🤔Why Was Cloudflare Up So Much?🤔

Why Cloudflare Is The Most Efficient AI Inference (better than Nvidia's Chips!)

Hi Multis,

If you are in the USA or following the NFL, I hope you have enjoyed the Super Bowl game this weekend.

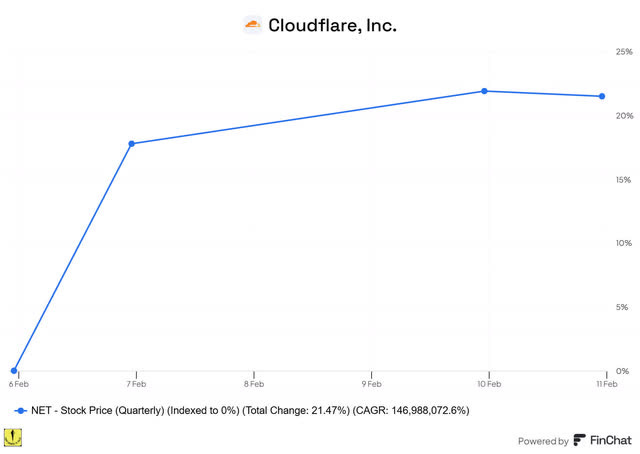

Anand here with the Cloudflare (NET) Q4 2024 earnings review. Cloudflare reported its Q4 2024 results last Thursday. After the results, Cloudflare stock was up more than 20%.

Source: Finchat

The Numbers

Total revenue reported was $459.9 million, which means an increase of 27% year-over-year, beating the consensus by $8 million.

Source: Finchat

Revenue growth was fueled by a record number of customers spending more than $100,000 annually with Cloudflare.

Source: Finchat

As you can see above (thank you, Finchat!), Cloudflare reported 3,497 large customers with more than $100K of revenue, a 27% increase year-over-year.

Large customers accounted for 69% of the total revenue, the same as the previous quarter, but up from 66% in Q4 2023.

173 customers spent more than $1 million. That's up 47% year-over-year. The management team doesn't provide this number each quarter, but having the details is helpful.

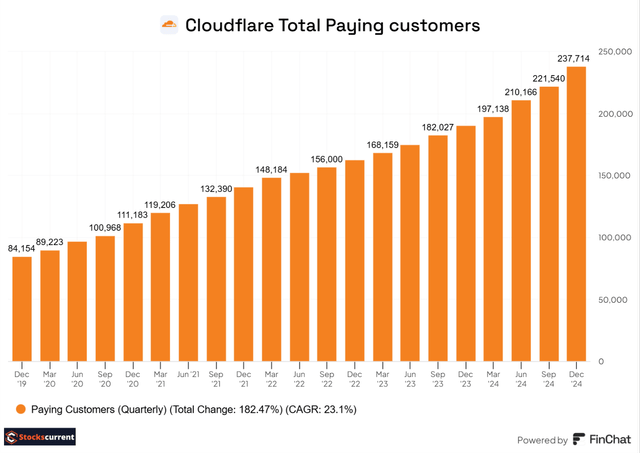

In total, the company reported 237,714 paying customers by the end of Q4 2024, an increase of 25.5% year-over-year.

Source: Finchat

Cloudflare's DBNRR (dollar-based net retention rate), came in at 111%, up from 110% in the previous quarter. Just to remind you, DBNRR means that you take 100 customers of the previous year and look at how much they spent this year, including those that stopped being customers. If the number is above 100%, it shows that customers paid more, and that's definitely the case here.

Management has advised against placing too much emphasis on DBNRR, as they are see positive momentum with the pool of funds deals among their largest customers. Due to these deals, DBNRR may not be the best metric to evaluate Cloudflare's performance.

A "pool of funds deal" is a contract where a customer pays a certain amount that can be used for various Cloudflare products and services over a specified period without the need to negotiate separate contracts for each service.

The pool of funds deals accounted for nearly 9% of the new annual contract value booked in the quarter, compared to last quarter. On the call, CFO Thomas Seifert mentioned that because of a pool of funds contracts and sustained momentum with their Workers developer platform, they see a notable uptick in close rates and an improvement in sales cycles.

The remaining performance obligations, or RPO, totaled $1.687 billion, an increase of 12% quarter over quarter and 36% year over year. The current RPO (the amount that will be billed in the next 12 months) was 70% of the total RPO, growing 30% year over year in the fourth quarter.

Source: Finchat

The gross margin was 77.6%, a decrease of 1.3% year over year, but it's still above the company's long-term target range of 75% to 77%.

Cloudflare's non-GAAP income from operations was $67.2 million, or 14.6% of revenue, up 69% from $39.8 million, or 11% of revenue, in the fourth quarter of 2023.

GAAP loss from operations was $34.7 million, or 7.5% of revenue, compared to the loss of $42.8 million, or 11.8% of revenue, in the fourth quarter of 2024. I see this GAAP loss from operations narrowing, which is a good sign.

Non-GAAP net income was $68.8 million, compared to $53.5 million in the fourth quarter of 2024, so up 28.6%. Non-GAAP net income per diluted share was $0.19, compared to $0.15 in the fourth quarter of 2024, beating the consensus by $0.01.

Cloudflare's GAAP net loss was $12.8 million, compared to a loss of $27.9 million in the fourth quarter of 2024. The GAAP net loss per basic and diluted share was $0.04, compared to $0.08 in the fourth quarter of 2024.

Net cash flow from operating activities was $127.3 million, compared to $85.4 million for the fourth quarter of 2024.

The company ended the third quarter with $1.85 billion in cash and cash equivalents.

Source: Finchat

Cloudflare reported a free cash flow of $54.2 million, in line with the expectations, despite ongoing investments in its network and enhanced capabilities, such as faster and more powerful GPUs worldwide.

Management has taken a disciplined data-driven approach to scaling Cloudflare, balancing investments for future expansions with financial and operational efficiencies to ensure that every dollar they deploy drives returns in the form of durable long-term growth and profitability.

Guidance

For Q1 2025, management guided for revenue between $468 million and $469 million, in line with the consensus. Non-GAAP operating income is expected to be between $54 million and $55 million, which translates to non-GAAP EPS of $0.16

For the full year, management expects revenue between $2.09 billion and $2.094 billion, also in line with the consensus. Non-GAAP operating income is expected to be between $272 million and $276 million, translating to non-GAAP EPS of $0.79 to $0.80.

Since this is the first quarter for full-year guidance, I will not stress too much because they are providing it conservatively right now. They always increase it in subsequent quarters as the information becomes clearer.