Hi Multis

It’s Sunday.

So, here’s the Overview of the Week again, best enjoyed with your drink of choice and zero distractions.

In the upcoming week (in a few hours, actually), I will be traveling to Klosters, Switzerland (not far from Davos) for ValueX.

Robert Karas, one of the other participants, wrote about ValueX Klosters on LinkedIn:

Why ValueX is a community, not a conference.

It all started in 2011, when Guy Spier organized his first gathering of investors in Switzerland. Over the past fifteen years, a level of deep trust has developed among participants that is hard to find anywhere else.

Everything traces back to a small set of principles that have shaped ValueX from the very beginning.

1. Sharing of knowledge

We learn from each other in a supportive, open environment.

2. Strict confidentiality

It’s all about trust. Nothing is shared unless there is explicit permission.

3. Non-solicitation (no pitching)

No one wants to be sold to. It’s a clear no-no.

4. Exclusive and focused

It’s a private, invitation-only event.

5. Work and play balance

We are in the mountains. It would be a sin to spend all our time in a room. The greatest value often emerges through conversations while walking, hiking, or skiing. And it doesn’t cost an arm and a leg either. Guy’s approach is generous. It’s about covering costs, not building a business around it.

These principles were inspired by the format of TED talks, specifically the “Ideas Worth Spreading” mission.

The secret sauce of ValueX is Gestalt. We don’t tell others what to do and give advice. We only share our personal experiences. It helps to remove ego and judgment from the room.

For fifteen years, this framework has worked remarkably well, fostering intellectual honesty, humility, and a genuine sense of community.

It’s always great to talk to so many extremely smart people and get new ideas.

Articles In The Past Weeks

This is the third article this week.

In the first article this week, I took advantage of the software sell-off and bought shares for my Forever Portfolio. You can read all about that here.

We also looked at CrowdStrike. Is it a buy now on AI or not?

Memes Of The Week

Two memes this week. Neither is directly related to investing, but funny enough, and still related enough to share them here.

As I mentioned in the article about my additions to the Forever Portfolio, I fooled around a bit with what used to be called no-code coding. Now everyone calls everything vibecoding.

But, while the start looked extremely promising, we are not there yet. While you hear that anyone’s grandmother can vibecode enterprise-level software before lunch now, we are still far from that dream.

That’s why I found this meme so funny.

The other one is from last year, but Multi Market Sense shared it in our Stonk meme channel and I thought it was funny.

Interesting Podcasts Or Books

This week, I listened to a few private podcasts, meaning they are not generally available to the public, so I can’t share them.

But I have added a podcast episode to my watchlist and want to share it. It’s in the Founders podcast, and it’s with Kevin Kelly.

Kevin Kelly is the thinker behind the “1,000 True Fans” concept: the idea that creators don’t need millions of followers, just 1,000 dedicated fans who want everything they make. In 1994 already, he wrote the classic Out of Control, on decentralized systems, and how complex organizations work like beehives rather than top-down hierarchies. Now, many think that idea has always been there, but it was Kevin Kelly who introduced it.

He has written books like The Inevitable (2016) and a few years ago Excellent Advice for Living, which he started writing for his children on his 68th birthday. The title says what it’s about.

Kelly also co-founded Wired magazine. So, enough reasons to listen to this episode.

