Hi Multis

It’s Sunday and...

Oh, no, it’s Monday, haha. I’m so used to that Sunday rhythm and many of you as well, of course.

But yesterday, I was traveling. That means I write this from Malta. I’m here for business. I know that sounds vague but nothing is sure yet, so there’s not much to communicate about now.

Next to me traveling, I know many of you will have had friends over to watch the Super Bowl. The Seattle Seahawks beat the New England Patriots and, thus, won the 60th Super Bowl.I hope you enjoyed the game.

I hope you can still grab a cup of Joe (if it’s not too late where you live) and enjoy the Overview Of The Week.

Articles In The Past Weeks

Last week, I only published one article because of Klosters. We had a preview to the upcoming week of earnings releases of Potential Multibaggers stocks. You can read that article here.

Memes Of The Week

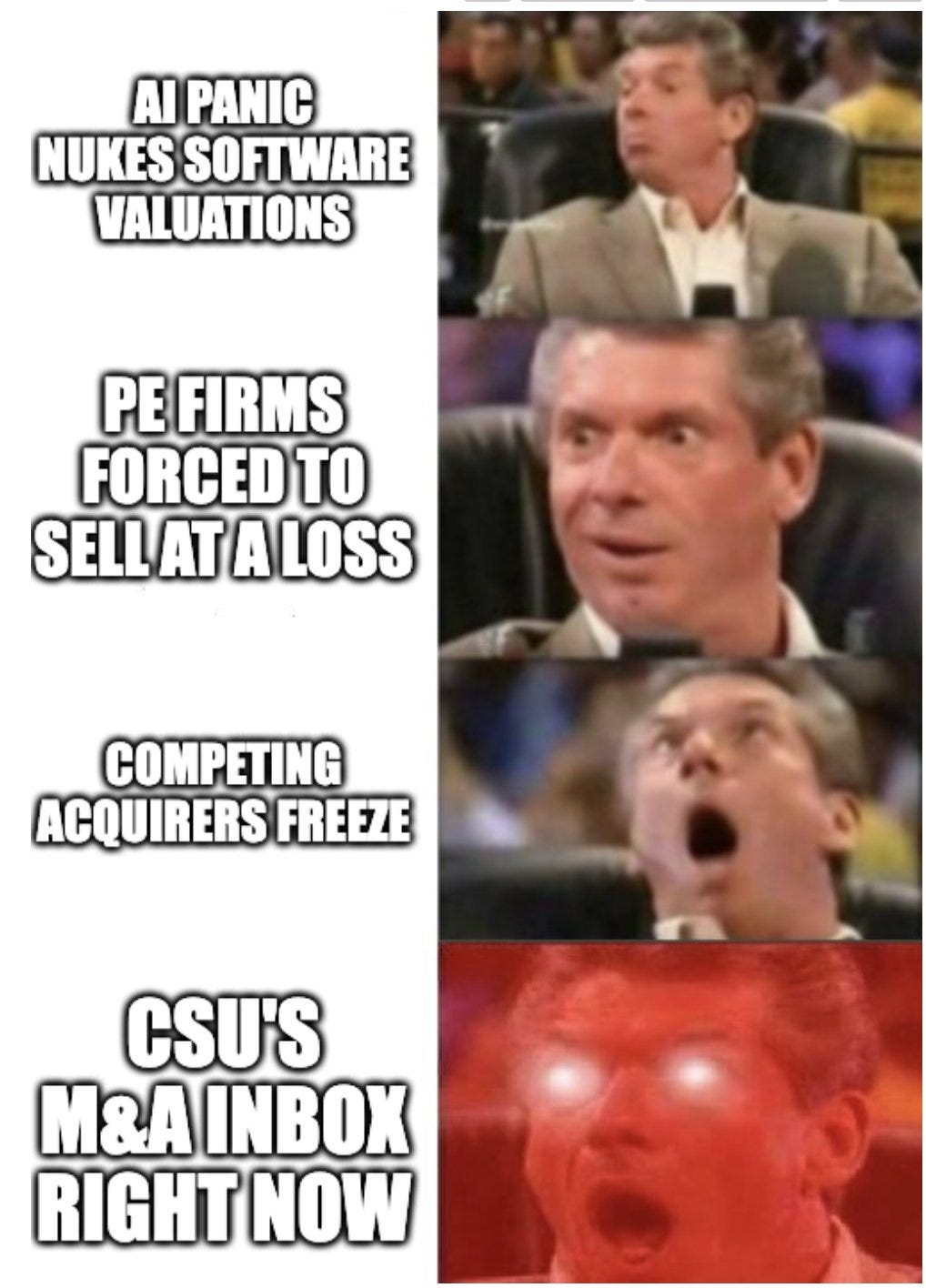

The times are a bit tougher now for software investors and usually, that results in more memes.

