The NU Analysis (The Perfect Weekend Read)

A banker and a financial blogger nerd out about NU.

Hi Multis

I know many of you have been waiting for this one, Karan’s analysis of the Nu Holdings (NU) earnings.

It even sparked this fun conversation in our Slack group.

So, let’s go to the analysis. For those who don’t know Karan yet, he is a banking insider working for one of the Big Four US banks. So, he’s perfectly placed to analyze Nu Holdings.

And let me tell you already, it will have been worth the waiting! This is the perfect weekend read.

The floor’s yours, Karan.

Alright, folks, it’s time to check in everyone’s least interesting bank, NU Holdings.

I would have said everyone’s least interesting Potential Multibaggers pick, but that title belongs to Kinsale. Why do I call it “least interesting bank”? Because it rarely gives us a reason to panic when it comes to fundamentals.

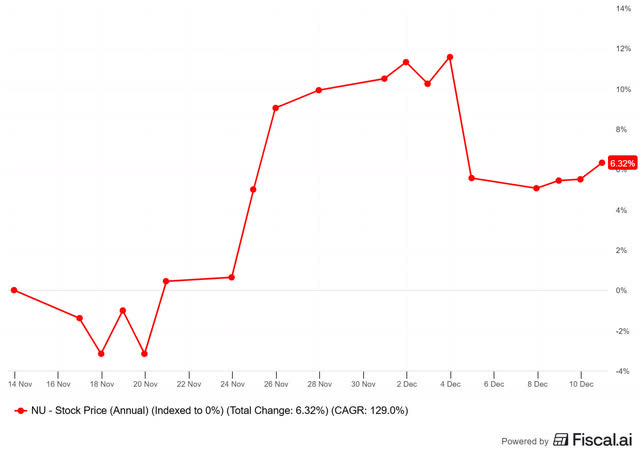

Now let me begin with a mea culpa. Kris first asked me to cover this name on 14th November, so there’s been a 2-week delay on my part because of life, etc.

Apologies for the delay, but the fault is entirely my own. Fortunately, the stock has been up since then. :-)

So just by delaying this article, the price has gone up, you’re welcome. But more crucially, we need to understand where this leaves the stock from a price vs value perspective.

Since we’ve covered NU at length for several years now, there’s already a solid foundation in place as to its key drivers, so here we will focus on the highlights to see if there are any red/yellow flags we should worry about, when it comes to:

Financial Performance (Revenue, Costs, Profitability)

Credit Performance

Future Growth Plans

After this, Kris will amend his Quality and Valuation Scores so you can get a sense of how attractive the stock is right now. So, let’s get into it.

Financial Performance

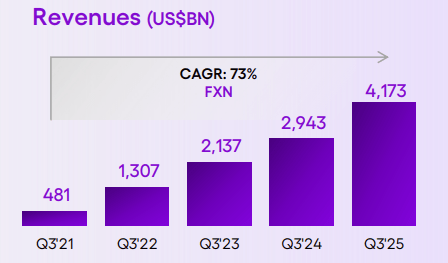

Revenue: $4.17 billion, up 41.8% YoY, which was a beat by $130 million. That’s 3.2%.

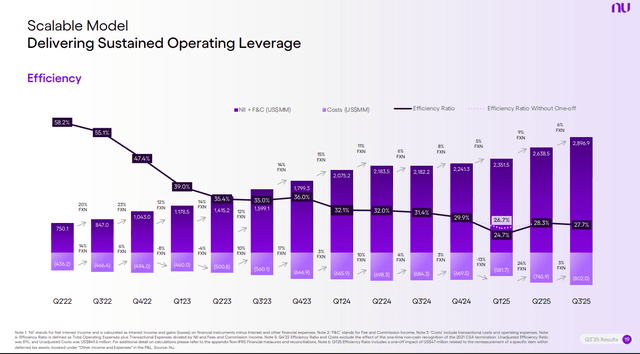

Costs: Operating expenses climbed to 697.1 million (up from 667.6M in the previous quarter). I couldn’t find any specific management commentary around this either in the ER or the earnings call, but given that we have overall efficiency and return metrics climbing, the important thing to note is that these are growing slower than revenue, so NU is clearly showing operating leverage, as we will see.

