Cloudflare: 4,000% AI Growth, Quality & Valuation

Why Cloudflare's stock is up so much since the earnings

Hi Multis,

Anand here with the Cloudflare (NET) Q1 2025 earnings result. We'll go over them and then Kris will update the Quality and Valuation Scores to see if the stock is attractive now.

The Numbers

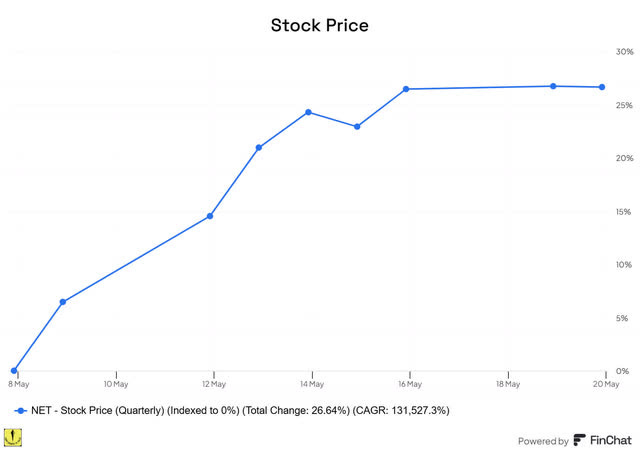

Cloudflare reported strong Q1 results on May 8, 2025. The stock price went up 9%. The stock price is up more than 26% in the meantime.

Source: Finchat

For newer Multis: Cloudflare has been a long-time Potential Multibaggers pick, from September 24, 2020, to be exact, at the price of $39.08.

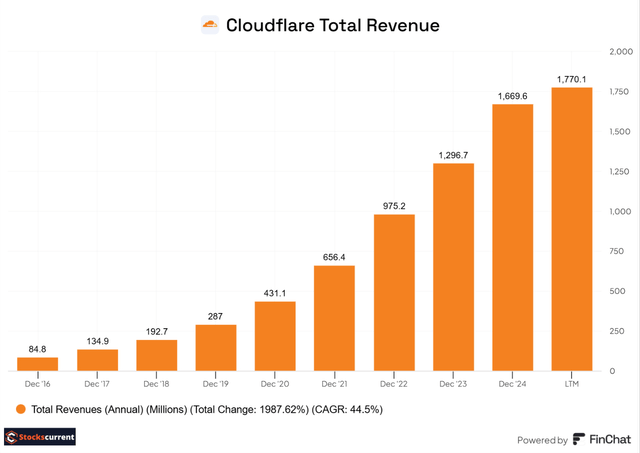

But let’s look at Q1 2025. Total revenue reported was $479.1 million, an increase of 27% year over year and beating the consensus by $10 million.

Source: Finchat

Notable deals and strengths with the largest customers fueled revenue growth during the quarter. Cloudflare reported total paid customers of 250,819 compared to 197,138 in Q1 2024, which is up more than 27% year over year. There were 3,527 customers with an ARR (Annual Recurring Revenue) of more than $100,000, a 23% increase year over year. Those are strong numbers.

Source: Finchat

Source: Finchat

Revenue contribution from more than $100k ARR customers grew 32% year-over-year, and they now contribute 69% of revenue, up from 67% in the same quarter a year ago. Management didn't provide the exact numbers but mentioned that they saw strength in the largest customer segments, those who spent over $1 million and $5 million. The customer counts in these segments increased by 48% and 54%, respectively, on a year-over-year basis.

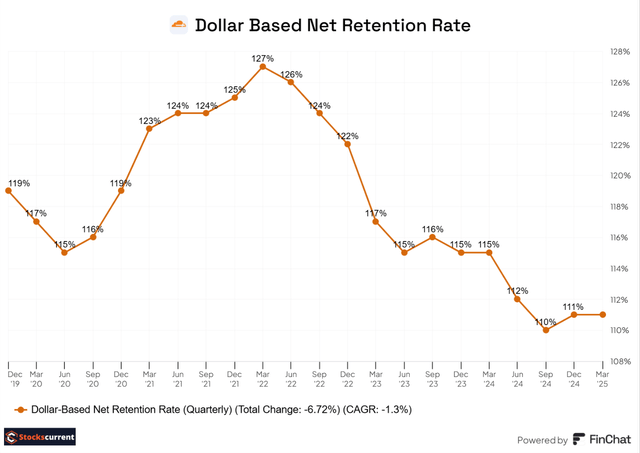

The dollar-based net retention rate is steady at 111%; it looks like it is bottoming here.

