Datadog Q2 2025 Deep Dive

A complete breakdown of earnings, product innovation, and valuation

Hi Multis,

Anand here with the Datadog (DDOG) Q2 2025 earnings result. Datadog reported strong Q2 results on August 7, 2025.

The stock price went up 11% in the pre-market but closed around 4% down. That is because the macro environment overshadows the company-specific strengths. Or in other words: you never know with the stock market.

We first go through the earnings, and then Kris will take over for the Quality Score and Valuation Score updates.

I just wanted to share a big milestone with you all: I've officially earned the Google Cloud Generative AI Leader certification!

That means you are receiving AI updates not only from an investment perspective, but also encompassing industry knowledge and practical technical work.

The Numbers

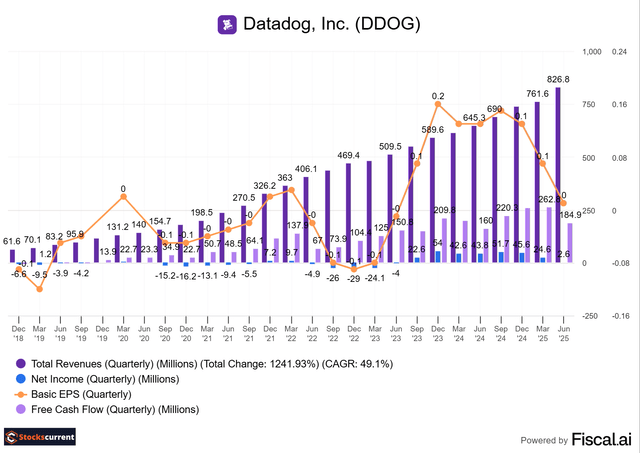

Datadog reported total revenue of $827 million, an increase of 28% year-over-year. The company's eight-year revenue CAGR of 51.02% (see the bottom of this chart) shows how strongly it has delivered.

Datadog saw a continued rise in contribution from AI native customers in the quarter, who accounted for about 11% of revenues, up from 8% of revenues in the last quarter and about 4% of revenues in the year-ago quarter.

The management team saw revenue concentration in AI native cohort in recent quarters. Without the largest customer in the AI native cohort, the year-over-year revenue growth in Q2 was stable relative to Q1.

Source: Fiscal.ai

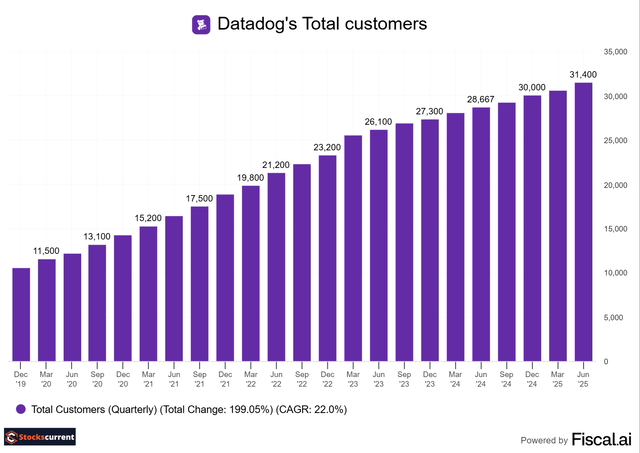

Datadog ended Q2 2025 with about 31,400 total customers, up about 9.4% from about 28,700 a year ago. This includes the 150 new customers from Eppo and Metaplane acquisitions.

There were 3850 customers with an ARR (Annual Recurring Revenue) of $100,000 or more, an increase of 14% from 3390 a year ago. These customers generated about 89% of annual recurring revenue. Management didn't provide numbers for total customers with more than $1 million in ARR.

Source: Fiscal.ai

The dollar-based net retention rate remains steady at 120%, a positive indicator; expansion into existing customers seems to be at a normalized level.

Source: Fiscal.ai

Datadog's platform adoption is growing steadily. Datadog's land-and-expand model is working as management expected.

