Celsius: Earnings And Acquisition, Quality And Valuation

Is Celsius attractive after the Alani Nu acquisition announcement?

Hi Multis

No long introduction, let's just jump into Celsius Holdings' (CELH) Q4 2024, look at the Alani acquisition it announced and see if the stock is interesting right now or should be avoided. Let's dive in!

The Numbers

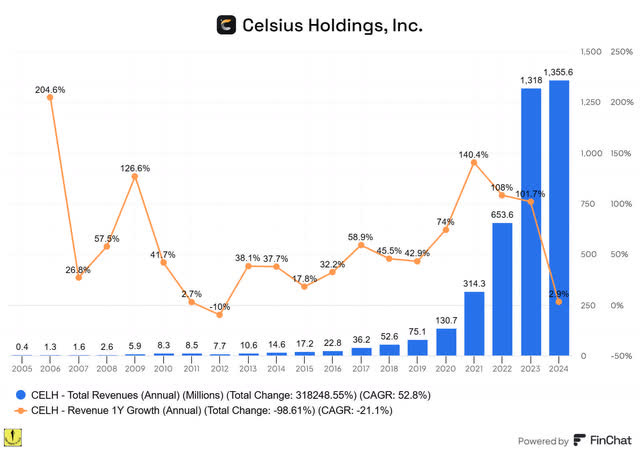

To put the numbers into context, this is Celsius revenue growth, as seen through Finchat.

I find this overview extremely insightful for at least two reasons. The first one is that you can see that Celsius has grown its revenue by 52.8% per year on average. But this big drop in revenue growth, just 2.9% in 2024, is not the first drop. 2011 and 2012 were particularly weak years as well. So, people declaring Celsius dead here are premature, to say the least.

In 2021, Celsius signed a distribution agreement with Pepsi. That had an immediate effect. Growth more than doubled for three years in a row. And from 2020 to 2023, revenue went up 10x. In that context, it's not that strange there is a pullback now.

In the meantime, Celsius became the third biggest player in energy drinks, after Red Bull and Monster.

(All images in this article are from the Celsius Q4 2024 presentation, unless mentioned otherwise)

While this looks great, since the second quarter of 2024, the company had been losing some market share, from 12.3% to 10.9%.

In Q4 2024, net sales were $332.2 million, down 4.3% from last year. The main reasons were promotional discounts and order timing. But still, this beat the estimate by $5.18 million or 1.6%.

It's also important to look at the comps. The company's quarterly revenue was down 4% year-over-year, but that was compared to 95% growth in the same quarter a year ago.

Full-year 2024 revenue reached $1,360.3 million, up 2.9%.

Profitability was better than last year's Q4, with gross margin at 50.2% in Q4, up from 47.8%, thanks to lower costs. But gross margins didn't reach the Q1 & Q2 2024 numbers.

On a GAAP basis, Celsius reported a loss of $18.9 million, mostly because of one-time costs like legal expenses for the Alani acquisition. In this case, I think adjusted earnings show you reality better. On an adjusted basis, net income was $23.7 million, or $0.14 EPS, beating the estimate of $0.10.

The Alani Acquisition

The big news from the earnings was the Alani acquisition. Celsius bought its competitor for $1.8 billion.

One of the lessons I learned from my losers in the past is this:

Logically, I considered selling Celsius. But there are at least three differences with Teladoc and Block.

1. The size of the acquisition

The acquisitions for Teladoc and Block were much bigger. Teladoc paid a whopping $18.5 billion for Livongo. That was about the same size as Teladoc itself. Block issued 20% new shares to buy Afterpay, valuing Afterpay at a price of $39 billion at the time the acquisition was announced. The Celsius acquisition is much smaller.

You could say that Alani is about 30% of Celsius' market cap of about $6B. That's close to Block's initial AfterPay acquisition price, which was about 30% of its market cap too. However, the difference is that the AfterPay acquisition happened at the top of Block's market cap.

Here you can see when the acquisitions happened.

For Celsius, which is down a lot from its highs, a 30% acquisition at the top of its market cap would have meant an acquisition of about $7 billion, almost 4 times more than the $1.8 billion price.

2. The Valuation

When Block bought AfterPay, that company had about $650 million in yearly revenue. That means the initial price valued the acquisition at a whopping sixty times sales. When the deal closed, the valuation of Block had collapsed, and the deal was only worth about $12 billion. But even then, this is a sales multiple of 18.5 times.