This one already shows that. It’s a meme, and at the same time, it’s true, which makes it always more fun.

Multi Frederic shared this one.

Meme King Flo shared this one:

The Trade Desk keeps getting punches and Zack posted this meme about it.

This is one for the developers and programmers to think about:

And the last one this week is a pun, which is always fun.

Interesting Podcasts Or Books

While I was in Klosters this past week, I didn’t have time to read or listen to podcasts. I added a few to my waiting list, so probably you will get those next week.

The markets in the past week

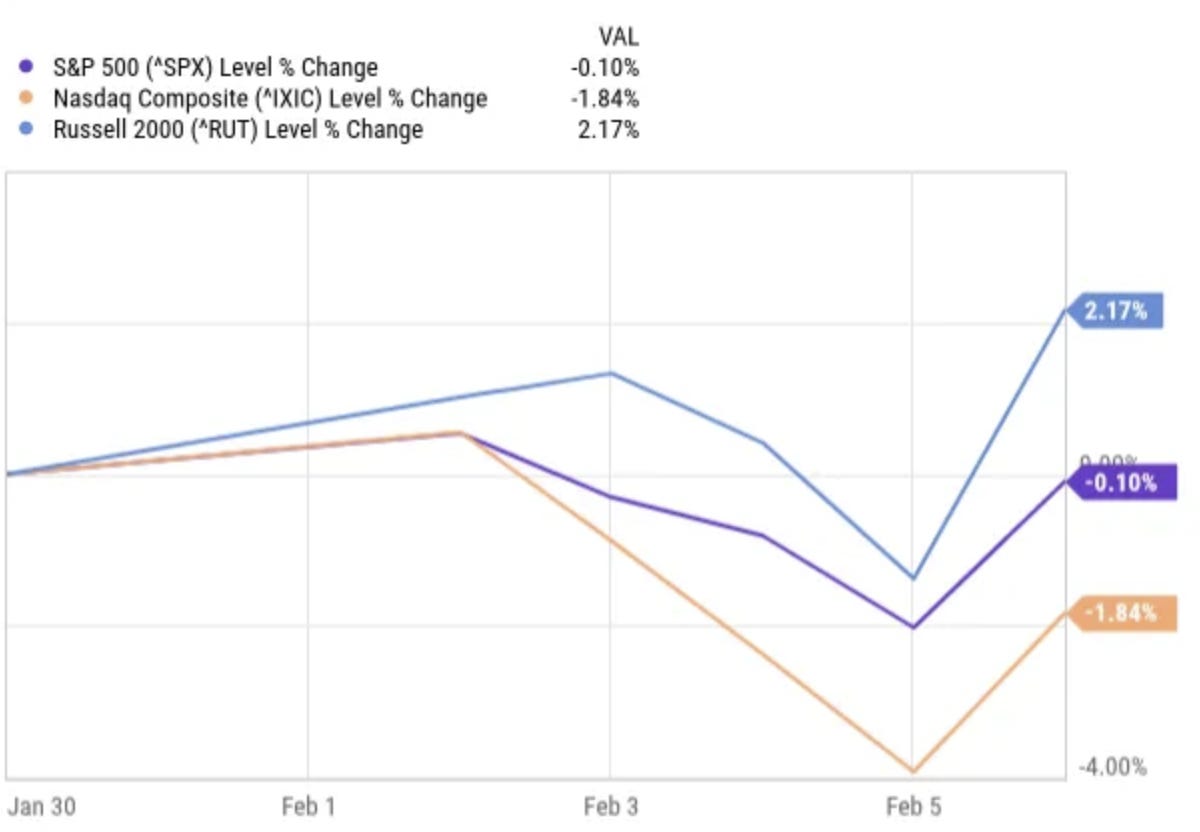

The markets continue to feel weird and divided. Just look at this chart of the indexes over the last week.

