Hi Multis

Yesterday, I published an update about Cloudflare's latest earnings and why the stock shot up by 20%.

So, let's see if Cloudflare is still interesting at this point, by updating the Potential Multibaggers Quality Score and then examining at the valuation.

Of course, the Overall Quality Score is always linked to your own conviction and a few other parameters. That's why you can download the sheet here to give your own score alongside me.

Personal conviction 10/10

Since July 2022

I have never changed my conviction for Cloudflare, as I have never seen any valid reason to do so. When the stock price cratered after Q1 2023, it was down 30% on a single day, I was happy to add shares. Personal conviction is very important in investing, and even more for Potential Multibaggers.

Profitability 7.5/10

Since February 2025

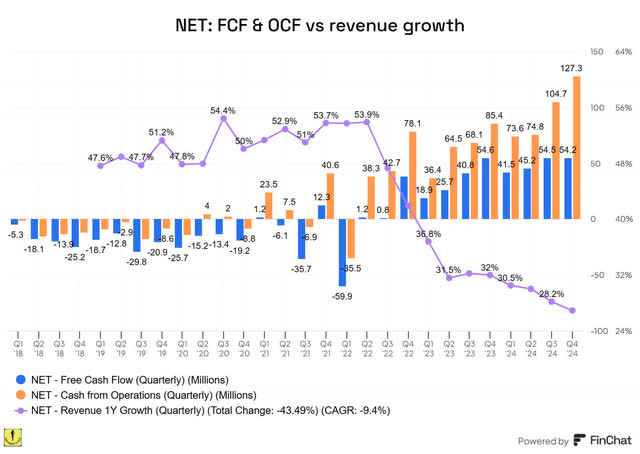

I mostly look at Free Cash Flow and Operational Cash Flow (=cash from operations). But that doesn't mean that they always make sense. Most companies growing their revenue fast will look very expensive on these two metrics because they invest so much for growth.

It's clear profitability has become much more important in this context, but Cloudflare continues to push for growth. It has proven to the market it can be profitable and balance that out with growth. It could be very profitable if it wants, but that would kill the growth.

When I started with the Overall Quality Score and I scored Cloudflare in July 2022, I gave Cloudflare a 4/10. But revenue was growing at 50% back then. This shows Cloudflare gave up some of its growth for profitability.

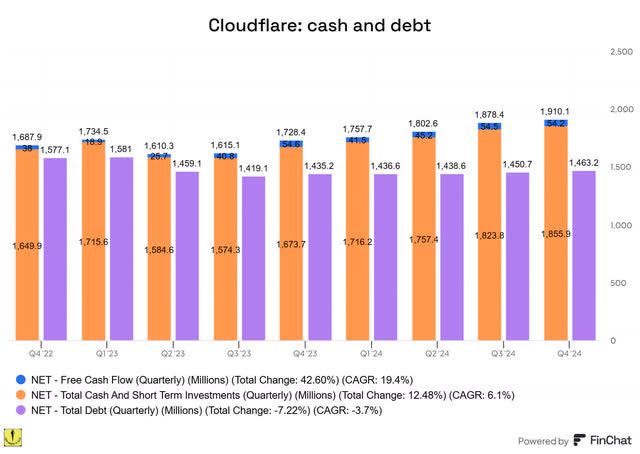

You can see the combination of profitability and growth in this graph.

Source: finchat

As you see, the mostly unprofitable 50%+ revenue growth has been changed for more profitable 30%-ish growth. I like that, as it shows Cloudflare can perfectly use the buttons to produce the outcome it wants.

It shows how well management controls the company. When the market asked for more profitability in 2022, management clearly communicated they would give up some of the revenue growth for profitability.

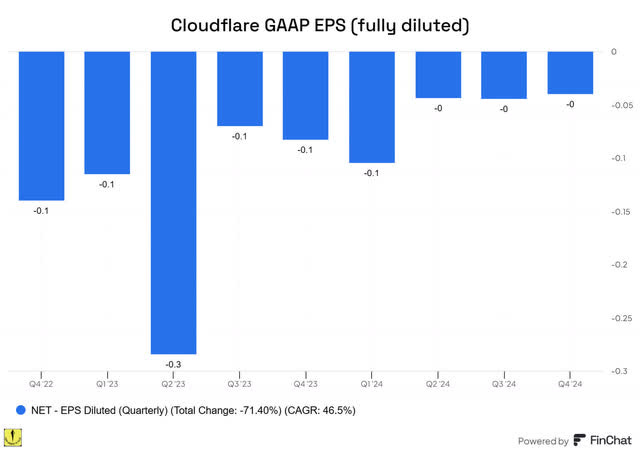

If we look at GAAP (generally accepted accounting principles) and EPS (earnings per share), we see that Cloudflare is still unprofitable because of stock-based compensation, but it's close to break even.

