The Trade Desk: ALL details

Summary

The Trade Desk reported strong Q4 2023 earnings, beating revenue expectations and experiencing significant growth in net income. The stock jumped.

This article explains everything The Trade does in all detail. It explains why UID2 is so crucial in the battle with Meta and Google and how it works, for example.

CTV is a big driver for The Trade Desk. We explain how in detail.

Kokai, Supply Path Optimization, and Shopper marketing are all incredible growth drivers for many more years.

How Jeff Green uses Shopify's "brilliant" Shop Pay experience as an example for The Trade Desk.

Hi friends!

This is an article that Karan wrote and I added a bit of info here and there, so this is a joint collaboration, with most of the work done by Karan. In case you didn’t know, Karan is one of the authors at Potential Multibaggers, my paid service on Seeking Alpha. He lives in Singapore, as you’ll see later in this article. This article is an example of what you get there. Not just one per week, but usually around 5, sometimes more.

For now, Multibagger Nuggets remains free if you read the articles immediately after their release. Make sure you subscribe, so you don’t miss these free articles.

First, let’s go back a few months. On November 9, 2023, TTD “shocked the market” by issuing conservative guidance and the stock price slid by 28% pre-market, before ending the day down 20%. It was a brutal sell-off and many a bear came out of the woodwork to talk about the impending doom of advertising and the fact that The Trade Desk was “so overvalued” that it seemed logical this had happened. One analyst lowered his price target from $96 to $68.

The stock slid specifically because “Guidance was conservative, though, with a forecast for Q4 revenue of "at least $580M," vs. Street expectations for over $611M (~25% growth).”

Kris issued an article with a clear title for the Multis, the subscribers to Potential Multibaggers: "No Reason To Panic." Each stock is rated on 17 criteria in Potential Multibaggers, updated after every quarter. In The Trade Desk’s Overall Quality Score update, the action was a shock (insert your favorite ironic emoji here). It went from a score of 91 to ... 91.

We jump three months forward. On February 16th, TTD reported revenue of $606 million, significantly beating their prior guide and almost matching the original expectations. Cue for the stock to shoot up 18% on the day.

Since November 8th (the day before the Q4 shocker), TTD is up almost 6%.

It's almost as if short-term price action doesn’t tell us much, huh? Or SNAP. For the love of all that is holy, please stop selling off TTD and Google every single time SNAP reports; it’s tiresome!

This is a direct quote from the SA News Article reporting on the quarter:

After the 4Q guide indicated growth stepping down to high-teens, we saw investors raise questions on fundamental growth drivers for 2024," analyst Ygal Arounian wrote. "While we still see the outperformance in the quarter as being driven by a return to a better macro since November, which has continued into 1Q, more than vindication of any questions around CTV CPM growth or the impact of cookie deprecation, management spent time on why it believes TTD is positioned well to manage a changing CTV landscape, and cookie-deprecation.

The analyst boosted his price target to $110.

I share this because it’s the same analyst who cut his price target from $96 to $68 in November. That’s how the cookie crumbles on Wall Street. In a span of 3 months, while the stock has moved 6%, the analyst adjusted their target from $96 to $68 to $110, which, hilariously, is outside of TTD’s actual trading range over the same period.

This game is hard, so I won’t beat up on the analyst except this as an opportunity to remind everyone – “Do not use short-term price action to judge how a company is doing.”

Now with that out of the way, we can focus on another excellent quarter from TTD, led by the crown prince of ad-tech himself, Jeff Green.

Historically, TTD has been amongst the fundamentally best-performing companies since it came public:

For what it’s worth, GAAP EPS was in line at $0.19, so no actual miss there on headline numbers.

This quarter was more of the same, of course, and in TTD's that's exactly what you want.

Q4 2023

Revenue: BEAT

Revenue of $606 million (+23.5% Y/Y) beats by $23.77 million.

EPS: BEAT

Q4 Non-GAAP EPS of $0.19 (in line)

Adjusted EBITDA:

$284 million, up 16%

Adjusted EBITDA margin was 17.6% in the fourth quarter of 2023, compared to 11.3% in the fourth quarter of 2022.

