Is The Trade Desk Screwed?

Insights from someone who has written more than 150 times about TTD

Hi Multis

I hope you could sleep Wednesday night or you didn't choke on your Thursday morning coffee when you found out the price action of The Trade Desk (TTD) after the company announced its Q4 2024 earnings results.

The stock dropped by 34.4% since the earnings. Ouch.

I got several messages from Multis who were worried and I get it.

This was the very first time in 33 quarters, since the company went public, that The Trade Desk missed its own guidance.

On top of that, guidance for Q1 2025 was disappointing too.

If you have these elements combined, the question becomes if this is a pivotal moment and The Trade Desk has lost its magic.

On CNBC, Josh Brown, who I respect, said that The Trade Desk would be in the penalty box for a few quarters until it gains back the confidence of investors. This is definitely a possibility.

But just like everything in investing, it's definitely not a certainty. If the next quarter is outstanding, investors will quickly label this quarter as a one-off.

I think it's safe to say that I know The Trade Desk better than 99.9% of the investors. I've followed it intensely since I picked it as a Potential Multibagger in May 2019 at (a split-adjusted) $19.5.

Since May 2019, I've written more than 150 times about The Trade Desk, from short news to deep analysis and everything in between.

I know a thing or two about this company, so I want to critically analyze whether this is a turning point for The Trade Desk or just a blip on the screen.

The numbers

In Q4, The Trade Desk's revenue grew 22.3% year-over-year to $741 million, but it's a miss of $18.55 million versus the consensus. More importantly, The Trade Desk also missed its own guidance of 'at least $756 million.'

That information is crucial if you want to understand the big stock price drop. For the first time since its IPO 33 quarters ago, The Trade Desk missed its own guidance, by about 2%. Normally, the company beats the consensus by 2% on average. This time, it missed it by almost 3%.

The non-GAAP EPS came in at $0.59, beating the estimates by $0.02. This already shows that The Trade Desk has leveraging power. Even with a revenue miss, the company can squeeze out more earnings. On a GAAP basis, EPS came in at $0.36, up 81.5% year over year.

The big difference between GAAP and non-GAAP is still caused by the stock grant plan for Jeff Green, but that's stopping in 2025, so GAAP and non-GAAP should be much closer to each other.

The company also issued another $1 billion for the stock repurchase plan.

With the company's extremely strong financial position, this is no problem at all. It has $1.9 billion in cash and short-term investments and with the free cash flow, we end up at $2.1 billion in the most recent quarter. The Trade Desk has no debt.

For the eleventh consecutive year, The Trade Desk saw customer retention of more than 95%.

Guidance for Q1 FY25 is “at least” $575M or 17% growth year over year, lower than the 18% growth consensus. The guidance missed the consensus by just 0.9%.

The Call: The Jeff Green Monologue

The Trade Desk's founder and CEO Jeff Green is someone who's clearly passionate about his industry. If you want a masterclass in ad tech, just listen to all of Green's earnings calls. He always takes his time to share new insights, trends and fundamentals of the industry. I wish all CEOs would share so much wisdom and insight.

And he's not a man who sugarcoats things.

First, he stressed that the full year 2024 was another strong year for The Trade Desk, but then he immediately said this.

I want to acknowledge upfront that for the first time in 33 quarters as a public company we fell short of our own expectations.

During COVID we revised our expectations once along with the rest of markets, but for the first time in 8 years we missed the expectations we set, and it was our fault.

