Hi Multis

You already saw it in the title. The new Potential Multibaggers pick will be released in the upcoming week.

The first article is almost ready. I will release it on Tuesday.

And, to revive an old Potential Multibaggers tradition, you can vote on what you think will be the pick.

These are the choices you will see.

With the first article, I will give the results. Don't wait to vote, as the article will already be published on Tuesday!

Vote here.

Curious?

Tune in on Tuesday!

Now, let's dive into the news of this week.

Articles In The Past Week

As I dedicated a lot of time to the research for the new pick and compiling it into the first article, this is 'only' the third article this week.

In the first article this week, Anand guided us through the CrowdStrike earnings.

The second article this week examined whether CrowdStrike is a buy or not.

Memes Of The Week

Even before I announced that I would release a new Potential Multibaggers pick (I only did that earlier today on our private channel), Flo posted this:

Flo seems to have a sixth sense for such things. He has predicted the new Potential Multibaggers pick multiple times in the past. It's really weird that Flo posted this while I had already started writing the first article of the new pick. Flo, could you please remove your spyware from my computer now? 😝

Karan posted this one in our subscriber community:

In this way, both Nvidia and CrowdStrike are huge losers for my portfolio, hahaha.

And David also posted in our meme channel. This is how we all sometimes, right?

And the last meme of the week, because we all like taxes so much (ahem):

Interesting Podcasts Or Books

I've been reading intensely about Mercado Libre for over five years, as I picked it as a Potential Multibaggers pick in August 2020. But this is a thorough overview. You can listen to it here or on your favorite podcast player.

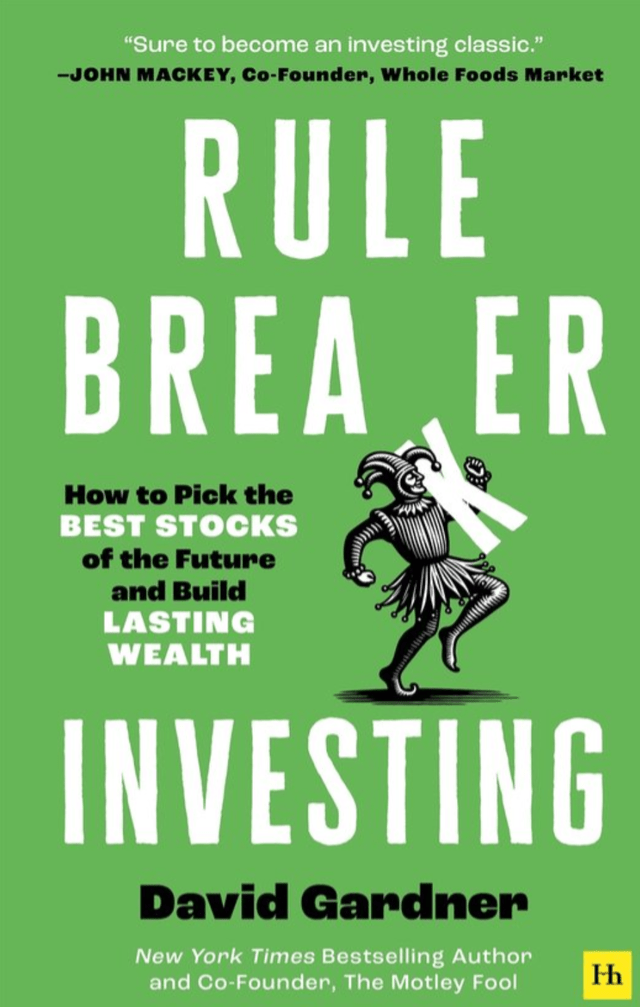

I also listened to the Rule Breaker Investing episode, where David Gardner, who is always the host, was interviewed himself in the Authors in August series. He has written an investment book, his first alone (the others were with his brother Tom) and his last investment book, he says.

I have already pre-ordered his book months ago.

David Gardner was one of the inspirations for Potential Multibaggers, together with Phil Fisher, and Peter Lynch.

You can listen to the David Gardner interview here or, again on your favorite podcast player.