Other Key Metrics of Note:

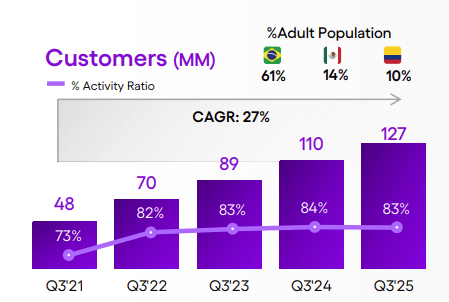

Total customers now stand at around 127 million, with 4.3 million new additions (representing growth of 3.5% Q/Q and 16% Y/Y), and the activity rate remains at 83%.

This breakdown is spread across Brazil (110 million, 60% of adults), Mexico (13 million, 14% of adults) & Colombia (4 million, 10% of adults)

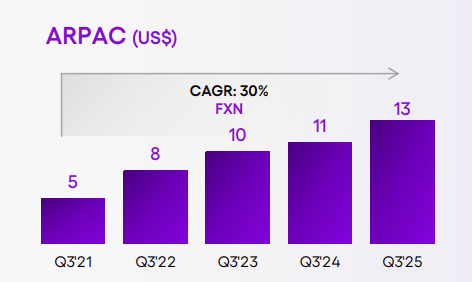

Monthly average revenue per active customer of $13.4 increased from $12.2 in the previous quarter and $11.2 in the year-ago quarter.

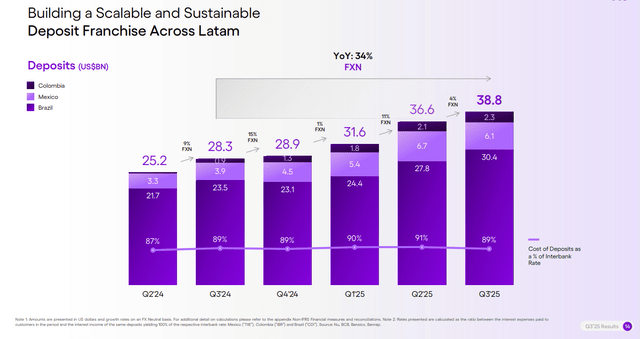

Deposits increased 48% YoY FXN to $38.8 billion

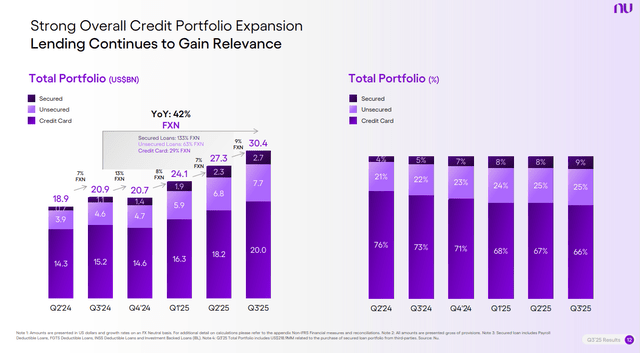

Total receivables across Nu’s credit card and loan portfolios expanded 40% YoY FXN and 8% quarter-over-quarter FXN to $30.4 billion, while its total Interest-Earning Portfolio increased 62% YoY FXN to $13.8 billion on March 31, 2025.

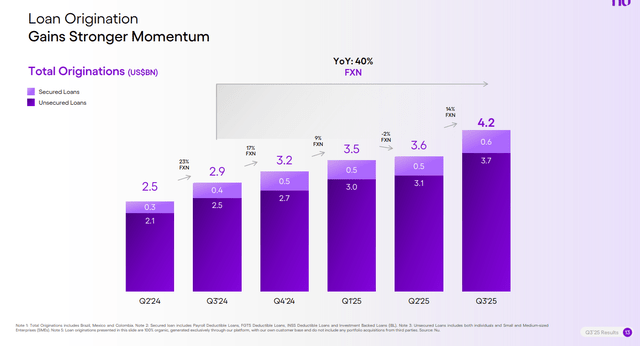

Purchase volume (so all the money transacting on the platform) increased to $36.5B (vs. the Visible Alpha consensus of $35.8B), from $33.3B in the previous quarter. Total originations (new money flowing in) grew to $4.2B from $3.6B in Q2 and $2.9B in last year’s Q3.