Source: Finchat

DBNRR is stabilizing at these levels despite continued near-term headwinds from increased traction with the pool of funds deals.

A "pool of funds deal" is a contract where a customer pays a certain amount that can be used for various Cloudflare products and services over a specified period without the need to negotiate separate contracts for each service.

The remaining performance obligations, or RPO, totaled $1.864 billion, an increase of 11% quarter over quarter and 39% year over year. The current RPO (the amount that will be billed in the next 12 months) was 66% of the total RPO, growing 29% year over year in the First quarter of 2025.

Source: Finchat

The gross margin was 77.1%, a decrease of 2.4% year over year, but it's still above the company's long-term target range of 75% to 77%.

Cloudflare's non-GAAP income from operations was $56 million, or 12% of revenue.

GAAP loss from operations was $53.2 million, or 11% of revenue, compared to the loss of $54.6 million, or 14.4% of revenue, in the first quarter of 2024.

I see this GAAP loss from operations narrowing year over year, but it increased on a sequential basis. It is not a sign of weakness, but it looks like that's the pattern; it's generally high in the first quarter of the year.

Non-GAAP net income was $58.4 million, compared to $58.2 million in the year-ago quarter. Non-GAAP net income per diluted share was $0.16, compared to $0.16 in the first quarter of 2024, so it was flat.

Cloudflare's GAAP net loss was $38.5 million, compared to a loss of $35.5 million in the first quarter of 2024; it increased slightly. GAAP net loss per share was $0.01, compared to $0.10 in the first quarter of 2024.

CFO Thomas Seifert mentioned that variability in foreign exchange rates during the quarter resulted in unrealized losses of $2.7 million. Network CapEx represented 17% of revenue in the first quarter, slightly higher than their range of 11 -13% of revenue, but that's on a yearly basis. The Q1 capex is always higher.

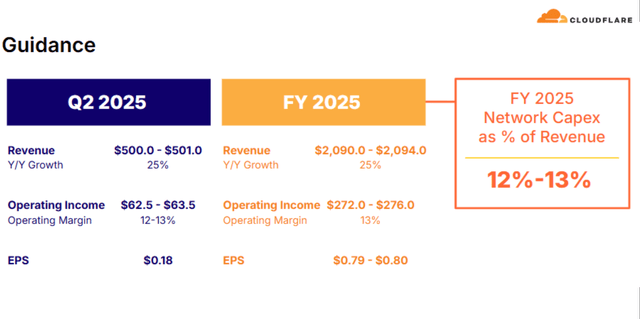

That was confirmed. Seifert estimated the network CapEx to be 12% to 13% of revenue for the full year 2025. The management team confirmed they have robust and diversified supply chains to mitigate tariff and trade risks. Tariffs have no direct impact on their business.

Net cash flow from operating activities was $145.8 million, compared to $73.6 million for the first quarter of 2024.

Source: Finchat

Cloudflare reported a free cash flow of $52.9 million, 11% of revenue, compared to $35.6 million or 9% of revenue in the same period last year. Despite ongoing investments in its network and enhanced capabilities, such as faster and more powerful GPUs worldwide, they were able to improve the free cash flow.

Guidance

Q2 2025 Outlook:

Management guided revenue between $500 million and $501 million, which is up more than 25%. Non-GAAP operating income is expected to be between $62.5 million and $63.5 million, which translates to non-GAAP EPS of $0.18.

Full-Year 2025 Outlook

For the full year, the management team guided revenue to be between $2.09 billion and $2.094 billion, or 25.2% up year over year on the midpoint. Non-GAAP operating income is expected to be between $272 and $276 million, but it decreased from the previously guided range of $655 to $675 million. Non-GAAP net income per share ranges from $0.79 to $0.80. They unchanged the full-year guidance from the last quarter.

This is the overview for guidance.

Source: Finchat (yes, it also has the earnings calls and slides!)

Highlights from the conference call

Largest contract in Cloudflare's history

For over a year, CEO Matthew Prince has been providing updates on the Developer platform, one of the fastest-growing segments inside Cloudflare. In my articles, I have regularly covered its growth and potential.

I liked it because of its bottom-up approach. Developers build on Cloudflare and then present their work to management for approval and contract signing. It's developer-driven and management-approved, making it easy to cut out some business negotiations.