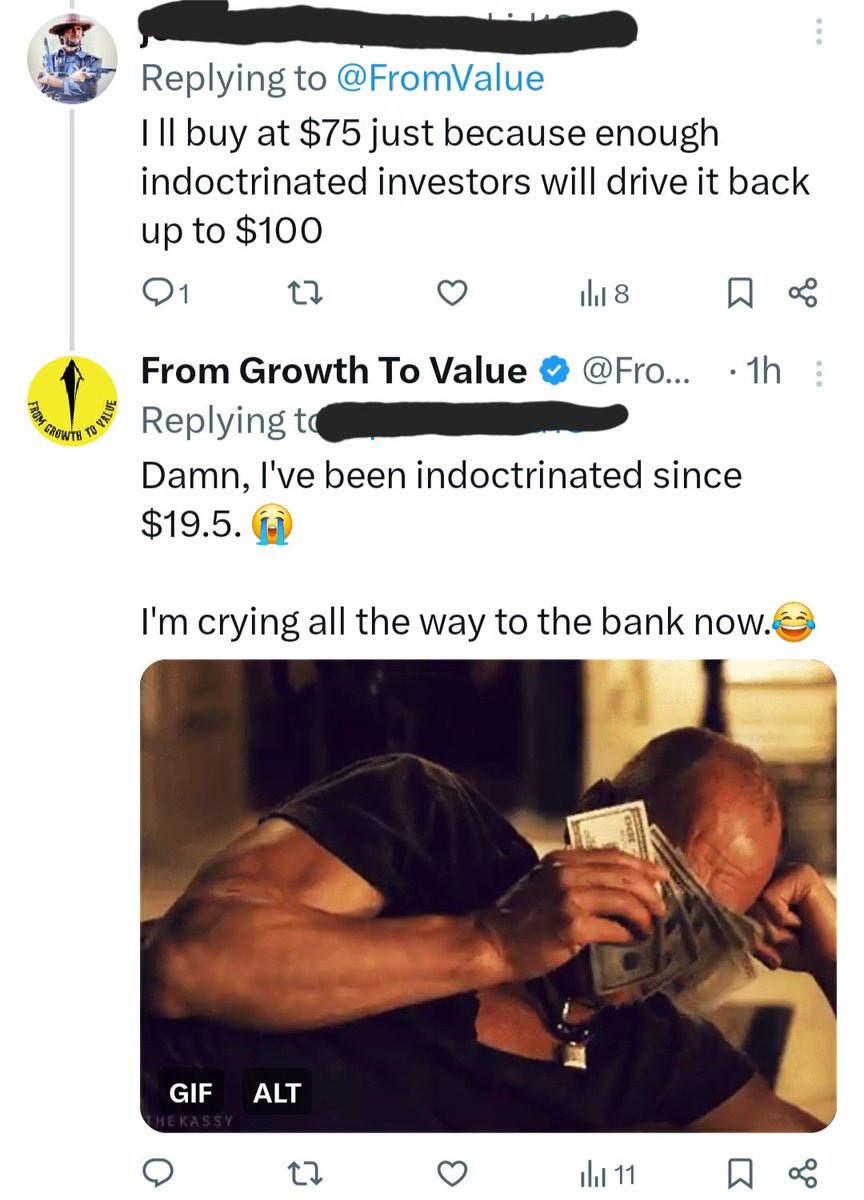

Several Twitterati (can you still call them that?) quickly concluded that The Trade Desk's days were over.

This is an example:

And the same man (it must be a man, women are usually not that confidently wrong), made me laugh a second time.

Or this one.

And so on and so forth.

It's always the same. These bright lights follow price action and then post an arrogant opinion to get attention. I believe Jeff Green until proven otherwise above these trolls. He has proven for 32 quarters in a row that he's trustworthy.

The Trade Desk has always exceeded expectations, and Jeff Green nailed so many predictions that I found risky to share. When Google comes out saying it will stop third-party cookies, Jeff Green said they would never be able to do that within the time frame they wanted. I found that a very bold and risky prediction. I mean, this is Google, right? But Green was right. Not only was the date postponed multiple times, in the end, third-party cookies were not stopped.

And, by the way, Green made another Google prediction this quarter. Here it is:

We are preparing for a world where Google exits the open internet. I’m confident that one way or another Google will exit the open internet. I think they should. Most of their anti-trust and regulatory problems come from the draconian ways they have engaged with the open internet in the past. (...)

If and when Google exits the Open Internet, they will leave a big hole and a big opportunity for the rest of us.

Let's see if this is another correct prediction.