The year before the acquisition by Teladoc, Livongo had $170 million in sales and in 2020, the year of the acquisition, it was projected to have $287 million in sales. At the price of $18.5 billion, that means Teladoc paid 109 times revenue or 64.5 times forward sales.

Looking back, these valuations were extreme red flags.

Celsius buys Alani for $1.275 billion in cash and $500 million in stock for revenue of $595 million. That's a bit less than three times Alani's revenue.

3. The Type

Block bought AfterPay to get access to a market it was not present in before, BNPL (Buy Now, Pay Later). For Teladoc, the reasons were not so clear, although the company cited preventive healthcare, more data insights and (don't laugh) shareholder value.

For Celsius' Almani acquisition, the reasoning looks more straightforward and more focused. It's taking out a competitor that was growing fast and instead of competing, the companies can work together now to get bigger.

It’s this together now.

So, how does this affect the balance sheet?

Celsius has about $900 million in cash and no debt. So, that means the company will have to issue debt for the acquisition, as there's $1.275 billion in cash in the deal. Celsius said it would borrow $900 million, which was already committed. That will leave the company with a net debt of $375 million. On top of that, there's an immediate tax benefit of $150 million for Celsius.

In 2024, Celsius generated $170 million in free cash flow. With Alani, that's potentially more, although there may also be costs involved. We don't know that. Of course, companies will always pound their chest about synergies. I see them as bonuses. If they really come to fruition, that would be great, but I don't believe that strongly in synergies as a given.

But I do believe in the brands working well together. This is the product line of Alani NU.

So, there's energy drinks, but there's also more, with preworkout powders, sticks, packs, shakes, and snacks.

And while you often hear management talk nonsense about why they did the acquisition, the overview Celsius gave actually makes sense.

Yes, it's still business buzz, but all in all, the company is just throwing out some PowerPoint bullet points.

If you talk about number three, for example, the complementarity of the brands, this is shown convincingly.

This is not just promo talk of a management team that has a new toy. This looks like good business strategy to me.

Alani Nu is targeting more women and you can already see that jump off the page.

And the fifth point looks at the numbers. These too look very convincing.

So, all in all, I really like this acquisition. It's a sizeable one but not so big it chokes the company chewing it up. It will add more revenue and profitability (which was definitely not the case for the previous acquisitions we discussed, those of Teladoc and Block). The brands are close enough to understand each other but different enough not to really cannibalize each other. The balance sheet remains strong enough.

Of course, I know the numbers. 72% to 84% (depending on the source you consult) of the acquisitions are not good for shareholders and actually destroy shareholder value.

Could this be the case here? For sure. There can be integration problems, cultures that don't mix well, dead bodies in the Alani Nu closet, etc.

I've become much more skeptical about acquisitions, except for tuck-in acquisitions and acquihires (where you buy the company to have great people on your team).

Of the many deals I hear about, this is in the top range when it comes to business logic. This makes intuitively sense. But execution will be needed, of course.

More Insights From The Call

For 2024, Celsius posted meagre revenue growth, at just 3%. But the real story is in the retail sales numbers, which were up 22% year over year. That number excludes the Pepsi inventory problems. So, it seems that in stores, Celsius is still selling well. Once the inventory problems at Pepsi are (finally!) over, it also shows that Celsius can go back to growth.

The 22% retail sales growth was also boosted by Celsius being in more stores. CEO John Fieldly on the earnings call:

Consumers can purchase cold, refreshing Celsius in more than 241,000 outlets in the United States.

In an industry like the energy drink space, being everywhere matters. Celsius will also be available in Subway in March. That's great, as Subway has 18,000 potential locations. It will also be sold in Home Depot.

That 22% retail jump also outpaced the energy drink market as a whole, which grew at 5%. So, even with this tough year, overall, Celsius is still grabbing market share.

Important for the investment thesis: Celsius drove 30% of the category’s growth in 2024. The investment thesis has always been that the company would

CEO John Fieldly acknowledged the increased competition.

We expected our competitors to respond eventually, and it came with a flurry of new sugar-free products last year.

Monster launched its sugar-free product in 2023 and Red Bull doubled down on zero sugar with its very first totally sugar-free flavour, the Pink Red Bull, with a combination of raspberry, other forest fruits and verbena.

In this context, Celsius’s 22% retail sales growth in Q4 shows considerable strength.

International growth remains a highlight, although still from a small basis.

The expansion to Canada, the UK, Ireland, France, Australia and New Zealand had effect, but there's still has a ton of upside left.

The Potential Multibaggers Quality Score

So, how does this all influence the PM Quality Score? Let's find out.