Hi Multis

Mercado Libre reported its earnings already at the end of October, and Baur sent me his earnings analysis already a few days later, but I didn’t have the time yet to edit it. I’m sorry for the delay. On the other hand, we are long-term investors and I have written quite a bit about Mercado Libre, for example, in the most recent Best Buys Nows article.

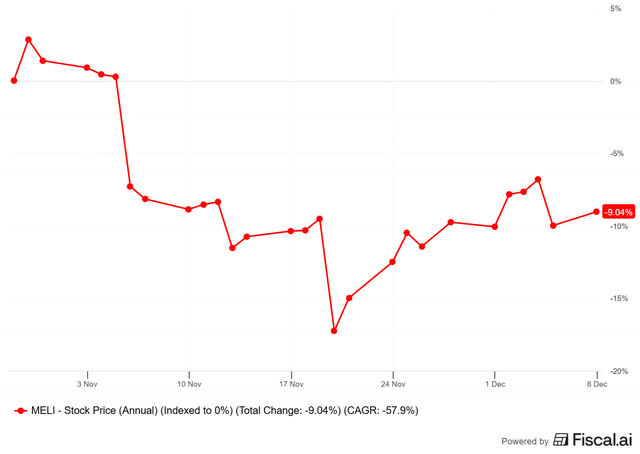

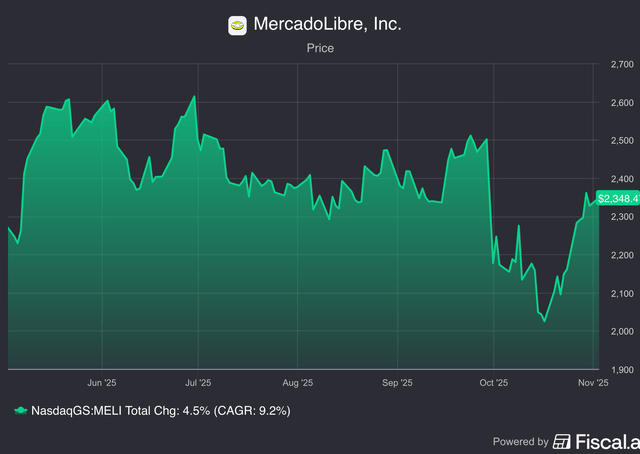

This is what the stock has done since the earnings.

As you can see, it first went up, then dropped (to -18.5%) and now it’s still down 9% compared to the pre-earnings price.

With that context, let’s go to Baurzhan’s analysis.

Hi Multis

Baurzhan here with an earnings update on Mercado Libre (MELI). For long-term investors, what matters most is the business trajectory and that’s what we’ll analyze here.

In the previous quarter (Q2, so not Q3 that we are analyzing in this article), Mercado Libre made several moves that Wall Street didn’t like. It announced aggressive reinvestment in logistics and user acquisition, with lower margins as a result.

Essentially, it gave up short-term earnings to drive higher long-term profits, a decision the market dislikes, but we, as long-term investors, love. Let’s see what this quarter tells us.

At McKinsey, we used to say, “Strategy without numbers is poetry.” So, let’s start with the key numbers to understand the overall business trajectory and then dive deeper.

The Numbers

Revenue: $7.4B (+39% YoY), beating estimates by $200M (27th quarter or almost 7 years of >30% growth, as the only public company worldwide, out of 83,000), see the Best Buys Now article for more context.

EPS: $8.32, missing estimates by $0.98 (-10.5% YoY)

Operating margin: 9.8% (-2.4pp QoQ, -0.7pp YoY)

Free cash flow margin: 35.1% (+9.2pp YoY)

Gross margin: 43.3% (-2.6pp YoY)

FCF margin should be taken with a grain of salt because of Mercado Pago, but I wanted to give it anyway.