I could give many other examples from the past where Green made these bold predictions, and each time, he was right. But that's beyond the scope of this article. I just wanted to show that because I have followed Jeff Green so closely for so many years years, and he has proven time and time again to be trustworthy, I give him my trust until proven otherwise.

And that's why I believe him when he says:

Starting off, let me explain it as I see it, what falling short of our own expectations does NOT represent. This didn’t happen because the opportunity isn’t as big as we thought. In this case, it isn’t because of competition either.

It's essential that Green emphasizes that this is not about a competitive threat. Because that's also something I saw in several comments. "Amazon is eating their lunch!" or "AppLoving is stealing market share." Jeff Green denies this and I believe him. Not just because I'm naively following everything he says but because it makes sense.

Why would Amazon suddenly become a stronger competitor while it has been into this space for years already? Green on Amazon:

More and more the only competitors we encounter today have the worst objectivity problems. Amazon is asking advertisers big and small for their advertising budgets. Meanwhile, Amazon competes with most of the Fortune 500 companies in some way, whether we are talking about Microsoft in cloud, or P&G in CPG products, or UPS, or Nike, or all the rest.

Jeff Green has been saying this for years. Google and Facebook 'get to grade their own homework' (in other words, there's no certainty that the numbers they give you as an advertiser are 100% correct), and indeed, Amazon competes with many brands. The Trade Desk is an independent player and was focused on being one from the start.

AppLovin isn't a big threat to The Trade Desk right now because their focus is not the same. They dominate in mobile gaming and in-app ads. The Trade Desk is more in brand advertising. Or, to put it differently, The Trade Desk serves the big brands and ad agencies, AppLoving the smaller ones.

So, what is the real reason for the disappointing results then? According to Jeff Green:

For Q4, the reality is that we stumbled due to a series of small execution missteps while simultaneously preparing for the future.

For Q4, the reality is that we stumbled due to a series of small execution missteps while simultaneously preparing for the future. (...)

Simply put, as you have seen before, as companies grow and become increasingly complex, they need recalibration to unlock new opportunities. We are recalibrating our larger company for an even stronger future.

Green didn't want to go into specifics, as it would expose people who made honest mistakes, moved on:.

And when we talk about the missteps specifically, many of them involve people, mistakes that aren't appropriate to discuss publicly, especially when people are already learning from these mistakes.

He also mentioned that there were a few instances where the company could have chosen for short-term performance but chose for long-term opportunities. Implicitly, there was an implication that The Trade Desk could have met its guidance if it wanted, but it didn't do this because they didn't want to sacrifice long-term goals for short-term gains.

And management already changed a few things to right the ship. Four main points were mentioned.

1. Reorganizing

In December, The Trade Desk did the largest reorganization in its history so far. Green:

While we often make structural changes at the end of the year to improve our business, this was bigger than usual. For most people in the company, we provided a much clearer view of their roles and responsibilities, and for most that also meant a change in reporting structure. (...)

2. Internal Effectiveness

The Trade Desk always saw such a big market that it totally focused on that. Now, it has become of such a size it also needs to focus internally. Green:

Over the past two months, leadership has spent more time discussing operational improvements than at any other point in our history. While we’ve historically been focused on external opportunities, we understand that this moment requires us to scale our internal operations and continue hiring senior talent to support long-term growth.

3. More Focus On Brands

Our commitment to agencies remains strong, but we are also expanding brand-direct relationships, particularly through Joint Business Plans, which grow 50% faster than the rest of our business.

That last part is important. The Trade Desk started working with brands like Walmart, Home Depot, Amazon and many other giants. Ad agencies are intermediaries and with technological revolutions, like with AI now, you often see that the middlemen are cut out.

4. Revamping The Product Development Process

Green mentioned that the product teams had become too big. The Trade Desk reorganized its software teams into smaller scrum teams again instead of "waterfall methods," which are inherently slower. Green:

Our engineering team is now divided into nearly 100 scrum teams with a system to more easily ship and collaborate with the business team on what has shipped and what will ship and when

Green also talked CTV (Connected TV) being "the kingpin of the Open Internet." The reason is that nearly 100% of viewers are logged in. He even claims:

CTV should be the first place all brand advertisers spend, not walled gardens.