The markets in the past week

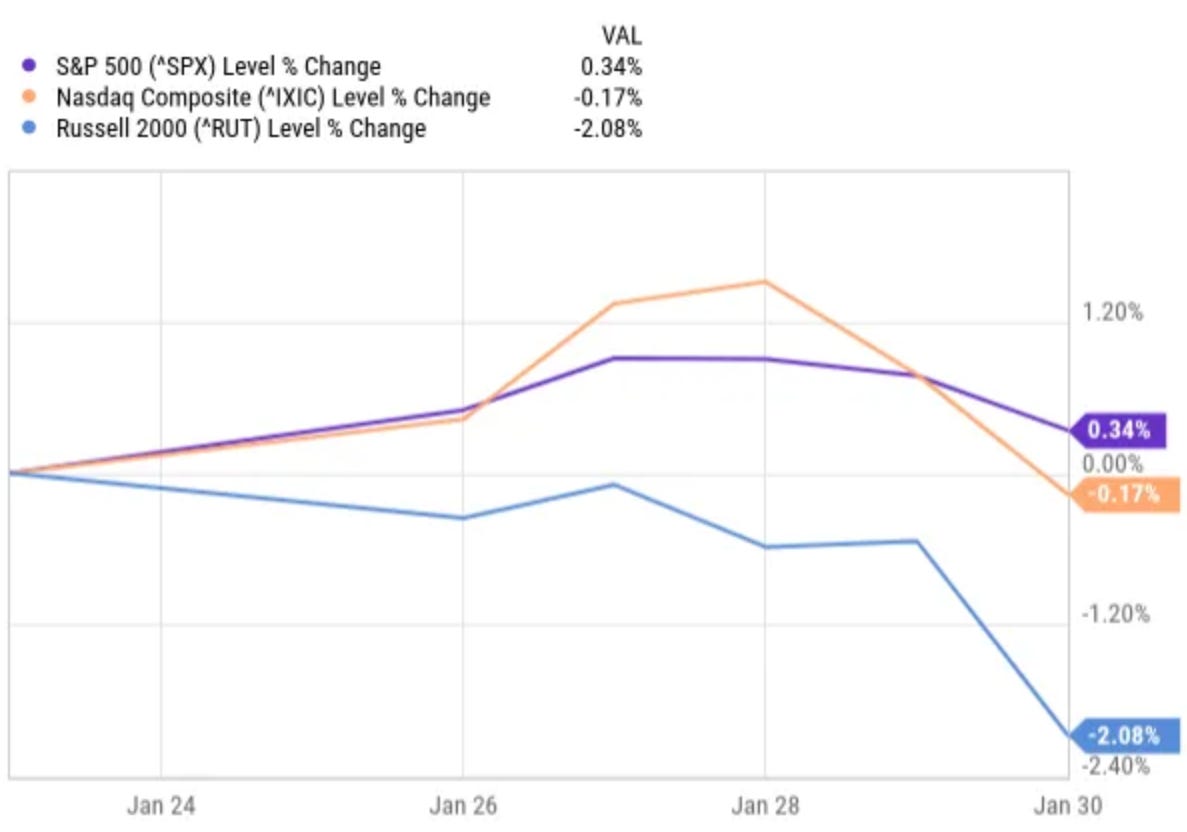

Sometimes, we focus so much on our own holdings that we lose sight of the market. That’s why I give you this overview every week.

As you can see, the Russell 2000 dropped quite substantially this week. This was probably a reaction to President Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair. Warsh is seen as more hawkish than other candidate names that were circulating. Because Russell 2000 companies generally have higher debt, that’s seen as a negative.

The Nasdaq was down jus 0.17%, which may be surprising if you only look at the software sell-off. The S&P 500 was up 0.34%.

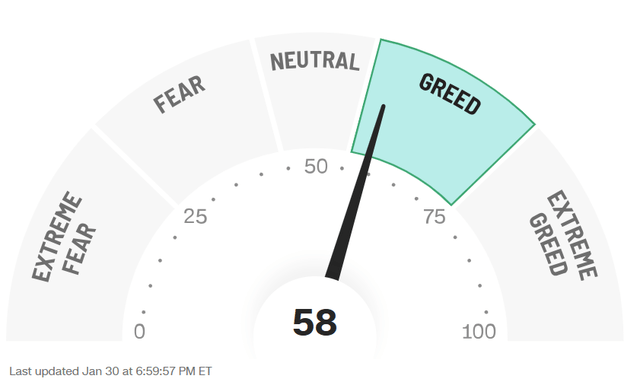

The Greed & Fear Index surprisingly jumped from Neutral to Greed.

Quick Facts

1. RPO = $0?

I have written about this in my article on Friday, but no, I don’t think software’s dead.

