation updates for The Trade Desk. That article should be out tomorrow.

Memes Of The Week

Two memes this week. This is the first one.

This inspired me for this meme.

This week, Switzerland got a 39% tariff attached to it. That gave someone inspiration for this meme.

I also made a serious meme.

Interesting Podcasts Or Books

Next to an investor, I'm also a business owner and I know many of you are as well. That's why I want to share two podcast episodes of My First Million. Both are with Alex Hormozi. In the first one, he goes through the principles of his new book that will be launched soon. You can look at it here or find the episode on your favorite podcast player.

In the second episode with Alex Hormozi, Shaan and Alex listen to five entrepreneurs who seek advice from them about their business. Again, you can watch it on YouTube or listen to the podcast.

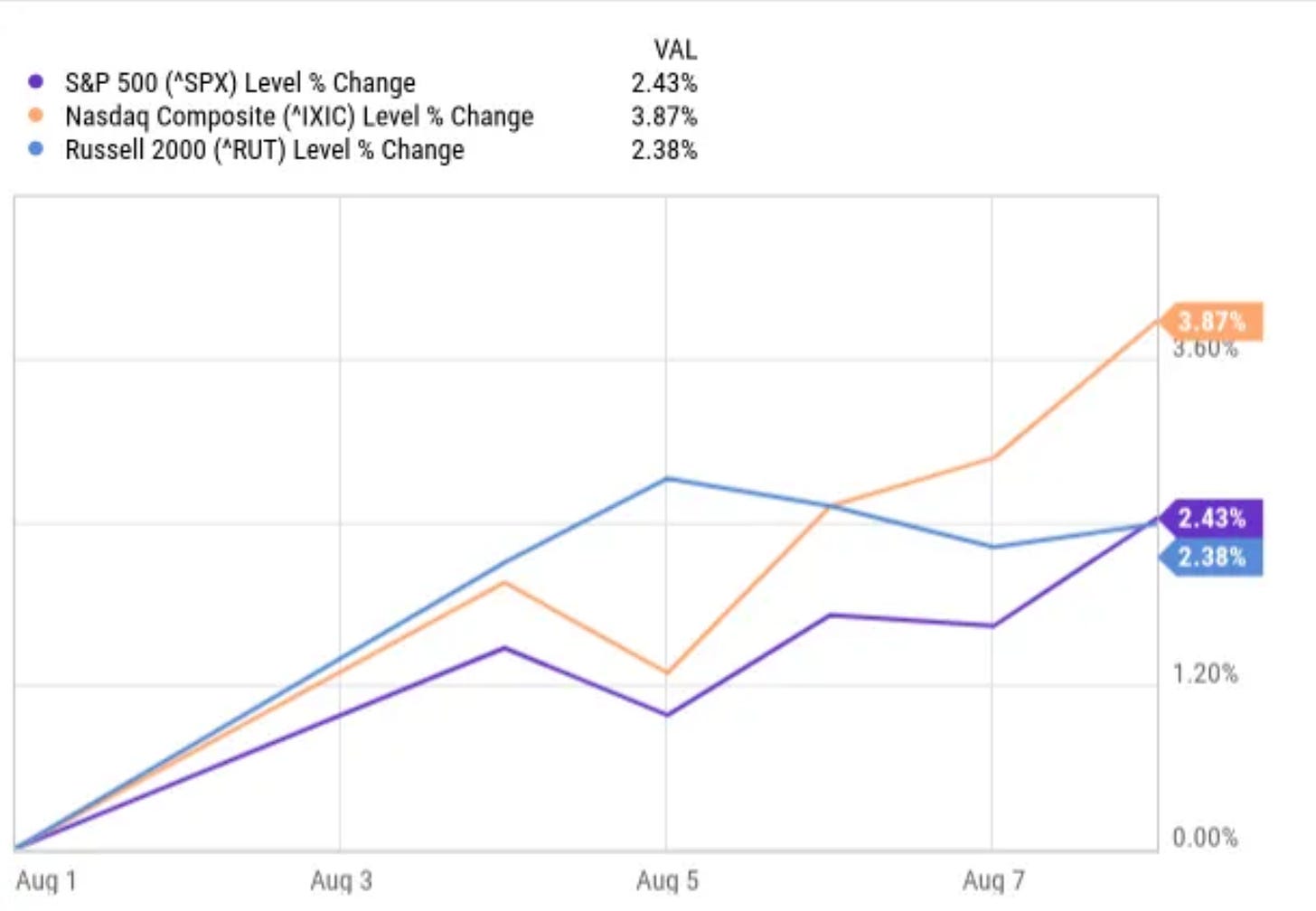

The markets in the past week

The markets shot up again this week. The Russell 2000 was up 2.38%, the S&P 500 2.43% and the Nasdaq even 3.87%.

