This is the new position I bought

One announcement, two buys

Hi friends!

Today, I added to my portfolio, just like I do every two weeks. If you are a paying member, you will get all of my buys once I launch my paid service here (just a bit of patience… Black Friday is coming, so how about a launch discount?) Or subscribe for free but hitting this button.

But to give everyone an idea of what you will get….

Normally, you will get three to five articles per week. That goes from new picks, earnings analyses, quality score updates and valuation updates to articles when something unexpected happens (think CrowdStrike outage, Japanese carry trade day etc), the Overview Of The Week, the Best Buys Now every month and much more. And a part of that ‘much more’ are the additions to my real-money portfolio. You will not only get all of the stocks, but also why I bought those stocks.

Today, I added to 7 positions in my portfolio and I started one new position. That new position is shared in this article. It shows you a part of what I sent to my paid subscribers at Potential Multibaggers and what you will also get if you become a paying member to Multibagger Nuggets.

Don’t worry, though, if you are a free subscriber here. You will always get value. Instead of 3 to 5 articles, you can expect maybe one article per week. Something like this, maybe, where I don’t share everything, but still valuable (I hope).

But let’s cut the promo talk and get to the portfolio.

The Anouncement

This morning, I saw this announcement.

That made me buy two stocks: ASML (ASML) and TSMC (TSM). Well, I should not exaggerate this statement. I would have bought ASML without this anyway, but I doubted between 1 and 2 shares. As you could hear on their last earnings call, the company is not doing great because the downcycle in 'legacy' chips lasts longer than anyone expected. But AI compensated for that to a big extent. That's why ASML was my biggest addition.

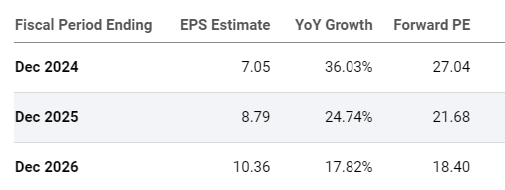

If you look at the forward PEG, so the forward PE divided by the expected growth, you see that the stock is already quite cheap here.

A 2025 PEG of 1, a 2026 PEG of 0.85 and a 2027 PEG of 0.78? Count me in!

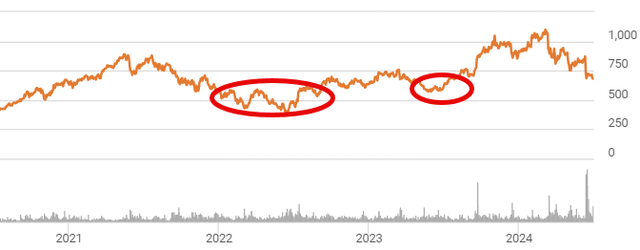

I bought a lot of ASML shares when the stock was in the $400s and also when it was in the low $600s and high $500s.

To me, the current price looks like another gift from the market to load up shares from this wonderful company. And, as a reminder, it's the only company that can make the highest-end EUV machines. They are called High NA EUV, short for High Numerical Aperture Extreme Ultraviolet. You can see one here.

ASML has a 100% monopoly in that market and that won't change anytime soon. This machine is so complicated that

That's exactly what the announcement was about, that TSMC will receive the first this year. They are the second after Intel received them earlier this year.

'Standard' EUV machines cost $181M per unit. ASML's high-NA EUV machines cost between $290M & $362M per piece. In 2030, ASML plans to launch Hyper-NA EUV. That is expected to cost around $725 million per machine. No other company is even close to getting to the High NA EUV Machines and once they are, probably even after 2030, ASML will already have a new generation ready. That's the power of ASML.

For two weeks, already, I had been pondering if I would add TSMC to the portfolio. That's also what inspired this tweet earlier this week.

Chart: Finchat

I decided to do it and start a position in TSMC (TSM). If you look at the high-end chips, the ones that power the ongoing AI revolution, they are all made by TMSC. It's the only chip maker that can make them. Samsung might be licensed by Nvidia next year, but that's still uncertain and even if they would be, TSMC is way ahead, especially with ASML's High NA EUV machines in their factories. Now, don't get me wrong, these machines are no plug-and-play and it will take a year before they are fully functional, but Samsung will be later no matter what.

Also, I think TSMC is still quite fairly priced, despite the 123% gains over the last year.

I know, you will hear bears say that we are at the top of the chip cycle, but this is my reaction to that.

If you listen to producers like Nvidia, TSMC, ASML, customers like Tesla, X, Microsoft, Google, Meta, Amazon and observers like Cloudflare and The Trade Desk, you come to one conclusion: we haven't seen anything yet. And TSM will be the manufacturer of the chips that power this revolution we all see under our very eyes.

Masayoshi Son, Softbank's visionary founder and CEO, said this week that there would be needed $9 trillion in capex for the AI revolution. He thinks that by 2035 artificial "superintelligence" could be there. He calculates it will be 10,000 times more powerful than the human brain. However, there has to be an investment to buy more than 200 million GPU processors to achieve this. He says that if this would even add just 5% to GDP, that $9 trillion in spending would be earned back in just 2 years.

If this is even remotely true and with TSM's near-monopoly in manufacturing these high-end chips, there's a ton of upside left.

Of course, there's the geopolitical risk that China might invade Taiwan, but the US wouldn't let that happen. Also, TSM is building out its infrastructure in the US as fast as it can to diversify this risk. By the way, that was also Buffett's reason to sell his TSM position, geopolitical risk.

It is a risk for sure and that's why my ASML position will be higher than my TSM position. Suppose it happens, then ASML can destroy the high-end machines with an emergency button operated from its headquarters in The Netherlands. That would mean that TSM would need new machines, which would give ASML another boost in orders. So, in a way, ASML is my hedge against TSMC's geopolitical risk.

In the meantime, keep growing!

Well done Kris 👏

Both are great and still below fair price 🙌