To be precise, Cloudflare's EPS was -$0.04 in the most recent quarter.

But accounting income is not the same and inferior to cash income. That's why I raise Cloudflare's score by half a point. That makes 7.5/10.

Sales efficiency 5/10

Since February 2025

The sales efficiency score first looks at the marketing efficiency by looking at what percentage of revenue goes to SG&A (selling, general and administrative) and how much revenue growth that brings in the trailing twelve months and what is expected next year. I divide the average of those two by the SG&A number as a % of revenue and that is marketing efficiency. I then multiply that by the gross margin to look at sales efficiency.

Of course, this formula is far from perfect, but it gives you some idea of how well the company sells its product. There are plenty of nuances to add here, but the numbers are what they are.

The sales efficiency score goes down slowly, by half a point, from 5.5 to 5. You can see the calculations here.

Innovation 5/5

Since July 2022

This is part subjective, part measurable.

As for measuring, you can look at the % of the revenue that goes to R&D. At the same time, I want some efficiency there too, so I look at R&D efficiency by dividing R&D expenses in the previous year by revenue growth in the trailing twelve months.

Cloudflare spends 25.8% of its revenue on R&D. That results in an R&D efficiency of 1.09, not bad at all, but definitely not exceptional. But it's especially the speed and the impact of the innovation that impresses me. So, quality gets a bit more weight for the 5/5 I give.

Must-have? 5/5

Since December 2023

I introduced it because of what Matthew Prince, the founder and CEO of Cloudflare, said in June 2022:

I think that the world is about to get sorted into must-haves and nice to haves.

I think that it is clear immediately that Cloudflare is a must-have, no question about it. You will not suddenly compromise on speed or security if the economy goes sour. That's also why Cloudflare continues to grow its revenue so substantially.

As an extra element, I want to add Cloudflare's strategy. Land-and-expand and freemium are combined in a very smart way. Cloudflare gives away its new products for free, collecting very valuable information from power users. Then it adapts it in a very substantial way and continuously and only then the paying model is launched. That's also why the use of Cloudflare products kept up pretty well during the SaaS winter season we saw in 2022 and early 2023.

Revenue growth 5/5

Since July 2022

This is very simple: how high was the revenue growth over the last twelve months? Cloudflare's revenue was up 28.2% over the trailing twelve months, which deserves 5/5. Sometimes it can be simple. :-)

Revenue growth durability 10/10

Since July 2022

Even more important than revenue growth is the durability of revenue growth.

Management Quality Score 10/10

Since July 2022

Great management is often one of the most important keys to long-term success. I look at the track record here, so execution and vision.

Matthew Prince, the founder and CEO of Cloudflare, is a charismatic leader, a great marketer, a constant innovator, someone on a mission and a great innovator. I have hesitated to write this down, but I want it here for reference in 10 years, or 20 years. To me, Matthew Prince is in that very elite top-notch league with the likes of Jeff Green and even the Mount Rushmore guys like Jeff Bezos. 10/10, without a doubt.

On top of that, I also really like Michelle Zatlyn, co-founder, COO and President of Cloudflare. Her role is often not emphasized, maybe also because it's a woman, but definitely because of the big shadow of Prince. But Prince uses every opportunity he can to put Zatlyn in the spotlight as the one who ensures things get done. She puts him with his feet on the ground.

Insiders' Ownership 5/5

Since July 2022

Does management have skin in the game? This is out of 5 as it is not always a make-or-break but often it's a useful indication.

For Cloudflare, co-founders Matthew Prince and Michelle Zatlyn own a big part of the Class B shares.

At the current price of $172.84, that means more than $5.5 billion for Matthew Prince and about $2 billion for Michelle Zatlyn. CFO Thomas Seifert, not a founder , owns more than 1.5M shares too, worth about $265M. This deserves 5/5.

Multibagger Potential 4/5

Last Change: February 2025

For Cloudflare, I picked it at $39.08, at a market cap of around $11B. It now trades at around a market cap of $59.5 billion. For me, the multibagger opportunity is still there over the next ten years, though.