Net Income:

That led to a 37% gain in net income on a GAAP basis, and non-GAAP net income ticked up 9% to $207M.

Full Year 2023

Revenue

Revenue of 1.95 billion, up 23% YoY. Gross spend on the platform was at an all-time high of $9.6 Billion

Adjusted EBITDA:

~772 million

Guidance:

For Q1’24:

The Company expects revenues will be in the range of $478 million vs. the consensus of $452.27 million (beat)

Adjusted EBITDA $130 million

For FY 2024:

TTD doesn’t provide FY guidance

PowerPoint Presentation (seekingalpha.com)

A Quick Refresher on the Trade Desk Thesis:

Before we dive in, a quick refresher from Trade Desk, about who they are:

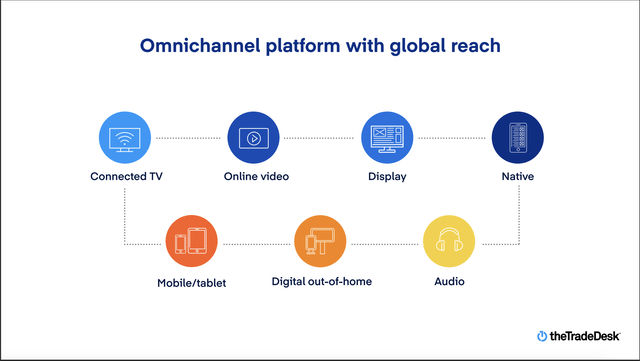

I find this important to keep in mind because it’s not well understood how ubiquitous ad space has become. Every device is a billboard, whether a phone, tablet, connected TV webpage or a podcast, digital billboards on the way to your work and so much more. Even the display space in your brick-and-mortar supermarket is now secretly digital and consumer brands can bid on that space. The Trade Desk enables advertisers to access all of them in a single platform.

So, if you’re an ad buyer working for your company or agency, you engage the Trade Desk to help coordinate all of your campaigns across channels you wish to reach and you get back an enormous dashboard of data on how you’re doing across those platforms.

TTD is not a one-trick pony. We see increasing adoption across the board, with virtually every major industry (in terms of ad spending) now contributing over 5% each to spending on the platform.

And diversified revenue base

From a scale channel perspective in Q4, video, which includes CTV, represented a mid-40s percentage share of our business and continues to grow as a percentage of our mix. Mobile represented a high 30s percentage share of spend during the quarter. Display represented a low double digit percent share of our business and audio represented around 5%.

Geographically, North America represented about 88% of spend and international represented about 12% of spend for the fourth quarter. It's worth noting, international growth again outpaced North America for the fourth quarter in a row. As I mentioned, CTV across international regions was particularly strong during the fourth quarter and throughout 2023.

It's crucial to identify an inflection point in your competitive environment and adapt to it, and Green is as good as it gets there. What does he think is going to happen next?

In general, the current shifts will help companies with authenticated users and traffic, which also sit next to large amount of advertiser demand. These macro changes hurt those, especially content owners and publishers who don't have authentication.

So this year, CTV and audio have big opportunities ahead, and the rest has pockets of winners and losers. But nearly everyone will be either better off or worse off. And I believe 2024 is a year of volatility for the global advertising market.

Fun times.

Update on UID

One of the things we always look at in the TTD earnings is understanding how the adoption of UID2 is going.

To quickly recap, UID2 is the alternative TTD developed to replace cookies: a new, open-source identity framework that lets companies securely convert identifiable customer information like email addresses and phone numbers into unique and anonymized IDs that can then be freely used within the ad ecosystem.

If you want to get a flavor of what it can do, TTD has a cool case study on how Singapore’s largest grocer, Fairprice, adopted UID. It did not occur to me until I saw this, that I have personally been served ads backed by UID2. I do 95% of my grocery shopping there and, yes, the prices are quite fair.