As you can see, the Russell 2000 jumped by an impressive 2.17% this week. But at the same time, the Nasdaq dropped by 1.84% and it was even down 4% before the rebound on Friday.

The S&P 500 was down 0.10%.

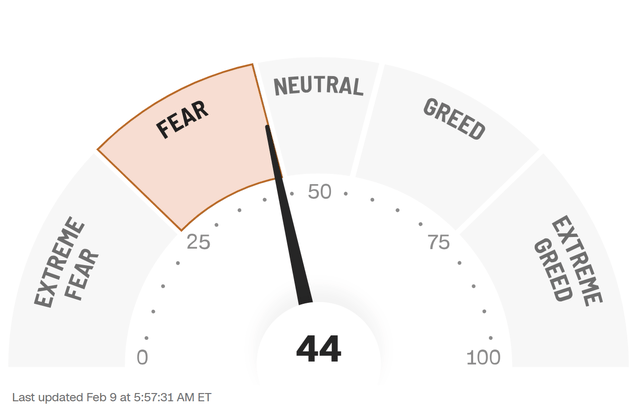

So, what does this mean for the Greed & Fear Index? It dropped from slightly in Greed last week to slightly in Fear this week.

Quick Facts

1. Capex = Bad?

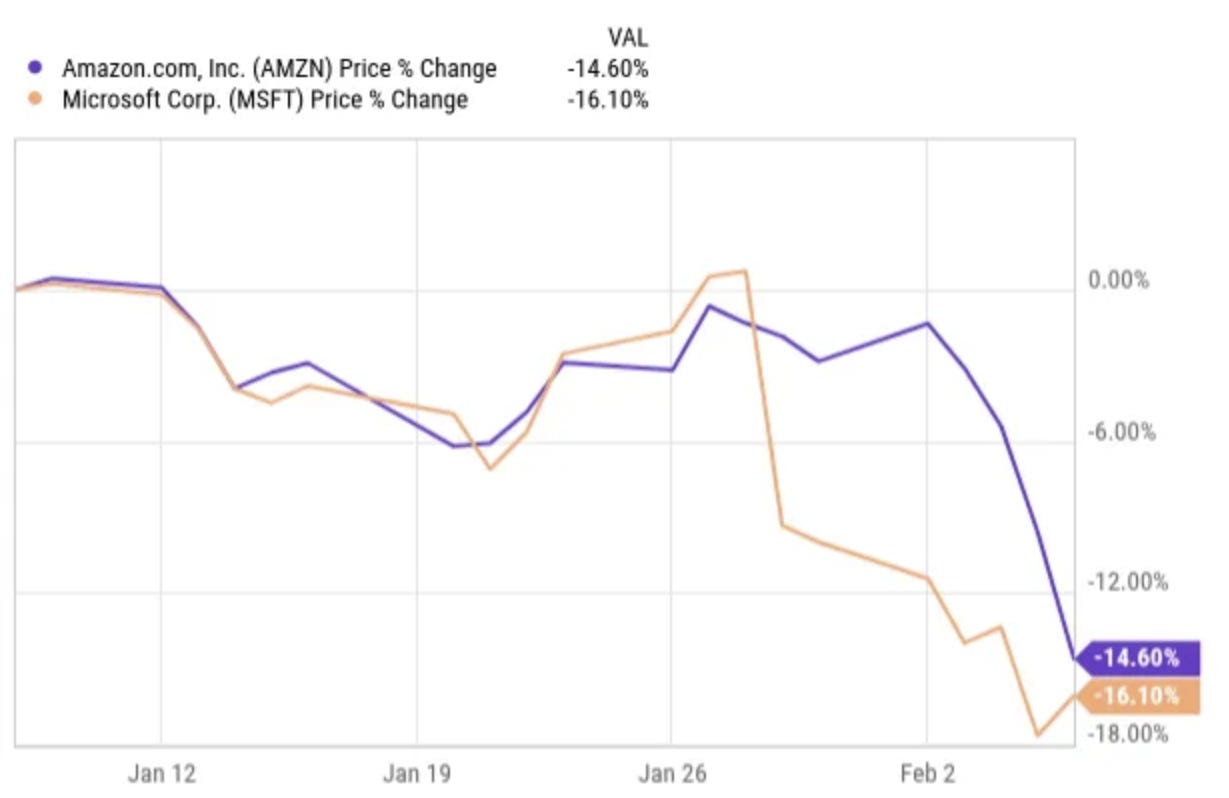

You saw a consistent pattern in Big Tech's earnings so far. The earnings were good to very good, but investors still sold the stock because of the high Capex plans. This is the chart for Microsoft and Amazon over the last month.

