Hi Multis 👋

How are you? I hope you feel as good as I do after my week in Curaçao. I swam with dolphins and sea turtles (in the open water, yes) and above all, enjoyed the rest that a good holiday gives: reading, swimming, and relaxing were the main ingredients of my holiday.

It was just the second time in five years I took a full week off. There were previous weeks I didn't publish, but that was, for example, when I was in Omaha, Vail, Vancouver, New York, Klosters and Hamburg, and that was work-related. But you don't hear me complaining at all. I like these events so much that they also feel like holidays.

Anyway, my batteries are recharged, so watch out for what's coming in the upcoming weeks!

Last week, you didn't get an Overview Of The Week, so this will be an extra-long, double version with a ton of updates. If you are American, you may be celebrating Labor Day on Monday and this double OOTW comes exactly at the right time now that the markets are closed.

Articles In The Past Week

As I only returned on Wednesday evening (and was pretty jetlagged on Thursday), this is 'just' the third article this week.

In the first article this week, I showed you which shares I bought for the Forever Portfolio and why.

The second article this week was one to celebrate. Warren Buffett, arguably the GOAT (greatest of all time) of investing, celebrated his 95th birthday yesterday and that's why I wrote an article with 95 Warren Buffett lessons.

Memes Of The Week

On holiday, I also shut off most social media usage, so I didn't see any great memes this week. Fortunately, Multi bep posted this great meme on our Stonk Memes channel in our private Slack group (let me know in the comment section if you want to be invited!)

Interesting Podcasts Or Books

One of the quotes I used in the article celebrating Buffett's 95th birthday was:

"I am a better investor because I am a businessman, and a better businessman because I am an investor."

That's why I also keep studying businesses, business models, and business strategy. I've been fascinated with Alex Hormozi's success lately. His live book launch lasted for 7 hours and he broke records. So, that's what I've been analyzing (although I'm not even halfway yet). You can watch it here.

The markets in the past weeks

One of the advantages of skipping one week of the OOTW is that we get to look at the market returns of two weeks instead of one. It's still way too short, of course, but it is already better than just a week.

