The Trump Impact on Tech Stocks

The impact on Tesla, Enphase, SolarEdge, The Trade Desk, CrowdStrike, Cloudflare, Datadog, Upstart, Adyen, Mercado Libre, Nu Holdings, Sea, Shopify, ASML Holding, Nvidia, and Amazon.

Hi friends

Unless you followed some esoteric no-media training program in the last two days, you will have heard by now that Donald Trump has been elected as the new President of the United States of America.

Before we go any further, I want to share a single but clear rule: Please do not give purely political opinions in the comments. They will be removed. Any disdain or disrespect for opposing views from one side or the other will be deleted, no matter how interesting the rest of the comment is. Politics have become too much of a dividing subject matter. Let's unite, not divide, OK?

Having said that, I wanted to look at some tech stocks to see what the implications could be of a new Trump administration. Mind that word 'could,' as nothing is certain, as usual in investing. We can only make educated guesses and draw the lines into the future.

Tesla

Of course, Tesla (TSLA) is the one stock that is probably most associated with Trump after his own stock DJT, which I would absolutely avoid because of its poor quality.

Many scratched their head at why Musk supported Trump when the Democrats are associated with the EV subsidies that have benefitted Tesla so much throughout the years.

But yesterday, Tesla's stock jumped almost 15%.

Of course, this has to do with the Trump - Musk association, and there's probably some relief there. As Musk said himself, if Harris won, he'd be, in his own words, "f*cked."

But there's more substance to this than just relief. Tesla could benefit from less regulation for its full self-driving or FSD.

On top of that, while the Trump administration may reduce EV incentives, that could turn out to be an advantage for Tesla. As the first mover in the EV market, it has a much larger war chest than all its competitors. That means much of the competition could be eliminated because of tougher circumstances, which would benefit Tesla.

There are not only benefits, though. A trade war with China could be bad for Tesla. On the one hand, it could hurt a competitor like BYD, but China is also an important market for Tesla. Moreover, its Shanghai factory is essential for Tesla's global sales. A real escalation could hurt Tesla's supply chain and close or hinder a big market.

Of course, there's also always the danger of Musk getting spread too thin if he really takes on a role in what he calls DOGE (Department Of Government Efficiency). But that has been a risk for years from a man leading Tesla, SpaceX, Neuralink, X, The Boring Company, and I probably forget a few.

Enphase & SolarEdge

Enphase (ENPH) was down 16.82% yesterday.

I think that says enough, right?

Enphase Energy is likely to see considerable challenges under Trump. He is, with an understatement, not directly supporting green energy solutions. If the federal support for clean energy is rolled back, there may be even more pressure on the stock.

An overview of the benefits Enphase has benefitted from:

Production tax credits

IRA's clean energy incentives,

Domestic content adders for its microinverters.

Together, they have contributed significantly to Enphase's finances.

Enphase's competitor SolarEdge (SEDG) had an even worse day. It was down 22% today. And then it reported its earnings, causing the stock to drop another 21%.

SolarEdge is an Israeli company, which means there's also the potential for tariffs on top of the subsidy cuts. That's why the stock dropped more.

The Trade Desk

The Trade Desk (TTD) was up more than 4% yesterday.

That's because the market thinks it could benefit from a Trump administration. There are three main reasons here:

Corporate tax cuts could mean more ads.

It's well-known that Alphabet (GOOGL) (GOOG) is seen as a liberal company, and it could be under even more scrutiny under Trump.

Meta's (META) Mark Zuckerberg was first seen on the Democratic side, but he has recently been positive about Trump. We don't know how if that was strategic or not, but he will probably not have convinced Trump. Don't forget that Musk and Zuckerberg are also not best friends, as they decided to fight it out in the boxing ring. Although that never happened, it may be an extra reason for the Trump administration to look into Meta's practices.

Meta and Google are The Trade Desk's biggest competitors. If there's more regulatory pressure on them, that could benefit The Trade Desk.

CrowdStrike, Cloudflare, Datadog

These two could benefit from a Trump administration spending more on national security. Trump has said he would strengthen cybersecurity efforts. In 2018, Trump signed the first national cybersecurity strategy in 15 years.