By the end of the second quarter, 83% of its customers had adopted 2 or more products, the same as a year ago. Furthermore, 52% of Datadog's customers used 4 or more products, up from 49% a year ago. 29% of the customers were using 6 or more products, an increase from 25% a year ago. Finally, 14% of the company's customers were using 8 or more products, up from 11% last year.

Datadog reported a GAAP net income of $0.1 per diluted share, while the non-GAAP net income was $0.46 per diluted share.

For Q2 2025, the company's operating cash flow was $200 million, with a free cash flow of $165 million and a free cash flow margin of 22.4%. Free cash flow and free cash flow margin are down, but that is a pattern for Q2 over the last 5 years for the company. Part of the reason is that Datadog made two small tuck-in acquisitions and hosts its annual conference in Q2, and expenses related to that are also causing a slight decline.

By the end of Q2 2025, Datadog had cash and cash equivalents totaling $3.9 billion.

Source: Fiscal.ai

If you like these graphs as much as I do, then you should use Fiscal.ai.

Potential Multibaggers has a partnership with Fiscal ai (the research platform I use every single day, for charts, screening, research, conference calls, company-specific KPIs, and so much more.) This allows us to give you a 15% discount with this link.

Guidance

Q3 2025 Outlook:

Management guided for revenue between $847 million and $851 million, which is up more than 23.8%. I still think it is conservative, and the company will beat in actual results. That's more or less a tradition for Datadog. But 23.8% is already strong, of course. Non-GAAP operating income is expected to be between $176 million and $180 million, which translates to non-GAAP EPS from $0.44 to $0.46 per share.

Full-Year 2025 Outlook

For the full year, the management team guided revenue to be between $3.312 billion and $3.322 billion, or 24% up year over year on the midpoint. The company raised full-year guidance from $3.215 billion to $3.235 billion from the last quarter. Non-GAAP operating income is expected to be between $684 and $694 million, but it decreased from the previously guided range of $625 to $645 million. Non-GAAP net income per share ranges from $1.80 to $1.83, increased from $1.67 to $1.71.

Highlights from the conference call

Product Updates.

The company held its annual DASH conference in June, where management announced over 125 exciting new products and features for its customers.

The company launched a Datadog MCP server to enable AI agents to access telemetry from Datadog and to act as a bridge between Datadog and MCP-compatible AI agents like OpenAI Codex, Cursor, and Claude Code by Anthropic. Datadog has collaborated with OpenAI to integrate its MCP server into the OpenAI Codex CLI. Additionally, the Datadog Cursor extension now provides developers access to Datadog tools and observability data directly within the Cursor IDE or Integrated Development Environment. If it's too technical, please watch the 3-minute video for the live action (video time: 1:10 to 3:55)

I want to highlight this update because it's so helpful and unlocks significant productivity gains for developers and SREs, or Site Reliability Engineers.

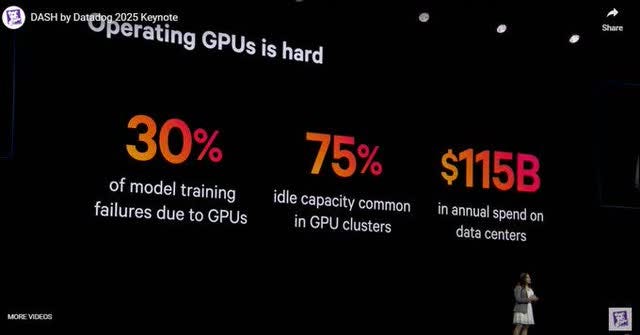

GPUs are expensive, operating a GPU is hard, and if it sits idle, it's losing money. Datadog launched the most-awaited product. "GPU monitoring" at the DASH conference this year. According to Datadog, 30% of model training failures are due to GPUs. There's 75% idle capacity in the Cluster, and $115 billion annual spending is increasing. It will be super helpful and save a lot of money for its customers.

Datadog's security suite of products now generates over $100 million in ARR and is growing at mid-40 % year-over-year. That's an exciting milestone to achieve. Datadog launched its first security product in 2021 and, in just four years, has achieved $ 100 million ARR. Datadog security product suites include cloud security, code security, cloud SIEM, sensitive data scanner, workload protection, and app and API protection.