I can still see the potential for a 5x and even a 10x in the next 10 years. A lot has to go right, of course, but if I look at everything, how much Cloudflare is on the forefront of AI and all other things, how 20% of the internet runs through Cloudflare, I'm giving Cloudflare 4/5 for multibagger potential, even now it's so much bigger already.

TAM/SAM: 5/5

Initiated March 2024

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

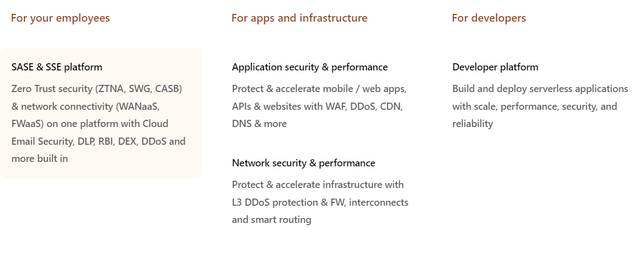

The TAM is huge for Cloudflare because it has so many products. Here's an overview.

The TAM for SASE is already $25 billion. For SSE, you can add another billion, expected to grow to about $3 billion in 2028. The WAN market as a total was valued at $8.2 billion in 2022, and is projected to reach $582 billion by 2032. I'm not sure how much of that could be as a service, but it's probably substantial again. The DDoS market was $2.21 billion in 2022 and is estimated to reach $9.80 billion by 2031. The total CDN market has a TAM of about $20 billion and is expected to grow to $67 billion in 2031. Again, Cloudflare doesn't address the whole CDN market, of course.

I could go on and on but the bottom line will remain the same: Cloudflare has a huge TAM & SAM. 5/5.

Financial Strength 7/10

Since July 2022

Financial stability is much more important in this environment than in the last decade. That's why I rate it out of 10.

Cloudflare is free cash flow positive, which is a good start. Let's also look at the balance sheet.

As you see, the long-term debt could be immediately paid off with the available cash & ST investments. Cloudflare is in a pretty good condition. At the same time, it's not a financial powerhouse like some other Potential Multibaggers, and there is debt here. That's why I'm rating it 7/10.

The negatives

I also have negative scores that can subtract extra points from that score. The scores are marked out of 5 because a lot is already captured implicitly in the other numbers. The lower the score on these negative categories, the better, of course.

Risk 1.5/5

Since September 2023

A lot is already baked in financial strength, but this is an overall risk score that shows more than just financial risk.

Cloudflare has proven has found its place, despite the competition of the big boys: Amazon, Google, Microsoft and so on. It now even partners with some of them.

Although the sector as a whole is expanding quickly, technology is an industry that experiences rapid change, so Cloudflare must continue to be innovative. However, the company is constantly coming up with new ideas, products and features, so up to now, that's no problem.

Competition 1.5/5

Since February 2023

How strong is the competition? Again, you can't objectively measure that but there are indications.

Cloudflare is also in a very competitive market, but at the same time, it stands alone as an aggregator of all of its services. That's why I rate it a 1.5/5.

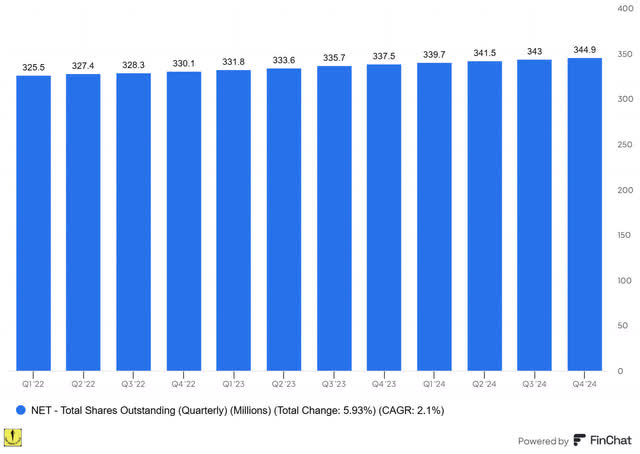

Dilution 2/5

Since March 2024

Dilution is negative over the long run but that doesn't mean that companies should not issue stock when they are still growing fast. Look at Apple's shares outstanding before 2012, when it started buying back shares:

At the same time, I don't want to ignore dilution completely, so I give a negative score.

We look at this over a 3-year period to exclude missing something.