Marketplace

Commerce revenue $4.2B (+33% YoY)

GMV: $16.5B (+28% YoY, +35% FX-neutral) (GMV= gross merchandise volume, the total sum of everything sold on the platform)

Items sold: 635M (+39% YoY)

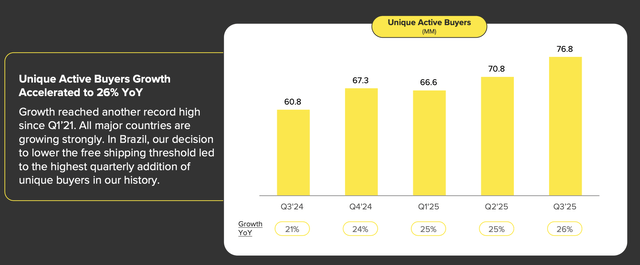

Unique active buyers: 77M (+26% YoY)

Commerce take rate: 25.3% (+1pp YoY)

Mercado Pago

Fintech revenue: $3.2B (+48.9% YoY, +65% FX-neutral)

TPV: $71.2B (+41% YoY, +54% FX-neutral) (TPV = Total Payment Volume, the total value of all transactions processed through the platform)

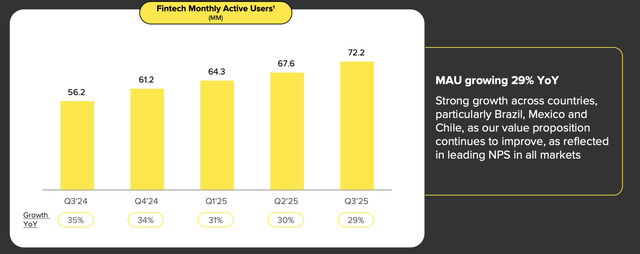

Monthly active users: 72.2M (+29% YoY)

Credit portfolio: $11.0B (+83% YoY)

Regional Breakdown

Brazil: $4.0B (+38% YoY, 54% of total revenue)

Argentina: $1.44B (+40% YoY, 19% of total revenue)

Mexico: $1.65B (+44% YoY, 22% of total revenue)

Other (combined): $0.3B (+39% YoY, 4% of revenue)

More Insight

E-commerce

This quarter brought several positive shifts in Mercado Libre’s business trajectory.

The platform achieved its fastest user growth since 2021, adding 7 million new active buyers, a 10% increase, in one quarter. 4 million come from Brazil, where free shipping thresholds were reduced.

This user growth clearly shows a strong short-term response to MELI’s investments in logistics and marketing. (Quick recap for new readers: MELI made a key move in Brazil in Q2 2025, cutting the free shipping threshold from R$79 to R$19 — roughly $14 to $3.50.)

CFO Martin de Los Santos also mentioned record-high NPS levels in Brazil during the earnings call, supporting this positive trend. NPS stands for Net Promoter Score and ranges from -100 to +100. It measures how much customers liked the product and experience.

Attracting new customers in a market as competitive as Brazil shows the strength of MELI.

At the same time, engagement per user continues to rise, and items sold per buyer have reached an all-time high. Another impressive sign of deeper platform stickiness.

This shows a deepening moat for Mercado Libre. More users and engagement drive data advantages and scale efficiencies. Kris has used this visual for Scale Advantages Shared. Mercado Libre is a perfect example of this.

You have to make sure you understand how important Mercado Libre is for many people. Have you heard of David Gardner’s snap test? It means that you snap your fingers and the company’s gone. Would many people notice? Mercado Libre is used by many consumers daily, to pay or to buy. A habit is emotional, and once it’s formed, it makes retention much better.

The habit is formed by improving and optimizing the customer journey across:

1. UX/UI for search, comparison, and purchase

2. Broad assortment and competitive prices

3. Smooth checkout and payment experience, with access to credit (credit cards and BNPL with high approval rates)

4. Fast, reliable delivery and smooth claims handling

MELI is simultaneously advancing and leading in all these areas (point 3 will be covered in the next section on Mercado Pago). On point 1, incoming CEO Ariel Szarfsztejn shed some light on how MELI is leveraging AI:

We are extremely excited about the potential of agentic AI to enhance discovery, surveys, and productivity within our ecosystem. We’ve just launched our own Seller Assistant, a conversational tool that gives sellers personalized advice and recommendations on managing their activity on our platform.

Some critics focus on the margin impact of the free shipping initiative in Brazil, seeing it as a form of price cut. In a sense, they’re right, but it’s short-sighted.

The move has bigger long-term advantages. Fulfillment is critical for e-commerce in any market. It involves high fixed costs (warehouses, trucks, planes, etc.), and since MELI doesn’t charge for it now, efficiency becomes essential. CFO Martin de Los Santos confirmed this on the call:

Higher transaction volumes helped us reduce unit shipping costs in Brazil by 8%, with slow deliveries enabling us to leverage on the unused capacity. Brand preference scores reached new record highs across the region, helped by our marketing investments and free shipping policies.