Honestly, all good news here and signs of healthy growth everywhere across both assets and liabilities

Profitability

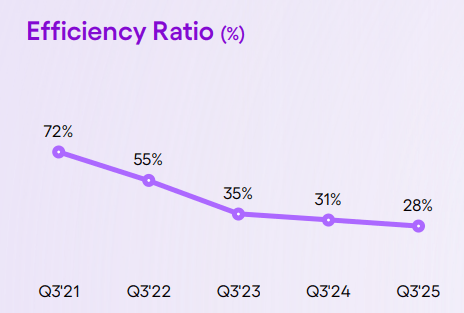

The efficiency ratio improved to an outstanding 27.7%%.

The efficiency ratio in banking measures how much a bank spends to generate one dollar of revenue. You can calculate it like this: Operating expenses ÷ Net revenue. So, you understand: the lower, the better.

Excluding a one-off impact related to deferred tax assets, the efficiency ratio would be an impressive 26.7%. As a reminder, an efficiency ratio below 60% is world-class. Nu is twice as good as the definition of World Class.

Other key metrics:

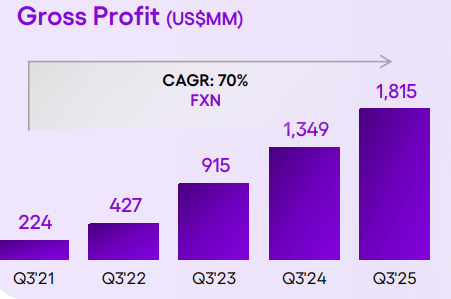

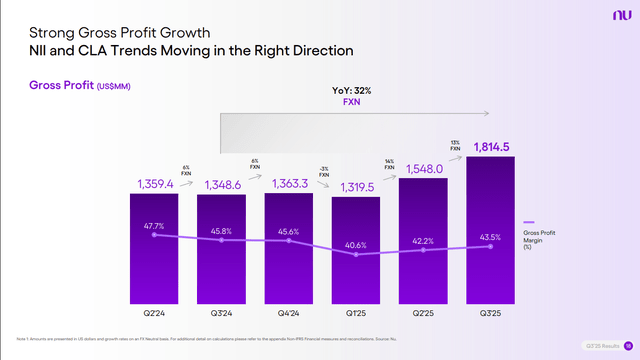

Gross Profit - $1.8 billion, down 3% sequentially but up 32% YoY FXN.

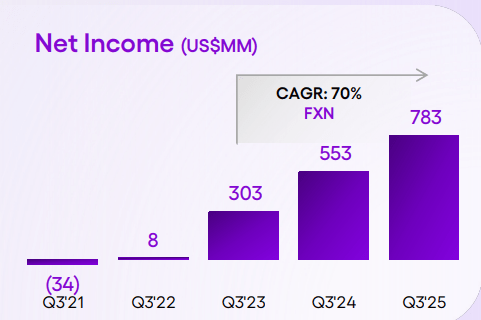

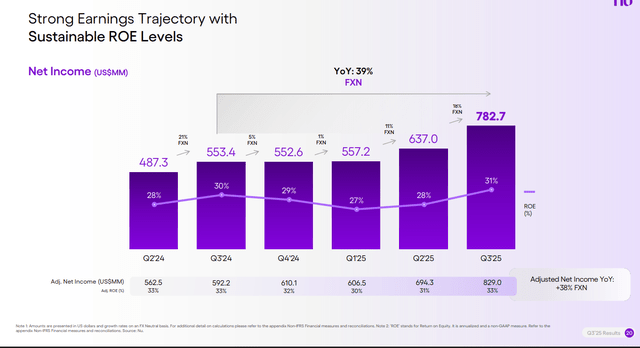

GAAP net income for Q1 was $783 million, marking a tremendous 74% YoY increase FXN.

Adjusted net income surged to $606.5 million.

GAAP EPS of $0.16 came in one cent higher than the expectations of $0.15, up from $0.13 YoY & QoQ’25

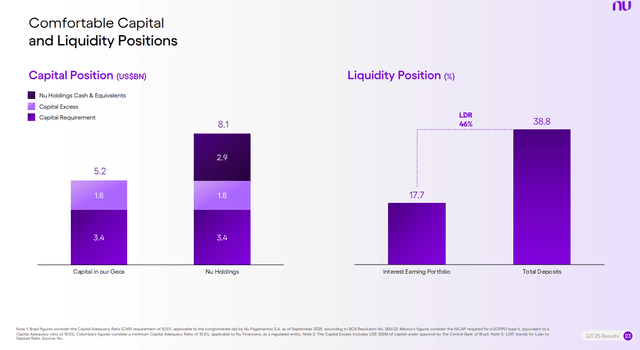

Return on equity remained robust at 31%%, despite maintaining an arguably over-capitalized position with more than $4.3 billion in excess capital across geographies. In other words, it keeps $4.3 billion more on its books than it has to. I believe the technical term for this is “Crazy.” Or “Opportunity.”