And one more tip, but only for the people who can read Dutch. I'm reading in Pierre Huylenbroeck's new boek Altijd Belegger. As someone with a language background, I'm very sensitive to the quality of writing in books. Not just the content, but also the style. It's one of the reasons I don't like Benjamin Graham's The Intelligent Investor. Pierre has the best style of any writer who writes about the stock market in Dutch.

His book Iedereen Belegger is a classic (for good reasons!) and I also enjoyed Onsterfelijk Beursadvies.

I have just started in the new book Altijd Belegger, and I already have a few great images in my head. One example? Pierre characterizes his idol, Warren Buffett, as the best mattress tester in the world, and I really like that image.

As always, Pierre knows how to entertain both the newbie and the experienced investor.

The markets in the past week

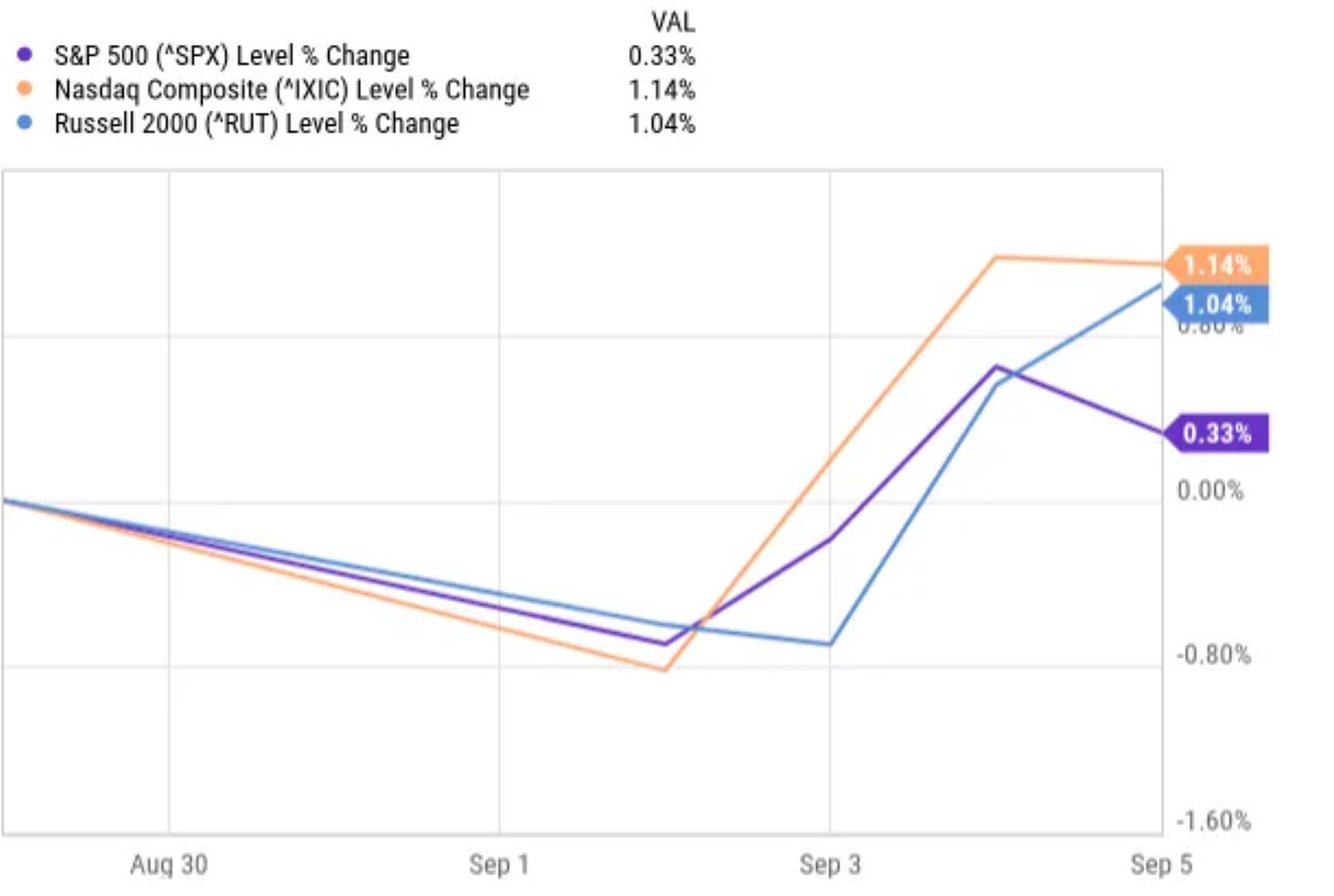

Usually, I know more or less what the markets have done in the past week, but right now, I don't have a clue. I was so deep in my research that I didn't even pay attention. I guess nothing extreme happened, as I would have heard it in that case. So, I'm curious to see if the indexes were up or down this week. Of course, it was a shorter week, as Monday was Labor Day.