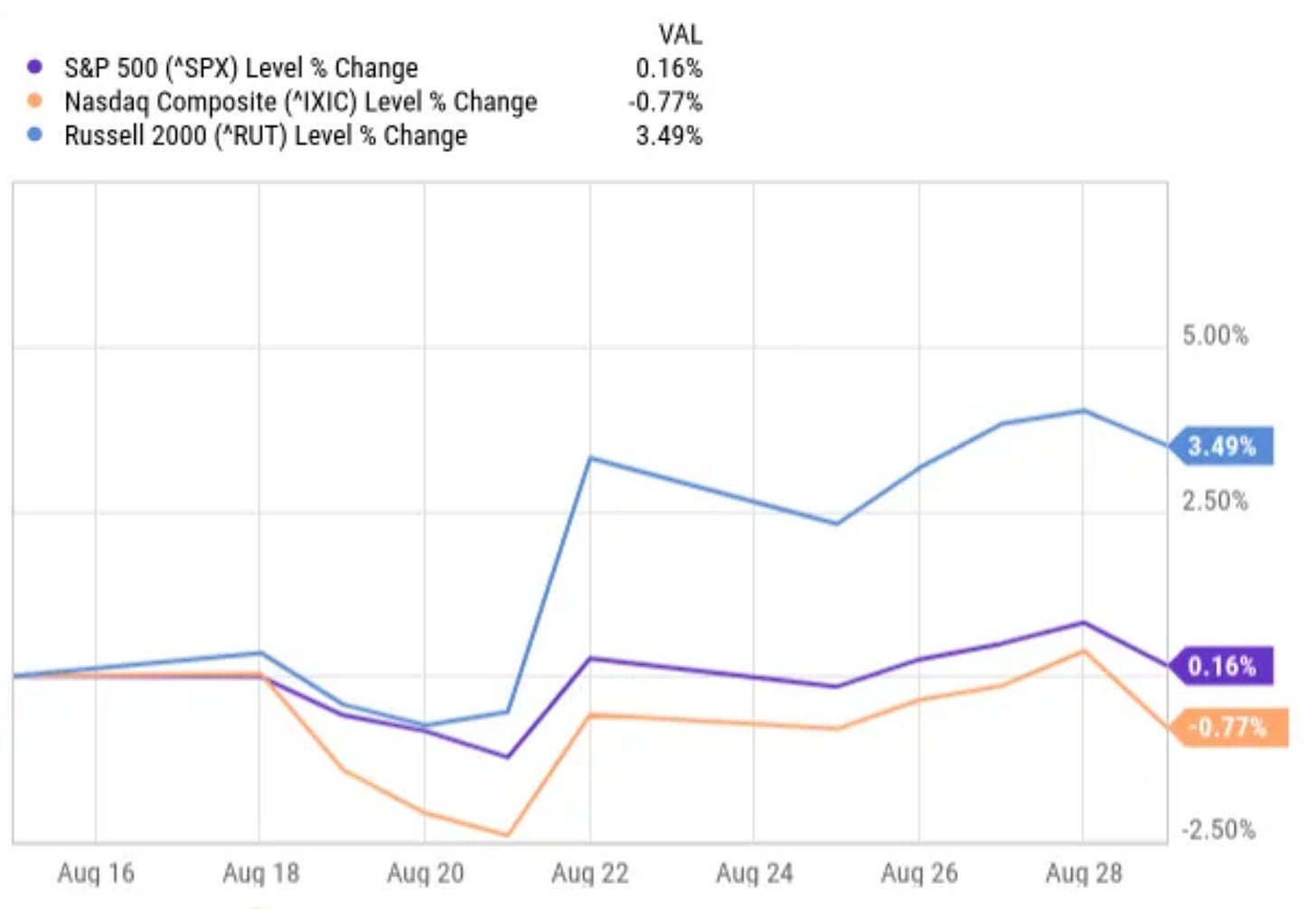

As you can see, the S&P 500 didn't move that much. It's up 0.16%, while the Nasdaq is down 0.77% and the Russell 2000 is up 3.49%.

Let's check how the Greed & Fear Index looks.

It's exactly at 64 again, the level it was at two weeks ago.

Quick Facts

1. Free Fire is CRUSHING it

This week, Bloomberg reported that Free Fire, Sea Limited's (SE) hit game is seeing growing success in the US, even if the game is 8 years old (it was launched in 2017).

US gamers now spend more on Free Fire than Call of Duty Mobile, which is quite amazing.

Anime and Squid Game helped US gamers to find Free Fire. I reported about the collaboration with the Japanese anime Naruto Shippuden in this article, and Forrest Li talked about the Squid Game content integration in the most recent earnings call.

The result was that Free Fire jumped 7 spots to the 6th place in mobile games overall.

2. My Partnership with Fiscal ai

You may know it by now, but I have partnered with Fiscal ai, the former Finchat. I get questions for paid promotions every week, but I refuse them all. Fiscal ai is the only exception. Why? Because I use it literally every single day.

If I need charts, a stock screener, research, conference calls, company-specific KPIs, and so much more, I go to Fiscal. Oh, and did you know that Fiscal now has the earnings results already in its data minutes after the earnings release?

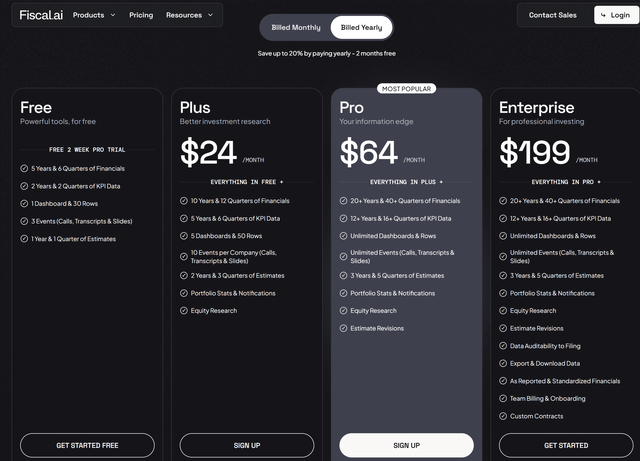

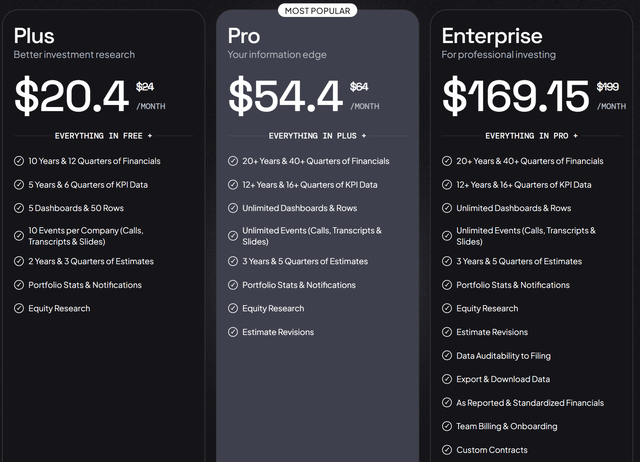

Do you know which other service has that as well? Bloomberg. There, you pay $2000 per month. For Fiscal ai, these are the tiers.

That's right, for just a fraction of the price, you get 90% of what a Bloomberg terminal gives you.

My partnership allows us to give you a 15% discount with this link.

That means this (paid yearly):

I'll be honest here. I used to use many other data platforms consistently. Now, I canceled all my subscriptions because I only need Fiscal ai. That has already saved me thousands of dollars on subscriptions.

If you want the 15% discount, click here.

3. Nubank Entering Argentina Through An Acquisition?

This week, I saw this headline.

According to rumors, Nubank (NU) has started its due diligence process to acquire Brubank. Brubank was founded in 2017 and got its license in 2018. It's considered to be the first digital bank in Argentina.

It offers a digital account with a Visa card, currency exchange services, investments, QR payments, loans, and interest-bearing accounts. It has about 4 million customers.

