The Best of 2023 (part 1): A Lesson From 23 years ago

Hi friends!

I already want to wish you a Happy New Year and may 2024 become the best year of your life!

In this series, I’m looking back at some articles from 2023, that the Multis, subscribers to Potential Multibaggers got in the past year. It’s just a tiny selection. In total, there were 217 articles and I will show you a bit more what I do at Potential Multibaggers. If you don’t want to miss the next articles (all free!) …

This article was published on January 11, 2023. Remember the gloom-and-doom that was all around back then? Everyone and their aunt predicted a recession in 2023. Well, that turned out different. The market had a great year.

If you read this article, you have to keep in mind the panic many investors had, especially growth investors. I had my ‘dollar-cost averaging on steroids’ on. Every two weeks, I invest the same amount. But if the market drops substantially, I don’t add to my emergency fund, but I invest that money into the market as well. From the moment there is a real deep discount, a drop of 20% or 25%, depending on the circumstances, I even take some (!!!) money from the emergency fund to add extra money to my portfolio. That’s how I could add an extra 20% to even 60% for months. That paid off very well this year.

Conviction, context and knowledge are very important and that’s what I tried to give to my subscribers in this post. I think it’s an evergreen. Here we go!

Hi Multis

I know that some of you have become desperate, beaten to pulp by this tough market. Some think they will never see their money back. And then you are some of the brave. Many have already left. They have sold their growth stocks and left investing altogether, or went to index funds or dividend stocks.

I get it. Most people are just not made for the high volatility we have seen. In the last 65 years, the S&P 500 has only had three years of worse returns than in 2022, as I shared in the most recent Overview Of The Week. If you haven't canceled your subscription yet, you are part of a rare kind: a REAL long-term investor. Many are long-term investors as long as things go well, but they start panicking when their stocks go down.

For the general public, 20% to 25% seems to be the breaking point when they usually give up. With many Potential Multibaggers down 60%-70%-80% or even more, the pain is even much bigger and that's why it shows your strength that you are still reading this.

And of course, there will be losers. No matter which investment approach you take, with individual stocks, you will always have losers. That's simply how this works. Even the best investors have 40% to 60% losers, sometimes even more. It's the amount that you win that makes the difference, not the number count on winners and losers.

But even if you know all of this rationally, for long-term investors, sometimes it's still tough in markets like this. We are all human, and our feelings are impacted by this tough market. You may wonder if you were not stupid investing this way. Does this actually work? Were you not duped out of our money by the stock market? What if you had FOMO and invested too much money near the top? Maybe you don't have enough left to invest now in a meaningful way? The best thing you can probably do then is... nothing. I know, it's against human nature. If we see a problem, we want to DO something and that's partly where your stress comes from.

I hope this article can alleviate some of your pain. I will show you an example that can hopefully inspire you. It's from the past, from 23 years ago, to be precise.

Learning from the past: the dotcom bubble

In January 2000, the Wall Street Journal published a book about the "new" market and 'The Amazing Future,' the title of the special issue.

As a part of the special issue, the Wall Street Journal had an interesting question: to make a portfolio "that would best suit the lifetime needs of a newborn this week." This means that the portfolio was started near the absolute top of the dotcom bubble, one of the biggest bubbles ever. David Gardner of The Motley Fool made the picks.

If you think 2021 was a clear bubble, it's just a mini version of the dotcom bubble. Amazon traded at a PS ratio of almost 18, while the gross margin, yes, gross margin, not operating margin, was -6.5%. Microsoft traded at a PS ratio of 30. Yes, I know, several Potential Multibaggers traded at a PS ratio of 30 as well, but their revenue growth was sometimes close to 100%, sometimes higher. Microsoft's revenue growth at the time? 17.5% year-over-year. You get the picture, I think. For the macro aficionados, the average interest rate in 2000 was above 6%.

How would that 23-year-old have done, knowing, with hindsight, that the bubble popped just a few months later?

Here are the portfolio picks David Gardner proposed.

11 stocks. America Online bought Time Warner but was later shredded to pieces and sold off. If you invested $1,000, you only had $300 left when Time Warner was acquired by AT&T in 2016, so that's -70%.

Millenium Pharmaceuticals was bought by Takeda for $8.8 billion in 2008. That would have made your $1,000 grow to $2,444.

P.E. Corp.-Celera Genomics changed names several times, Celara Genomics was spun off in 2008, and then bought in 2011 for $357 million, but its former owner also spun out another division for $6.7 billion. It's quite complicated to calculate the returns here. I propose we don't include this one and only bought 10 stocks instead of 11.

The other eight are still on the market. These would be their returns if you invested $1,000 in each.

As you can see, of these 8 that are still on the market, Gap is the only one that made you lose money over that time period. I also added the return of the S&P 500.

Let's look at the returns.

Stock $1,000 now

Microsoft $6,208

Cisco $1,287

Coca-Cola $4,020

Qualcomm $1,960

Amgen $5,996

Gap $421

Amazon $22,950

eBay $7,008

AOL $300

Millennium Pharmaceuticals $2,444

TOTAL= $52,594

As you can see, that $10,000 would have grown to $52,594. And mind you, that's now, when we are in the middle of a very bad period for stocks. A year ago, the returns would have been much higher. If you would have invested $10,000 in the S&P 500, you would have $40,320 now. That means the portfolio beats the market by $12,274 or 30.5%.