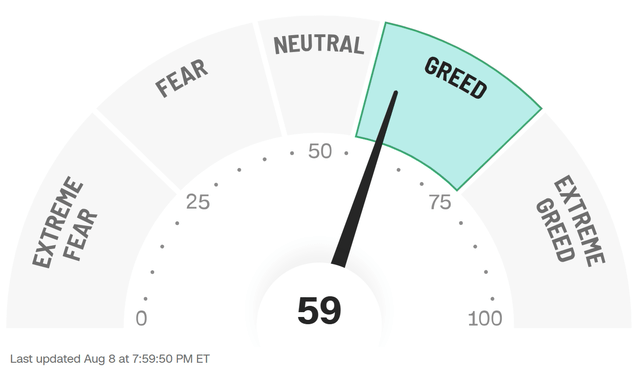

As a consequence, the Greed & Fear Index climbed from Neutral to Greed again.

Quick Facts

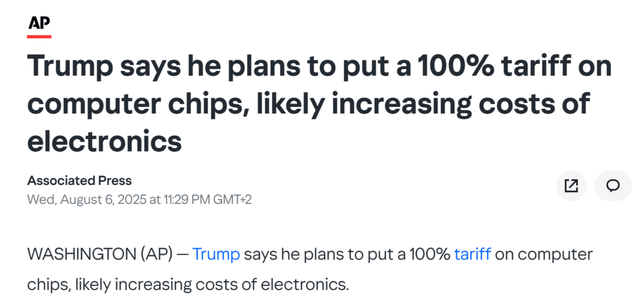

1. 100% Tariff on Chips or Another TACO?

President Donald Trump announced this week that he wants to put a 100% tariff on imported computer chips.

The goal is, of course, to force companies to make chips in the US. But the reality is that higher prices could be coming for everything from smartphones and laptops to cars and appliances.

Details are not available yet. We don’t know when it starts or exactly which products will be hit. There will be exceptions for companies that commit to building chips in the US.

The US already makes high-end semiconductors and exports $58 billion worth a year. But cheaper, lower-end chips mostly come from countries like Malaysia, and ultra-advanced ones from Taiwan. Experts say it doesn’t make sense to make all types here, and the US can’t scale up fast enough to meet demand.

Some warn the move could slow progress on new chip plants rather than speed it up. If costs jump, companies may cut production.

Tariffs this high will put pressure on manufacturers. Automakers are already dealing with $1–2 billion per quarter in added costs from the tariffs. If they pass chip costs on, cars, repairs, and even insurance could get more expensive.

Shortages aren’t expected to be as bad as during COVID-19, but if chips cost more, companies will buy fewer. That means fewer products on shelves and higher prices for the ones that remain.

But of course, this could be another TACO (Trump Always Chickens Out).

2. Nvidia's Great Win

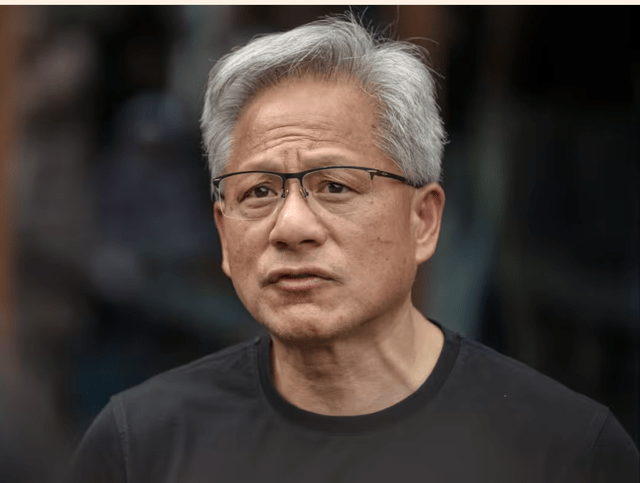

Jensen Huang is not just one of the best CEOs, he seems to be one of the best negotiators as well.

After months in which selling Nvidia’s H20 chips to China was forbidden, and just a day after President Trump talked about the 100% tariffs on chips, the US has now given the green light to sell them again. The decision came right after CEO Jensen Huang met Donald Trump at the White House.

For Nvidia, this is big. Losing China could have cost up to $8 billion in quarterly revenue. The damage was already clear, with $4.5 billion in lost sales last quarter and another $2.5 billion in missed deals. With the license back, Nvidia’s stock jumped and analysts expect a strong boost in China sales.

Not everyone is happy, though. Security experts warn that the H20 could still help China in sensitive tech. Nvidia says blocking sales would just speed up China’s own chipmaking.

Chinese state media is also raising doubts, claiming the H20 might have hidden “backdoors” or shutdown controls. Nvidia denies that.

But Jensen got Nvidia back in China and that's the most important takeaway.

3. Google's Datacenter in India

Google will spend $6 billion to build a massive data centre in the southern Indian state of Andhra Pradesh, government sources told Reuters.

Source: Wikipedia

It’s the company’s first such project in India and will be located in the port city of Visakhapatnam (which I had never heard of). The plan includes $2 billion for renewable energy to power the 1-gigawatt facility.