FairPrice Group drives results with Unified ID 2.0 | The Trade Desk

TTD had a slew of announcements around the adoption of UID: Dish, HP, Warner Bros - Discovery, Walmart Connect, all started working with UID. And:

NBCUniversal announced it is implementing UID2 on Peacock across all devices and consumer touchpoints, including on CTV, the web, apps and devices.

But TTD also developed EUID:

EUID, the European counterpart to UID2 specifically developed for the European market, is gaining support across Europe from brands, publishers, and retailers. Initial industry engagement includes Bacardi, Kimberly-Clark, Aller Media, Future, OneFootball, Prisma Media, Tesco and others.

Now this is great and all but how exactly does it help TTD? Or any of us, really? It’s an open-source standard meant to replace cookies. TTD doesn’t make any money from it, as they gave it away to an open-source organization after they developed it, so why bother?

Let’s take a step back. Cookies were invented as a shorthand way of identifying a user or session. When you visit a website, they want to know you’ve come before or where else you’ve been so they can figure out what ads to show you.

Ideally, they would know who you are, which is why every website on the planet now asks you to open an account with them. This has gone out of hand and cookies were a convenient shortcut to solve this problem.

But they are a privacy and security nightmare for obvious reasons and need to be phased out. Google has postponed the deprecation of cookies several times, as Green had predicted correctly, but the amount and type of cookies they allow via Chrome has dropped a ton. Since it’s the largest browser, it carries the most punch; Firefox and Safari already did it years ago. But without cookies, the business problem remains – how do you identify who is visiting your digital real estate, to figure out what they want?

Green helpfully shares an example:

A great example of this is the work that we're doing with HP. They initially started to think about new approaches to identity because of the imminent cookie deprecation in Chrome. But while the conversation started there, it quickly turned to how new identifiers, such as UID2, could help manage campaigns across all channels, especially channels with high levels of user authentication.

HP started using UID2 for CTV campaigns on Disney and Hulu, Disney being a notable and early adopter of UID2. HP started with their first-party data that consumers had consented to provide after making a purchase. That data was then matched with UID2s on our platform. As a result, HP segmented its audience into specific groups, allowing better targeting and measurement of specific product campaigns with more accuracy.

HP was then able to link ad exposure data from UID2 identifiers with the device registration data in its CDP to connect consumers with actual online conversions and sales. That measurement proved to be more effective than the multi-touch attribution model that HP had been using, according to Caitlin Nardi, their head of programmatic for North America.”

Cookies are legacy tech that will be phased out; it’s inevitable but what comes next? If we just remove all cookies blindly, we’re going back to TV days, blindly serving nonsensical ads everywhere to the highest bidder and pray someone clicks on them. Advertisers will always need to serve relevant ads to target customers and if cookies suddenly disappeared tomorrow, there would be no standard replacement or worse, advertisers would have to rely on a mix of proprietary algorithms from Apple, Google, Facebook, or Amazon, the largest custodians of personal data. That would further give pricing power to these monopolies and potentially disadvantage advertisers.

I apologize for the long quote but it is THE takeaway from the call in my opinion and is worth reading in full. Jeff Green explains it better than I could:

There is cookie deprecation, which is, Chrome is removing the use of third-party cookies, and they're doing that gradually. They introduced 1%, and that created a lot of discussion about it. But really, as an industry, so far, we -- beginning of the year, 35% of cookies were already gone because of Safari and Firefox, and now it's 36%, or something like that.

So it wasn't a dramatic move, but the fear that it's going to go from 36% to 100% removal has lots of people concerned. I think it even has Google concerned who's doing this because they fear that they're taking something away and they're not replacing it with anything, Which gives their engineers a very difficult dilemma. What do we replace it with? So what they're proposing to replace it with is this product called Privacy Sandbox. Now it's a series of different APIs. There's actually more products than just Privacy Sandbox, but everyone in our industry just talks about that umbrella of APIs as Privacy Sandbox.

I really believe that Google has missed an opportunity to build something better than this.

And:

Others have reported that declines in publisher CPMs in Chrome, where cookies have been deprecated, are around 30%. That's potentially devastating for publishers, of course.

