Hi Multis

As you probably know, there has been a short report on TransMedics (TMDX).

Scorpion Capital honored the first part of its name and it injected venomous poison into TransMedics with a short report that's a whopping 342 pages. It took me a whole week to finish reading it (with my other work, of course).

But I also wanted to write about everything, so you can judge for yourself. I was too ambitious, though, as this is a ton of work. After all, Scorpion Capital claims to have worked 6 months on its report. Short sellers often claim long periods of research and writing because it elevates their credibility. They know this and I often have suspicions of exaggeration when I see the reports. But in this case, I believe it. That's why it was probably a bit over-ambitious of me to want to address the whole short report in one week. This is the second week I've been working on it and this is just the first part of the assessment of the short report.

This is how the title page looks.

Scorpion Capital also filed a Citizen Petition at the FDA (Food and Drug Administration) to suspend TransMedics' OCS approval.

The petition is based on alleged off-label usage, safety concerns, and questionable business practices by TransMedics.

As you can see, the language is overly dramatic, like most short reports. Don't forget that these short sellers have taken a position before they release the report. The more they can scare investors, the more money they make.

I always think of my idol Charlie Munger when I see such situations.

But that doesn't mean all short reports should be put away like this. After all, the most convincing short report is the one that's true.

Scorpion Capital

I had never heard of Scorpion Capital before this TransMedics Short report. When I went on their site to look, I was not impressed by their track record. They had some successes shorting stocks in 2021, when many stocks were hyped up, but even there, they didn't uncover "frauds" as they claim. Just look at some of the stocks they shorted and the headlines.

They had success with Ginko Bioworks (DNA), but there too, it was just one of the many SPACs that failed. Nevro was another one of their successes. That's why they put out this tweet, uhm X post.

I find this a weak argument. Even today, four years after Scorpion's short report, the company is not profitable, which you can't say about TransMedics. So, this is totally different and looks like cherry-picking.

The Short Report

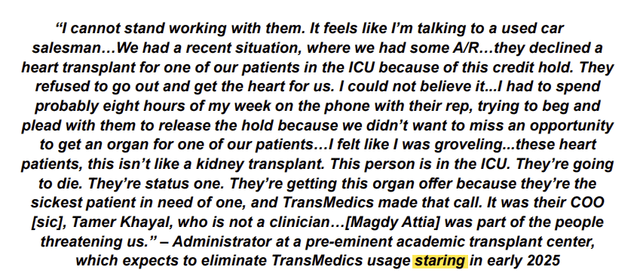

The short report starts with certain quotes to immediately put the company in a negative light. This is an example.

I highlighted the spelling mistake, which shows some sloppiness. But I have that too sometimes, so it's a weak argument. Still, it's immediately at the beginning.

The quotes work well for the effect they are used for: creating negativity. Are they true or not? We don't know, as all sources are anonymous.

Then there's some sort of foreword that attacks the company vehemently from the start:

In 20 years of shorting, TransMedics is the most extreme and grotesque healthcare fraud we have encountered, not only for its scale, but because it is predicated on the exploitation of the most vulnerable patients – the terminally ill, desperate for an organ.

The “lucky” patients who receive a diseased, damaged organ rejected by reputable surgeons and centers – the type that TransMedics NOP service traffics in and flings off-label onto its rig – or ones with dead, necrotic tissue after rotting on the device, are oblivious to the cesspool of perverse, secret incentives that steered the organ their way.

The tone is set. Frontal attack mode.

The problem is that Scorpion uses this for almost all of its short reports and that makes its credibility low.

Of one thing, I'm pretty certain. TransMedics is NOT the biggest healthcare fraud ever. I mean, ever heard of Theranos? This is a preposterous and laughable statement. TransMedics is a profitable company that has proven it can do what it claims to do. This type of statement is only meant for extra association effect.

There are many more in this short report. "Mafia-Style," "Organ Trafficking," "death spiral" and many other examples of horrifying words are there only to influence the reader. The inflammatory language is designed to evoke an emotional reaction.

The same can be said about the price target of $0. This is a profitable company, not some sort of castle-in-the-sky company that dreams of big things that are out of its reach.

The whole report is not a great read, and it's very unnuanced, as you can expect from a short seller who can benefit from a drop in the stock price.

There's also a lot of manipulation. An example:

If Medicare will reimburse any and all organ acquisition charges, and you’re already selling $70-90K disposable kits for your rig, why not look for other ways to run up the tab? TransMedics thus rolled out its National OCS Program (“NOP”) in 2022 – its end-to-end organ procurement and transport service.