As you can see, together with me, the indexes were up. The S&P 500 underperformed the two others. It was up 0.33%, while the Nasdaq is up 1.14% and the Russell 2000 is up 1.04%.

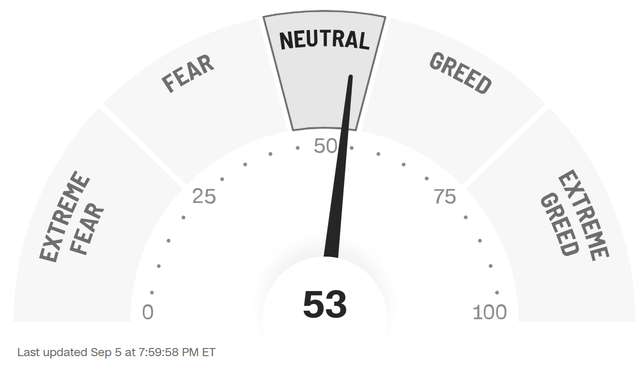

Let's check how the Greed & Fear Index looks. Weirdly enough, even though the indexes were up, the Greed & Fear index dropped from Greed to Neutral.

Lesson Of The Week (New!)

Here I will post a lesson every week. One that I learned over the 12 years I've been investing. That can be text or an image, long or short. Today, it's just an image.

As investors, we make the same mistakes over and over again, until we finally learn it. One of the biggest mistakes I have seen investors make? Selling a phenomenal stock too early. Probably half of the investors once held Nvidia, Netflix, Apple, Amazon, or any other stock that could have changed their life forever, but an overwhelming majority sold. That's a lesson I learned. That's why I will always err on the side of holding too long, not selling too early.

Quick Facts

1. Nvidia Is Not Dead Yet 😂

This week, I got questions again about Nvidia (NVDA). Is it not in a bubble? It will be disrupted. Usually, people point to headlines like this as support of their claim.

(From the WSJ)

You should understand that these are ASICs or Application-Specific Integrated Circuits, not replacements for Nvidia's GPUs. And yes, that also goes for Google's TPUs like Ironwood.

ASICs are great for certain very specific tasks, usually where GPUs would be overkill. GPUs can be used for many more tasks. Nvidia's GPUs can handle a wide range and are also needed for the software platform CUDA.

Compare it to your smartphone and a calculator. Nvidia's GPUs are like a smartphone. You can use it to text, call, play games, watch videos, take pics, post on social media, as a jukebox, and so much more.

Broadcom's ASICs are more like a calculator. If you only need to calculate, it may be faster and more efficient than your smartphone, but you can't take pics, game, play music and all the rest.

In other words, these custom chips are not directly competing with Nvidia's GPUs. That's also why Nvidia guided for its biggest QoQ growth ever: +$7.3 billion QoQ growth and knowing the company, that will be a very conservative guidance.

On top of that, what investors also miss, is that Nvidia is not simply a chips company anymore. If we continue the comparison, Nvidia has evolved from being the best calculator to the best smartphone. It's a rack company now. With Blackwell, it's not just the GPU, it's the networking, it's how GPUs talk to each other, it's the software. Or put differently, it's the total package. So if you have any ambition to be among the best, and I think companies like OpenAI, X, Microsoft, Google, Amazon, Tesla, and many others will not compromise on quality and use Nvidia, no doubt about that.

That's also the reason I own Nvidia, AMD and Broadcom in my portfolio. I'm bullish on all three.