There’s a new story now, that RPO (remaining performance obligations) should be discounted to $0. Chamath Palihapitiya, aka Scamath, launched that story.

The man is one of the guests of the All-In podcast, together with Jason Calacanis, David Sacks & David Friedberg, and he’s a venture capitalist. He was an early investor in Facebook. He was also behind multiple SPACs (Special Purpose Acquisition Companies), which bought Virgin Galactic, Opendoor, Clover Health, and SoFi.

Chamath is partly a good businessman and partly a clown, probably in equal parts and this proves the second part.

Now, don’t get me wrong, there will be some contracts that will be renegotiated. But discounting all RPO to $0 is just laughable. There is a lot of software out there that you buy because you need reliability, regulation-approved, solid software that can’t be replaced with in-house vibecoded software. You don’t want your cybersecurity to be coded with an LLM. Or your procurement, invoicing, HR, and so much more.

Chamath may be on to something, but not what he thinks. I have a feeling that he’s an indicator of peak tech negativity.

2. Moltbot Hell?

Last week, I wrote about Clawdbot. It had to change its name already because Anthropic (with Claude) didn’t like it. The new name is Moltbot.

This week, there was a lot of controversy around these bots getting their own Reddit-like social media platform. You saw issues such as threads where people were shut out, trading places for stolen identities, and other alarming trends.

Don’t get me wrong, I can see the dangers of such platforms but up to now, the bots are just emulating behavior. In other words, if people don’t program like that, they won’t get out of control. That doesn’t mean that with AGI (artificial general intelligence) this can’t become a real problem. But AGI is not here yet.

Still, we need to monitor the evolution closely.

3. De Winnaars zijn...

As with last week, this section is for Dutch speakers only, as it concerns an investment event in Ghent where I will be a speaker. You can scroll to the next thing if you don’t understand Dutch.

Op zaterdag 14 februari ben ik één van de sprekers op het beleggersevent Een Hart Voor Beleggen in Gent.

Ik mocht van de organisatie twee tickets weggeven, goed voor een waarde van €50 elk. Dank je voor jullie massale deelname.

Ik stak alle namen in een randomizer en die pikte er twee uit.

De winnaars zijn...

Jef Megens

&

Wido Tancer

Proficiat! Jullie krijgen verdere info via mail.

Niet gewonnen en je wil er toch nog bij zijn? Dat kan, uiteraard.

Praktische informatie

Prijs: €25 voor leden, €50 voor niet-leden, €25 voor studenten

Broodjes en frisdrank voor ‘s middags zijn in de prijs inbegrepen.

PS: als je nog geen VFB-lid bent, dat kan voor €75. Daarvoor krijg je kortingen op de bijeenkomsten en krijg je ook 10x per jaar het prachtblad Beste Belegger. Je kunt je hier lid maken.

Locatie: HoGent, Valentin Vaerwyckweg 1, 9000 Gent

Aanvangsuur: 9 uur

Tot in Gent!

4. Nvidia’s $100B OpenAI Deal In Jeopardy?

According to rumors, Jensen Huang has questioned the deal with OpenAI, citing both competition from Google and Anthropic and OpenAI’s lack of discipline.

I don’t think Jensen Huang should be surprised by OpenAI’s lack of discipline, as it has been my concern for over a year now, and anyone following this area, even from afar, can see it.

It would also be one reason the rumors that OpenAI is rushing to go public may be true.

As always, I will definitely not invest in an OpenAI IPO. I never invest in IPOs. Of all IPOs, only a handful traded below their IPO price. On top of that, I want companies to prove themselves over time before I invest in them.

As an Nvidia shareholder, I think it’s prudent to show some restraint. There are others, like Softbank, that will support OpenAI and for Nvidia, $100B is a ton of money.