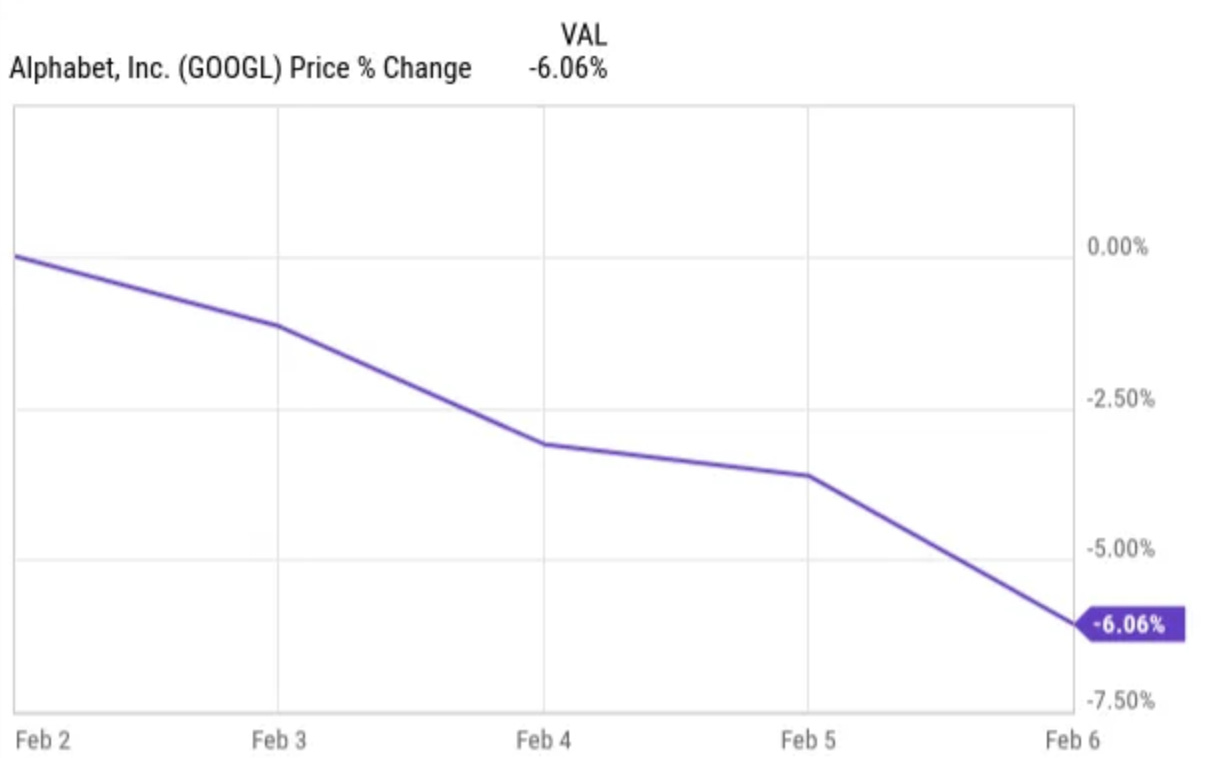

Even Google’s stock price dropped after very strong earnings and overall bullishness on Gemini.

Worries about the huge Capex are understandable, but sometimes, it makes sense to go a bit deeper.

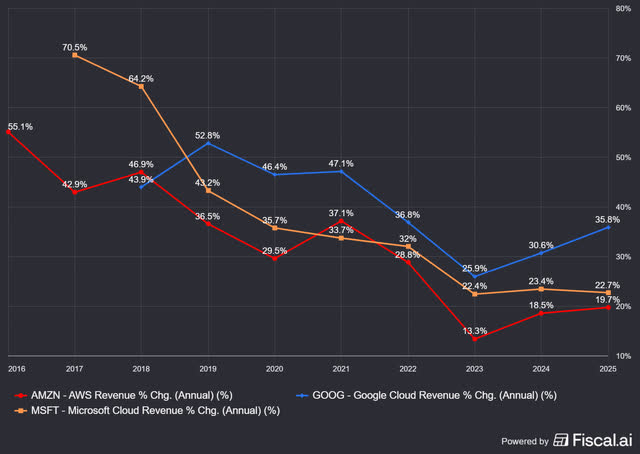

First, you can see that cloud revenue growth for all three increases, but it accelerates for Google Cloud (especially) and AWS, not as much for Azure.