The project will be the largest data centre in Asia by capacity and investment size. It’s part of Google’s regional build-out, which also includes new sites in Singapore, Malaysia and Thailand. In the latest earnings call, Alphabet said it would spend even more, with $85 billion in global data centre spending this year (up from $75 billion).

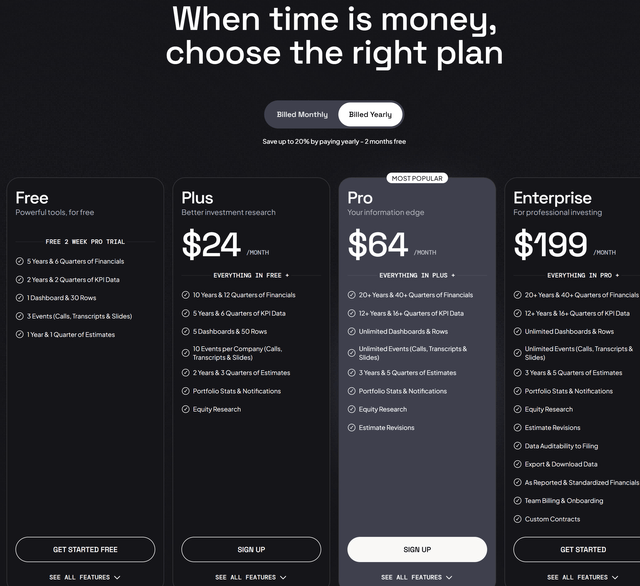

4. Fiscal(.)ai

In all those years I've been doing this, I've gotten dozens and dozens of brands that reached out to me for a partnership. I've only said yes to one: Fiscal(.)ai, the former Finchat.

Why? Because I use it every single day myself, so I'm proud of my partnership with them.

I listen to and/or read conference calls on Fiscal, look at Morningstar's research (yes, that's also included), make custom charts, look at the analyst estimate consensus, custom-made KPIs per company and so much more.

And there was an update: Enterprise, which many people from the industry had been asking. Why? It has:

Unparalleled data speed (all financials are updated within minutes of earnings)

Data exporting (for you, yes, you, excel addict!)

Click-through auditability (click directly into the source)

Much more

With my discount link, you get the Plus plan for just $244.8 per year or just $20.4 per month, the Pro plan for just $652.8 per year ($54.4) and the Enterprise plan costs $2,030 per year ($169 per month) instead of $2,388.

5. AMD's earnings

I always analyze the earnings of the companies I own, even if I don't always write about them. From now on, I will write my brief summary here regularly.

This week, AMD (AMD) reported its Q2 2025 earnings. Let's look at the numbers.

Revenue: +32% YoY to $7.7B, a beat by $260M or 3.5%

Gross Margin: 40% (-9pp YoY due to $800M China export control charge)

Operating Margin: -2% (-6pp YoY)

Non-GAAP EPS: $0.48 (in-line with estimates)

Data Center: +14% YoY to $3.2B (MI300 accelerators & EPYC strength)

Client: +67% YoY to $2.5B (record Ryzen sales, share gains vs Intel)

Gaming: +73% YoY to $1.1B (PlayStation/Xbox semi-custom chips)

Balance Sheet: $5.9B cash, $3.2B long-term debt

Q3 Guidance: ~$8.7B revenue ($0.4B beat vs consensus)

Non-GAAP Gross Margin Guidance: 54% (excluding China restrictions)

AMD delivered strong underlying growth despite the margin compression that was mentioned in the headlines. That came from the tariffs.

The $800 million inventory write-down from MI308 export controls to China made the financials look uglier than they really were. But if you leave that out and you see the real story. Then, the gross margin would've been 51% instead of 40%, which would have been up 2pp. Data center growth of 14% seems modest until you realize AMD is cut off from a market that represented 24% of its revenue last year. And maybe (you never know) there's an exception for AMD in the works as well, just like for Nvidia.

Even better, the Q3 guidance of $8.7 billion beat consensus by $400 million and excludes any China revenue. Lisa Su expects "significant growth" in the second half driven by the MI350 series ramp-up. The 54% gross margin show that AMD is already seeing traction. Big tech is begging for more chips and if AMD can supply good chips at a slightly more affordable price than Nvidia, there will definitely be demand. AMD doesn't even have to take market share from Nvidia. The market as a whole is growing so fast AMD will also benefit.

Stocks On My Radar

With the Stocks On My Radar list, you know which stocks I follow up and which could become Potential Multibaggers picks.

This week, I added a new stock.

This is where free readers stop.

But if you’re a paid subscriber, you’ll get:

My complete portfolio

All my transactions

The Best Buys Now

Deep analysis of the picks and the earnings

The Quality Score

Valuations

A private chat group where you can ask questions or just talk about stocks

A new pick soon. Some of my previous picks included Shopify at $7.78 (no typo!), Cloudflare at $39, Crowdstrike at $93, Duolingo at $92, Nu Holdings at $4.47, etc.

Upgrade now to unlock the full value of Potential Multibaggers.

👉