Higher volume also makes the model more sustainable for the long term. On top of that, this competitive advantage is difficult to replicate because it requires substantial capital investments in fulfillment hubs and fleet, geospatial intelligence to identify the most efficient locations, and strong execution and operational excellence. Or, to put it differently, this is why Mercado Libre has been beating Amazon since it entered the Brazilian market in 2012. Even in Mexico, which is so close to the US, Mercado Libre beats Amazon in market share.

On point 2, MELI also lowered seller fees for items priced between R$79 and R$200 (roughly $15–$37), attracting more sellers to the platform.

The company also continues to invest in and improve its first-party (1P) operations, where revenue grew 70% year over year to $0.9 billion. IMELI remains primarily a third-party (3P) platform, but in categories where it underperforms, it directly buys and sells goods (1P) itself.

1P is an addition, not the main activity. It’s meant to improve assortment, quality, and price in those categories MELI chooses. 1P is a different model altogether, as it requires inventory management and exposes MELI to reputational risk if product quality falters. MELI is approaching it smartly and selectively.

Finally, as mentioned on the call, MELI partnered with Casas Bahia, a major Brazilian retailer specializing in furniture, home appliances, and electronics.

The agreement involves Casas Bahia opening an “Official Store” on the Mercado Libre platform to list appliances, electronics, and furniture. Casas Bahia has extensive expertise in handling bulky logistics but will use MELI’s general logistics network for smaller items. The home appliances and electronics are some of the biggest markets for e-commerce.

Fintech: The Crown Jewel Continues to Shine Bright

Kris has always said that he started investing in Mercado Libre because he saw the potential in Mercado Pago, the fintech division of Mercado Libre. It has become the crown jewel.

Mercado Pago’s monthly active users (MAUs) reached 72 million, up 29% year over year.

The credit portfolio grew 83% YoY to $11 billion.

83% is an impressive pace.

Assets Under Management (customer cash, deposits, and investments held in MELI accounts) are rising even faster at +89%. These assets generate both short-term revenue (overnight interest returns) and long-term revenue through lending.

Mercado Pago is rapidly growing the share of users who treat it as their main financial account, especially in Brazil and increasingly in Mexico. “Principal” users, those channeling at least half of their income through the platform, already benefit from yield-bearing accounts and credit products. The next milestone is enabling salary deposits, pending a banking license in Mexico, which could significantly boost engagement and monetization. As CFO Martin de Los Santos said on the call:

“What we don’t have yet is the ability to collect your salary in the Mercado Pago account. In the case of Mexico, this is because we are not yet a bank. We are in the process of obtaining a banking license, and that is a requirement.”

Credit cards now make up 44% of the portfolio, growing 20% quarter-over-quarter and 106% year-over-year. CFO Martin de los Santos on the call:

Our credit card, which plays a key role in NPS and principality, is growing very rapidly, driven by higher usage and share of wallet.

MELI is also gaining share of wallet: average credit card exposure rose to US $406, up 9% QoQ. Finally, a new credit card was launched in Argentina this quarter.

This is another exciting pocket of growth for AuM of Mercardo Pago, because higher debit card activity (of course, driven by e-commerce) drives higher remaining balances, and it’s logical. If you spend more on your card, you keep more money on that card to minimize top-up friction (this is also empirically proven by my analysts at Mastercard Data & Insights when I worked there).

Such aggressive credit-portfolio expansion usually carries risk, which should be treated carefully. However, the 15-90-day NPL ratio stood at 6.8%, up 0.1 pp QoQ but down 1 pp YoY. Note: NPL = non-performing loan, so a loan that’s not fully paid back.

The 90-plus-day NPL ratio also improved slightly to 17.6%, down 0.9 pp QoQ and 0.3 pp YoY. (These loans are fully provisioned through regular P&L charges, which accumulate as reserves on the balance sheet: 15-90-day NPLs are covered at 100%+, and 90-day-plus NPLs at 150%+, reflecting their higher default risk.)

Given such rapid credit expansion, maintaining stable or even slightly better default rates is a strong outcome.