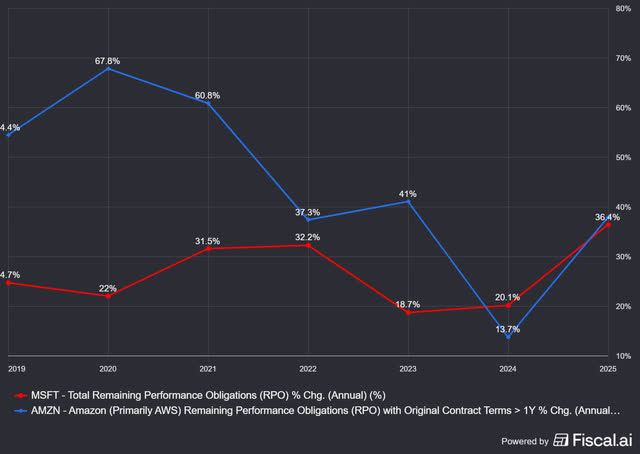

If you look at RPO, though, you see that Azure also accelerates. RPO is the abbreviation for Remaining Performance Obligation. It’s the amount that is already contracted but cannot be recognized as revenue because the services have not been delivered yet.

By the way, if you want to gain such great insights through Fiscal, grab my 15% discount through this link.

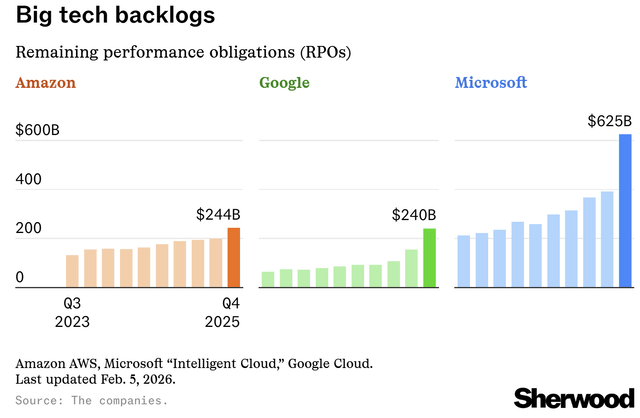

So, yes, you can point out the huge Capex spending. But how about this?

Of course, for Microsoft and even Google, that’s not just cloud, although most of it is for Google. For Microsoft, there’s also Windows and Office.

But the point is that while the investments seem crazy, the RPOs look crazy too, and are higher than the Capex. If companies see that their investments generate more revenue than they cost, it would be crazy not to invest.

Of course, you could wonder if there will be overcapacity at a certain moment, when AI gets more efficient, but I think the demand will explode even more at that point, so investing such huge amounts right now is exactly what you should do if you don’t want to be disrupted. As Mark Zuckerberg said, the risk of not investing enough is now much bigger than investing too much.

