Hi Multis

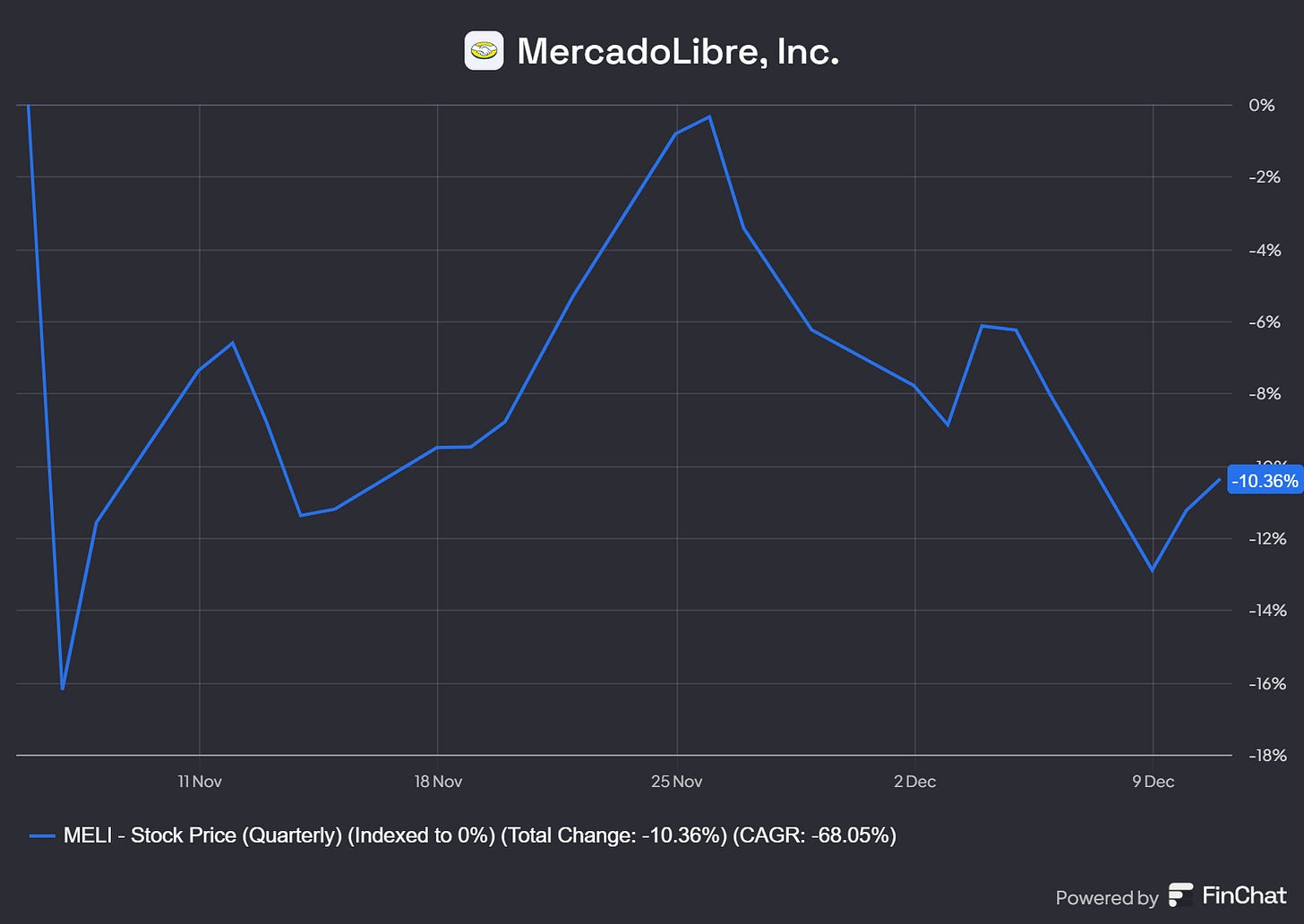

One of my holdings is Mercado Libre (MELI). When the company announced its earnings, the stock dropped by 16% last month. Was that noise or signal?

The Numbers

Mercado Libre's revenue was up 35.1% year over year, reaching $5.31 billion and beating the consensus by $30 million.

Now, I'm pretty sure many American companies would give an arm and a leg for 35% growth. But if you look at the underlying numbers, it's even much more impressive. On an FXN basis (so the foreign currencies Mercado Libre gets for its products and services), revenue was up a blistering 103%.

The company's Q3 GAAP EPS came in at $7.83, missing the consensus by $2.02.

Let's look at the different departments of the company.

Mercado Libre (the marketplace)

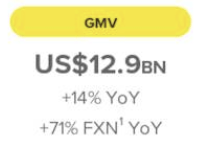

A very important number for any e-commerce business is GMV or Gross Merchandise Volume. That's the dollar amount of everything sold on that marketplace. GMV was up 14% YoY and that doesn't seem to be too much, but bear in mind that it was 71% FX-neutral.

I think both don't really show the true number, though. The dollar amount has very strong headwinds from the dropping Brazilian real and especially the Argentine peso. But that 71% is also not the real number because of high inflation, especially in Argentina. How should we know, though, where the real number would be?

I think this might help.

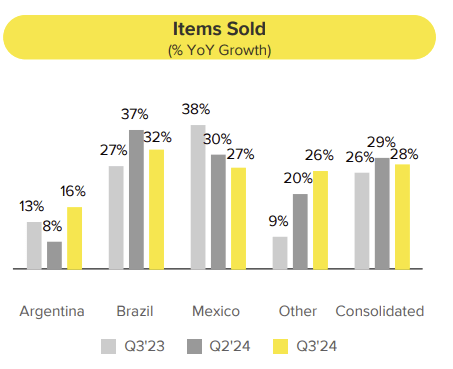

28% more items sold. With a bit of pricing added to the mix, and the fact that people usually buy more expensive things once they trust an e-commerce company, I think the 'real' realistic growth will have been somewhere around 35% or so. At least, that's my educated guess.

If we look at the numbers per country, this is what you get:

This is what I mean. Inflation in Argentina is very high (but dropping) and therefore, you can't just look at the numbers without context.

Here, too, the number of items sold puts things in context.

As you can see, there's an acceleration in Argentina and 'other.' Just so you know, 'other' are Colombia, Chile (the two biggest markets after Brazil, Mexico and Argentina), Peru, Bolivia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Panama, Paraguay, Peru, Uruguay, Venezuela. To me, that means that Mercado Libre has a long path left for expansion within its current market.

Mercado Libre added this text to this graph:

This is broadly in-line with Q2’24, which had the fastest growth since Q1’21. Brazil and Mexico are performing well, whilst trends in Argentina have improved significantly. This is being driven by our growth initiatives and better consumption trends more broadly in Argentina.

Spoiler alert, this already foreshadows my conclusion of this article, but this already shows why I didn't agree with the big stock price drop.

Source: Finchat, the best charting, screening and finance AI tool

Was this noise or signal?

The stock recovered quickly, in less than three weeks, but in the meantime, it's down again because of the worries about the Brazilian tax plans.

Again, you can ask yourself again if this is noise or signal. Both questions will be answered clearly in the rest of this article.