2. No More Hallucinations?

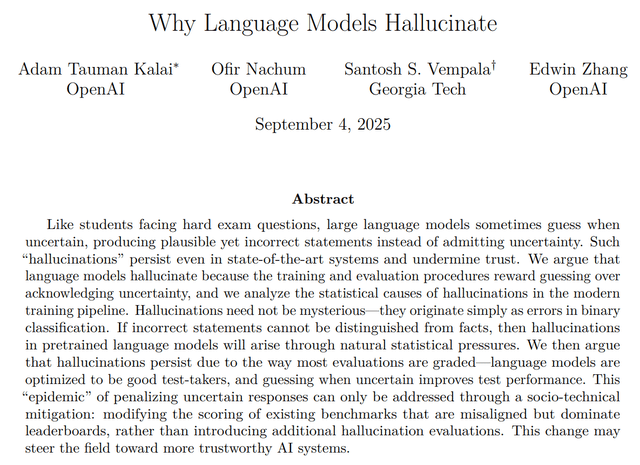

This week, there was a publication from OpenAI about hallucinations. We have all experienced them. Where ChatGPT doesn't find an answer, it sometimes just makes things up.

The paper argues that it's because of the way the models are trained. It's like a test for a student. If you don't know it, it's better to answer something, anything, than nothing at all.

This is the abstract of the paper.

3. My Partnership with Fiscal ai

Every week, I get messages from people thanking me that I introduced them to Fiscal (the former Finchat). They can't believe the value they get. I can only agree. I use it literally every single day.

If I need charts, a stock screener, research, conference calls, company-specific KPIs, and so much more, I go to Fiscal. Oh, and did you know that Fiscal now has the earnings results already in its data minutes after the earnings release?

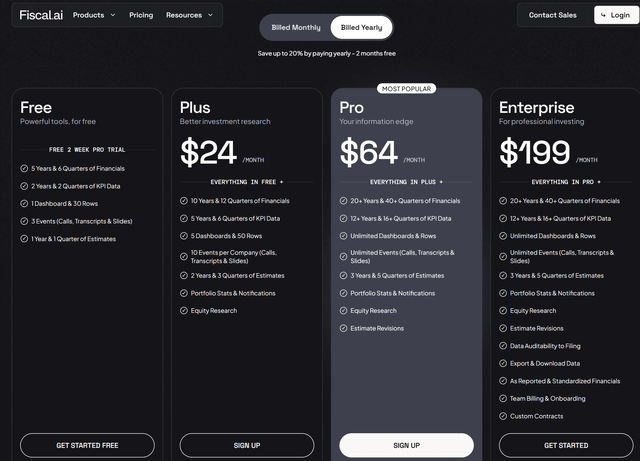

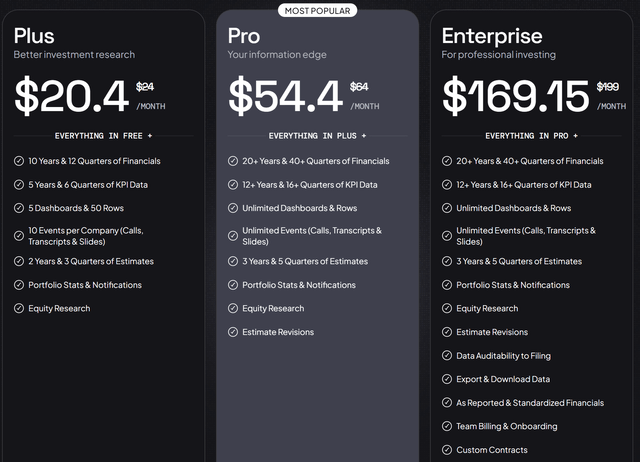

Do you know which other service has that as well? Bloomberg. There, you pay $2000 per month. For Fiscal ai, these are the tiers.

That's right, for just a fraction of the price, you get 90% of what a Bloomberg terminal gives you.

My partnership allows us to give you a 15% discount with this link.

That means this (paid yearly):

I'll be honest here. I used to use many other data platforms consistently. Now, I canceled all my subscriptions because I only need Fiscal ai. That has already saved me thousands of dollars on subscriptions.

If you want the 15% discount, click here.

4. Three new additions to the S&P 500

What so many had expected for a while already happened: Robinhood is joining the S&P 500, replacing Caesars Entertainment in the latest reshuffle of the index. AppLovin and Emcor will also be added, while MarketAxess and Enphase Energy are kicked out.