An acquisition would make sense for NU, as it would give it immediate access to a customer base, a license and local infrastructure.

But also according to the rumors, the negotiations broke off. Nu said it “does not comment on rumors or speculation.”

The most important news is that Nubank is preparing to enter Argentina again. It started an office in Buenos Aires in 2019, with 12 employees, but it decided not to launch because of "adverse macroeconomic conditions." Read: hyperinflation caused by the socialist government. With President Milei and the much lower inflation now, it's only logical Nubank turns its eyes on Argentina again.

4. Mercado Pago Launches Credit Card in Argentina

While Nubank considers launching in Argentina, it's Mercado Libre's (MELI) home turf. This week, MercadoPago launched a Mastercard credit card there. It will be free and users can choose for the physical or virtual format. There will be three interest-free installments on purchases over 30,000 Argentine pesos (about $22.4) on Mercado Libre's marketplace or offline merchants using Mercado Pago’s QR system.

This fits into Mercado Libre's strategy to give access to financial means for people who don't have that up to now. I also really like the tight integration between Mercado Libre's marketplace and payment platform.

I know many often wonder if Mercado Pago and Nubank won't clash. My answer has been consistent throughout the years: yes, eventually, they will. But that doesn't worry me a bit, as there's still such a huge market to be conquered from the incumbents that both can be major winners.

5. Will Google Kill Duolingo?

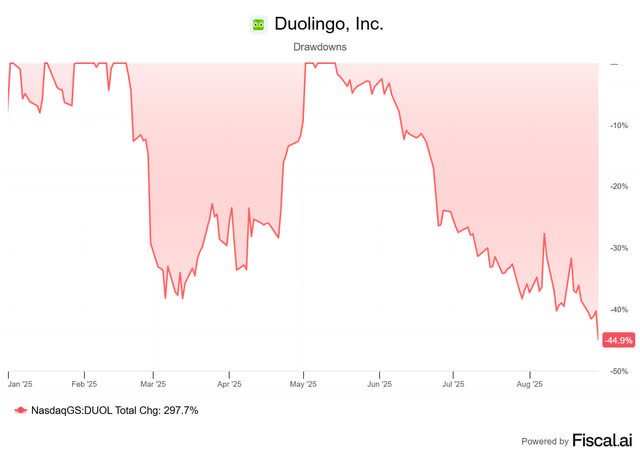

Duolingo's (DUOL) stock keeps dropping. It's now down 45% year-to-date.

Source: Finchat

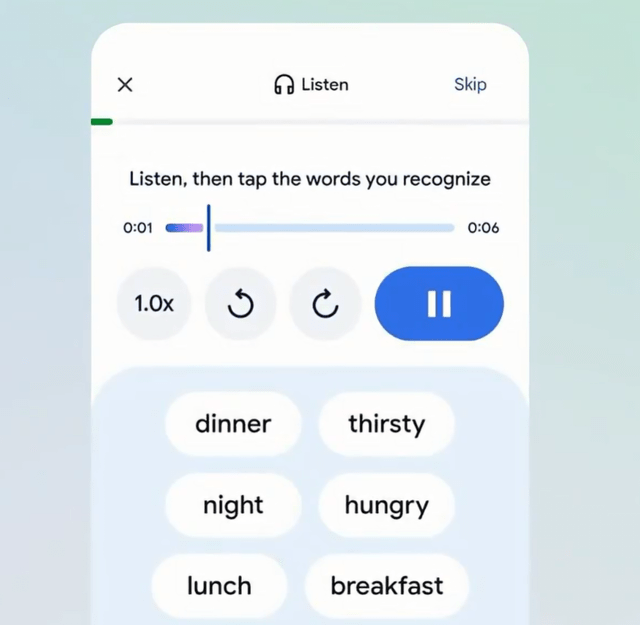

The panic stems from two developments: first, the launch of ChatGPT-5, which spooked investors about AI disruption, and second, this week's announcement that Google has integrated language learning capabilities into Gemini.

Here's what the market is missing: it's not the learning that creates the moat, it's how the learning is delivered.

Duolingo has built a system that makes learning genuinely fun and habit-forming.

I have already shared my streak multiple times. It's at 1,320 days now. Do you think that I would go to Gemini every single day for 1,320 days? I think not.

Investors also seem to forget Duolingo isn't just about languages anymore. The platform now covers math, chess, and music, and I'm confident that many other subjects will follow: coding, geography, and accounting, to name a few.

The market reaction is actually quite ironic. Google (GOOGL) (GOOG), which was previously seen as being disrupted by AI, is now being viewed as the big disruptor. This is a classic example of market overreaction, swinging from one extreme to another.

The free version scratches the surface. But behind the paywall is where we unpack what actually matters.

This week, paying members get:

A surprising AI acquisition that could redefine an entire sector

A streaming stat that looks small but signals something huge

A payments play that’s more than just tech

My full portfolio

The market movers

My Best Buys Now (outperforming the S&P 500 by 25%+ per pick!)

Much more

If you want the edge, not just the headlines, join us.

👉 Unlock the full OOTW now