(...)

The CEO on a 2023 call: “This is a fact of organ transplant. All aviation and logistics transport are fully reimbursed through the same mechanism of organ acquisition…there’s no limit…there is no limit.”

This makes Waleed Hassanein sound as if he's consciously misleading the system. But what did he actually say (with context)?

This is totally different, right? On top of that, as you can see from the transcript, it was not "the CEO" who said this but CFO Stephen Gordon. The report is full of those types of mistakes and misleading "evidence."

But again, let's not swipe everything under the rug because of the short seller bias. After all, we have to admit that as shareholders, we also have a bias, albeit the opposite one.

Let's go over the most important points one by one.

The claims in the report (part 1)

There are a ton of claims in the short report. That's why I can't cover everything in one article. Even this article is already a long one. And there are more accusations to research, there's the answer of TransMedics and the final verdict. So, let's start with 11 accusations.

1. The CFO was fired:

Investors sense something is afoot, after a spate of recent bad news: a Q3 miss and startling drop in sequential revenue; the CFO fired a month later, after a 10-year tenure; a disastrous Dec investor day and 2025 guide – backhalf weighted, naturally.

The CFO was not "fired." This is what TransMedics wrote when the CFO transition was announced:

The appointment is to help the company during its next wave of growth, with Hernandez focusing on operational excellence and margin improvements, while Gordon continues to assist in more strategic functions with the organization.

That's quite vague business talk, but during the Piper Sandler Healthcare Conference, TransMedics added color here. Stephen Gordon, the previous CFO, would be involved in lobbying in Washington, which is, indeed, key to the next round of growth.

This is what Waleed Hassanein, founder and CEO of TransMedics said about Stephen Gordon:

Stephen, his depth of knowledge of TransMedics business and his ability to articulate the value of TransMedics and NOP (National OCS Program, the end-to-end service including transport, added by Kris) and OCS is critical. And we are going to work together on our strategic initiatives of educating the national stakeholdership in organ transplant in Washington, D.C., and we need that I need that bandwidth. And there’s only 3 members of our team that could do that. It’s myself, Steven and Tamar.

So we want Tamar to focus on the growth. Steven and I will focus on national stakeholder outreach for 2025 and beyond.

Either Scorpion knows this and hides this (which is awful) or they don't know this and that means they didn't do their job properly (which also reflects bad on the whole short report).

We're only at the beginning, and Scorpion is either uninformed or hiding the truth on purpose. If you read the rest of the report, I'm convinced it is the latter.

Let's go through some other points.

2. A lot of customers are "pissed off" and are leaving in droves.

Here's a quote to summarize this:

UCSF, Massachusetts General, UCSD, and Cedars-Sinai are just a partial set of the large, current customers we spoke with who are on the verge of fleeing - all of it, we believe, yet to reflect in the coming quarters. With Vanderbilt gone and UCSF/MGH next – three of the top centers in the US and globally, by case volumes and influence – it is game, set, match. Per their figures, these four alone - just as a vignette of the field - use 255 OCS Liver units per year, which we peg as ~10% of TMDX total product revenue.

Here, I would argue that the proof of the pudding will be in the eating. If TransMedics keeps missing targets, it could be that it loses customers indeed. We should be able to see that in the next three quarters of which the numbers are announced: Q4 2024, Q1 2025 and Q2 2025. It's something I will pay attention to, of course.

That's also why I came up with this Selling Rule for TransMedics (I'll share them all near the end of this article).

3. The concept is not new

The concept as well as the “intellectual property” for TransMedics perfusion system have been around since the 1930’s – a plastic bucket, some tubing, a little pump, a heater, and a novel therapeutic solution called “PlasmaLyte perfusate,” which we realized after an exhausting 30 seconds of research is an electrolyte brand sold online by Baxter, the same as Gatorade or Pedialyte, jacked up to $400 for the IV drip bag.

Well, guess what? Electric vehicles are not a new concept either, and they even predate the 1930s. So, we should probably all short Tesla now?

4. It's a commodity

This is one of the more worrying passages for me as an investor.

I think these represent some real risks for TransMedics. The price is indeed higher than the alternatives and with Elon and Vivek running DOGE (the Department Of Government Efficiency) costs will probably be more of scrutinized in general.

Scorpion Capital continues:

The problem for TransMedics is that its monopoly position was fleeting. Cheaper, better pumps and preservation devices have been approved, with a second wave in the FDA queue.