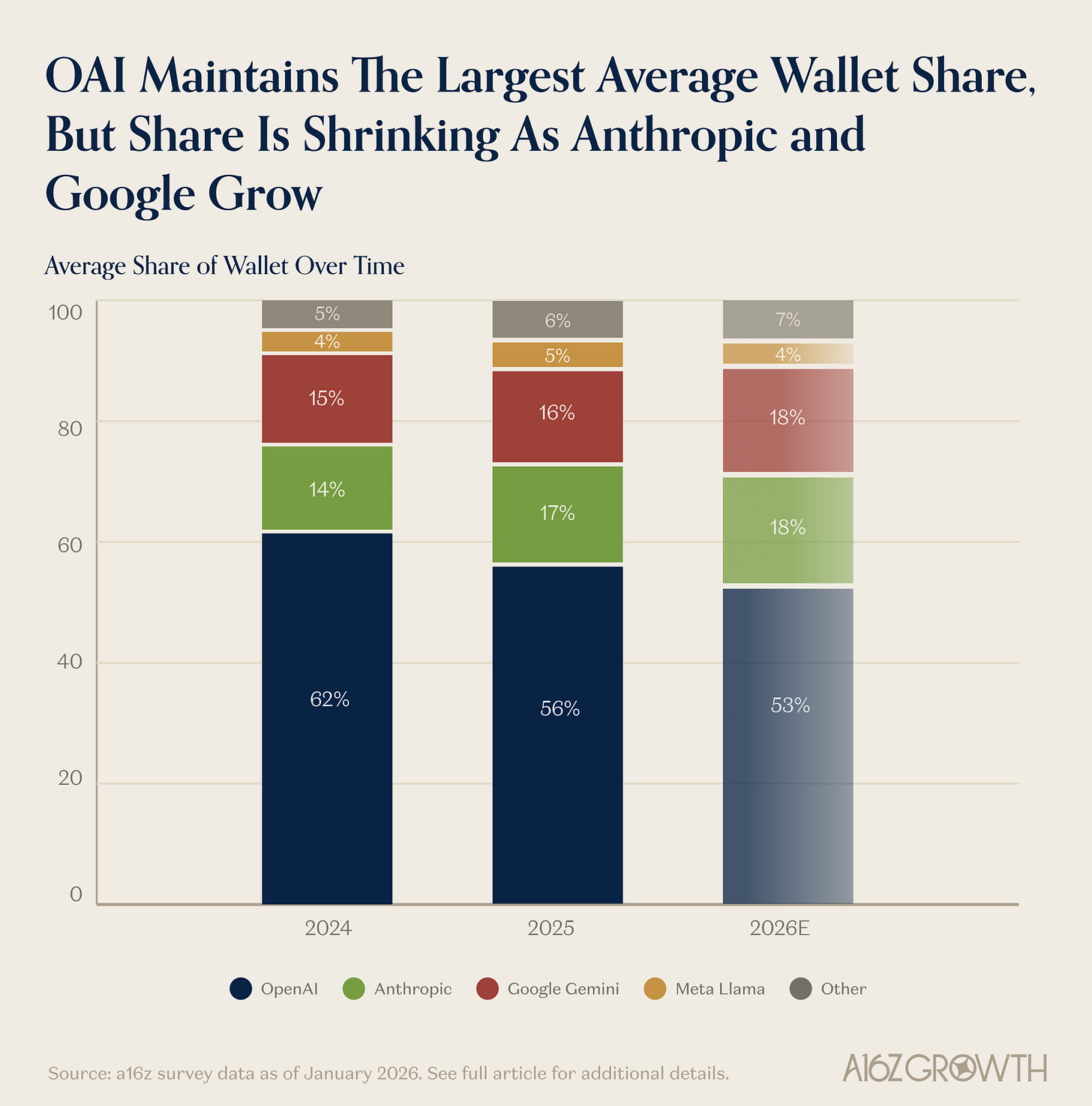

There’s still the potential that OpenAI will be the MySpace of AI. Both Claude and Gemini have taken market share from OpenAI, and I don’t see any sign that will stop anytime soon. Just look at this chart.

(Source)

Do you want to read the rest of this article?

Become a paying member of Potential Multibaggers!

(If you already are, just scroll past this)

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beats the S&P by more than 40%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.