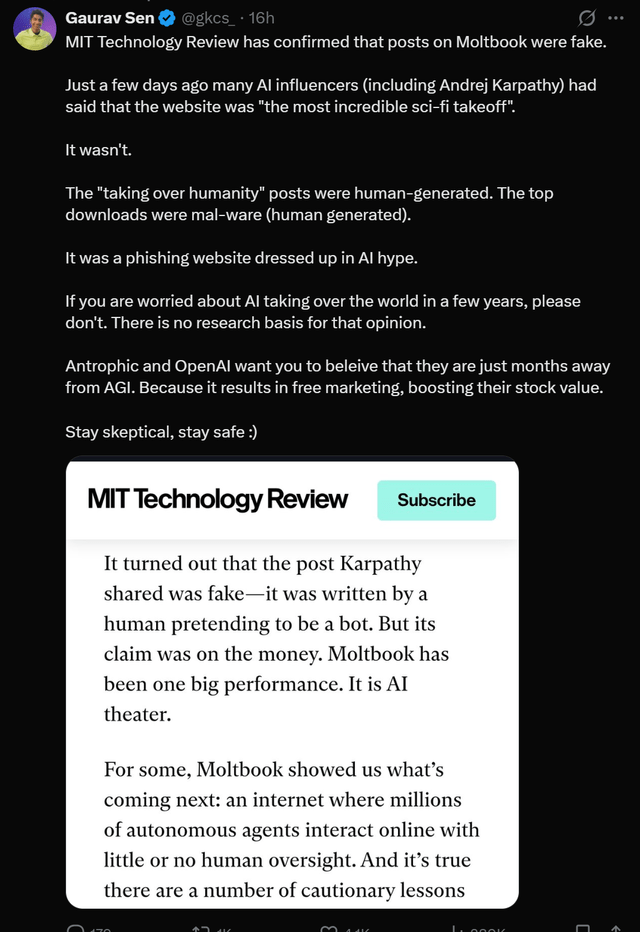

2. Molbook: FAKE!

There was quite a bit of controversy last week about Moltbook, similar to a Reddit for Moltbots (previously Clawdbot). This is what I wrote about this last week in the Overview Of The Week:

This week, there was a lot of controversy around these bots getting their own Reddit-like social media platform. You saw issues such as threads where people were shut out, trading places for stolen identities, and other alarming trends.

Don’t get me wrong, I can see the dangers of such platforms but up to now, the bots are just emulating behavior. In other words, if people don’t program like that, they won’t get out of control. That doesn’t mean that with AGI (artificial general intelligence) this can’t become a real problem. But AGI is not here yet.

This week, what I wrote turned out to be even more true than I thought. Just read this.

So, there’s a lot of hype right now. I don’t say that this can’t become a real problem in the future, but right now, it’s not.

3. Kom Zaterdag Naar Gent

On Saturday, I will speak at an investment event in Ghent. I speak in Dutch, so I will write this in Dutch. You can scroll to the next thing if you don’t understand Dutch.

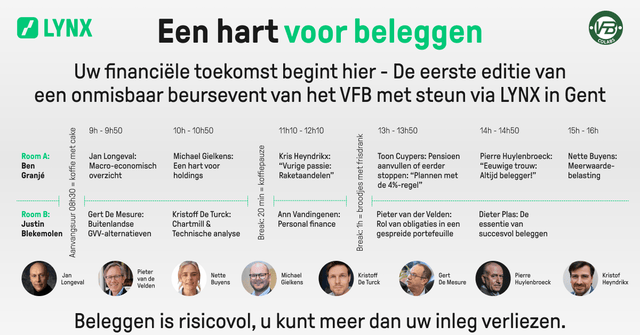

Op zaterdag 14 februari ben ik één van de sprekers op het beleggersevent Een Hart Voor Beleggen in Gent.

Dit evenement wil je niet missen! Niet alleen vanwege the topsprekers (zei hij bescheiden), maar ook om een praatje te doen met je medebeleggers.

Praktische informatie

Prijs: €25 voor leden, €50 voor niet-leden, €25 voor studenten

Broodjes en frisdrank voor ‘s middags zijn in de prijs inbegrepen.

PS: als je nog geen VFB-lid bent, dat kan voor €75. Daarvoor krijg je kortingen op de bijeenkomsten en krijg je ook 10x per jaar het prachtblad Beste Belegger. Je kunt je hier lid maken.

Locatie: HoGent, Valentin Vaerwyckweg 1, 9000 Gent

Aanvangsuur: 9 uur

Tot in Gent!