The monthly average cost to serve per active customer remains “ridiculous.” Ridiculously low, just to be sure.

$0.90 per customer in Brazil, a 4% year-over-year reduction and a 12% quarter-over-quarter decline on an FX-neutral basis.

$1.0 in Mexico, 25% CAGR reduction on an FXN basis since 2021

Colombia has not broken out yet because it’s still very new but I suspect it’s lower than the competition, whatever it is.

Again, truly elite levels of efficiency.

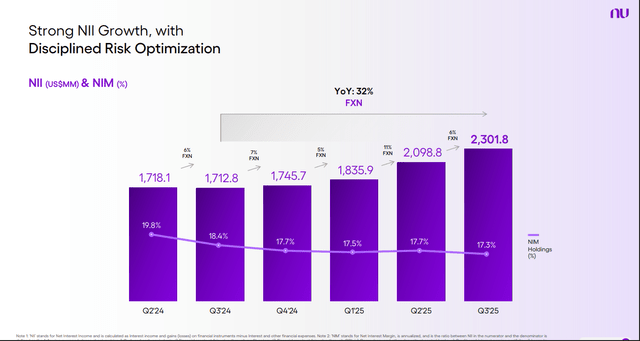

I want to make a quick comment on why NIM (net interest margin) seems to have declined since I saw it referenced and this exchange was very helpful in understanding the overall context.

I’ve highlighted the important bits if you want to skim through quickly.

Jorge Kuri Morgan Stanley, Research Division

My question is around your net interest margin. I heard what Lago said about the mix of credit being responsible for the decline in NIM. I have -- I’m looking at just the nominal numbers and your interest income was up 14% quarter-on-quarter versus a loan book in total that was up 11%. So, it doesn’t seem that you’re growing your income less than the assets, which would be sort of like a signal of mix deterioration. It’s actually the other way around.

But on the flip side, your interest expense was up 24% quarter-on-quarter versus your deposits up 6%. And so, you talked about the cost of deposits coming down, but it’s just in this -- in dollar numbers, it’s kind of like doesn’t add up. And so, I’m just wondering if you can walk us through these dynamics and exactly what explains that NIM contraction.

Guilherme Marques do Lago Chief Financial Officer

Sure, Jorge. Look, 2 things on this. So first on the revenue and then on the cost. I think on the revenue side, we have seen the growth being kind of more heavily weighted into less risky assets, not only asset classes per se. For example, you can see that if you go to Slide 12, you can see that, for example, secured lending has outpaced the rest of the portfolio. Secured assets have, everything else constant, lower kinds of yield levels.

But even within lending and within credit card, Jorge, we are seeing kind of a faster growth on a balanced basis. towards less risky customers that would have, all else equal, kind of lower yields.

So that is one of the things that would justify, but you correctly pointed out that we have also seen an increase in interest expenses, and that has come entirely from Brazil. So, our average funding cost in Brazil has gone up and the average funding cost in Mexico and Colombia have been coming down.

So, the combination of lower asset yield because of the mix with a slightly more expensive funding base in Brazil has compressed net interest margins in the quarter, which is what you see on Slide 15 that has gone from 17.7% to 17.3%.

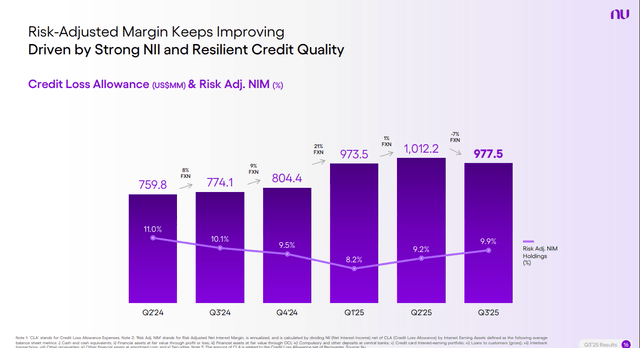

What I would, however, point out is, when you’re taking into account the asset quality or the cost of risk, you actually see an expansion in margin. And that is what is shown on the subsequent slide, which is Slide 16. Our risk-adjusted margin has actually gone up from 9.2% to 9.9%, which goes to show that even though we have kind of increased the growth towards less risky assets that has come at the expense of slightly lower asset yield. This has been more than offset by much lower cost of risk, which has led to the expansion of risk-adjusted NIMs.”