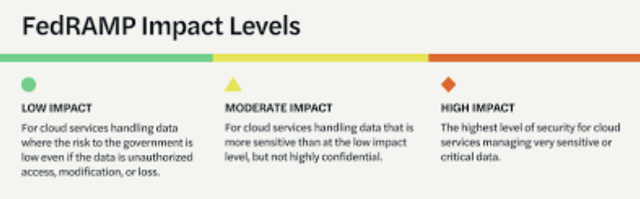

Of course, there was also controversy around CrowdStrike (CRWD) in 2019, when Trump spread a conspiracy theory about CrowdStrike and Ukraine, but overall, I think the company is too important and too good to be ignored. CrowdStrike has also achieved a FedRAMP High-Impact Level, more specifically level 4, meaning it can handle all the most sensitive data that is not classified. FedRAMP stands for Federal Risk and Authorization Management Program.

Cloudflare (NET) has profiled itself as the protector of safe elections, so that can be an advantage for government contracts.

Cloudflare has FedRAMP level moderate, but CEO Matthew Prince often stresses on conference calls that this already brings in quite a few big customers.

Datadog (DDOG) is also at level moderate, but since the end of 2023, the company has been in the process of applying for high levels, level 4 and even 5 (classified). If you wouldn't know, it's common for this to take a year and a half to two years, so no worries about that already taking a full year.

Upstart

Upstart's (UPST) stock was up considerably.

Upstart could benefit from less strict regulatory oversight under Trump’s administration. In that sense, I can understand the rise.

On the other hand, 16 Nobel Prize winners in economy warned in June that tariffs could fire up inflation and we have seen what inflation can do to Upstart's results and, consequently, its stock price. But are these economists politically motivated or not? That's a tough question nobody can answer objectively.

The question is also that if it's true what the Nobel Prize winners say, and what the biggest impact will be. But it's not that I only see advantages for Upstart. One of the few that I don't fully agree with the stock price movement, although the next one is another one.

Adyen

The stock was down 3.27% yesterday. It’s down more today, but that’s on a business update, not the election.

I don't see too many positives or negatives for Adyen (ADYEY), though. I think there might have been some impact because the company is Dutch, but don't forget that Adyen has an American banking license and that can't just be taken away.

I don't think Adyen will see too much pressure. On the contrary, if the regulation is softened a bit, security will become even more important, and that's Adyen's strong suit.

Also, North America is the company's strongest growth area for Adyen and that could bring currency tailwinds, as it reports in euros. Now, of course, you never know what currencies do, but today, there was a jump in the dollar versus the euro. And more about currencies...

Mercado Libre, Nu Holdings, And SEA

Mercado Libre (MELI) and Nu Holdings (NU) are Latin American companies operating in Latin America, so in that sense, there will be little to no impact. The only headwind can be a stronger dollar. As they both earn their revenue in local currencies and report in dollars, this could bring down their revenue somewhat. Both are hedged, but there's always impact.

Sea (SE) has about the same thing. It doesn't operate in the US. If there were a Chinese-American trade war, the company could maybe profit a bit by not having to pay Chinese counterattack tariffs. That might be enough to offset the headwind of a stronger dollar.

Shopify

Shopify (SHOP) operates from Canada, but of course, there are many American customers. And quite a few are dropshippers. These order in China and then sell in the US at marked-up prices. If there are tariffs, this could impact dropshipping.

In 2021, Shopify also permanently banned Trump's official online stores, citing policy violations related to promoting violence. So, that may make Trump want to take revenge.

On the other hand, if there are rules that support SMBs (small and medium-sized businesses), that could be a boost for Shopify's merchants and, as a consequence, for Shopify.

So, there's a bit more risk to Shopify, but I don't worry too much for now. Wait and see.

ASML Holding

ASML (ASML) was down but not too much.

I understand this. The market probably thinks there could be tariffs on TSM chips, which could make TSM hesitate to buy more of ASML's expensive High NA EUV machines.