4. Claude Legal AI: Not the SaaS Killer

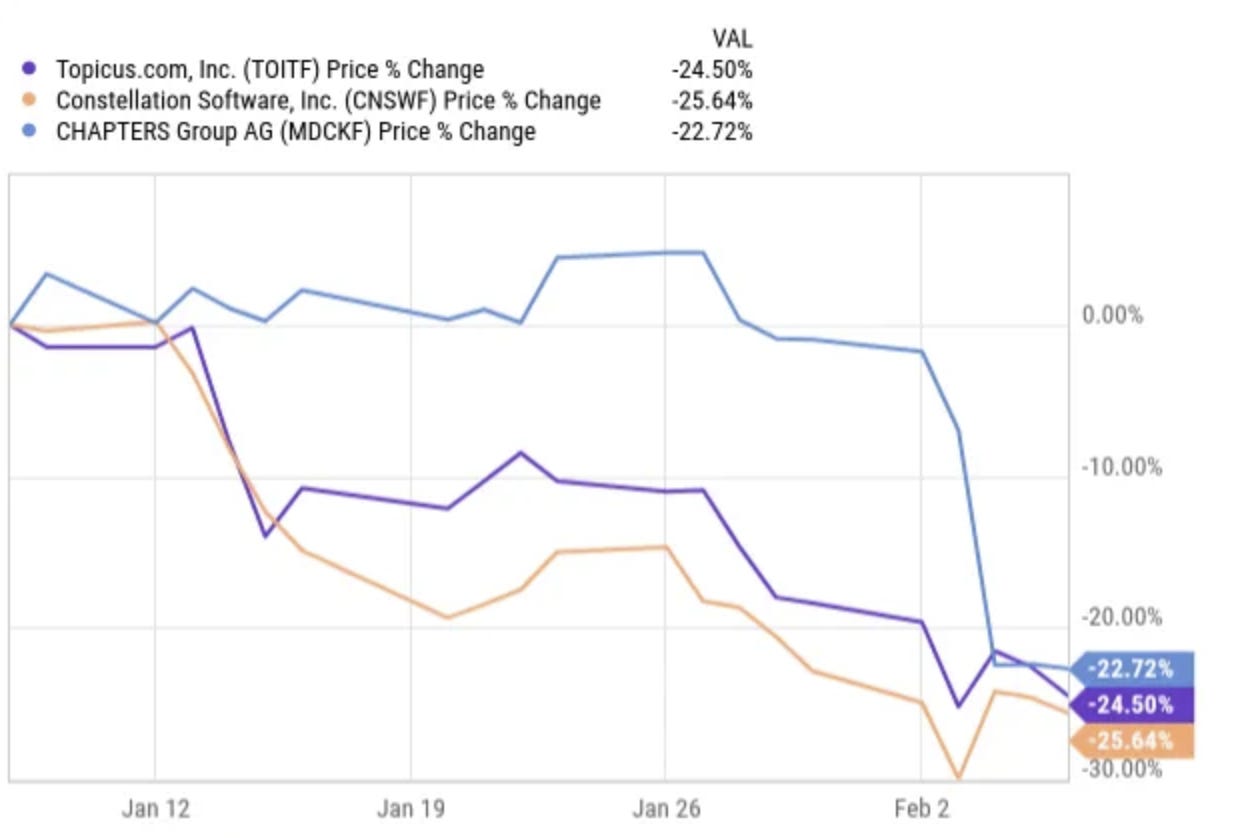

This week was another dark week for VMS companies. Just look at the drops in the last month alone. Constellation Software, Topicus and Chapters Group all lost about a quarter of their market cap.

Chapters in particular had a big drop this week (see later). The reason? The Claude Legal AI plugin for Claude Cowork was launched this week. The stocks of many SaaS companies working in that area fell.

Now, let me make it clear up front that I really like the great work Anthropic is doing. It has much more progress than OpenAI in the last year or so.

But if you look at what’s underlying this Legal plugin, it’s... SaaS.

Tae Kim, author of the great book The Nvidia Way had a great post about it. He fed the Claude Legal AI GitHub to... Claude 4.6. This is what it said:

It’s basically a prompt engineering guideline that USES software from Microsoft, Slack, etc. as its “real power.”

“There’s no custom code, no legal database, no proprietary engine. It’s a structured way to give Claude the right context and procedures for legal tasks.”

“The real power comes from connectors. The plugin works best when connected to your existing tools via MCP. Pre-configured servers include Slack, Box, Egnyte, Atlassian, and Microsoft 365.”

“But it’s still fundamentally prompt engineering and workflow design, not traditional software”

So, just as with the Moltbook hype, this is not as futuristic as it looks. It’s still prompt-engineered, which means it’s unreliable for autonomous work. For legal work not exactly what you want. If there’s any sector where you need 100% correct output, it’s in legal matters. This will help lawyers to increase their productivity, but not replace them. Let alone it would replace their software.

JP Morgan agrees. In its report this week, it wrote:

It feels like an illogical leap to extrapolate from Claude Cowork Plugins, to this expectation that every company will hereby write and maintain a bespoke product to replace every layer of mission-critical enterprise software they have ever deployed.

There is a strange AI bubble going on: it’s more an anti-non-AI bubble.

Do you want to read the rest of this article?

Become a paying member of Potential Multibaggers!

(If you already are, just scroll past this)

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beat the S&P by 54%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.