Overall, NIM is down because they’re trying to improve credit quality, leading to a better risk-adjusted NIM. That definitely makes sense to me.

Credit Quality

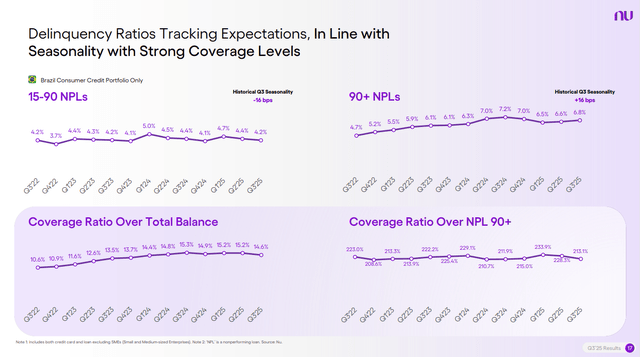

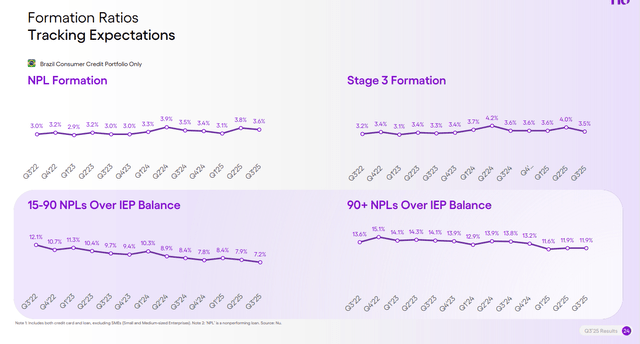

If bad, these lines go up. NPL = non-performing loan, so a loan that’s not paid back on time.

15-90 continues to go lower, 90+ goes higher. Why does this happen? Interest snowballs mostly, but the front end (15-90 NPLs) coming down means the back end (90+ NPLs) will eventually come down as NU burns those off. The key is that total coverage ratios remain broadly stable and very elevated. Or in other words, even if none of these loans were paid back, Nu has more than enough cash to cover them and then some.

I see lines that are flat to down, let’s not overthink it: credit remains essentially stable.

The home-run slide from the deck, however, was this: props to the IR team for putting this together:

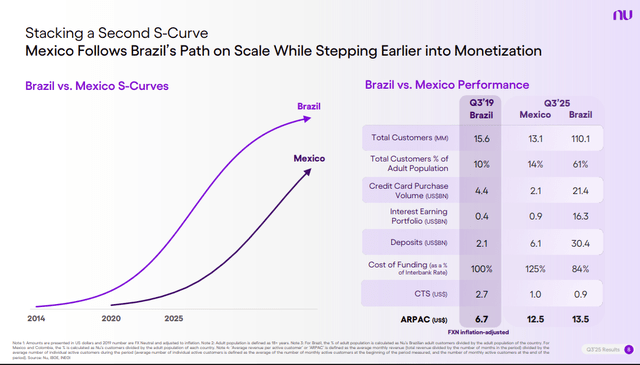

They’re basically comparing Mexico to where Brazil was at a similar stage about 6 years ago, to show that Mexico is growing much faster and is close to an inflection point where Mexico’s growth will drive NU’s future. Very exciting times if your time horizon stretches out to 2030.

Brazil has more inhabitants than Mexico, but the GDP per capita is higher in Mexico, so that means that the economic opportunity in Mexico is as big as in Brazil.