But this is a hard one to untangle. Typically, in such situations, you look at gross margins. Lower gross margins indicate more competition. But these are now heavily influenced by TransMedics' airplanes. If multiple airplanes are in maintenance, TransMedics uses third-party transport partners, which influences gross margins negatively.

For now, I only know of one similar device, and it's Metra's Organ Ox, FDA approved in 2021 for liver (and only for that). I initially thought this was only for the use in hospitals but from more research (thanks Multi Kasper for asking!) taught me that it's also used for transport.

Suddenly, painting OrganOx as a colossal competitor is not correct, as it is not a new player that suddenly challenges TransMedics. But it is a competitor, of course. It's an alternative for TransMedics and it's cheaper. If you look on a comparable basis (so including transport), OrganOx is seen as a little bit cheaper. Initially, I thought there was a big difference, as the report said there was an average price of $100K for TransMedics. But this is what Waleed Hassanein said in Q3 2023:

As far as the average, again, it's too early. It depends if you are flying, shorter distances, the average is somewhere between $25,000 to $30,000. If you're flying longer distances, it could go as high as $100,000. So, it's really -- it depends on what type of missions you're flying.

To take 'as high as $100,000' as the average price is just not fair. OrganOx is quite a bit cheaper if you combine it with ice transport, the old way, but not much cheaper when you use it for transport as well.

If the statement that several other potential competitors are in the line to be approved by the FDA is true, the competitive pressure could make TransMedics much less attractive indeed.

5. Nepotism

Scorpion Capital also accuses TransMedics from nepotism. It about giving certain people promotions, a high position, or other perks because they are family (or sometimes also used for very close friends). Waleed Ha

Waleed Hassanein's sister Amira is indeed responsible for the OCS Lung Program. But that has always been disclosed properly. On top of that, she's a doctor, not just a random family member. And it's not as if she gets an exuberant compensation:

Dr. Amira Hassanein, the sister of Dr. Waleed Hassanein, our President and Chief Executive Officer, is employed by us as Product Director for OCS Lung Program and reports to our Chief Commercial Officer.

Her compensation, including salary and bonus, earned in the fiscal year ended December 31, 2023 was $463,833, consistent with other employees at her level and responsibility. She also participated and currently participates in company benefit plans generally available to similarly situated employees.

Is employing family members a red flag? Not 100%, if they are competent. Kimbal Musk is on the Board of both Tesla and SpaceX and had several other roles. Is that a red flag? Not to me. So, this is not a smoking gun, especially if you look at her qualifications, her role in the company, and the compensation, which is in line with others from her level.

6. Guilty by association and racism

One of the tricks used a lot in the report is guilty by association. There are several elements to this. Let's try to untangle them.

As mentioned, we find that nepotism - of both the family and tribal variety - is an infrequent but reliable indicator of fraud.

This is wrong. Nepotism is only used for favoritism based on family or close personal relationships, not shared cultural or regional backgrounds. The 'tribal variety' is as wrong as it sounds. But let's go on.

TransMedics bears a striking similarity with Nevro (NVRO), a device company and Scorpion’s first report – both arefueled by a clique of high-volume users of Middle East background. We didn’t flag it then, given the sensitivity, but have no such hesitation now. Frauds are often based on ethnic networks, such as ponzi schemes – and sunshine is the best disinfectant.

Two sell-side TMDX analysts also covered NVRO. The stock has fallen 98% since our 2021 report, from $6B to $130MM market cap (0.3x sales). Nevro’s ex-CEO was of Middle East background.

Are you serious? Again, Nevro was and is a money-losing company, while TransMedics is already profitable. Secondly, Steve Jobs also had a Middle East background (he was adopted from Syria). Did that make him a con man as well? This is either racism or guilt by association. And the unsubstantiated claim that "frauds are often based on ethnic networks" makes this seem ever more racist. This stinks.

It also becomes laughable when Scorpion Capital reports that two sell-side analysts that covered NVRO also cover TMDX. Duh, that's how the industry operates. You have your specialty and that means you will cover 10 or 20 companies in medtech. This is a joke and makes Scorpion Capital look ridiculous. It's throwing things on the wall to see what sticks.

Another accusation of "guilty by association" is Sir Magdi Yacoub, another Egyptian doctor.

Egypt punches above its weight when it comes to organ transplants, and seems to export a large number of surgeons to the US and UK, who in the US seem to be rather heavy TransMedics users.

We suspect a surgeon named Sir Magdi Yacoub had a lot to do with it. Now 89, he moved to the UK after medical school in Cairo, becoming the UK’s most famous transplant surgeon. Yacoub is a flamboyant publicity hound, prone to photo ops with Royals and “daring” surgical stunts that earned him international condemnation.

