Cloudflare Is Quietly Building the Next AI Platform

Cloudflare's growth accelerates, but this is why I'm NOT buying

Hi Multis,

Anand here with the Cloudflare (NET) Q2 2025 earnings result. Kris will take over later in the article for the valuation, the Quality Score and the Buy-Hold-Sell scale. He will also introduce Selling Rules for Cloudflare.

Earnings season kicked off really well. Cloudflare reported strong results, and the stock price was up more than 7% after-hours trading. However, the next day, the stock was down around 4%. This is because the overall market was down due to weak job data, and unemployment claims ticked up 4.2%. Let's not get into the weeds in macro and focus on the earnings analysis because that's what savvy investors do.

The Numbers

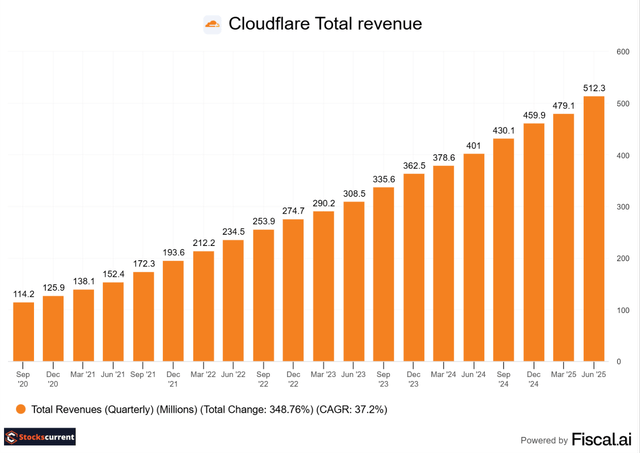

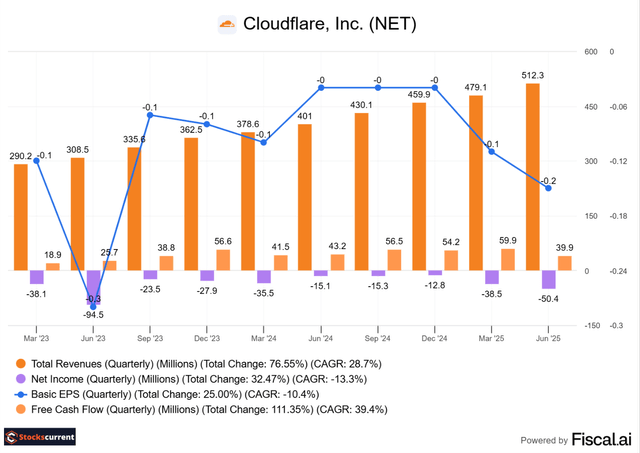

Total revenue reported was $512.3 million, an increase of 28% year over year and beating the consensus by $10 million.

(The charts in this article are all made with Fiscal(.)ai. Kris has a partnership with them, and through his link, you get a 15% discount.)

Cloudflare started the year by detailing the strategy to drive reaccelerating growth. That's why we see continued growth in revenue, customer count, and headcount.

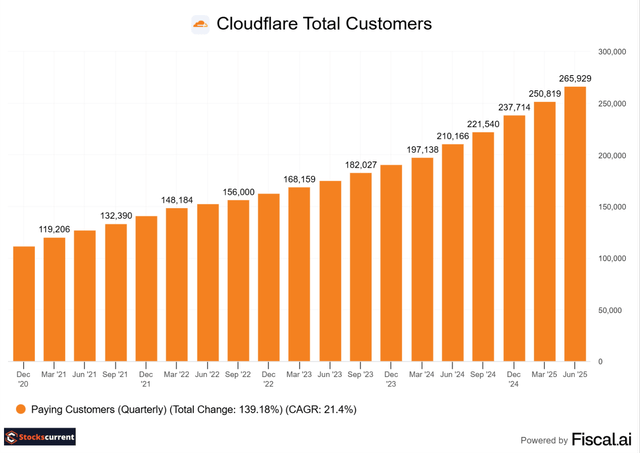

Cloudflare reported a total of 265,929 paying customers, representing an addition of over 15,000 paying customers quarter-over-quarter (+6%) and an increase of 27% year-over-year. There were 3,712 with ARR (Annual Recurring Revenue) more than $100k, a 22% increase year-over-year. Those are strong numbers.

Revenue contribution from these large customers grew at 35% year-over-year, contributing to 71% of revenue during the quarter, up from 67% in the second quarter last year.