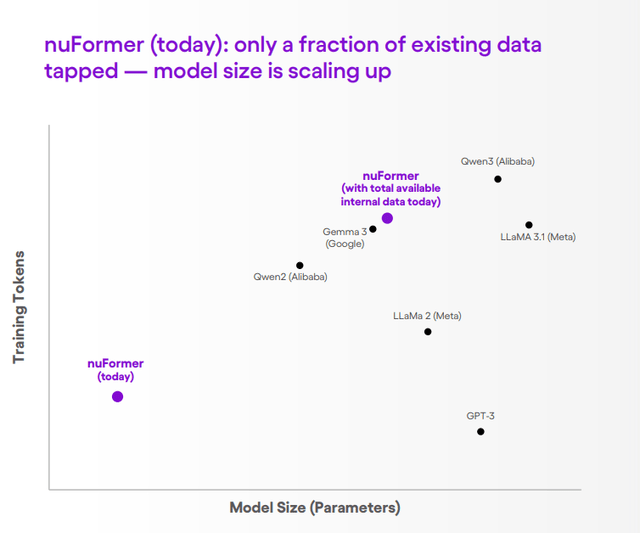

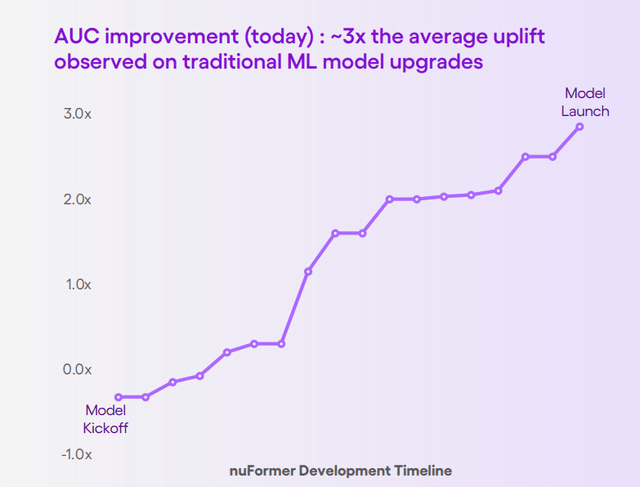

It’s 2025, and everyone must talk about AI, but did you know NU has its own LLM? Not only do they have their own LLM, but they also published this chart of scaling vs some better-known ones you may recognize.

To make drool all of you, tech nerds:

“To reach this level of performance, the first generation of our nuFormer model was built with 330 million parameters and trained on approximately 600 billion tokens, an unprecedented scale of data by financial industry standards. Yet that represents only a fraction of our full data set, which spans trillions of tokens and reflects the vast scale and diversity of Nubank’s platform.

Our business model with principality at its core generates a deep repository of high-quality transactional and behavioural data, giving us a distinctive edge by enabling nuFormer to learn from richer context and continuously strengthen its predictive power.

Historically, gains in credit performance have come from our main fronts, incorporating more and better data sources into models, expanding training samples or reducing bias within them, optimizing positive frameworks, including the use of complementary models that evaluate different dimensions of credit risk, and finally, refining modelling techniques from definition of targets to model architecture and feature engineering.

The adoption of foundation models represents a radical expansion of this last frontier. It brings a research-driven approach that moves the needle through advances in model architecture and training processes, enabling rapid and continuous improvement as AI researchers push the boundaries of what’s possible.

When we applied this approach, the models were built to deliver an average improvement about 3x higher than what’s typically observed in successful machine learning model upgrades. Translating this into business outcomes, our initial models enable a major upgrade to credit card limit policies in Brazil, allowing us to meaningfully increase limits for eligible customers while maintaining the same overall risk appetite.

This successful breakthrough within an already robust underwriting model, like Credit Card Brazil, underscores the significant potential of these advanced approaches.

We’re now focused on scaling this innovation beyond Brazil, already in motion in Mexico and extending them across every part of Nubank from personalization and cross-sell to fraud and collections, further reinforcing both the strength of our model and our ability to execute at scale.

That said, we’re still just scratching the surface. As always, at Nubank, it’s still day 1, but we believe that embedding AI into our business represents a once-in-a-lifetime opportunity to further differentiate Nubank from traditional banks.

A 3x increase in credit performance for an industry-leading company is outstanding. Very, very impressive for them to have built this using their own datasets, and it gives them an enormous advantage vs. third-party or general models that don’t have the context and delinquency history NU has.

All that being said, NU is still sitting on a fortress of cash and continues to be conservatively managed from a capital standpoint.

So, again, an excellent quarter from NU and we must now ask ourselves if NU is a screaming buy.

The Rules Of Thumb of Bank Valuation

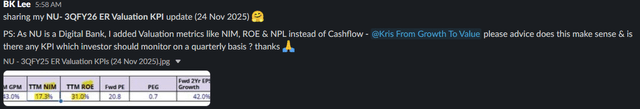

I don’t want to steal Kris’ thunder but I will spend a bit of time expanding on a question from fellow Multi-BK who asked this in the Slack channel:

This is an excellent question and I love that BK asked it. It’s also extremely relevant because most Potential Multibaggers stocks are software-related tech companies, while NU is an exception as a (tech-) bank. So, I will spend some time unpacking these metrics and how to read them in the context of a bank, which are important to keep in mind whether you’re thinking of NU or JPM.

