Nu: What's Going On?

The stock dropped 35% since November 12. Should you be worried?

Hi Multis

Let me introduce you to Karan. He’s a regular contributor to Potential Multibaggers.

Karan is 34 years old and was born in India. He has lived in various countries, including Japan, Malaysia, the US and Singapore. He moved to Singapore in 2017 and considers it home. In Karan's words:

I work in finance, for a large multinational bank, where I have a range of responsibilities primarily on the credit side in wealth management. I have past experience in transaction banking, equities technology, asset management and consumer operations.

I started investing for myself in about 2018 primarily through Robo-advisors & ETFs. As my experience and confidence grew I eventually made the leap into individual securities in 2020 (yep, impeccable timing.) My original plan was to save up enough money for financial independence but I fell in love with this crazy, dynamic game known as the markets and I love studying businesses, investing strategy, market mechanisms and everything under the sun. I love learning and the markets have infinite lessons to teach us.

My hobbies are reading (I will read anything under the sun), food (try anything once!), gaming (primarily strategy & simulation), travelling (living in 5 countries will do that!) and I'm an unapologetic history buff - everything from the world to cinema.

But that’s not really why you are here, right? So, let’s go to Nu Holdings (NU).

The Q3 2024 Numbers

Revenue: Seeking Alpha was keen to say this was a “MISS” but diving a bit further makes this quite funny, but sure, for posterity we will note that NU “missed” it’s Q3 2024 revenue estimates by $10 million when measured in USD. Why is this funny? A picture speaks a thousand words:

These are the currency moves in BRL and MXN (where NU earns most of its revenues) vs the USD (where it reports them as a US-listed stock) this year. Given that NU makes about 3 billion USD equivalent in a quarter, currency moves of 15% to 20% is a MATERIAL cause of volatility.

Notice I used volatility because sometimes this will be in NU’s favor, and others (like now) will be against it. And so, on a 3 billion USD revenue run rate given the underlying currencies moved by an absurd amount as US election probabilities constantly shifted – I would say it’s a great result for NU and I wouldn’t worry too much about a rounding error on the foreign exchange.

To put things into context:

Brazil’s currency is down more than 19% this year, leading losses among majors. The Ibovespa stock index has lost more than 7% this year, lagging EM stocks and most global benchmarks.

As investors, we can look at “holistic” growth – customers and revenue per customer, lending, deposits etc, which increased once again.

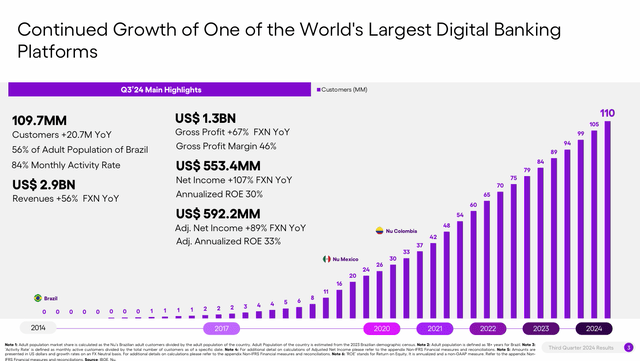

Customer growth increased by the same number as last quarter and similar to their growth (~5 million) as it did in the last 10 quarters, so while the percentage increase is lower, the absolute numbers remain strong.

The monthly average revenue per active customer of $11.0 increased 2% Q/Q on an FX-neutral basis and 25% Y/Y. The monthly average cost to serve per active customer was $0.7 (or $0.08 when adjusted for one-off items) vs. $0.9 in Q2 and $ in last year's Q3.

Most of the key metrics grew this quarter, we don’t need to overcomplicate it, this was once again, excellent execution from NU.

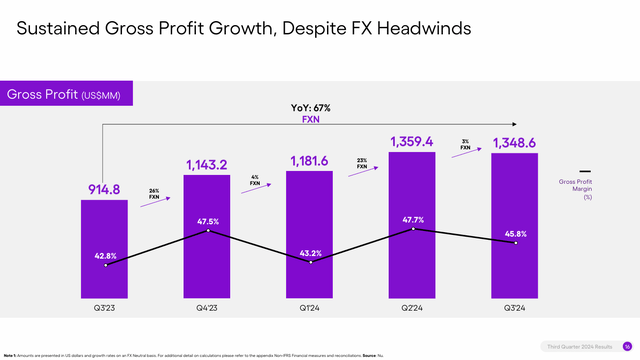

Profitability: STRONG

The bottom line continues to improve healthily and not just the top line, great performance.

Adjusted net income of $592.2M climbed from $562.5M in the previous quarter and $355.6M a year ago.

EPS: BEAT

Q3 EPS of $0.1132, beating the consensus estimate of $0.10, rose from $0.0998 in Q2 and $0.0624 in last year's Q3.

Efficiency: BONKERS

Operating expenses of $624.8M fell from $634.0M in Q2 and increased from $503.3M in Q3 2023.

Long-time readers know that personally, these are the best metrics I have seen at any bank, anywhere, ever, and continue to shock me (in a good way!). We will come back to these numbers when we get to the macro, but these charts are the envy of modern finance.

Credit performance: STABLE

The numbers speak for themselves, there are no signs of any problems or weakness as of the end of Q3’24.

Capital Position: FLEXING

2.4 billion Cash, more than capital requirements, which is hilariously conservative, although we are about to explore why they are right to do so.

So, NU hit it out of the park, once again. So, the question on everyone’s mind is, what happened since November 12, 2024? The stock is down 35%.

Now is a good time to remember 2 rules about investing in NU:

NU is a bank.

Banks are amongst the pro-cyclical companies in the economy precisely because they rely on economic growth (and consumer prosperity) to grow.

Now let’s look at that chart again, but with the largest banks in Brazil, NU’s biggest market and key competitors:

All banks fell, of course not as much as NU, but we should expect this because NU is valued at a multiple of the others and also, this is the YTD chart for the same companies:

NU is still the best-performing bank among the group.

So, what happened exactly?