That's a bold statement, but it makes sense. If you advertise on Google or Meta's apps, you can only see the numbers they give you. When people are all logged in to CTV, the measurability of ads is so much better and more accurate.

And what's often used for this measurability on CTV? UID2, the standard developed by The Trade Desk, which is now an independent organization.

Green emphasized that CTV continues to be the fastest-growing channel, even if it is already the biggest channel. He says that neither The Trade Desk or content owners think the saturation point is anywhere close.

Smaller still, but a big opportunity, according to Green, is audio. He called it 'still the most on sale corner of the Open Internet.' I think that's true and it's probably true it's still a big opportunity.

Of course, just like on every call from any company nowadays, there was attention for AI as well:

We started our ML and AI efforts in 2017 with the launch of Koa, but today the opportunities are much bigger. We’re asking every scrum inside of our company to look for opportunities to inject AI into our platform. Hundreds of the enhancements recently shipped and coming in 2025 would not be possible without AI.

The difference is that The Trade Desk has indeed been an early adopter of AI and ML (machine learning).

Green emphasized another feature, one that the competition, be it Amazon or AppLovin in the future, doesn't have:

In Kokai, we have the industry’s richest retail data environment, including data from many of the world’s leading retailers to help advertisers understand the connection between campaign spend and consumer action.

This has always been the holy grail of advertising: being able to measure in the stores how your advertising campaign worked. With The Trade Desk, that's possible.

Green also said that The Trade Desk would simplify the platform:

We will simplify our platform. As platforms mature, they add features but that can make it more complex. We will continue to add features and powerful controls for the most sophisticated buyers in the world. However, we are finding ways to improve the experience and make decisions easier and more intuitive for our users.

That's great. Most great leaders do this simplification exercise regularly.

All in all, Green outlined 15 initiatives that The Trade Desk will focus on. That also means the company will invest in VP-level and above executives and infrastructure. Green named the function of COO, for example.

Capex will remain low, though, at just 5% of revenue. But there will be impact on the EBITDA margin.

The Call: Q&A

As Green talks for so long and already explains so much, the Q&A is often less interesting for The Trade Desk.

Of course, the first question was about the miss. Green basically answers the same thing, with restructuring and new initiatives. But there was also this very candid admission:

So first, let me own that we missed and that we missed our own expectations, as you point out, which is in my mind, very different from missing Wall Street's expectations.

So when we set our guide and set our expectations, I view that as a commitment.

It's understandable in a moment like this for those outside the company, especially shareholders to be wondering what does this mean? Is the opportunity not as big as The Trade Desk claims? Or is it different than what they thought? Is the company not executing? Is there something wrong, if so, is it big or is it small?

I just want to be super clear, we missed because we had a series of small execution missteps.

Green also gave an example of what went wrong and why it was a decision that gave up short-term gains for long-term opportunities:

One of those -- you're right, that Kokai rolled out slower than we anticipated. But much of that was for good reason. We've seen moments and places to inject AI like improving the foundation of our forecasting and performance models. That is a short-term negative for sure, but it is a long-term negative. We are working -- I'm sorry, it's a long-term positive.

Green also talked about how the political campaigns had an effect not observed before to that extent: companies holding their budgets because they know there will be a flood of political campaigns they could drown in.

Political put some advertisers on the sidelines, that's absolutely true. But it also brings out budgets, especially, of course, the political budgets. And on the net, was it a positive or a negative? To me, it's too close to call.

In the past, political spending was always a tailwind for The Trade Desk. But now, other brands paused their spending. And that effect was big enough to offset the political spending. I think many overestimated political spending. It accounted for about 5% at the peak in Q4.

Green also went deeper into his comments about Google and Amazon. If you are interested, you can read the transcript on Finchat.