I call these the rules of thumb of bank valuation:

Rule 1: Never use the cashflow statement, it’s irrelevant for a bank that’s essentially a box of revolving cash built on massive leverage.

Rule 2: Metrics like NIM (net interest margin) or ROE (return on equity) help us understand the drivers of a bank’s income, as a standalone they are useless. They must always be combined with leverage, capital and asset quality if you plan to use them for any analysis

NIM is a measure of profitability as a function of asset-liability matching, and as we saw for NU above, it can be “noisy,” i.e., a high value for NIM doesn’t mean it’s a good thing; credit quality matters. You can lend a lot of money in quarter one to everyone and calculate a ridiculous amount of interest, only to watch your credit portfolio crumble in 6 months. So, we should keep an eye on it versus its own history, but NIM is usually more relevant for a mature bank where it drives the majority of revenues, less for one growing as rapidly as NU that’s still acquiring customers and increasing penetration.

Furthermore, remember that a bank is a cash box built on enormous leverage. Most banks operate at around 10%. Even NU, being conservative, operates at about 14%. Which means for every 100 dollars of lending, only 14 is at the bank at any point in time. Welcome to fractional reserve banking.

In other words, assume NU is making 5 dollars on a loan of 100, but it used only 14 of its own money, so to speak, its ROE would be ~36% (5/14) and not 5%, but that’s because it used 86 dollars of leverage that wasn’t counted.

Hence, any metric that excludes the impact of leverage is misleading without context. This also extends to PE or PEG, because the denominator is earnings or EBIT, which doesn’t include total debt. PEG becomes even worse because in theory, you could reduce the amount of equity and juice your earnings in the short term, leading to a high ROE, low P/E and low PEG, but that’s a bank about to blow up.

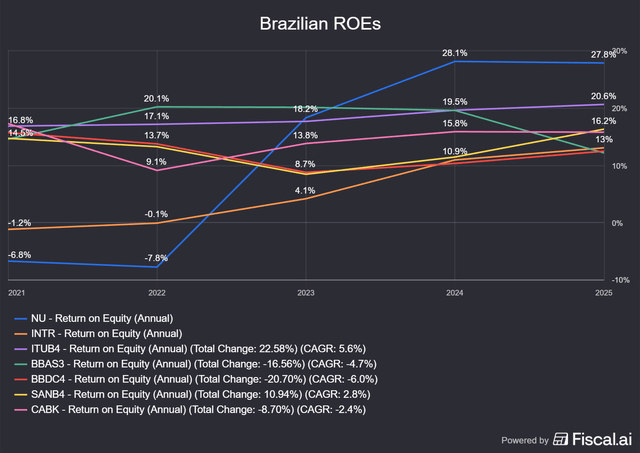

In a bank, equity is the capital that absorbs losses, so ROE for a bank is better thought of as a measure of how much return investors get for bearing that loss-absorbing risk. Regulators require minimum capital ratios, so ROE must always be against capital and liquidity rules. And as we can see, ALL Brazilian banks have good double-digit ROEs; NU went from “worst” to “best” as a function of its growth.

In summary, a high ROE could mean an efficient, well-run bank, or it could just mean the bank is taking more risk or running with too little capital, so ROE must be read together with leverage, capital, and asset quality metrics.

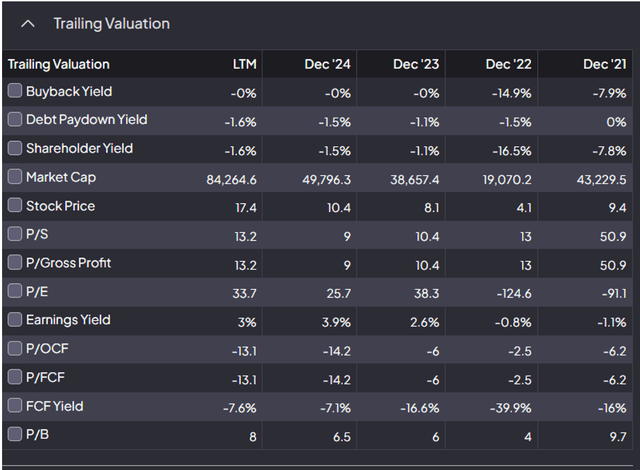

In conclusion, if you use “standard” metrics that we typically employ for companies, you get junk like this.