For Robinhood, the step is symbolic. The trading app came to the attention of the broader public because of the meme-stock frenzy in 2020-2021. Now it will sit in the portfolios of pension funds and retirement accounts worldwide. The stock rose more than 7% after the news. The rebel punk has been invited to the posh finance dinner, so to speak.

Robinhood was founded in 2013 and got popular fast because of its commission-free trades and an easy-to-use app. Millions of retail investors started using it. It became the face of pandemic meme stock speculation, with stocks like GameStop and AMC. Critics saw it as reckless. Today, Robinhood manages billions in assets: stocks, options, and crypto.

AppLovin, a mobile app marketing firm, and Emcor, which provides construction and facilities services, will also join the S&P 500. Their stocks jumped 7.5% and 2.5% respectively after the news was announced.

5. Please, Spread Financial Knowledge

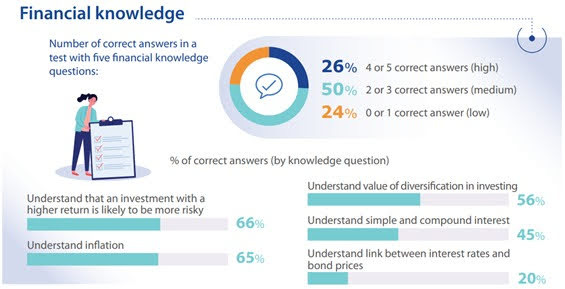

One of the reasons I make so much content free is that I hope to help you with financial knowledge. This week, I saw this stat from a 2023 report in Europe.

35% of the population doesn't understand inflation and a whopping 55% doesn't understand simple and compound interest. That's shocking.

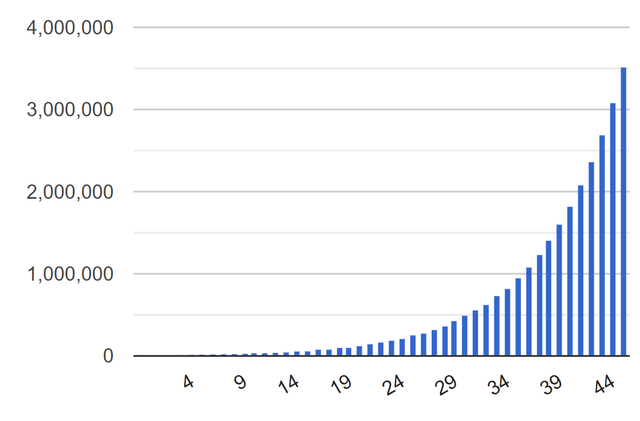

In his book Altijd Belegger (see above), Pierre Huylenbroeck shares the example of his son Milo. He got €7,032 from his grandparents for his 18th birthday, with the question to invest it and only start using it at the age of 68. That's an investment period of 50 years. In the first five years, Milo had a return of 6.5%, so that €7,032 was €9,657 in May 2025. That's 6.5% per year. Not awful, but not great either, thanks to two bad biotech investments.

If Milo keeps that 6.5% return for the next 45 years, he will end up with €640K. Not bad for a €7K investment, right? Suppose he can achieve a return of 14% (which he can obtain if he listens more closely to his father), that would become €3.5M. All from an initial sum of €7,032, without any additional investment. That's the power of compounded interest.

The last years are extremely important. That's why you should always favor time in the market over trying to time the market.

If you have children, grandchildren, or someone dear to your heart has them, show them this to convince them to start investing. Of course, they have to have proper knowledge. That's why starting with ETFs is probably best for most people. Once they are interested in doing better than the index, send them to Potential Multibaggers, then, haha.

Here the free part of Potential Multibaggers ends.

But NOW is the time to upgrade!

Why?

Because it’s the last time you can do that at $479 per year. Tomorrow, the price goes up to $499 per year.

On top of that, you will get the new Potential Multibaggers pick, which free subscribers don’t get. My previous pick is up 50%+ in 4 months. The one before that? 117%! Missing the next could COST you money…

So upgrade now and lock in the old price!

So, what’s in the rest of this Overview?

How our Potential Multibaggers stocks have performed.

An addition to my Stocks On My Radar list (and a link to the whole list)

Very positive signs for one of our stocks!

Karan, who lives in Singapore, got an offer.

Much more

If you don’t want to miss this, upgrade now.