On the other hand, domestic semiconductor companies could benefit from tariffs, and this could help Intel order more from ASML. TSM is already building in Phoenix, Arizona. While this is a big production facility, it will only be able to handle about 4% of TSM's total capacity. With the risk of an invasion from China in Taiwan and the tariffs, TSM may start building much more capacity in the US, and that would benefit ASML over the mid-long term.

Nvidia

Nvidia (NVDA) was up yesterday, about 4%.

With more spending on defense, AI investments would probably shoot up, and needless to say, that would benefit Nvidia. On the other hand, China is important in Nvidia's supply chain and tariffs on TSM chips could impact Nvidia.

Amazon

Historically, Amazon (AMZN) has faced quite some criticism from Trump. He threatened to jack up the U.S. Postal Service prices, which would be a headwind for Amazon. At the same time, AWS is Amazon's biggest business now.

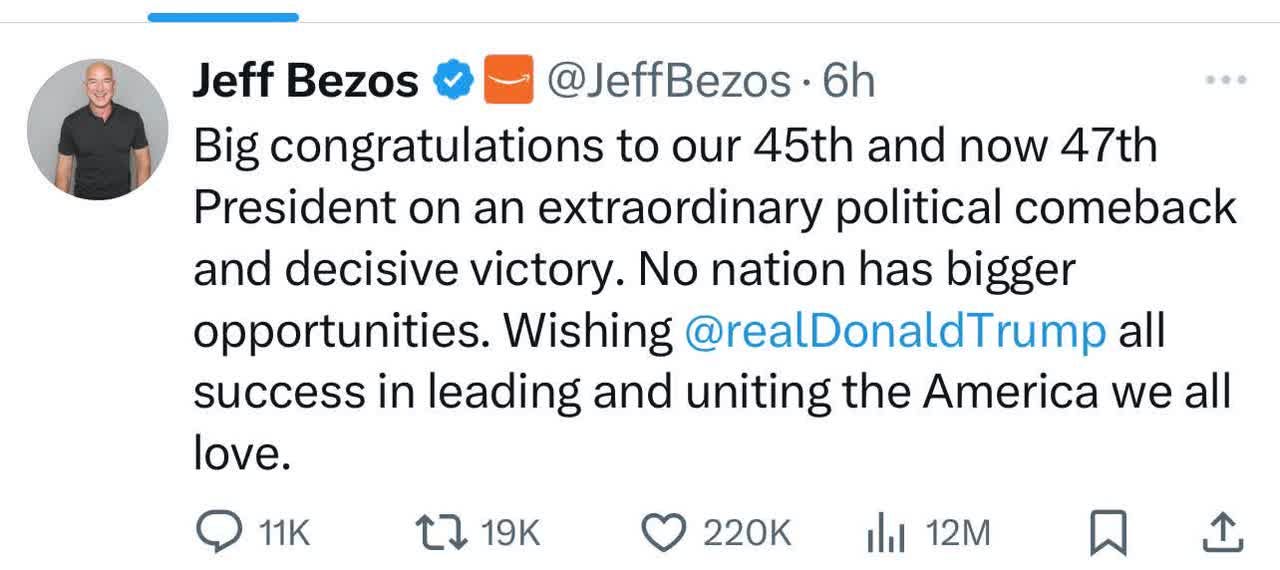

It was remarkable that Jeff Bezos decided to let the Washington Post (which he owns) not take sides in the campaign. And today, he tweeted this:

All in all, I think there could be some headwinds, but probably not too much.

Conclusion

In this article, I only give my opinion on the potential impact. The future is inherently impossible to know. There are certain indications, but those could prove to be false.

But I wanted to provide my opinion, as some Multis were worried about certain stocks. There's only one that I can see potential red flags, and that is Enphase. I might consider selling it, but first, I'll try to calculate the impact of the potential subsidy cuts.

There might be little shifts, but with the potential exception of green energy stocks, I don't really see big landslides for the companies discussed in this article. There are some negatives and some positives for most companies.

I think the best conclusion is this graph.

In other words, don't mingle your investing with politics. The market does what it does regardless of which party provides the President.

In the meantime, keep growing!

Thanks!

Fantastic read!