If you don’t understand banks, you’d think this was an overvalued “shitco”, not perhaps the best-run banks on the planet.

So, what should we use to value a bank? The safest measure is Price to Book, preferably with adjustments to intangibles (which fortunately NU doesn’t have much of, but it is relevant if a company does lots of acquisitions). Other measures that are commonly used in banking include ROTCE (Return on Tangible Common Equity, which excludes preferred and normalizes the impact of leverage) or RAROC (Risk Adjusted Return on Capital). But as a simple exercise let’s focus on P/B on what NU’s current P/B valuation says about it.

Imagine a bank’s “book value” as the net worth of its assets: cash, loans receivable minus bad debts, office or branch buildings, and deposits owed after subtracting liabilities; it’s like the liquidation value if the bank sold everything today. P/B is simply the stock market price divided by the book value per share, showing if investors are paying a premium (P/B >1) for growth prospects or intangibles like brand, or a discount (P/B <1) due to worries over asset quality or risks. So again, P/B<1 means “cheap” but you have to check why.

For banks, P/B is powerful because most value is in loans and deposits (not factories or data centres), which fluctuate with economic health; a fast-growing bank might trade at P/B of 1.2-1.5 if assets look solid, but drops below 1 signal fears of hidden losses or regulation hits. For Non-bankers: Think of it like buying a house. P/B tells if the price matches the appraised land and structure value, adjusted for neighbourhood risks, instead of the owner’s income or growth prospects.

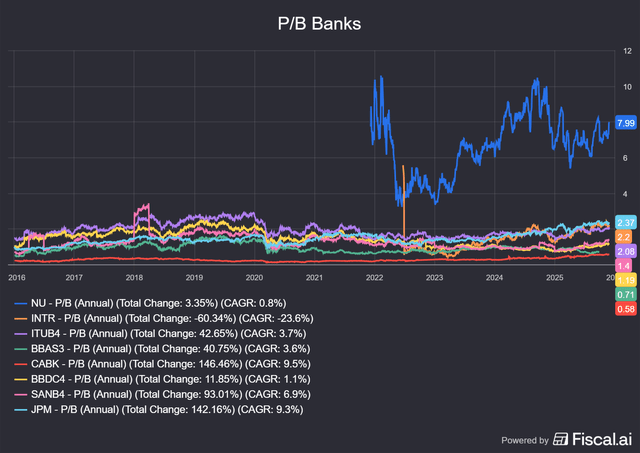

If we apply PB to NU, suddenly the picture changes dramatically:

I added JPM because it’s the best-run large US bank and trades at a premium, reflecting its asset quality and durable growth. It clocks in at a pretty expensive book value of 2.37. INTR, the other Brazilian neobank, is at 2.2; most of the traditional Brazilian banks are much lower, with 2 trading below book.

I would say NU deserves the premium valuation based on everything we’ve seen it do and it’s runway, remember the second S curve incoming, but the market seems to have priced this in based on the P/B.

At the same time, P/B may not be the correct measuring stick for NU. The reason is that it’s a bank, yes, but it’s also not a bank. It has no branches, no expensive (sub)regional lush buildings etc. In other words, the reason it looks expensive on a P/B is definitely also because it just operates much more cost-efficiently. Not having a network of bank branches is a huge asset, but in a P/B valuation, NU is punished for that, not rewarded, which it should.

None of the traditional metrics make much sense so it becomes hard to value Nubank. Neobanks are a new concept. Without much historical comparative material, the analyst community hasn’t really figured out yet a way to value them compared to traditional banks.

Based on traditional metrics that are widely available, PB makes the most sense because NU is a bank after all, but the composition of the book is very different from a traditional bank, so it’s simultaneously also not a great metric to use.

Hope that helped to understand the context around NU a bit more, now off to Kris for his PM Quality Score and his valuation verdict.

Here, the free part ends.

Do you want to know if Nu Holdings is a buy now? Get full access to Potential Multibaggers. Here’s what you’ll get:

✅ The rest of this article (with a new way of valuing the stock!)

✅ Best Buys Now (outperforming the market by 22% over 3 years!)

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ My Top 10 Stocks for 2026. The top 10 for 2025 is up 58% per pick on average.

Don’t hesitate. Don’t miss the next multibagger opportunity!