Cloudflare's management team again saw particular strength with the largest customers, those that spend over $1 million and $5 million annually, with both cohorts growing year-over-year at their highest levels since 2022. The management team confirmed that the new pipeline attainment exceeded expectations and grew at the fastest rate in more than two years.

CEO Matthew Prince on customer growth:

Cloudflare keeps innovating faster than ever, and customers are voting with their wallets. I once again feel like the company is firing on all cylinders.

The dollar-based net retention rate is steady at 114%, up 3% quarter over quarter. In the last quarter, I mentioned that DBNRR is bottoming, and this quarter it's confirming that it was a bottom.

The company posted an operating profit of $72.3 million, representing an operating margin of 14.1%, and generated free cash flow of $33.3 million during the quarter, exceeding expectations. The momentum continued into Q2 2025, and the investment in sales and the pool of funds is now yielding tangible benefits, as evidenced by the real numbers.

A "pool of funds deal" is a contract where a customer pays a certain amount that can be used for various Cloudflare products and services over a specified period without the need to negotiate separate contracts for each service.

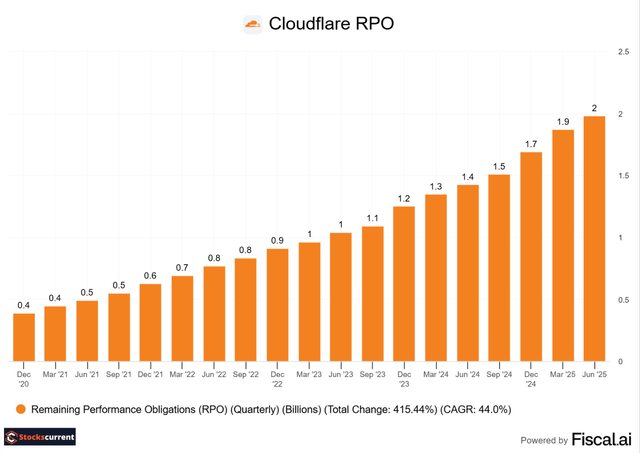

Remaining performance obligations, or RPO, totaled $1.977 billion, an increase of 6% sequentially and 39% year-over-year. The current RPO, contracts to be fulfilled in the next 12 months, was 66% of total RPO, increasing 33% year-over-year versus 29% in the first quarter and 30% for the fourth quarter. This again shows the reacceleration.

The gross margin was 74.9%, a decrease of 2.9% compared to Q2 2024, but more or less still in line with management's long-term target range of 75% to 77%

Cloudflare's non-GAAP income from operations was $72.3 million, or 14.1% of revenue.

GAAP loss from operations was $67.3 million, or 13.1% of revenue, compared to the loss of $34.7 million, or 8.7% of revenue, in the second quarter of 2024. I see that the GAAP loss from operations is growing in tandem with the revenue year over year.

Non-GAAP net income was $75.1 million, compared to $69.5 million in the year-ago quarter. Non-GAAP net income per diluted share was $0.21, compared to $0.20 in the second quarter of 2024, so it was flat.

Cloudflare's GAAP net loss was $50.4 million, compared to a loss of $15.1 million in the second quarter of 2024; it increased along with revenue. GAAP net loss per share was $0.15, compared to $0.04 in the second quarter of 2024.

Cloudflare reported a free cash flow of $33.2 million, 6% of revenue, compared to $38.3 million or 10% of revenue in the same period last year.

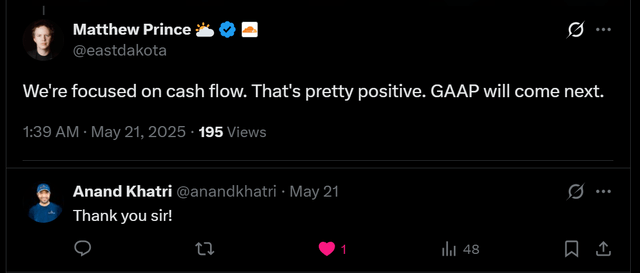

I have asked the Cloudflare CEO, Matthew Prince, on the X platform about the GAAP profitability.

My question: I know you guys are almost there, but when can we see the GAAP profitable growth for consecutive quarters?

CEO Matthew Prince generously responded:.