No wonder this quarter Cloudflare landed the largest contract in Cloudflare's history, a milestone deal of more than $100 million driven by the Workers developer platform. Cloudflare Workers has become a complete solution where developers can develop faster and get much better performance at a lower cost.

Cloudflare is increasingly in the decision mix with the hyperscalers. For this deal, they were competing with hyperscalers. The customer was deep down the line, but they met with the customer, built a proof of concept, demonstrated the values, showed how fast and easy the platform is, and struck the deal.

CEO Matthew Prince on the call:

I think that I've tried to caution that it was going to take probably a little bit longer for Workers to deliver real revenue. I think this shows that this is way ahead of what I would have thought that timing was.

Cloudflare Workers developer platform is gaining momentum and becoming a choice for developers.

Updates on customer wins and sales trends

CEO Matthew Prince talked about seven notable deals during the call. We saw one above. Another major deal was the longest-duration contract in Cloudflare's history for Zero Trust. Cloudflare's Zero Trust products were significantly more performant than competitors. In the words of this customer, Cloudflare has by far the broadest and most programmable cloud security and connectivity platform on the market.

Direct customer feedback is helpful and shows the strength of Cloudflare's Zero Trust security product. The Zero Trust approach is not optional but mandatory for the government and high-level security certifications for enterprises. Cloudflare was lagging in the past in terms of critical features and functionality, but they have caught up now, and their solution has significantly better performance than the competition.

Since the company hired Mark Anderson as President of Revenue in February 2024, Cloudflare has increased its sales and go-to-market team headcount. He is focused on building an efficient sales organization and enhancing sales productivity.

The management team saw quarter-over-quarter improvement in the sales cycles even as they closed larger deals with more sophisticated buyers, and the new pipeline attainment is ahead of the forecast. Despite the highly volatile external business environment, the company has delivered double-digit sales growth, and its pipeline is stronger than estimated.

CEO Matthew Prince on the call:

These Q1 wins not only serve as a great springboard for the rest of 2025 but are also reminders that while the world may be uncertain, what's absolutely certain is that innovation wins and no company out-innovates Cloudflare.

Workers AI and inference

I hope you remember my article from last quarter, in which CEO Matthew Prince shared that he also sees AI inference representing a larger opportunity than training. Kris has mentioned this multiple times already.

He mentioned that based on what he saw, the number of Cloudflare Workers AI inference requests is up nearly 4,000% year over year, and the number of requests running through its AI Gateway is up more than 1,200% year over year. That's remarkable because both of these products are just one year old and growing significantly.

The company will invest in the future, building the first, fastest, and most powerful Model Context Protocol or MCP server. This technology is key to enabling AI agents or agentic AI.

What is Model Context Protocol?

The Model Context Protocol, or MCP, is an open standard and open-source framework that standardizes how large language models (LLMs) interact with and share data from external sources, tools, and systems.

Initially, Anthropic released the protocol, which can run on developer machines or locally where the AI application runs. The Cloudflare team worked with the Anthropic team, and now the MCP runs on the cloud and across Cloudflare's network. That makes it so much easier for developers. They don't have to worry about the protocol and can just focus on developing the AI agents and AI apps.

It's remarkable to witness the speed with which companies leverage the Cloudflare platform to deploy these agents and facilitate seamless interactions between them. Companies like Asana, Atlassian, Block, PayPal, Century, Stripe, and many others are adopting the Cloudflare Workers AI to give AI agents a way to interact with their underlying platform. I am impressed with the progress of the Workers AI.

Security is important in agentic AI, especially when it is open to communicating with the underlying platform. These companies also trust Cloudflare for its performance and security.

Conclusion

Before we switch to Kris for the valuation update, a quick takeaway from the earnings. Cloudflare reported strong quarterly results and showed that AI growth is accelerating. The company is making good progress with its go-to-market strategy and investing in key areas like Worker AI and the Worker Developer platform.

Disclosure: I have personally owned Cloudflare since October 2020.

If you like the article, please share your feedback in a comment on the article and follow me on X@anandkhatri.

Matthew Prince’s X Q&A

Hi Multis

Kris taking over here.

Just before I published this article, Anand sent me a message on Slack. Matthew Prince, the founder and CEO of Cloudflare, did a Q&A on X. Here, he answered my question.

And Anand’s question.

There are many other interesting questions and answers. You can read them all here.

But let’s get to the Quality Score.