At the AI data layer, a sensitive data scanner can now prevent the leakage of sensitive data and training data, as well as LLM prompts and responses. At the model layer, Datadog helps secure against supply chain attacks in open source models and prevent model hijacking attacks. At the application layer, we help prevent prompt injection attacks and data poisoning at runtime.

Datadog announced the TOTO foundational model for time series forecasting, which shows state-of-the-art performance on all benchmarks and specialized observability use cases. The company has a large volume of rich, clean, and detailed data to train the model. Currently, the model is under training, and we will get more updates from the management team on this. If they are able to successfully train a model and integrate it straight into the platform for all their customers, the opportunity is vast. The whole effort comes with cost, but the management team ensures that the R&D cost will see a small marginal increase, but will not move up significantly.

Updates on customer wins and sales trends

Since the end of 2024, Datadog has increased its sales and marketing headcount. Generally, it takes a year or two to see the results from such an investment but management shared that they are already 'seeing some good positive momentum' within the first 6 months. CEO Olivier Pomel announced six major seven-figure deals.

CFO David Obstler on the call:

We have been successful in increasing. We're seeing evidence of that through our new logo production and our pipeline. We need to, as we talked about previously, go through the ramping of that, but in looking at the size and productivity and performance, we see some good signs that that core capacity is becoming productive.

Datadog is going through the cloud cost optimization efforts internally and saving on the cloud bills while shipping new features, which is a fantastic way to increase the margin. Datadog is eating its own dog food (using the product or service by a company's staff to test/use it). The company is using its own cloud cost management product and profiling products, and sees substantial improvements in months. If you recall, CrowdStrike also went through a similar exercise in 2023. Optimizing cloud costs is a winning formula with proven results; every company should do it on a very regular basis.

Updates on acquisitions:

Datadog announced two small acquisitions, Eppo and Metaplane. They already included 150 customers from those two companies. Not only that, but Datadog has already integrated Metaplane into the Datadog platform. It offers a complete approach to data observability across the entire data life cycle, from iteration to transformation to downstream usage. I love strategic and small tuck-in acquisitions because they require less time and effort to develop in-house. This allows for quick integration and enables the company to start offering products to existing customers with little extra overhead. Additionally, it helps to accelerate its go-to-market strategy.

CEO Olivier Pomel on the earnings call about acquisitions:

You should expect us to do more M&A around that (meaning the security strategy), as we do in the rest of the business, as there are a lot of assets out there, and there are a lot of opportunities to grow.

I am sure CEO Olivier Pomel's email and LinkedIn will be flooded with messages after this, haha. We can expect some acquisitions for security products soon. CrowdStrike has done a fantastic job so far in acquisitions, and if Datadog follows in its footsteps, I am hopeful for the expansion. Datadog also has $4 billion in cash, so it wouldn't hurt to make acquisitions if it can find some interesting takeover targets. I like the strategic and small tuck-in acquisitions that can be easily integrated into the existing platform and extend the product offerings. Any big and bold acquisition will need to be evaluated thoroughly.

S&P 500 inclusion

On July 2, Datadog was included in the S&P500. That's a great milestone to achieve. Remember, inclusion in the S&P500 is not the ultimate goal, but to remain there longer and increase the weight in the S&P500 is the ultimate goal for most companies. If Datadog remains hyper-focused on execution and improves its profitability gradually, then it will have a good runway. Kris covered this in the Overview Of The Week.

Datadog has also been named as a leader in the 2025 Gartner Magic Quadrant for Observability platforms for the fifth year in a row.

Source: Datadog investor presentation

Conclusion Earnings

Datadog reported strong quarter results, beat earnings, and raised guidance for the full year. I am confident that the Datadog team will deliver strongly. Datadog is a GAAP profitable company with a lot of opportunities ahead. They are investing in capturing growth, delivering new products, and remaining profitable. You can't ask for better than this in the given environment.

🔒 The rest of this deep dive is for premium subscribers only.

Unlock Kris’s Quality Score update, valuation breakdown, and buy/hold/sell rating below.

The price will be hiked soon, so if you were on the fence about subscribing, don’t hesitate now.