Articles state he put a baboon’s heart into a child; did open-heart surgery on a terrorist; and did a heart transplant on a 10-day old infant, sparking global rebuke from surgeons. Predictably, when the press looked into why 29 infants allegedly died at his hospital, they reported that it had the second-worst outcomes in the UK – “the majority of the operations…are believed to have been carried out by the pioneering surgeon Sir Magdi Yacoub."

Then Scorpion establishes the link with TransMedics:

TMDX originally filed to go public in 2007. The S-1 listed Magdi Yacoub as a Board member. A few weeks ago in early December 2024, what we believe to the “inner circle” at TransMedics appears to have traveled to Cairo for the Egyptian Liver Transplant Society meeting.

That sounds scary, right? Again, this is fearmongering.

Sir Magdi Yacoub didn't get his title for nothing. He is a pioneer when it comes to transplants. If you check his Wikipedia page, you will find nothing but good things about him. The only controversy Scorpion Capital could find was a 1999 article in The Guardian that says that of 12 hospitals performing child transplants, the one where Yacoub did most transplants, called Harefield, had more failed procedures than all but one hospital. But The Guardian cites the reason why, which Scorpion fails to do:

"If the figures are correct, the higher mortality rate at Harefield during this time was almost certainly partly due to the fact that the Harefield team accepted children for treatment who were more profoundly sick, some of whom had been turned down by other hospitals."

Read Sir Magdi Yacoub's Wikipedia page to see if this looks like the shady butcher Scorpion tries to picture.

I have googled "Magdi Yacoub controversy" and other things and there's very little evidence that there is any "international condemnation" of Yacoub. This is defamation and this is pretty disgusting again.

There are numerous other insinuations. Some professors from two Egyptian universities were condemned for organ trafficking and immediately Scorpion says that these two universities are also the ones where a few of TransMedics' execs studied. Duh. How many universities specialized in organ transplants do you think Egypt has? 50?

Even Scorpion has to admit the wink is very weak here:

We allege no link to their alumni, but as short-sellers we take note - with a small asterisk - of origin stories from high-risk jurisdictions.

OK. So, you have nothing on this but you still want it to sound bad, that's all.

7. TransMedics can charge whatever it wants

This sentence summarizes this point clearly:

With no reimbursement limit, TransMedics has free reign for price gouging – and transplant centers just pass it on to the taxpayer.

Of course, price "gouging" is again very charged language. Is it true that TransMedics can charge what it wants and that is passed on to Medicare? To a big extent, that is the case, yes. Prices should be "reasonable," but that word is obviously undefined.

Besides the overly dramatic language again, Scorpion Capital could have identified a real risk here. If you think away the extreme language, this could be a real threat to the bull case.

The TransMedics bull case boils down to a simple hope: that the Medicare organ acquisition charge boondoggle continues - into perpetuity. In reality, the abuses it has spawned are too extreme to avoid scrutiny.

Scorpion Capital also insinuates that the Washington Post is working on an article about TransMedics in this context.

8. Misusing Its Monopoly

Scorpion says that TransMedics has a monopoly on its device and misuses it.

On Feb 21, 2024, Congressman Paul Gosar wrote CEO Waleed Hassanein a detailed letter alleging “anti-competitive business practices deployed by TransMedics” tantamount to its medical devices “being held hostage.”

So, let me get this clear. Earlier in the short report, Scorpion writes that TransMedics' OCS is completely unnecessary, as cold perfusion transport is "the golden standard" since the sixties and OCS is completely useless. But now, it says that TransMedics uses its monopoly to push out every other solution.

And then later in the short report (for those who really follow, p.310):

Surgeons indicated enormous pent-up demand for OrganOx

Next to OrganOx, there's also Paragonix, and both are eating TransMedics' cake, according to Scorpion. Now, what is it? Is there are Monopoly that TransMedics uses to price gouge or is its lunch eaten by competitors? It can't be both. Again, Scorpion just throws all the dirt it could possibly think of, even if the information contradicts each other.

Nevertheless, here too, we should not simply dismiss the short report. The letter Congress member Paul Gosar wrote points out a few things that could be worrying. (red line from Scorpion Capital, not mine)

If there were indeed minimum quota and prices were jacked up that much, it doesn't look good on TransMedics. But that $60K is not what you see as a typical cost at all for the disposable cassette.

On top of that, 5 days after the letter, Waleed Hassanein answered this letter clearly stating that:

The allegations of anticompetitive business practices are unfounded…none of these actions are practiced by TransMedics.