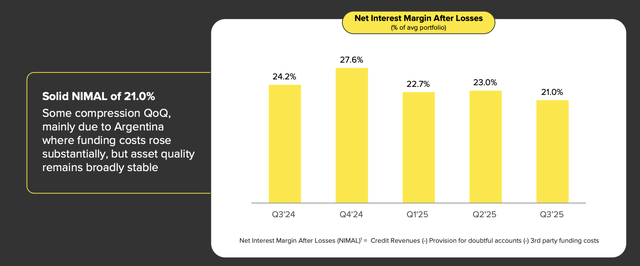

A 17–18% NPL ratio on 90-day-plus loans might sound high, but in high-inflation regions like LatAm, that’s within the normal range. The NIMAL (net interest margin after losses) chart explains why.

From the chart above, two things stand out:

(1) the NIMAL trend is decreasing

(2) it might look unusually high.

For example, Nu Holdings reports a risk-adjusted NIM of 8–9%. However, most of that is driven by macro conditions, so external factors are largely beyond MELI’s control. The 2 pp QoQ and 3.2 pp YoY decline mainly reflects higher funding costs (market deposit rates) in Argentina, where the central-bank rate hit 29%, as management explained.

In high-inflation environments like this, central banks maintain high rates to cool inflation and support the local currency. Where I live, in Kazakhstan, the situation is similar: the central bank rate is 18.5%, savings earn around 19–20% (USD rates capped at 1%), and cash loans reach 40–50%.

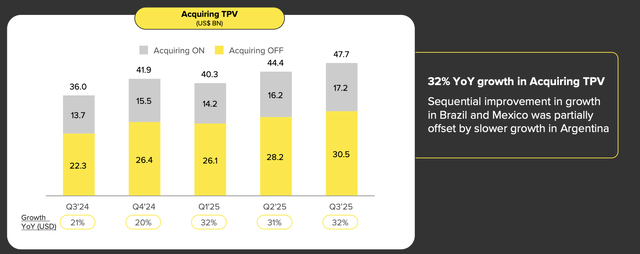

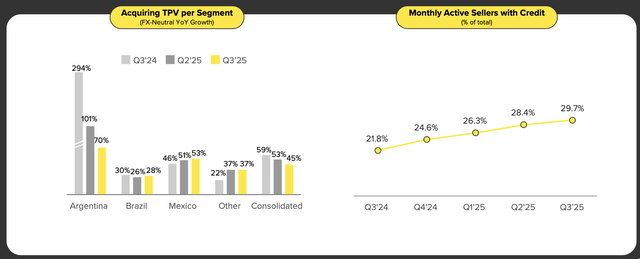

Acquiring volume (total payments processed) rose 32% YoY. That’s strong and it’s the result of accelerated merchant adoption and deeper integration within the MercadoLibre e-commerce ecosystem.

Once more, off-platform acquiring (transactions outside of the marketplace) is growing faster. That underlines Mercado Pago’s move toward being a full payment solution, not just a checkout option.

Take-rates (merchant fees) remain stable, meaning volume growth is translating largely into revenue expansion.

The credit-backed acquiring model (acquiring + lending) is proving effective: as merchants accept cards and wallets, Mercado Pago is concurrently growing its credit book and building “stickiness”.

The Advertising Opportunity

Mercado Libre’s advertising revenue surged 56% year over year (63% FX-neutral) versus 38% in USD terms in Q2 2025. So, that’s a clear acceleration. Display and video ads are nearly doubling. Management attributed this acceleration to new strategic initiatives, especially the April 2025 integration with Google Ad Manager and partnerships with Roku and HBO. The advertising opportunity for MELI remains substantial, backed by its vast data ecosystem and user insights.

