Hi Multis

No Overview Of The Week on Sunday this week, but one day later.

Mark couldn't help this week, and we had a bridging ceremony party for our daughter yesterday. It was great. But now, back to the markets.

I'm writing this on the train to Hamburg for the Capital Markets Day (on Tuesday) and the Annual General Meeting (on Wednesday) of Chapters Group.

I added the company to the watchlist a while ago, and my good friend Michael Gielkens of Tresor Capital invited me to these events. Michael is a specialist in serial acquirers and holdings. I'm more than happy to do more due diligence like this for once and see how it works.

It’s my first time in Hamburg, so I hope to have some time to enjoy the city. It looks great in this picture.

(Hamburg)

Articles In The Past Week

Just one article in the past week: my article about Hims & Hers, in which I discuss the Q1 earnings and give the first PM Quality Score and valuation for the stock. You can find it here.

Memes Of The Week

No memes this week.

Interesting Podcasts Or Books

This week, I listened to The Compound & Friends, a podcast featuring Josh Brown and Michael Batnick, who discuss the stock market. This week, though, Josh Brown was in Italy, so it was only Michael Batnick who asked the questions.

The guests this week were Joe Fahmy and Shay Boloor. While I liked the episode (it was entertaining), I want to warn you that you should take some things in it with a grain of salt. There's quite a bit of hype and that's always dangerous. Maybe we are in the late stage of a bull market? Don't get me wrong, I'm not predicting this, but it feels a bit like it.

You can listen to the episode here.

The markets in the past week

Of course, with the Fourth of July, the stock market week was shorter. But again, the indexes were up.

The Russell 2000 was up the most, 3.52%, while the S&P 500 did a little bit better than the Nasdaq: 1.72% versus 1.62%.

The Greed & Fear Index went from Greed to Extreme Greed.

It's remarkable how fast things change in the market nowadays. Just two weeks ago, we were at Neutral.

Last week, I mentioned that it may be a good time to take some profits off the table if you can't add substantial money to your portfolio in the event the market tanks. Now, don't get me wrong. The market can still go up for months, maybe years. Nobody can predict it. So, that's why I stay fully invested. I have substantial money on the side to add if the market tanks, and if you have too, trimming doesn't make much sense.

Quick Facts

1. Datadog added to the S&P 500

This week, Hewlett-Packard (HPE) announced that it completed the acquisition of Juniper for $13.4 billion. As Juniper was a constituent of the S&P 500, it had to be replaced.

To the surprise of many, Datadog (DDOG) was chosen as the substitute for Juniper.

Standard & Poor's launched the S&P 500 on March 4, 1957. The goal was to track the stock price of 500 prominent companies in the United States. There are a few criteria to be included.

The company must make a profit in its last quarter and the last year. There must be enough liquidity, the market cap has to be above $10 billion and it has to contribute to the 'sector balance.' What this exactly means is unclear.

The S&P 500 has been adding more and more tech companies. In 2024, Palantir, Dell, Workday, CrowdStrike, GoDaddy, and Super Micro Computer were added, similar to DoorDash, which can also be viewed as a tech company.

The stock was up 17% this week on the news because fund managers tracking the S&P 500 need to buy the stock now to continue their tracking. But as such, nothing much has changed for Datadog.

2. Musk starts America Party

While Elon Musk promised to focus on his companies now after his DOGE job was terminated, he didn't keep that promise. This is what he announced.

I'm not sure if Tesla shareholders are happy with that.

3. Another TACO

Last week, I was in an X Spaces discussion. I said that when the ultimatum for the expiration of the tariffs (July 9) drew closer, Trump would claim he was near trade deals with many countries and would delay the tariffs once more. And so happened.

The new date is now August 1. I expect the announcement of trade deals in the next few weeks. Another TACO (Trump Always Chickens Out).

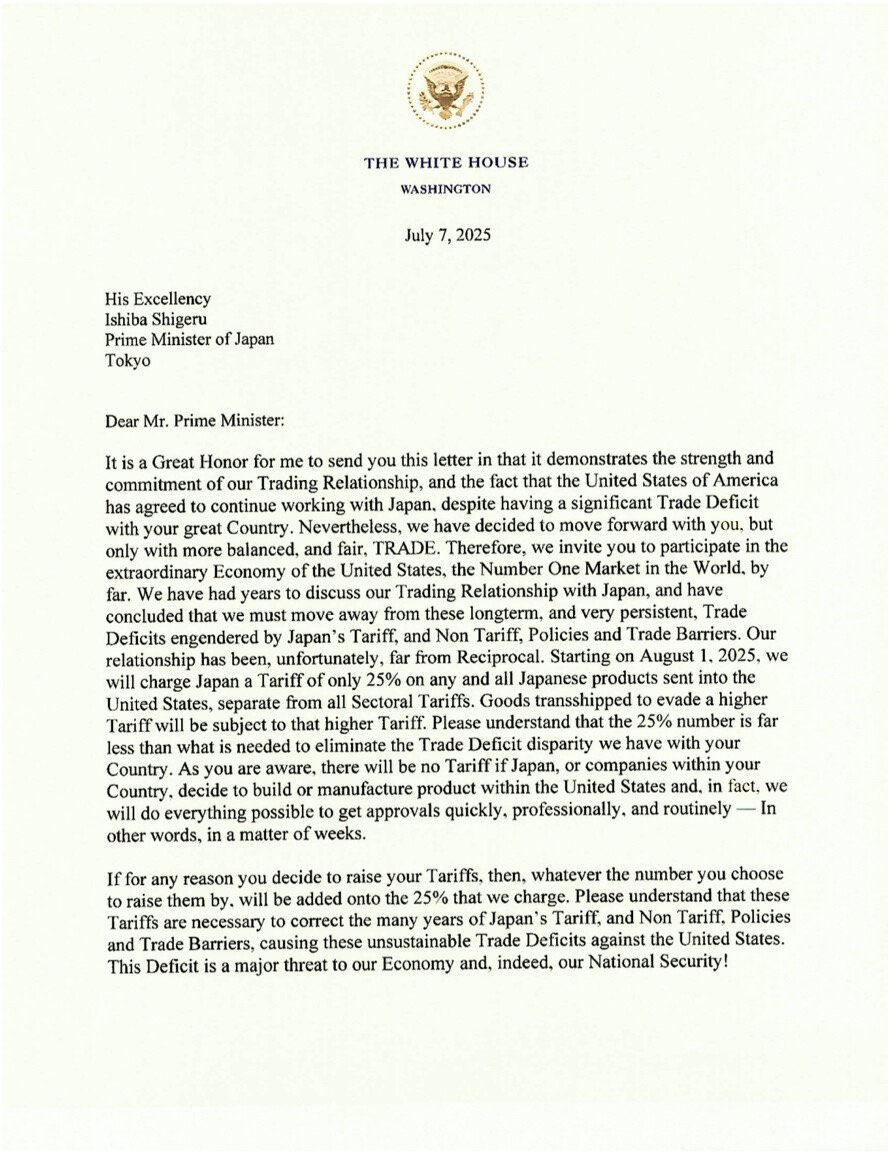

At the same time, this letter circulated on X.

My initial impression was that it was fake, but it appears to be genuine. South Korea also received a 25% tariff. I have already mentioned that the focus on goods alone is misleading in a world dominated by services. If you include services, the US deficits with most countries are much smaller. And of course, if American companies produce their shoes in Vietnam, the trade deficit will be huge. This is and remains a very weird way to look at tariffs.

If you’re already a paid subscriber, thank you. 🙏

You’re getting the full experience.

If you’re still on the free plan, this is just a preview. The full insights are waiting on the other side.