But Scorpion says the denial is false:

The allegations and key points in the letter were confirmed by numerous former employees, as well as by major transplant centers.

But the "evidence" given by Scorpion is weak here. Yes, TransMedics now also does transport and yes customers use it. Does TransMedics pressure hospitals to use their planes? Probably, that's what you would expect, right? But Scorpion Capital calls this racketeering. Again, very strong language, but one expects a bit more evidence here.

9. Pricing

Scorpion also says that TransMedics is unnecessarily expensive.

He estimated TransMedics charges about $8,000 per hour while his institution pays $4,500 for private charter; this underestimates the price discrepancy as TransMedics often sends multiple planes.

As another data point, the surgeon pointed to other third-party organ procurement services that do not tie their service to a device. As a result, their price is $20,000 to $35,000 including the jet versus $130-140,000 via TransMedics – “a much more reasonable price because it’s not associated” with a bundled device; “they’re not buying the jets…they’re using charters just like we use currently.”

To me, this is one of the main points of worry. If other solutions are much cheaper and as good as TransMedics, doctors will choose the more inexpensive solution. It's not simple to assess the technical part but up to now, I think TransMedics is superior. With TransMedics, donor organs are maintained in a living, functioning state, perfused with warm, oxygenated, and nutrient-enriched blood, which means the organs can be used for a longer period.

But this is a real risk for TransMedics.

10. Charging for unnecessary airplanes

Another accusation is that TransMedics charges for unnecessary airplanes. This quote summarizes the accusation more or less:

The OCS Specialist provided numerous examples of TransMedics flying in nonlocal procurement teams to Seattle when teams were already present at the local hub and with nothing to do. The specialist stated the company was secretive and that Seattle staff were not “given a reason” – “why are you flying a team from Texas or California when we have a full team of 10 people up here waiting to do cases?”; “it’s cheaper to send a local team…they are utilizing their aircraft to bill for the aircraft.”

You have to know that TransMedics has local centers, which you can see on this map.

The accusation is that they fly anyway, even if a local team is ready. That's definitely what you want to see, but is it true? There are only anonymous sources to talk about this.

11. Off-Label Usage

Scorpion Capital says the OCS devices are used for off-label usage. The first one is the comfort of doctors, who can do transplants by day because of the OCS.

I won't claim this won't happen, but often this will be because, well, doctors need sleep. You can't expect them to stay in the hospital 24/7. Maybe it also happens indeed for comfort, but that is not TransMedics' fault and it only demonstrates how much confidence doctors have in OCS.

The second type of misuse, claims Scorpion Capital is that high-risk organs on the device in violation of specific criteria on the FDA label. Scorpion claims that "almost every organ placed on the device" violates one or more of the criteria and is therefore off-label use.

The 3 most critical parameters are

1) the DCD donor is ≤55 years old;

2) ≤30 minutes of warm ischemic time; this is the time an organ remains in the body when it has no blood flow anymore.

3) ≤15% macrosteatotis; (I had to look this up. Macrosteatosis is the accumulation of triglycerides in the form of large lipid droplets that displace the nucleus to the cell periphery. In other words, it's a quality meter for the health of the organ.)

Scorpion claims that the device is used for donors older than 55, (often 60-70+ years, they claim), with warm ischemic times of more than 30 minutes (up to 2 hours, they claim) and macrosteatosis of more than 15% (up to 50%, they claim). Scorpion claims that about a third of the livers are contraindicated.

Scorpion also claims that there are regular malfunctions on the OCS and, as a consequence, bad livers.

The third accusation is that TransMedics' procurement surgeons are "reportedly" unlicensed in the U.S., and the technicians are poorly trained.

Scorpion Capital also launched a call for everyone working in the field to collect evidence about this.

It's very tough to assess these claims. There is no smoking gun, no convincing evidence.

Conclusion

This is not the definitive conclusion yet, as there is much more to cover, but up to now, I see a lot of accusations and no smoking gun. Some of the things that insiders say could be scary, but we don't really know if these things are true, as they are anonymous.

What worries me most, so far, is the pricing issue and the claim of the off-label usage, more specifically the conditions that are not met. If the second one is true, it would be bad for TransMedics. But in combination with the pricing issue, it could be devastating. What I mean is that if the technology still ends up in subpar quality of organs and on top of that TransMedics is also more expensive, it would be bad for the bull case.

So far, though, I'm not certain if that's true. That's why, for now, I do what so few in investing can: nothing.

In the meantime, keep growing!