CrowdStrike: A Buy On AI?

What the numbers say, what the market thinks, and my call

Hi Multis👋

Yesterday, you got the earnings breakdown from Anand but you are probably still wondering if CrowdStrike's (CRWD) a buy right now or not. That's what this article should help you with.

Let's first check the Quality Score.

Quality Score

Personal conviction: 10/10 (unchanged)

I want to repeat this, but 10/10 doesn't mean I have no doubts at all. You should always have those in investing. But 10/10 indicates the highest possible conviction.

After the outage, this score was lower, but the way management handled the consequences really restored my confidence.

Profitability: 8/10 (unchanged)

You can still see the impact of the outage both in free cash flow and, especially in GAAP net income. But you can also see that the numbers are slowly turning up again.

But for now, I keep the lower score.

Sales efficiency: 4.5/10 (up from 4/10)

Here as well, you can still see the impact of the outage but also the recovery. CrowdStrike invests more in sales and marketing now, revenue growth is lower and the expectations as well. The compensations also have a (small) negative impact on gross margins. But all of that is already changing a bit and that's how the score went up from 4 to 4.5.

Innovation: 4/5 (unchanged)

The R&D efficiency is the only area that could be improved at CrowdStrike. The rest is world-class. Again, the lower R&D efficiency is influenced by the outage.

Must-have?: 5/5 (unchanged)

No discussion here. You should never spend less on cybersecurity.

Revenue growth: 4/5 (unchanged)

In the given context, 21% revenue growth is still strong. but it's not 25% anymore. That's why I keep the score at 4/5.

Durability of growth: 10/10 (unchanged)

With AI, the market continues to expand rapidly and I don't expect this to slow down anytime soon.

Management quality: 10/10 (unchanged)

Management did a good job navigating the challenging circumstances. I said that from the start and I never downgraded this score. George Kurtz is an exceptional CEO.

Insiders' ownership: 5/5 (unchanged)

Multibagger potential now: 4/5 (unchanged)

I think the market has become bigger with AI, but CrowdStrike already has a big market cap and with growth a bit lower (temporarily?) I keep this score a bit lower.

TAM & SAM: 5/5 (unchanged)

The total addressable market is huge, no doubt about it.

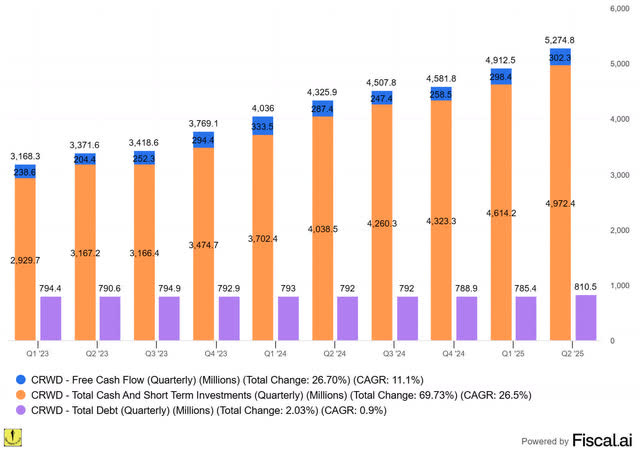

Financial Strength: 9/10 (unchanged)

CrowdStrike has a very strong balance sheet, but because of the debt, I keep the score at 9/10.

Risk (negative): 1.5/5 (From 2/5)

I lowered this (negative) score by half a point because of the good way CrowdStrike handled the outage.

Competition (negative): 2/5 (unchanged)

More and more, it becomes clear that CrowdStrike is the leader in its field. Yes, there's still competition with Microsoft, but AI will make multi-cloud more common and that is an advantage for CrowdStrike.

Dilution (negative): 2/5 (unchanged)

Scale advantages shared (-5/+5): 5/5 (unchanged)

PMQS conclusion

CrowdStrike continues to be reliable in its Potential Multibaggers Quality Score, with scores of 77, 79, 77 and now 78.

So, is CrowdStrike a buy now?

The answer depends on one thing: valuation. And that’s where it gets interesting.