I think this clearly shows that this kind of investing can work IF you look at the long term. Cisco, Qualcomm, Gap, AOL, and even Coca-Cola underperformed the index. Millenium Pharmaceuticals underperformed as well if you didn't reinvest the money but if you did, that $2,444 would have grown to $7,439. But that was not even used in our calculations.

But look and behold, the first three years of the portfolio. Ouch and at the same time very recognizable for many Multis who bought near the top. As you can see, after three years, the only stock that is up is eBay, and only 8%.

Does this mean we are doomed? Of course not. As we saw, the portfolio outperformed the S&P 500. And that's from 1 point near the top. I'm sure dollar-cost averaging would have done better because you could have bought at lower prices for several years. More about this in the next part of this article.

What can we learn from this?

There are several lessons here. The first is that long term really means long term, not a year, not even three years. I'm pretty sure that if investors bought this portfolio, a vast majority would have sold their holdings after a year, maybe two or if not then, definitely after three.

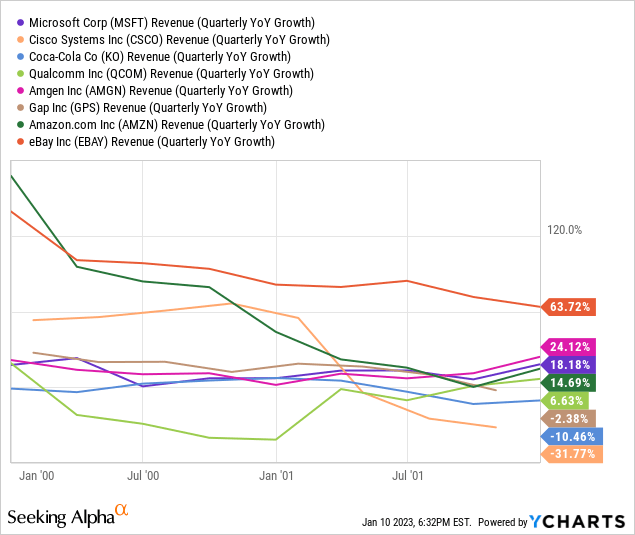

Secondly, look at the revenue growth of these companies in January 2002, when the crisis was in full swing.

Amazon growing its revenue by just 14.7%, wow! Just two years before, it grew at 150% year-over-year. Even a strong company like Coca-Cola saw its revenue drop by more than 10%. Recessions cut into companies' revenue growth, even in those of strong strong companies. But with economic recovery, the best will be able to recover their revenue growth.

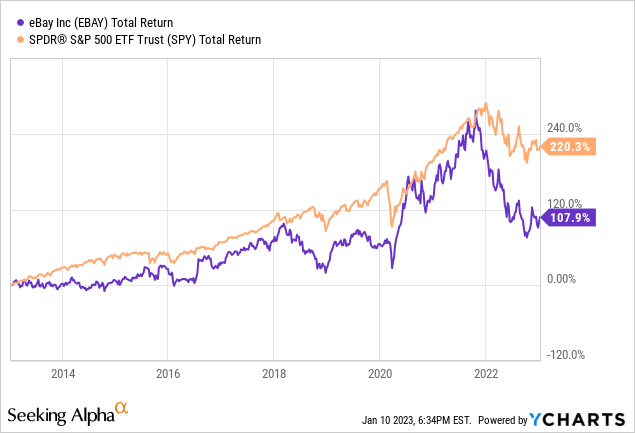

The only outlier here? EBay. It's not a coincidence that it's the second-best performer after Amazon, even though the company has not been doing great over the last decade and has seriously underperformed the S&P 500 during the last ten years.

But look at the first 5 years and see how much eBay outperforms the S&P 500, as the only stock, and all the rest.

Does this mean that in 5 years, you would still be down so much if you bought near the market top? Maybe if you put in everything at the top and you could never invest a single dollar anymore. But let's take Microsoft as an example. You would be down 48.5% if you only bought on January 1, 2000 and held until January 1, 2005. But suppose you started with $1,000 and added $75 dollar each month?

As you can see, you would be down only 1.68% per year then. With $50 per month, it would be 3%.

And look at Amazon, for example:

Now, of course, no two situations are identical, not historically, not personally. But I think that we can learn that what we think will be the winners, will not always be the winners and the other way around. That's why I still don't want to sell too fast and err on the side of holding too long.

There are more lessons to learn here, but for me, the main takeaway is that although Potential Multibaggers have underperformed now, this doesn't mean they can't outperform over the long term. That doesn't mean we shouldn't follow up our companies. But we should not take selling lightly. You never know if you sell the next Amazon. That might seem unlikely, but it was very unlikely to people in 2003 that Amazon would be a killer stock.

If you would want similar help in the next market dip and if you want to find multibaggers, you can take a two-week free trial, easy to cancel with a few clicks. On top of that, you get a 10% discount through this link.

Of course, you can also subscribe for free to this blog, Multibagger Nuggets.

In the meantime, keep growing!

Very interesting to read this now. Main takeaway for me is buy quality growth at a reasonable valuation, then hold for very long.