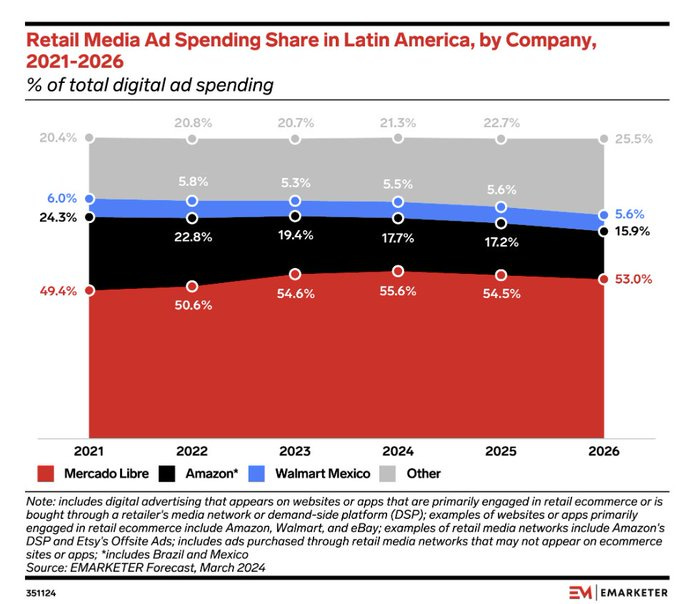

Kris has shared this chart already a few times but I think it remains impressive that Mercado Libre is beating Amazon on advertising as well.

Looking Forward: Secular Tailwinds Intact

Last quarter, Kris showed that the top 10 e-commerce markets had online penetration rates of 26–28% of total retail sales in China and Europe. I found similar insights in Euromonitor’s forecasts, which confirm the strong growth potential of Latin America’s online retail market.

According to Euromonitor, total Latin American retail sales (online and offline together) are expected to grow at a 6% CAGR between 2024 and 2028. Over the same period, online retail is projected to grow at an 11% CAGR versus 5% for offline retail. Online’s share of total retail sales in Latin America should rise from 12.3% in 2023 to 15.9% by 2028.

Another perspective: MELI’s 72–75 million active users across e-commerce and fintech still represent only about 25% of Latin America’s ~300 million bankable population (people at the bankable age). That leaves a substantial headroom for expansion.

I also wanted to share this interesting McKinsey article on payments market trends in LATAM region ( McKinsey article). Latin America’s payments landscape is undergoing a structural transformation, moving from cash-dominated to digital-first at an unprecedented pace. Debit and credit cards now lead everyday transactions, but the real breakthrough lies in mobile payments. They are easy to use, low-cost, and increasingly accepted across markets from Argentina to Peru.

This shift shows that millions of previously unbanked consumers are joining the formal financial system thanks to companies like Mercado Libre (and Nu, of course). As you can see, in 2023, cash accounted for roughly 30% of payments, but that share continues to shrink. That leaves plenty of room for digital growth. For comparison, in Kazakhstan, cash payments are estimated at just 10–15% today.

Platforms like Mercado Pago are perfectly positioned to capitalize on this shift. They can leverage the company’s data and ecosystem insights for better credit quality.

Governments are promoting interoperability (like Brazil’s Pix) and consumers favor seamless experiences. That’s why the region’s fintech companies are strong and growing fast. The next decade could see players such as Mercado Pago evolve from payment enablers into full-service financial platforms.

Earnings Conclusion

This quarter’s report once again demonstrates consistent execution of MELI’s long-term strategy.

Mercado Libre continues to strengthen its long-term investment case, driven by a broader ecosystem and sustained growth across e-commerce, fintech, and advertising. The company is steadily converting short-term cost pressure from logistics and credit expansion into durable competitive advantages. Its scale, technology stack, and data assets form a defensible moat that becomes harder for competitors to replicate over time.

With deepening user engagement, new monetization levers, and disciplined capital allocation, MELI’s profitability trajectory continues to improve year after year. Overall, the business looks structurally stronger today than it did even a year ago.

It took me time to build conviction in MELI, and my position is currently up about 20%. Indeed, the stock’s price action over the past six months hasn’t been particularly exciting.

P.S.: I’m a happy Fiscal.AI user thanks to Kris’s recommendation and his promo link. Highly recommend it to all Multis!

Kris made this meme about Mercado Libre’s stock price.

MELI is already my second-largest holding by invested capital (and Kris’ biggest), and I remain optimistic about this “money tree” in my Potential Multibaggers garden. While the stock price doesn’t move much now, the company continues to become stronger and stronger.

Here, the free part ends.

Do you want to know if Mercado Libre is a buy now? Get full access to Potential Multibaggers. Here’s what you’ll get:

✅ The rest of this article

✅ Best Buys Now (outperforming the market by 22% over 3 years!)

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

Don’t hesitate. Don’t miss the next multibagger opportunity!