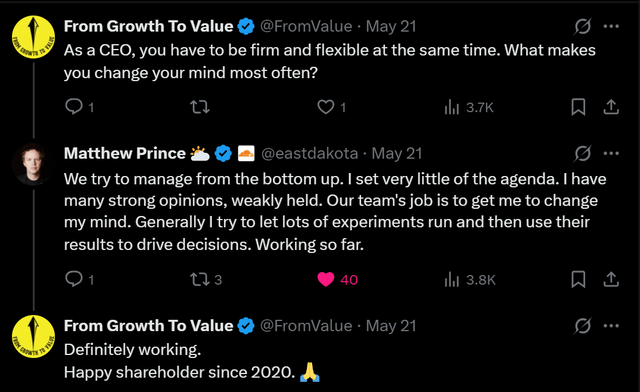

Kris also asked a question that was answered, by the way.

It was a strong quarter, but operational costs and net loss are increasing while free cash flow decreased. But revenue and the number of customers are increasing more.

The company is still investing to capture growth and stay ahead of the competition. That's the smart thing to do. AI poses a new opportunity and capturing that opportunity is more crucial now than anything else.

Guidance:

Management guided revenue between $543.5 million and $544.5 million, which is up 26.5%. Non-GAAP operating income is expected to be between $75 million and $76 million, which translates to non-GAAP EPS of $0.23.

Full-Year 2025 Outlook

For the full year, management guided for revenue between $2.113 billion and $2.115 billion, up from $2.09 billion and $2.094 billion from the last quarter. Non-GAAP operating income is expected to be between $284 million and $286 million, up from $272 million and $276 million from last quarter, which translates to non-GAAP EPS of $0.85. The management team has increased the full-year guidance and is showing strength in the go-to-market strategy and with big customers.

The management team also confirmed that the new pipeline attainment exceeded expectations and grew at the fastest rate in more than two years.

Highlights from the conference call

Continue seeing the momentum in large customers

Last quarter, Cloudflare announced the biggest deal in the company's history, worth $100 million, for the Workers developer platform. The management team again saw strength with the largest customers, those that spend over $1 million and $5 million with Cloudflare annually, with both cohorts growing year-over-year at their highest levels since 2022. That is encouraging that the largest customers are trusting the Cloudflare platform and voting for Cloudflare with their wallet.

At the beginning of the year and again during the Investor Day, the management team outlined the confidence that drives reaccelerating growth throughout 2025, and the strategy is clearly working out. The management team did a fantastic job of growing the cohort of large customers.

CEO Matthew Prince on the call:

So every time you hear that somebody is signing up for a pool of funds deal, they're betting on Cloudflare, they're betting on the broad product suite that we have, and they're betting on the ability for us as a team to continue to execute. And that, I think, is coming through quarter after quarter after quarter.

CFO Thomas Seifert on the call:

We are seeing strength in our business this quarter was driven by large $1 million and $5 million-plus customers continuing our momentum in the enterprise segment, green shoots across the financial services, public sector, retail and media verticals, continued momentum with our Workers Developer platform, including Workers AI and ongoing prioritization of security and resiliency by our customers.

New Business Model for Publishers, Creators, and Agentic AI

CEO Matthew Prince hinted at a new product for creators in the fourth quarter of 2024. He noted that traffic from search engines is decreasing for publishers due to the rise of AI-powered answer engines. The search engine directs you to actual content, where you can go, and the content creator can monetize it. An answer engine answers without you having to leave. It's impossible to monetize it in the current working model.

CEO Matthew Prince has been actively working on defining a fair revenue-sharing model for both creators and publishers. While it's still early for specific details, and the model will undergo many stages and iterations, he shared an insightful analogy of the risk of hubris, and I agreed with him.

He compared the situation to the music industry when Apple introduced $0.99 songs, which was a pivotal moment but not the final solution. Eventually, we moved towards a subscription model like Spotify's $10 a month.

The CEO, Matthew Prince, feels confident that, given the more than 20% of the Internet traffic that relies on Cloudflare, the company has a unique opportunity to help define the infrastructure that these agents will use. Cloudflare can take a fee from the transactions as we facilitate them, making them faster, more reliable, and more secure, while also providing access to these essential rails. He thinks it could be as big as a new vertical, and they are internally calling it Act 4. You could call it the next AI Platform.

This is where free readers stop.

But if you’re a paid subscriber, you’ll get:

The full breakdown of Cloudflare’s new AI model

Why it could reshape the economics of the internet

My Selling Rules (when I would sell or trim my position)

My Quality Score for Cloudflare

My valuation

If the stock is a buy, hold or sell now.

Upgrade now to unlock the full analysis.

👉