CPM stands for cost per mille, which is what it costs for a 1,000 ad impression. Let's go back to the lecture of Professor Jeffrey Green:

Without either cookies or publisher authentication, advertisers won't value those ad impressions nearly as much. This is a wake-up call for publishers.

And the math is obvious. $1 CPM turns into $0.70 with cookie deprecation. We're often seeing $1 CPM turn into a $1.30 when UID2 is layered on it. So when publishers get to consider the contrast of $1.30 versus $0.70, the math is more obvious than ever. In some cases, they only recently started looking at the math when the dollar suddenly turned into $0.70. So 2024 has started off as a year of action for our industry.

Instead of creating their own standard and trying to compete, TTD instead adopted the classic playbook of open-sourcing a competitive alternative, which not only helps them define a viable alternative but is neutral, and, hence, there’s no risk to ad buyers from adopting it. Contrast this to Google's standard, which is not neutral at all. Many retailers are very afraid to give the data of their customers to Google. UID also positions TTD at the forefront of innovation in the space and a valuable voice in how the industry develops.

Yes, one could say TTD NEEDS UID2 to survive on the internet in the long term. If all the ads were to be served within Big Tech’s own platforms, there’s no real need for TTD, but precisely for that reason, advertisers need an open-source alternative - to prevent a splintering of the ad tech business into the walled gardens of big tech.

Just some context about cookies, as this is often misunderstood. Cookies are only used on the internet, which accounts for about 20% of The Trade Desk's revenue. The rest is revenue from mobile, connected TV, traditional TV, and all the other platforms we already mentioned earlier, all of which DON'T use cookies. Too many people think cookies are used for everything, but that's not correct; just for the internet.

Green and I clearly think about things the same way (the difference between us comes down to just a few zeros, really) (Walled gardens are mostly Meta and Google):

As I've said before, walled gardens are not an optimal competitive environment for the open Internet. And the open Internet will continue to challenge the walled gardens as the place where the very first advertising dollar is spent. Because for the most part, premium content is outside of the walled gardens, and all the questionable user-generated content is inside of the walled gardens, from cat videos to political rants to hate speech to cyber bullying.

Walled gardens simply use self-reported numbers in an increasingly opaque black box. Meanwhile, retail data and premium content are making the open Internet more compelling than ever. I predict this trend will accelerate during this year, which, of course, is an election year.”

Jeff Green has emphasized the opacity of the walled gardens several times in the past. In typical Jeff Green style, he often repeats that the walled gardens can "grade their own homework."

New Products & Innovation

TTD offered what is essentially their roadmap to keep growing for the foreseeable future.

With such an enormous TAM across these verticals, there is a strong possibility of double-digit growth for years to come, which is crucial from turning this from a great company into a multibagger.

On Kokai

Kokai represents a completely new way to understand and score the relevance of every ad impression across all channels.

It allows advertisers to use an audience-first approach to their campaigns, targeting their audiences wherever they are on the open internet.

Our AI optimizations, which are now distributed across the platform, help optimize every element of the ad purchase process. Kokai is now live and similar to Nxtwave and Solomar, it will scale over the next year. It's our largest platform overhaul in our company's history”

That sounded like a bunch of jargon to me but, thankfully, I sent an analyst on the call to clarify what that actually means. The answer:

So it's a little bit like if you were to make a hypothetical trade in a trading platform for equity, and then I'll tell you what we think is going to happen to the price action in the next 10 minutes. So we're showing them what the effects of their changes are going to be before they even make them. So that they don't make mistakes.

Because sometimes what happens is, people put out a campaign, they'll put tight restrictions on it, they'll hope that it spends and they come back a day or two or even three later and then realize they made it so difficult with their combination of targeting and pricing for us to buy anything that they didn't spend much money. Or the opposite, they spend more and it wasn't as effective as they wanted.

So helping them see all of that before they do anything helps. And then we put data and decisions next to each other in a better way than we ever have before.”

I think you can see the competitive advantage there.

On OpenPass

With a huge shoutout to another Potential Multibaggers favorite, Shopify!