My Take

In honor of Jeff Green, I won't sugarcoat this either. This was a disappointing quarter, and it's understandable that The Trade Desk's stock was taken to the woodshed.

For months already, I shared with the Multis that I found The Trade Desk's stock too expensive. With a valuation score of 4/10, I think that's pretty clear.

I'll review the quality and valuation scores next week, as I think this is a crucial moment. But overall, I feel pretty confident for the long term. That's why I added 17 shares to the 3 I already had bought.

The Trade Desk's valuation will be much more attractive after this, especially because Jeff Green mentioned re-acceleration multiple times in the call. I see no reason not to believe him.

You see a lot of dramatic statements about The Trade Desk now, but the fact stands that this has consistently been one of the best companies out there.

Every great company goes through crises. It's how they are handled that matters.

Think about Netflix and the Qwikster debacle, Amazon's stock crash of 95% in the dotcom crash, Meta and the Cambridge Analytica scandal, Nvidia missing its own guidance in Q3 2018, etc.

Great leaders use crises to improve their companies. Jeff Green is a great leader, one of the best I know. So why would I doubt him now?

Of course, the pessimism may even become stronger over the next few weeks and months and the problems may not be solved in one quarter. It could take two or, who knows, three. But never underestimate a determined visionary leader. Troubles make them even more determined to show the world what they are capable of.

The Trade Desk didn't wait and started handling the problems right away.

Also, don't forget that, despite the weaker fourth quarter, revenue was up 26% for The Trade Desk. Programmatic advertising will only become bigger and The Trade Desk is the leader of programmatic advertising for the Open Internet. It has no conflicts of interest, and it innovates continuously.

This is not the first time The Trade Desk's stock price drops so much. It dropped by 28% just 5 quarters ago. Did you still know? And then it was up about 90% before this drop.

What I mean is that if this quarter is just a one-off slip, it won't matter over the long term.

Disappointing quarters are inevitable, even for the very best companies. The fact that The Trade Desk's valuation was so high makes the drop more spectacular.

I don't believe the fundamentals are in danger. Yes, there's some disappointment now, but that's mainly because the valuation was so high and there's little room for weak quarters like this one. Well, weak, many companies would still give an arm and a leg for these results, but in the context of The Trade Desk, it's weak. That alone already says something about this company.

I hope the stock goes down even further, as the $1 billion earmarked for buybacks can do its work and I can load up more shares as well. I wanted to make this a significantly bigger position in the Forever Portfolio, but the valuation refrained me from adding too much. Right now, that valuation looks quite a bit better and that's why I add to my position. This could take months, though, so I will probably not continue to add so many shares at once.

Don't forget that for a multibagger, which The Trade Desk still is after this drop (it's still more than a 4-bagger), how long the company grows is much more crucial than how fast it grows at any given moment over a long-term period. Or put differently, an earnings miss won't matter that much. It will be in the fundamentals over the long term.

So, I'll end with one last quote from Jeff Green. It seems appropriate to let him have the final say, also because it summarizes my own thoughts pretty well.

I am not happy with our results in the fourth quarter but there is so much opportunity in 2025 and the years ahead to help our clients take full advantage of data-driven advertising on the premium internet, to drive growth and brand loyalty for their businesses.

And that’s why I’m confident, The Trade Desk will eventually resume acceleration and continue the path we’ve been on for over 33 quarters as a publicly traded company.

You can expect the quality score and valuation score updates next week.

In the meantime, keep growing!

What a superb post, Thank You for detailed note!!

Been invested in TTD since 2017. Watched it morph into a wonderful company. I wonder if the management issues could have been better foreseen by Green. We all knew it would continue to grow and they still don't have a COO. Aswath Damodaran talks about having the right CEO to match a company's corporate lifecycle, Steve Jobs who was lucky to have a Tim Cook, I think we need one here (not to replace Green but to operationally right the ship). Any more thoughts on this or do you think that the re-org activity caused a couple of dropped assignments and hence the miss? Thank you, Kris.