For Cloudflare, this is how the picture looks:

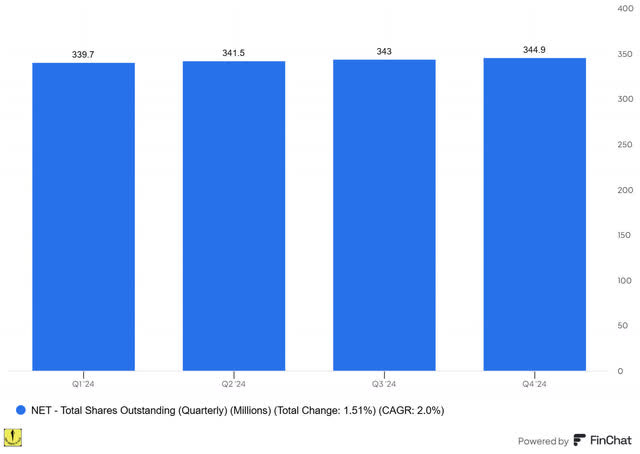

Over the last three years, the number of shares outstanding is up 5.93%, 2.1% per year.

If we look over the last year, the number of shares is up 2%.

I'm keeping the dilution score at 2/5.

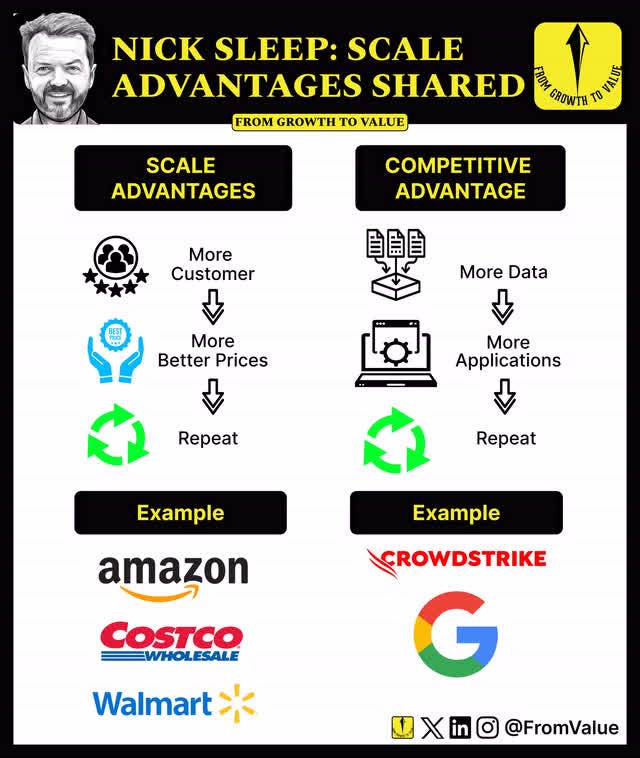

Scale advantages shared +5

Since July 2022

When I looked back at some of the best investments, they did not only have substantial scale advantages but also shared them with their customers in some way. For Amazon or Walmart (at the time), I think this criterion is obvious. Because they are bigger, they can give their customers better prices.

Google has always had a scale advantage: the more people used their products, the more they could give away for free. The data of people were leveraged to generate profits for Google, but the fact that Google could offer so much for free (Gmail, Fotos, Drive storage up to a certain limit, etc.) was because of this mechanism.

I have not come up with this concept myself. This is one that I borrowed from Nick Sleep from Nomad Capital. He uses this concept to guide all of his investments. That's why he started investing in Amazon in 2003 already. And he mostly held on to that position to now. He did the same thing with Costco, another company that shares the advantages of its scale with its customers, by only charging 15% on the purchase price, no matter what. This makes these companies almost impossible to compete with unless you start doing exactly the same thing.

This is a visualization I made about this concept.

The most famous advocate of scale advantages shared? Jeff Bezos, who made this napkin sketch about it.

So, this competitive advantage can be significant. I'm going to withdraw or add points with this criterion. For some companies, extra scale only adds extra complexity. Those will get a negative score. I think of Uber (UBER) here. The normal scaling is the second level, which will be given some points. This means that if you grow, your scale gives you cost advantages. The third level is where all users also benefit from the scale. Here you will see higher scores, 4/5, maybe 5/5.

Cloudflare uses the data it gets for more insights and gives so many free services in exchange for those data that it almost resembles an early Google. 5/5 for me.

To me, Cloudflare is also a clear example.

Conclusion PMQS

Cloudflare's Overall Quality Score is 78.5, down from 79.5. The main reason is that the stock price is up so much, which costs it a point.

Overall, another very strong score for Cloudflare. It remains one of the stocks with the highest Overall Quality Score.

But is Cloudflare a buy now? That will also be determined by the valuation. So, let's look at it.