So if you have ever used Shopify, I think that's the easiest way to understand it. I'm a big fan of Shopify, both the company and the product itself.

The first time you use Shopify, you go through a checkout process that feels just like any ordinary checkout process, you actually don't even necessarily see the value.

I actually think it was brilliant that Shopify, at least the way I experienced it, never took the time to explain what they were doing. I just experienced it. That was the fastest way to get people to adopt it was to get a few merchants to do it.

And then where you really see the beauty of their signup process is the second time you go to a merchant and you see Shopify there, and then you see how much faster the checkout process is.

And then if you're like me, you say, how did they do that? Where did they get the information? How is it secure? And then I'm literally putting together flow charts to understand how this worked and realize that both is faster and more secure than what I had before and it was just genius.

(...)

So that's exactly what we're doing with the SSO, which is we are trying to make it easier for people to sign on to websites. So the most lightweight, it's not joined with an email service. We're not launching something like Gmail. But instead, we've created this product that is OpenPass. We have a few publishers that have signed up during this invite-only beta.”

I love that entire sequence for so many reasons.

On international growth

We have made significant investments outside the US over the last few years in CTV and in retail media but also in our overall go-to-market strategy. Our business outside the US grew at a much faster pace than here in the US last year. We believe we are in a position to accelerate our international growth in many of the markets we serve.

I will skip to the 2 main topics Green spent time on – Connected TV and Retail

Connected TV:

Green had, unsurprisingly, a lot to say about the opportunity in CTV and why they are best placed to capitalize on it:

It is not a coincidence that our growth in 2023 was driven by ongoing strength in CTV and continued leadership through strong and expanding partnerships in retail and retail media.

In each of these markets, advertisers can really put data to work and drive precision because they have a greater sense of confidence and who they are actually reaching. In CTV and other emerging channels such as digital audio, there's a logged in authenticated user base. In retail media, our platform works with actual authenticated sales data. CTV continues to be the fastest growing channel at scale for The Trade Desk.

There's a ton of speculation right now about the future of the TV industry, but every major TV trend is good for us.”

With TTD present in over 90 million households and across 120 million CTV devices, the reach they have is, the technical term they use – HUGE.

Remember, CPM is “cost per mille,” the price paid per 1000 ad impressions.

What the above infographic shows is that the cost of ads on connected TV are higher, because it’s a controlled environment with a targeted group of individuals, which means the publisher can charge much more for the same space. As a consequence, because the cake is bigger, TTD's part will be bigger as well. But the benefit to the advertiser is manifold compared to normal TV because they have high confidence the ad is reaching the intended audience.

Let’s take an example. When the world watches the Superbowl on CBS, there are a limited set of ad slots that go for millions of dollars to millions of viewers. These are AWFUL ads from a conversion perspective because companies have no idea who’s seeing them or has changed the channel or kept the TV on mute while taking a break.

Contrast that with the ad you now see on Amazon Prime right before the episode starts – you’re focused and engaged, waiting to watch something, the streaming service knows exactly who you are (your are logged in), what you buy and can match your profile to the advertisers that want to reach you, who can then bid for the ad slot.

It’s a much more personalized and comprehensive experience and the Trade Desk is immensely bullish on this as a medium moving forward. Connected TV is sometimes 3–5x more expensive than a standard video placement, but the cost per completed view (CPCV) is almost always cheaper than the CPCV for video assets.

As Green says, regardless of the direction of travel, TTD is poised to benefit:

Linear is shrinking and users are streaming instead. We have built our business around streaming premium content. Subscriptions are moving to ad-funded models and both consumers and content owners want that.

As the industry oscillates back and forth from fragmentation to consolidation in all scenarios, we're partnering to provide demand from the biggest advertisers in the world.

But one thing is clear through all of this, ad-supported streaming is going to be an essential strategy for any successful TV provider moving forward. Nearly every major streamer has stated that they make more money from their ad-supported tiers than from their subscription only and was reported pretty extensively in recent weeks with the price of subscription models continuing to rise, consumer fatigue is settling in.”

This isn’t just about video streaming, but audio streaming as well. Think Spotify and Apple, who serve ads in the middle of podcasts, the TTD is there too:

Just like CTV, digital audio benefits from a highly authenticated, logged-in audience. Also, like CTV, digital audio listeners are highly leaned in. Advertisers have a captive audience that is engaged with quality, professional content. Whether it's a podcast or your favorite music, engagement is high.

And we're spending more and more time with audio streaming leaders in part because I believe they are in the very early innings of seeing the value of data driven advertising and about to set out on the journey that CTV companies began years ago.

Green believes all of the streaming players, whether audio or video, NEED ad-supported tiers or insertion not only to survive but grow profitably and he is attempting to position TTD to take advantage of this shift.

Retail Data Activation

Now we may have an image of TTD being present in our digital devices but it’s important to remember most of the biggest ad spenders exist and sell goods in the digital world. If you truly want to be a Big 3 ad player, you need to work with everyone.

TTD presented this slide during the deck about their efforts in improving retail media conversion,

To translate this, here are 2 small case studies they offered:

A great example of an advertiser leaning into retail media is Samsung in Canada. A large percentage of Samsung's device and appliance sales take place through carriers and retailers. In order to understand how advertising is influencing consumer purchases in those channels, they needed a way to unlock their first-party data and combine it with retail data.

Working with their agency, Starcom, we helped Samsung develop what they call the Samsung sales measurement tool on our platform. When buyers make a purchase, they are prompted to open an account with Samsung and opt in to marketing engagement. With the right permissions, Samsung can then look back through their marketing activations across masses of consumers and start to attribute campaign activities to different stages of the purchase funnel.

This helps Samsung be much more precise with their campaign activities looking forward. Working with us, they can attribute the effectiveness of marketing directly on sales 19 times more effectively than they were previously.

And another example:

One example of this is the work we're doing with Unilever in Thailand. They were looking to raise awareness for their new detergent product, as well as test new identifiers that could advance addressability in a post-cookie environment.

Using their own first-party data as a seed, they leveraged UID2 to target relevant audiences and measured against Unilever's traditional audience targeting methods. The results showed a marked improvement over these traditional methods, which include cookies across key areas of measurement such as click-through rate, brand awareness, and cost per completed view.

Interestingly, this work relied on UID2s created from encrypted phone numbers, which is a big part of the identity fabric in Asia. This UID2 work with Unilever is now expanding into additional markets in Southeast Asia.

This is great to see and important proof of concept that TTD’s innovations are bearing fruit across the board, both online and offline. Crucially, neither retail nor CTV ever relied on cookies to begin with, so this is genuine innovation being done to help these clients.

Industry Recognition

TTD had a number of notable wins during the quarter:

Institutional Investor Awards

Most Honored Company

Best CEO

Best Company Board

Best IR Program

Best IR Professional

Best IR Team

Best Analyst Day Digiday Video and TV Awards

Best TV/Streaming Ad Sales Product of the Year DigiZ Awards Hong Kong

Best Programmatic Advertising Platform Marketing Excellence Awards Singapore

Excellence in Data-Driven Marketing Gold

The Forrester Wave Omnichannel Demand-Side Platforms Leader Quadrant

Knowledge Solutions SPARK Matrix for Ad Tech

Technology Leader Stevie Awards for Customer Service Success

Bronze, Technology Industries Adweek 50 List

Ian Colley Ad Age 40 under 40 Award Winner

Jaime Nash Top Women in Media and AdTech Award Winners: Samantha Jacobson

Change-Maker, Catherine Patterson

Tech Trailblazer, Jaime Nash

Programmatic Storyteller Business Insider Rising Stars of AdTech - Ellen Mulryan, Sr. Dir. of Retail Data Partnerships

Fortune - Best Workplaces for Millennials

Fortune - Best Workplaces in Technology Institutional Investor 2023-2024

All-America Executive Team List - Jeff Green, Founder and CEO US News & World Report

Best Media Companies To Work For National Intern Day

Top 100 Internship Programs of 2023

Some companies aren’t great at celebrating success. TTD isn’t one of them. Most companies don't have that much to celebrate, of course.

Peer Group

I included this section because of the following quote from Green:

“The side of this that I'm really worried about though, is the publisher side. Again, we don't represent publishers directly. We represent the buy side.

But of course, we buy from all these publishers and we want to see an open Internet thrive. But I would say that 90% of publishers that have a meaningful amount of their traffic from browsers are not prepared at all.

And so you would see a rapid revaluing and you would see some struggle come as a result of Google accelerating cookies.

It could have a meaningful impact on the election in the sense that if people can't advertise on those sites effectively, then the prices would go down. And then it would change the way that they either generate content or even their ability to afford to continue to generate content on those journalistic outlets.

From Seeking Alpha’s peer group analysis, I am simply showing a snapshot of profitability to show that net income and revenue per employee as FCF margin are multiples of their competitors (not counting Google, of course). The joys of being a tech company leading the way.

Remember, Jeff expects all of these companies to suffer if Google follows through on the cookie elimination, something to watch carefully because weakness in some of these players may look like weakness in the sector and give us another sale down the line.

Shareholder Return

The Company repurchased approximately $220 million of its Class A common stock in the fourth quarter of 2023. The Company repurchased approximately $647 million of its Class A common stock in the year ended December 31, 2023, at an average repurchase price of $63.87. As of December 31, 2023, the Company had $53 million available and authorized for repurchases.

Given that’s below the current stock price, I hope they continue to use the buy back on pullbacks.

They also don’t intend to stop anytime soon:

The Trade Desk also announced an additional share repurchase authorization, bringing the total amount of authorized future repurchases to $700 million of its Class A common stock.

Just to make sure, The Trade Desk doesn't have any debt, generates free cash flow and has a powerhouse balance sheet. The buybacks are their way to deal with the below problem.

Stock-Based Compensation

“Stock-based compensation expense was $491 million, a smidge down from $498 million the previous year”

Remember these numbers are heavily skewed by the huge award granted to Jeff Green way back when so approx.. 198 million was Jeff Green’s award (out of 491), down from 262 million the previous year, which means compensation for other employees has gone up. This is still extremely high and does need to moderate though given Jeff’s entire financial future is tied to the company, for our sakes as well as his, we hope this works out.

Jeff Green got a big grant, 2 million shares because the stock had crossed $90 for more than 30 consecutive days. But it's a part of his compensation plan. He can get many more grants and as a shareholder, I would be very happy with this, as it would mean the stock price is up a lot, as you can see in this table.

If Jeff Green meets all those targets before 2031, when the plan expires, he will have received 16 million shares. Right now, there are 446.46 million shares outstanding. That means if Jeff Green gets all the remaining 14 million shares, that would mean a total dilution of 3.1%. For a 5x of the current stock price, I think that would be a small price to pay. So, don't let this distract you from the core investment thesis.

Balance Sheet

Cash, cash equivalents of approx. $895 million and no debt.

By the way, this chart is created with Finchat. I use it every day since I discovered it. If you follow this link, you can get a 25% discount.

I call this a sleep-well-at-night financial position. Very strong.

Summary

The Trade Desk is not a simple company to understand; it’s a true technology company marrying new innovations in an intensely competitive industry to deliver value to its clients.

Fortunately, they’re quite good at it, as shown by the tremendous growth in revenue, profitability and genuine innovation in the industry. Does Jeff Green worry about a slowdown? It’s an election year and an Olympic year. Watch the absolute firehose of ad dollars that are about to descend upon the world.

Customer Retention was 95%, similar to last 10 years. People who use the Trade Desk, really like using the Trade Desk.

As for me, I really like owning the stock of this business.

In the meantime, keep growing!

Disclosure: Kris is long TTD since May 27, 2019, at $19.59 (split-adjusted)

If you liked this article and would like more, see Kris’ portfolio, have a great group to chat with, direct access to Kris and much more, try out Potential Multibaggers. You get two weeks of free trial (yes, you see everything!) and if you decide to stay, you get a 20% discount. You have nothing to lose, so why not try, right?

👍🏼👍🏼👍🏼 thx!